I recently received email invitations to check out Dark Pool Trader by Stefanie Kammerman investment research service, so I decided to take a closer look at it.

Keep reading my honest Dark Pool Trader Review by Stefanie Kammerman to learn more about it.

How You Could Lock in a 1,110% Return on THIS Stock in Just 24 Hours

Table of Contents

- 1 What is Stefanie Kammerman’s Dark Pools Summit?

- 2 When will The Dark Pools Summit with Dark Pool Trader Stefanie Kammerman take place?

- 3 How to join The Dark Pools Summit with Dark Pool Trader Stefanie Kammerman?

- 4 What is Stefanie Kammerman’s Dark Pool Trader?

- 5 What’s included with your Dark Pool Trader subscription?

- 6 Dark Pool Trader Pricing

- 7 Dark Pool Trader Refund Policy

- 8 Dark Pool Trader – FAQ

- 9 Meet Stefanie Kammerman

- 10 Stefanie Kammermans’ Services

- 11 Dark Pool Secrets Book by Stefanie Kammerman

- 12 An Introduction to Dark Pools

- 13 Rationale for Dark Pools

- 14 Why Use a Dark Pool?

- 15 Types of Dark Pools

- 16 Pros and Cons

- 17 Curb Appeal

- 18 The Bottom Line

What is Stefanie Kammerman’s Dark Pools Summit?

Stefanie Kammerman’s Dark Pools Summit with Dark Pool Trader Stefanie Kammerman is an online event where Stefanie Kammerman will lift the curtain on the secret world of Dark Pool trading.

Dark Pool Trader areas are places where the biggest firms and richest investors make huge trades away from the public markets – ones that would cause prices to shift greatly while buying or selling.

Knowing where these huge swaths of money are moving can give everyday traders a major advantage.

The Dark Pool Trader Stefanie Kammerman knows where to look to find this movement and has proven that her system works just as well or even better in a falling or bear market as in a charging bull market.

The Dark Pool Trader Stefanie Kammerman will be interviewed during the webinar, and Matt McCall will be joining her as a guest panelist.

When will The Dark Pools Summit with Dark Pool Trader Stefanie Kammerman take place?

The Dark Pools Summit with Dark Pool Trader Stefanie Kammerman has been scheduled to take place on Wednesday, June 17, 2020.

How to join The Dark Pools Summit with Dark Pool Trader Stefanie Kammerman?

To join The Dark Pools Summit with Dark Pool Trader Stefanie Kammerman, investors will have to reserve their spot by simply submitting their email addresses.

Following registration, you will receive the timely updates and newsletters in your email inbox, and Stefanie Kammerman will reveal her service – Dark Pool Trader – of the upcoming The Dark Pools Summit set to take place on Wednesday, June 17, 2020 at 8PM ET.

— RECOMMENDED —

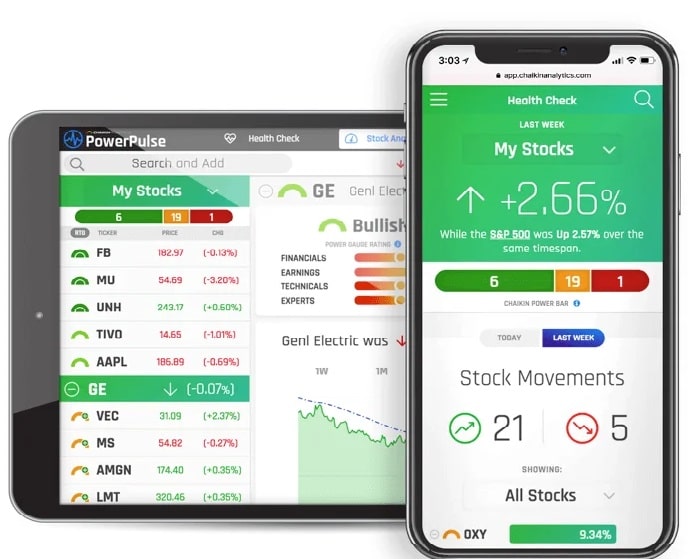

A New Way To See Which Stocks Could Double Your Money

We want to give you FREE access to the Power Gauge system ($5,000 value).

Claim FREE access to The Power Gauge Here

What is Stefanie Kammerman’s Dark Pool Trader?

Dark Pool Trader by Stefanie Kammerman is a brand new service which will be revealed to us at the upcoming The Dark Pools Summit. The Dark Pools Summit is scheduled for June, 17th.

What’s included with your Dark Pool Trader subscription?

Here’s everything you’ll get:

One-Year Membership to Dark Pool Trader

Once you’re a member, you’ll receive an average of six to 12 of Stefanie Kammermans’ fast-moving trade recommendations per month.

Each trade recommendation includes the stock trade as well as the options’ trade for the chance to maximize your gains.

Each month, she will also keep you up to date on what’s going on in the markets with regular newsletter research issues, which sectors are heating up or cooling down, megatrend opportunities Wall Street is focusing on, and any big market corrections she sees looming on the horizon.

BONUS REPORT: The Dark Pool Trading Primer

This report details the insights Stefanie Kammerman picked up over the last 26 years. Including the four different types of Dark Pool prints and how each one will affect a stock differently, the best time of the day to trade to capture the most momentum, her 10 “iron rules” for trading the Dark Pools, and how to spot a big market correction before it happens.

BONUS REPORT: The Dark Pool Trader’s Complete Options Guide

This report is a comprehensive guide on how to trade options. It’s perfect for folks who are new to options. And it details how options relate to the Dark Pools. When combined, these two concepts can turn any trader into a moneymaking machine.

Dark Pool Trade Alerts

Every time Stefanie Kammerman recommends a trade, she will post it on her website and immediately email it to you. If you want, you can also sign up to receive text alerts so you never miss an opportunity to see massive gains.

24/7 Use of the Members-Only Dark Pool Trader Website

As a member of Dark Pool Trader, you’ll receive complete access to Stefanie Kammerman‘s members-only website, where she will post all her research, recommendations, and market commentary.

And don’t forget… Stefanie Kammerman recently identified two stocks Wall Street has been focusing on for the past few days…

They’re poised for a big move.

And she would like to email the names, ticker symbols, and options’ play on these stocks to folks who sign up through this offer.

This will give you the opportunity to start using Stefanie Kammerman‘s Dark Pool research in just 5 minutes.

Because that’s how long it will take you to receive and read your confirmation email with links to Stefanie Kammerman‘s website and her exclusive special reports, including one with these two picks. You’ll just click the link that says…

Two Dark Pool Trades to Make Right Now.

Dark Pool Trader Pricing

We’re still in the critical early stages of the Dark Pool reporting period. That’s why only the folks who sign up by this offer will receive these trade recommendations.

When you sign up, Stefanie Kammerman will immediately email you all the details. She recommends you enter each one as soon as possible…

Because once the mainstream press figures out the “big boys” have piled into these stocks… they can jump fast…

So she encourages you to act quickly.

You’ll get these two recommendations and everything mentioned above for the “pre-launch” price of only $1,999.

The regular retail price for Dark Pool Trader is $2,999.

So act now to claim your 33% discount… and save $1,000.

Dark Pool Trader Refund Policy

If you join Dark Pool Trader today, you’ll get a full year to try out Stefanie Kammerman’s research and recommendations.

If at the end of the first 12 months, you haven’t seen twenty-five 100% winning picks in her model portfolio …

You’ll get a second year of this service free.

And remember, because members of Dark Pool Trader will immediately receive two trade recommendations to make right now… Stefanie Kammerman can’t offer any refunds.

Dark Pool Trader – FAQ

What are the Dark Pools?

Answer: Dark Pools are private stock exchanges where the “big boys” on Wall Street place their trades.

Regular investors buy stocks on public exchanges like the Nasdaq, AMEX, and the NYSE…

But big Wall Street institutions like Goldman Sachs and JP Morgan don’t.

They trade on private exchanges that most regular investors don’t know about — known as the Dark Pools.

And as many as 40% of all trades in the stock market trade in the Dark Pools. Billions of dollars change hands every day on these private exchanges, out of the public eye.

It’s a massive market mover most folks are unaware of.

Do I need to use a special brokerage account to follow Stefanie’s recommendations?

Answer: No — you don’t need to do anything out of the ordinary.

Even though Stefanie monitors the trading activity that goes on in the Dark Pools, for her recommendations you can use standard accounts at standard brokers — Schwab, Fidelity, TD Ameritrade… you name it.

If you choose to act on her advice, any trades you’d be making would take place on the public exchanges, so you don’t need a special brokerage account or anything like that.

Do I need a lot of money to do this?

Answer: That’s one of the benefits of Stefanie’s Dark Pool strategy… you don’t need a big account to get started.

It’s definitely possible to make a lot of money starting with a small account.

Who is this for?

Answer: Stefanie’s Dark Pool strategy is for anyone who’s brand-new to learning about trading and investing… has tried trading and is tired of picking losers… or a seasoned pro who wants a way of finding the most potentially lucrative trades on the market.

In other words, her strategy is for everyone wanting to learn about the Dark Pools.

What kind of gains can I see?

Answer: Following Stefanie’s recommendations in a unique way, you could have seen gains as high as 150%…338%…400%…744%…even an extraordinary 1,900% in as little as a few days… sometimes even a few hours.

With her strategy and this unique kind of play, gains from 500% to 1,000% are not uncommon.

Does Stefanie’s strategy work even if the markets are tanking?

Answer: That’s one of the great things about Stefanie’s research… it can help you see amazing gains in any market.

It doesn’t matter if stocks are climbing to record highs, plummeting due to a market shake-up, or going sideways.

Stefanie can find a way to see gains no matter what’s going on.

In fact, she recently found a beta test trade recommendation on the big oil exchange-traded fund XLE that gained 550% and a beta test trade recommendation on a company called Schlumberger for 108% gains as the markets went through the biggest decline since Black Monday.

If you want more details on Stefanie Kammerman’s background, track record, and Dark Pool strategy, she recently sat down for an interview with legendary investor Matt McCall to discuss her full findings.

To watch the interview, click here.

Meet Stefanie Kammerman

Stefanie Kammerman, aka The Stock Whisperer has trained over a thousand traders worldwide how to Day Trade and Swing Trade over the past 20 years.

She successfully ran a trading desk over the next few years teaching all the new traders the overnight swing system. Stefanie is also a published singer/songwriter with BMI, having placed numerous songs on some of the most popular television shows such as “Americas’ got talent,” and “American Idol” just to name a few.

She is the founder and managing director of The Stock Whisperer Trading Company, where she runs an online educational trading room called “The Java Pit”. She teaches her students by sharing her screen all day long with many audio meetings.

Her unique approach of old fashioned trading in a high tech world teaches her students how to trade by reading the tape and spotting where the dark pool prints are, which teaches here students how to spot a correction before it happens.

She is the author of “Counting the Cards of Wall Street”, an online workshop which focuses on trading around volume and technical analysis. She has taken hundreds of pictures of real time trades in an effort to teach her students how to follow the smart money.

She also does live workshops where she teaches her students in real time.

— RECOMMENDED —

Gold prices just surged to the highest level in a year and could be on the verge of the biggest bull run in half a century. (It gained 1,700% during the high-inflation 1970s.) Now, a top analyst says you can capture ALL of the upside without touching a risky miner or a boring exchange-traded fund. He sees 1,500% potential gains long term with very little risk.

Stefanie Kammermans’ Services

The Java Pit Trading Room

The Java Pit is a unique trading room experience. It is run by Stefanie Kammerman, also known as “The Stock Whisperer”.

She brings to the trading room 26 years of trading experience. She’s mentored and coached thousands of traders around the world. Not only does she teach beginner and advanced day trading and swing trading classes, but she also monitors her students very closely every day in her chat room. By sharing her screen with her students during pre -market and live trading, you learn by watching her trade, as if you were sitting right next to her. All throughout the day, she points out the highest probability trades following the Dark Pool. We trade stocks, options, futures, forex and crypto currencies.

Stefanie has two audio meetings throughout the trading day. The pre-market meeting is where she teaches her students how to find the highest probability day trading stocks. She teaches you by drawing lines on her charts and pointing out where the smart money is buying and where the smart money is selling, otherwise known as the big prints. She also points out the best trading levels for these stocks by zooming in and out of her charts. The afternoon meeting concentrates on the highest probability trades as well as what levels to enter and exit for the overnight swings.

The Java Pit consists of many experienced traders sharing their trades and trade set ups as well as many traders just starting out wanting to learn more. It’s an unbelievable trading community where the traders help one another with great advice about brokers, platforms, news stories, and stock picks. It’s a place where everybody works together as a team, and where knowledge is shared all throughout the day. It’s one big family where students can feel comfortably at home, have fun, tell some jokes here and there, but yet still obtain a serious attitude about trading.

The Dark Pool Weekly Whisper

Each week Stefanie records a “Whisper” video. These timely extended videos share the hottest trades for the week covering all sectors of the Market by following the Dark Pool! It’s Available Only on Dark Pool App Private Feed or in live trading room the Java Pit.

Dark Pool Secrets Book by Stefanie Kammerman

Check out her book on Amazon here. You can see how she developed her dark pool trading strategies. Stefanie discusses all the dark secrets of the stock market and exposes the manipulation that we all know exists.

Why is “Dark Pool Secrets” a MUST Read?

Profit: See big trades before they move stock prices, so you can profit off those moves.

Protect: See corrections and crashes coming before they happen, so you can protect yourself against losses.

With what you’ll learn in Stefanie Kammerman’s book, you can stop guessing when stock prices will move, and let the Dark Pools show you.

Every trade Stefanie Kammerman selected over the last 4 years has been documented. She has even recorded them on video. That’s why in addition to her book, she also created a companion DVD so you can look over her shoulder as she explains how to see into the Dark Pools and profit from them.

Best of all, anybody can do this. You don’t have to buy special software. With the secrets in Stefanie Kammerman’s book, you can get access, and see the Dark Pool trading activity for FREE.

She will teach you what the trades you’re seeing mean and how to use that knowledge to pick the hottest trades… just like she does.

Whether you’re an experienced trader or just starting out… whether you trade stocks, options, Forex, Futures or even cryptocurrency… seeing into the Dark Pools can transform the way you trade. And more importantly, it can transform your success rate and your rate of return.

— RECOMMENDED —

Charlie Shrem got in on bitcoin when it was trading for under $5… Now he’s issuing a “buy” alert on a new trend.

Click here to watch his next trade “on air.”

An Introduction to Dark Pools

Dark pools are an ominous-sounding term for private exchanges or forums for securities trading. However, unlike stock exchanges, dark pools are not accessible by the investing public. Also known as “dark pools of liquidity,” these exchanges are so named for their complete lack of transparency. Dark pools came about primarily to facilitate block trading by institutional investors who did not wish to impact the markets with their large orders and obtain adverse prices for their trades.

Dark pools were cast in an unfavorable light in Michael Lewis’ bestseller Flash Boys: A Wall Street Revolt, but the reality is that they do serve a purpose. However, their lack of transparency makes them vulnerable to potential conflicts of interest by their owners and predatory trading practices by some high-frequency traders.

Rationale for Dark Pools

Dark pools are not a recent phenomenon; they emerged in the late 1980s.1 According to the CFA Institute, non-exchange trading has taken off in the United States. Estimates show that it accounted for approximately 40% of all U.S. stock trades in spring 2017 compared with an estimated 16% in 2010. The CFA also estimates that dark pools are responsible for 15% of U.S. volume as of 2014.2

Why did dark pools come into existence? Consider the options available to a large institutional investor who wanted to sell one million shares of XYZ stock before the advent of non-exchange trading. This investor could either (a) work the order through a floor trader over the course of a day or two and hope for a decent VWAP (volume weighted average price); (b) split the order up into, for example, five pieces and sell 200,000 shares per day, or (c) sell small amounts until a large buyer could be found who was willing to take up the full amount of the remaining shares. The market impact of a one million sale of XYZ shares could still be sizable regardless of whether the investor chose (a), (b) or (c) since it was not possible to keep the identity or intention of the investor secret in a stock exchange transaction. With options (b) and (c), the risk of a decline in the period while the investor was waiting to sell the remaining shares was also significant. Dark pools were one solution to these issues.

Why Use a Dark Pool?

Contrast this with the present-day situation, where an institutional investor uses a dark pool to sell a one million share block. The lack of transparency actually works in the institutional investor’s favor since it may result in a better-realized price than if the sale was executed on an exchange. Note that, as dark pool participants do not disclose their trading intention to the exchange before execution, there is no order book visible to the public. Trade execution details are only released to the consolidated tape after a delay.

The institutional seller has a better chance of finding a buyer for the full share block in a dark pool since it is a forum dedicated to large investors. The possibility of price improvement also exists if the mid-point of the quoted bid and ask price is used for the transaction. Of course, this assumes that there is no information leakage of the investor’s proposed sale and that the dark pool is not vulnerable to high-frequency trading (HFT) predators who could engage in front-running once they sense the investor’s trading intentions.

Types of Dark Pools

As of February 2020, there were more than 50 dark pools registered with the SEC, of which there are three types:3

Broker-Dealer-Owned

These dark pools are set up by large broker-dealers for their clients and may also include their own proprietary traders. These dark pools derive their own prices from order flow, so there is an element of price discovery. Examples of such dark pools include Credit Suisse’s CrossFinder, Goldman Sachs’ Sigma X, Citi’s Citi Match and Citi Cross, and Morgan Stanley’s MS Pool.

Agency Broker or Exchange-Owned

These are dark pools that act as agents, not as principals. As prices are derived from exchanges – such as the midpoint of the National Best Bid and Offer (NBBO), there is no price discovery. Examples of agency broker dark pools include Instinet, Liquidnet and ITG Posit, while exchange-owned dark pools include those offered by BATS Trading and NYSE Euronext.

Electronic Market Makers

These are dark pools offered by independent operators like Getco and Knight, who operate as principals for their own account. Like the broker-dealer-owned dark pools, their transaction prices are not calculated from the NBBO, so there is price discovery.

Pros and Cons

The advantages of dark pools are as follows:

Reduced Market Impact

The biggest advantage of dark pools is that market impact is significantly reduced for large orders.

Lower Transaction Costs

Transaction costs may be lower since dark pool trades do not have to pay exchange fees, while transactions based on the bid-ask midpoint do not incur the full spread.

Dark pools have the following drawbacks:

Exchange Prices May Not Reflect the Real Market

If the amount of trading in dark pools owned by broker-dealers and electronic market makers continues to grow, stock prices on exchanges may not reflect the actual market. For example, if a well-regarded mutual fund owns 20% of company RST’s stock and sells it off in a dark pool, the sale of the stake may fetch the fund a good price. However, unwary investors who have just bought RST shares will have paid too much since the stock could collapse once the fund’s sale becomes public knowledge.

Pool Participants May Not Get the Best Price

The lack of transparency in dark pools can also work against a pool participant since there is no guarantee that the institution’s trade was executed at the best price. Lewis points out in Flash Boys that a surprisingly large proportion of broker-dealer dark pool trades are executed within the pools – a process known as internalization – even in cases where the broker-dealer has a small share of the U.S. market. As Lewis notes, the dark pool’s opaqueness can also give rise to conflicts of interest if a broker-dealer’s proprietary traders trade against pool clients or if the broker-dealer sells special access to the dark pool to HFT firms.

Vulnerability to Predatory Trading by HFTs

Controversy over dark pools has been spurred by Lewis’ claims that dark pool client orders are ideal fodder for predatory trading practices by some HFT firms, which employ tactics such as “pinging” dark pools to unearth large hidden orders and then engaging in front-running or latency arbitrage.

Small Average Trade Size Reduces the Need for Dark Pools

The average trade size in dark pools has declined to only about 200 shares. Exchanges like the New York Stock Exchange (NYSE), who are seeking to stem their loss of trading market share to dark pools and alternative trading systems, claim that this small trade size makes the case for dark pools less compelling.

Curb Appeal

The recent HFT controversy has drawn significant regulatory attention to dark pools. Regulators have generally viewed dark pools with suspicion because of their lack of transparency, and the controversy may lead to renewed efforts to curb their appeal. One measure that may help exchanges reclaim market share from dark pools and other off-exchange venues could be a pilot proposal from the Securities and Exchange Commission (SEC) to introduce a “trade-at” rule. The rule would require brokerages to send client trades to exchanges rather than dark pools unless they can execute the trades at a meaningfully better price than that available in the public market. If implemented, this rule could present a serious challenge to the long-term viability of dark pools.

The Bottom Line

Dark pools provide pricing and cost advantages to buy-side institutions such as mutual funds and pension funds, which hold that these benefits ultimately accrue to the retail investors who own these funds. However, dark pools’ lack of transparency makes them susceptible to conflicts of interest by their owners and predatory trading practices by HFT firms. HFT controversy has drawn increasing regulatory attention to dark pools, and implementation of the proposed “trade-at” rule could pose a threat to their long-term viability.