Our Most Popular Posts

Keep up with the most interesting topics

Recent Post

Luke Lango’s Breakout Crypto Project: Crypro Trader System Exposed

The upcoming Breakout Crypto Project event will showcase Luke Lango’s Crypto Trader quant system, designed to identify emerging cryptos before they skyrocket in value.

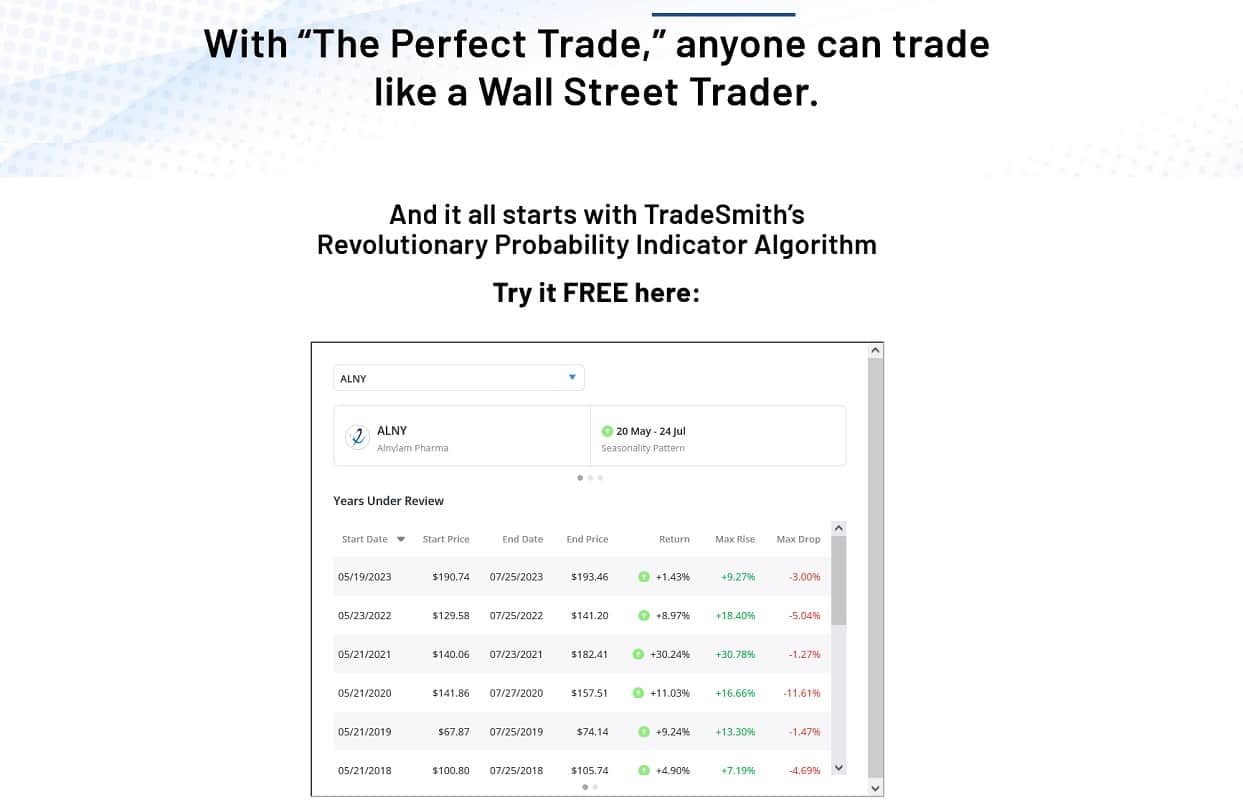

The Perfect Trade Event: Is Keith Kaplan Probability Indicator Legit?

Keith Kaplan and TradeSmith’s team claim they’ve found The Perfect Trade and scheduled an event to share the details. It is on April 18th, 2024, at 8 pm ET.

Charles Sizemore Freeport Alpha Review: Legit Money Flow Trades?

Is Charles Sizemore Freeport Alpha worth your time and money? Find out in this detailed Freeport Alpha review that covers everything you need to know about Money Flow Trades and this trading program.

Election Shock Summit – Is Louis Navellier Event Legit?

Louis Navellier is hosting a very urgent Election Shock Summit on April 10th at 8 pm ET. And it all centers on a shock he sees coming May 1st from Washington, D.C.

Navellier Quantum Cash Project: $60K Through Income Stocks?

Louis Navellier recently revealed his new retirement GAME CHANGER. He called this income generator Quantum Cash Project, one of his greatest professional achievements. Louis presented this new approach as a way to help you see at least $60,000 in payout opportunities over the next 12 months. Read further for all the details he shared during the urgent Quantum Cash Project briefing.

Chaikin’s AI Power Picks: Power Gauge Best AI Stocks Revealed

Marc Chaikin issues urgent A.I. Prediction and Warning. Read further to learn Power Gauge Best AI Stocks to Buy Now.

Eric Wade 2024 Crypto Melt-up: Crypto Capital Event

Eric Wade’s 2024 Crypto Melt-up is where Crypto Capital editor Eric Wade will reveal his favorite 3 altcoins with 5,000% gain potential.

Steven Brooks AI Trading Bot Webinar: TradeFusion Review

Steven Brooks is releasing his brand new AI trading bot, TradeFusion, to the public. Join him if you want to see how an AI trading bot can do the hunting for you 24 hours a day, and always find you the best trades.