Looking for more information about Tom Carroll’s Cannabis Capitalist Research? I’ve put an honest Tom Carroll’s Cannabis Capitalist Review, containing everything you need to know about Tom Carroll’s Cannabis Capitalist Service.

Table of Contents

- 1 Cannabis Capitalist Review – What is it?

- 2 What do you get for your money?

- 3 Who the heck is Tom Carroll?

- 4 Who is Cannabis Capitalist for?

Cannabis Capitalist Review – What is it?

The Cannabis Capitalist Portfolio is a model portfolio with more than a dozen stock recommendations that Tom Carroll believes are the best of the best in cannabis.

These are the companies you want to hold in your portfolio for the long term. Tom said he expects one of these stocks to rise by 500% in the next few years. And he says we could see similar results from the other companies in the model portfolio.

As part of the portfolio Tom included 4 recommendations that are an immediate buy as well as a roadmap for how he recommends you enter the other positions in the portfolio over the next twelve months.

The Cannabis Capitalist Portfolio is all part of Stansberry Research’s new research service, called Cannabis Capitalist.

Cannabis Capitalist will select recommendations from the best publicly traded cannabis investments in the United States major exchanges, as well as those on Canadian Exchanges, and Over the Counter markets.

One full year of Cannabis Capitalist recommendations includes a new issue each month. Tom will e-mail you the details on the latest income opportunities he finds.

You will NOT need any special options account or have to get your broker to give you special account access. And you can and should use tax-free accounts like 401(k)s and IRAs with these picks.

What do you get for your money?

At the moment of writing you can join Cannabis Capitalist for $2,500.

As a Charter Member to Cannabis Capitalist, you’ll have immediate online access to…

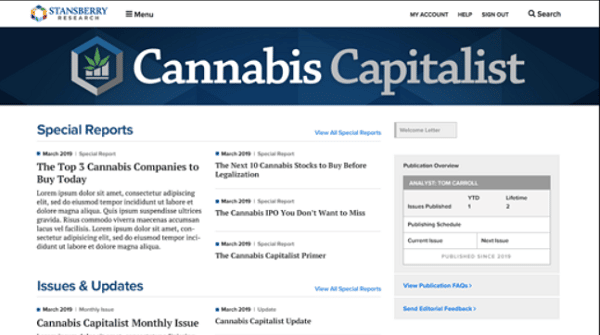

The Cannabis Capitalist Model Portfolio: The Top 3 Cannabis Companies to Buy Today.

These are Tom’s three absolute favorite cannabis companies right now. Tom says these stocks could soar hundreds of percent or more in the coming years. In this report, Tom explains everything you need to know about these companies including why he handpicked them out of dozens of other cannabis stocks. We haven’t seen these companies covered too heavily in the media… but that doesn’t mean their stories aren’t going to break soon. So be sure to review this report as soon as you can.

The Cannabis Capitalist Primer.

This in-depth report is the first thing you should read after you become a charter member of Cannabis Capitalist. It explains everything from the basics of opening a brokerage account, to buying your first cannabis stock. We’ve included specific instructions on how to manage risk and set yourself up for the best possible results. No matter how much you know about cannabis, or investing in general, this report will make sure you’re up-to-speed and confident when it comes to this booming corner of the market.

The Cannabis Capitalist Playbook: The Next 10 Cannabis Stocks to Buy Before Legalization.

Tom has combed through the cannabis industry for months, pinpointing the companies with the best chance of skyrocketing as the cannabis boom takes hold. This report contains the ten stocks he’s most excited about that he says you’ll likely have the chance to buy at better prices before the year is over. Consider this your high-priority watchlist of cannabis stocks in 2019. It’s essentially our roadmap for building out a portfolio of the most valuable cannabis investments on the planet.

The Cannabis Capitalist Members-ONLY Website.

This is where we’ll post monthly updates… special reports… as well as any changes to Tom’s model portfolio.

**BONUS REPORT** The Cannabis CapitalistProspectus: The Cannabis IPO You Don’t Want to Miss.

This special report for charter members only is unlike almost anything we’ve ever offered at Stansberry Research. It’s a report we’ve prepared on a company that isn’t traded in the stock market – at least, not yet. It’s one of the most exciting cannabis companies we’ve ever come across. And we expect it to IPO very soon. We first got turned onto this idea thanks to a friend of ours who is as high up as it comes in the world of Wall Street. He’s not a cannabis specialist. But he told us to look at this company. And once we dug deeper, we couldn’t look away. This is the kind of stock that could soar hundreds of percentage points right out of the gate. In this report, you’ll learn how to get your hands on shares of this company as soon as it IPOs, before the rest of the world catches on.

**BONUS REPORT** One Cannabis Opportunity that Could Soar 500% in the Coming Years.

During the big event, Tom shared the name and ticker symbol of an incredible, little-known cannabis stock he says is on track to soar 500% over the next few years. This in-depth report contains everything you need to know about this cannabis company, including specific buy information, important facts and figures about the company, and why Tom believes it will dominate the market as legalization takes hold.

**BONUS VIDEO** The Full Replay of the 2019 Cannabis Investing Event.

We aren’t offering any free replays of the event. But everyone who becomes a Charter Member to Cannabis Capitalist today will receive access to a full replay of the event which you can watch, in full, at your convenience.

Who the heck is Tom Carroll?

He has appeared regularly on networks like CNBC and Fox Business over the last two decades.

And he’s been interviewed and quoted by The Wall Street Journal, Bloomberg, The Financial Times, Kiplinger, The Street, CBS, USA Today.

The reason he’s received so much attention from the financial press is because Tom is one of the most respected and longest-serving health care analysts on Wall Street.

After earning his master’s degree from the Department of Healthcare Finance at John Hopkins Bloomberg School of Public Health…

He spent 17 years as an analyst and Managing Director for Legg Mason and Stifel Financial, with $752 billion in assets under management.

And during that time, he was recognized time and time again for his ability to find investments that soared hundreds of percent or more.

In 2005, for example, Fortune ranked him as the #1 healthcare analyst in the US.

In 2008, he received the All-Star Analyst Award, ranked #2 in the US.

In 2012, he won the Wall Street Journal Best on the Street Award, ranked #2 again for stock picking.

And in 2016, he received the All-Star Analyst award again, with the #3 ranking for stock picking.

Tom won these awards thanks to a history of finding incredible investing opportunities over his 20 plus year career.

For example, Tom appeared on CNBC in August of 2009, and recommended Anthem (ANTM) when shares were trading for roughly $50 because he thought the healthcare company would benefit from the rollout of ObamaCare…

Today those shares trade at around $310 for a 500% gain.

He appeared on CNBC again the following month and recommended UnitedHealth (UNH) when shares were trading at roughly $25 a share.

Today shares are trading at $270, for a 980% gain.

And 2010, Tom recommended a company called WellCare (WCG) when the stock was trading around $28.

Investors who acted on that recommendation had an opportunity to sell shares last September at a high of $320, for 1,042% gains.

Now with a history of finding red-hot opportunities like these in the healthcare sector and winning stock-picking award after award… you may be wondering…

“Why would a guy like Tom say goodbye to all that in 2017… after 20 years on Wall Street?”

The short answer, as you may have guessed, is that Tom says the opportunity to invest in a new market like cannabis is something we’ve never really experienced before in the world of finance.

In fact, as he pointed out, you have to go all the way back to 1933 — to find anything remotely like it…

Where an entire black-market economy was legalized, overnight.

To give you an idea — the last time anything like this happened — Warren Buffett was 3 years old. His 95-year-old partner, Charlie Munger, was in kindergarten.

In other words, there isn’t a single living analyst on earth that has covered anything like the opportunity we’re seeing in cannabis today.

Truth be told, frontier markets like this can offer as much risk as they do opportunity.

Which is why, we’ve spent a great deal of time and money thinking about the best way to approach investing in this new industry.

Who is Cannabis Capitalist for?

After a long 9-year bull market, it is time to seriously consider whether ordinary stocks can continue to make big gains a they have for the past 9 years.

Now is the perfect time to consider moving money into a market like cannabis that is positioned for huge growth in the coming years.

Even if the overall market doesn’t move any higher, these stocks could still conservatively soar hundreds of percent as new markets open up to cannabis here in the United States and abroad…

Of course, you could also decide to go out and research cannabis investments on your own.

But having an expert, with a proven track record of winning multiple national stock picking awards, and 20 years of experience in the stock market, including recommendations that could have made you 10+ times your money in the last few years… that’s even better.

That’s why Tom put together a great deal, for anyone who wants to try this cannabis-focused investing research service, Cannabis Capitalist.

Cannabis Capitalist will go out to readers on the second Thursday of each month. And in each letter Tom will share an update on what’s going on in the cannabis market, as well as any new opportunities he has come across that he believes you should take a stake in. Each of these cannabis opportunities are companies that you can learn how to invest in immediately right from your home computer.

It won’t be any different from buying any ordinary stock.

In every issue, he provides a market update – the full model portfolio of cannabis investments he recommends – including buy, sell, and hold recommendations on each one.

As well as his favorite new opportunities he recommends you consider.