Dan Ferris predictions and warnings about a huge market event on the horizon are turning heads in investing world. But is he really on to something? Check out my The Ferris Report review to find out.

In his new presentation, Dan Ferris talks about the destruction you’ve seen recently in stocks, bonds, and housing market. He believes that this could be just the tip of the iceberg. Because no matter the market fall, stocks today are still nearly twice as expensive as they were before the crash in 2008. Housing is more unaffordable than any other time since 2006. Some used cars are still selling more than new vehicles.

So, whether you’ve sold your stocks and are wondering if it’s time to buy back in… Or you are in your 50s, and your retirement plans depend on your portfolio recovering in the next few years.

This Ferris Report Review is for you.

In this review you will find out what comes with this service, pros, and cons, so you can decide if it is worth your time and money.

— RECOMMENDED —

What happens in the coming weeks could make or absolutely break your retirement. That’s what history has shown when stocks are falling, inflation is rising, the Fed is raising rates, and economic activity is slowing. But Dan Ferris just stepped forward with an insanely simple solution to protect your wealth.

Table of Contents

- 1 Dan Ferris Prediction about 2023

- 2 Who is Dan Ferris?

- 3 Dan Ferris Warning

- 4 What Are Dan Ferris Recommendations?

- 5 The Ferris Report Review – What Exactly Is the Ferris Report?

- 6 How much does The Ferris Report cost?

- 7 What is Included with The Ferris Report Subscription?

- 8 The Ferris Report Review: Final Words

Dan Ferris Prediction about 2023

If you hold onto your investment and are waiting for a loss recovery – you are waiting for a day that will never come.

I know this sounds very pessimistic, but Ferris strongly believes that stocks will not recover this time. At least not in the way you probably expect.

His research indicates that stock losses we all experienced are not over. Dan believes that something will happen that will send The Dow dropping down to 10,000….5,000 even lower.

As per Ferris, we are about to enter a period he refers to as a “Dead-Zone”.

Stocks will stagnate for months… suddenly a glimmer of good news will lift them a few points… only to observe the stock in your portfolio hit new record lows. Dan and his team fear this could last 5, 10, even decades until stocks hit new highs again.

History of the Dead-Zone

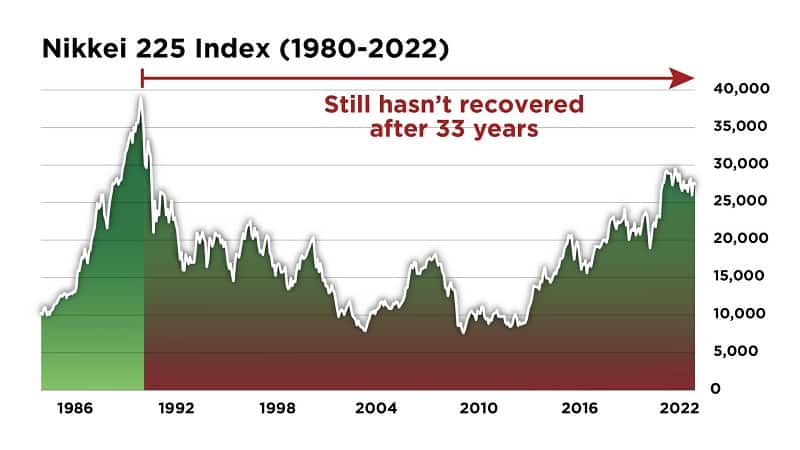

The situation we are in right now is no secret among those who study the historic bubbles we’ve been living through the years. Dan is comparing our country’s situation today with Japan back in 1989.

The bubble in Japanese stocks and real estate burst in 1989, starting a long and slow recession from which, the country has still not fully recovered more than 30 years later.

The same thing happened here in the United States back in 1965.

After the WWII, the Dow increased more than fourfold, rising from around 2,000 to over 9,000 at its high in 1966.

However, the Federal Reserve started raising interest rates in 1965 to return them to the average pre-war levels.

And no one expected what happened next…

That’s 30 years of no returns!

Consider, if Ferris is right, and we are at the very beginning of a similar “dead-zone”.

If you are over 50 years old, stocks may be at their highest point in your lifetime right now!

Following the logic “buy the dip” could be your biggest financial mistake.

I know many people are holding some “safe” stocks and believe current situation does not apply to their investments.

But Ferris is confident that even “big, safe, and boring” blue chip stocks won’t protect you.

If you are in doubt, here are few words about Dan Ferris and his work.

Who is Dan Ferris?

Since 2002 Dan Ferris is the editor of Extreme Value. This is a monthly financial guide that focuses on some of the market’s safest and most lucrative stocks. Recommending great companies trading at significant discounts.

His method of identifying secure, affordable, and profitable stocks has brought him a significant following as well as one of the best track records.

Dan is also the host of the weekly Stansberry Investor Hour podcast. He provides market insights and research findings.

Related:

Dan Ferris Crash Prediction and Warning event

Extreme Value Review – How’s Dan Ferris Advisory?

Now that you got familiar with Dan Ferris and his work, I would like to give you some more information about the warnings that he is sharing with his followers during his presentation. Of course, if you have time, better hear them directly from him.

Dan Ferris Warning

Stocks that give you feeling of fake security

Even the “greatest” and supposedly “safest” stocks in the United States crashed after the bubble burst in 1966:

- IBM, fell 57% and did not get back to even for nine years

- Disney’s stock fell 83% in less than two years (lots of people talk about buying Disney lately)

- Coca-Cola fell nearly 70%

- General Electric fell nearly 60% and both took nine years just to get back to even.

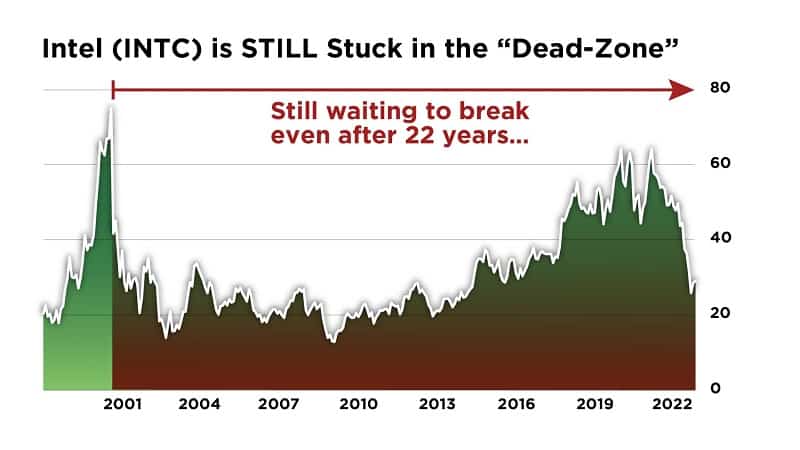

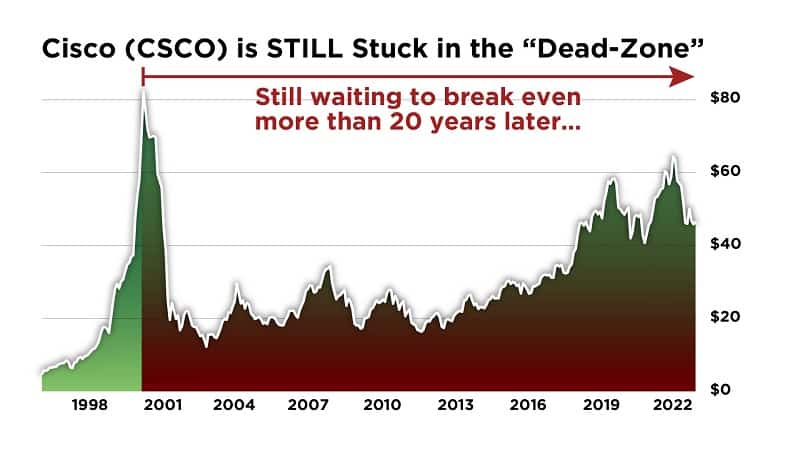

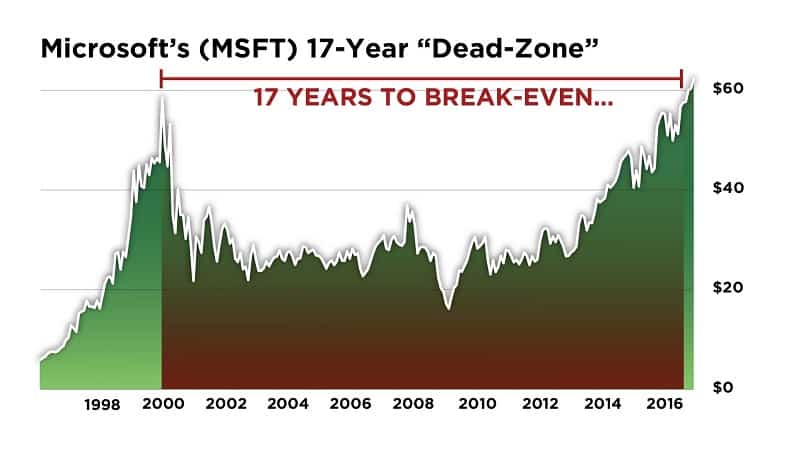

If you think that the largest winners from the past ten years, such as Amazon, Facebook, and Google, can keep you safe…Look at these charts:

People that bought Intel back in 1999 haven’t broken even yet.

CISCO is still waiting to break even more than 20 years later

You’ve been 17 years in the red on Microsoft, one of the world’s best dividend generators and cash cows!

Dan believes that there is no difference if your portfolio includes many of the best and most prosperous businesses in human history. Every asset on the earth, including these businesses, is in the same enormous bubble.

Amazon trades for more than nine times all the profit it has ever made since its 1994 founding.

Facebook is the most successful human enterprise in history with its 2 billion users. But that hasn’t stopped it from falling by half since the peak. And Ferris thinks this won’t stop it from falling another 50% or more.

Bottom line: don’t fall into the trap of thinking that the best investments of the last 10 years will look anything like the best investments of the next 10 years.

What Are Dan Ferris Recommendations?

Dan believes it is time to move your money into investments that could grow even if the rest of the market falls another 50% or more.

It does not require to open new accounts or invest your money in risky or secretive transactions or anything of the sort.

You only need to get familiar with this opportunity and take advantage from the tremendous SHIFT that has taken place.

Here are the steps you should take:

Dan Ferris Recommendation 1: Sell these stocks right away!

Dan and his team made a list of 12 most dangerous companies these days. The chance is you own some of these stocks already.

You can find the complete list in a special report called: Avoid at All Costs – These Stocks Will Never Trade This High Again in Your Lifetime.

Inside this report is valuable information about which investment sectors to avoid. The kind of investments Dan and his team expect to fall the furthest as this all plays out.

This report includes investments totally outside the stock market that many Americans currently own.

You will learn exactly what to look for in your retirement account (like a 401k) to make sure you aren’t at risk.

Dan Ferris Recommendation 2: Move your money to these investments

The next thing you need to know is what investments are likely to maintain and grow the value of your money in the coming years.

Of course, Dan does not recommend you put all your money in one place. Nobody who is serious investor would advise you to do that.

Dan and his team put everything you need to know to get started in a brand-new report called: The Best of the Best – The ONLY Stocks That Can Safely 8X Your Money During America’s “Dead-Zone.”

It includes the names and ticker symbols of the stocks they think will soar higher than any others over the next few years.

Since the government started its unprecedented money production in response to the pandemic, these stocks have already increased by about 100%. But they still have a long way to go.

Dan Ferris Recommendation 3: Get some money different than U.S. Dollar

Due to extremely low interest rates and extra stimulus spending totaling trillions of dollars over the last few years, the government has harmed the economy. We haven’t seen such a high inflation since the 1970s.

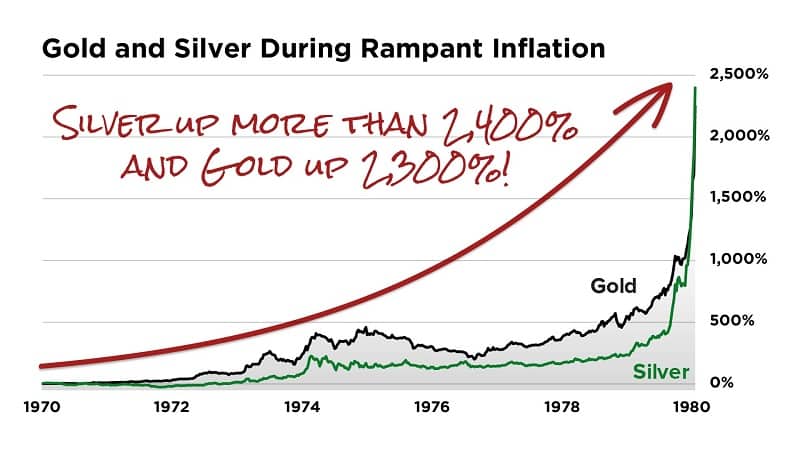

During the 1970s, the price of silver went up 2,400% and the price of gold went up 2,300%.

Dan recommends every American to go out and buy gold and silver bullion and to keep it in a safe place.

But he also recommends something totally different, which most likely you’ve never considered.

You only need a few hundred or a few thousand dollars to get started. However, you may see your investment move four or five times more when gold and silver values change.

Ferris believes the chances are to make gains of 1,000% or more over a period of several years.

Keep in mind: This is a pure and absolute speculation. You will almost certainly have a few losses along the way. But it’s very low risk because you should be making a very small bet.

Ferris and his team gathered all details in another report called: Trade Your Dollars for Potential 1,000% Gains Thanks to Gold and Silver.

But be careful. Stay with his other recommendations if you can’t afford to speculate or if you can’t afford to lose money.

Dan Ferris Recommendation 4: Stocks that Dan considers recession heaven, and more

Everything is explained in “The Recession Haven That Could 7X Your Money in 10 Years”

It’s perfect for people that want to keep money in the stock market with less risk.

These are some of the most financially secure businesses in the world, and they will suffer much less during this crisis than anyone else.

You can invest money in these businesses today without risk, and you probably won’t need to think about them again for the next five years.

By the way, while the rest of the market is down roughly 20%, all these equities are up by double digits this year!

You can all these reports for FREE when you subscribe to The Ferris Report service.

The Ferris Report Review – What Exactly Is the Ferris Report?

Here we tried to answer the most popular questions people ask when they first hear about The Ferris Report:

- How often The Ferris Report is published?

The Ferris Report is a monthly advisory, delivered on the fourth Wednesday of each month. It usually hits subscriber’s inbox around 5 pm Eastern Time.

- What recommendations are included?

Investment recommendations you will find are based on macro and micro trends.

- What industries are covered?

You can count on The Ferris Report to provide financial advice that will give you a direct stake in the significant trends happening right now and during the challenging times to come.

It covers wide range of industries.

- What will we buy?

Most investment recommendations will fall under one of two categories: individual stocks or baskets of stocks held by exchange-traded funds (“ETFs”).

Most individual stocks will be large, liquid corporations that are simple to buy and sell. Typically, companies with at least $1 billion in market cap.

ETFs let you purchase entire sectors, such as semiconductors or aerospace and defense, in just one transaction. Additionally, they also allow investors to buy representative baskets of stocks from various countries, including Japan, China, or the United Kingdom.

Large, liquid stocks and ETFs are among the easiest securities in the world to buy and sell quickly.

- How much money should I have to start?

You can start with as little as $1,000 with one or two shares per recommendation.

- What is the holding period?

It is difficult to know in advance. Typical holding period is between few months to few years.

Dan and his team usually make recommendations to benefit from medium- and long-term trends that last years, even decades.

On rare occasions, they may recommend buying inverse ETFs.

How much does The Ferris Report cost?

Normally 1-year subscription costs $199. Current promotion gives 75% discount.

For short period of time, you can become subscriber for only $49 for the first year.

They have great refund policy. If you are not happy with Dan’s work, just let him know within 30 days of your order. You will receive full refund.

This makes it 100% risk-free.

What is Included with The Ferris Report Subscription?

When you become a member, you will receive one year of Dan Ferris’ work and the following additional benefits:

- Full access to The Ferris Report Model Portfolio

- FREE Special Report: Avoid at All Costs: These Stocks Will Never Trade This High Again in Your Lifetime

- FREE Special Report: The Best of the Best: The ONLY Stocks That Can Safely 8X Your Money During America’s “Dead-Zone”

- FREE Special Report: Trade Your Dollars for Potential 1,000% Gains Thanks to Gold and Silver

- FREE Special Report: The Recession Haven That Could 7X Your Money in 10 Years

- FREE BONUS: The World’s Two Most Valuable Assets in a Time of Crisis

- Special email alerts and updates throughout the month

- Dan’s complete archive of issues and special reports

- The Stansberry Digest – you will start receiving Stansberry’s daily market news report. They send it every weekday after the market closes. You will also hear from Dan Ferris every Friday with info about major financial stories on the market.

- Stansberry Investor Hour podcast hosted by Dan Ferris. It is delivered every Monday. You will have the chance to hear valuable, unfiltered information from some of the greatest minds in business, investing, and political affairs.

The Ferris Report Review: Final Words

Dan Ferris became stock analyst at Stansberry Research almost 20 years ago. Their team includes more than 200 employees worldwide. They are all working toward the same objective: to manage a successful company that assists individuals in making the best financial decisions possible. Joining their world could be one of the best decisions you’ve made this year.

Here are Pros and Cons of this The Ferris Report:

The Ferris Report Pros

- Great service from reputable research company

- Current promotion gives the best price possible

- 100% risk free with 30 days money back guarantee policy

- Stock and ETFs recommendations from wide range of industries

- Low starting capital (as little as $1,000)

- Promotion includes generous package with bonuses.

The Ferris Report Cons

- Does not include options

- Mostly oriented to medium- and long-term trends. Occasionally may recommend buying inverse ETFs.

- This service is not well suited for daily traders because of the monthly stock or ETF pick.

Overall, The Ferris report is an excellent service at a great price. The package includes valuable special reports to exploit opportunities during one of the largest financial bubbles in the history.

If you are on the market for medium and long-term recommendations, this could be the right service for you.

Sound like a good fit? Sign up HERE for 75% off

Good luck!

1 thought on “The Ferris Report Review (I Joined)”