Looking for more information about Luke Lango’s Early Stage Investor research? I’ve put an honest Early Stage Investor Review, containing everything that we know so far about Luke Lango’s service.

Get Early Stage Investor Here – Best Offer + Bonuses

Table of Contents

- 1 Early Stage Investor Review – What Is All About?

- 2 What are venture capitalists? And how do they earn such massive returns?

- 3 Grand Slam Portfolio Management

- 4 What’s Included With Your Early Stage Investor Subscription?

- 4.1 The Next Nvidia: 7 AI Moonshots With 100X Upside Special Report

- 4.2 A Full Year of Luke Lango’s Early Stage Investor

- 4.3 10X Returns In AI Healthcare Bonus Report

- 4.4 The Top 10 Investment Opportunities In AI Startups Bonus Report

- 4.5 SUPRMAN Stocks: 7 Plays for the Coming AI Boom Bonus Report

- 4.6 Buy and Sell Alerts

- 4.7 Exclusive Members-Only Website

- 4.8 U.S. Based Customer Support

- 5 Early Stage Investor Subscription Fee

- 6 Early Stage Investor Refund Policy

- 7 Early Stage Investor Review – Is It Worth It?

- 8 Who is Luke Lango – the man behind Early Stage Investor Newsletter?

Early Stage Investor Review – What Is All About?

Early Stage Investor Research is a Premium-priced monthly newsletter that seeks to recommend small or early-stage investments.

Early Stage Investor – How it works?

Early Stage Investor is geared for investors who are looking to make massive gains from the best early-stage companies that will change the world.

Generally speaking, you’ll hold these recommendations for 3 to 10 years, sometimes longer if our profits continue to soar.

When it comes to extreme wealth creation, few endeavors can compare to being an owner of a small company that grows large.

Let’s take a look at an example to illustrate what I’m talking about here.

Imagine being an early investor in Microsoft… you could have made over 9,000% during the 1990s. That type of gain turns every $5,000 invested in $450,000.

It only takes one of these big hits to make a huge amount of money in early-stage companies. And that is why it is critical that you approach the companies Luke Lango recommends in this service with a “venture capitalist” mindset.

What are venture capitalists? And how do they earn such massive returns?

Venture capitalists are the early backers of start-up companies. They are the grand slam, home run hitters of the investment world. They don’t look to make 300% on their investments. They look to make 3,000%… even 30,000% on their investments.

Make just one great venture-capital investment and you’ll probably never have to worry about money. Venture capitalists have funded nearly every mega-hit technology company you know today: Google (now Alphabet), Facebook, Twitter, Uber, Airbnb, Pinterest, and the list goes on and on.

Before the public learned about these innovative businesses, venture capitalists were there, performing due diligence and making early investments.

By the time regular stock market investors hear about your average technology winner like Google, venture capitalists have made more than 2,000% on their original investments. And while we don’t recommend non-public companies in my Early Stage Investor research service, we still very much employ a venture capital mindset.

Luke Lango and his team are looking to hit grand slam home runs. They are looking to make hundreds, even thousands of percent returns in the world’s best early-stage public companies.

Grand Slam Portfolio Management

To the average investor, a 33% “win rate” on stock buys is a depressing thought. Having a high “win rate” – like “8 out of 10 stock picks are winners” – is important to average investors.

However, the best venture capitalists and professional traders don’t place any emphasis on “win rate.” They know that with a good strategy, you can be right just 33% of the time and make a fortune in stocks.

Early-stage stocks are among the riskiest securities in the market. They are more volatile and have higher failure rates than established businesses like Walmart and Coca-Cola. That’s just the nature of the game… and that’s why the payoffs in early-stage investments can be so huge.

Because early-stage companies can produce such gigantic capital gains – and because they have higher failure rates than established businesses – it’s vital to understand a key money management principle used by the best venture capitalists.

As an early-stage investor, you’re not going to achieve success on 100% of your investments. You probably won’t achieve success 75% of the time… or 66% of the time. And that’s fine.

When you invest like a venture capitalist, you can be right just 33% of the time and still make HUGE returns.

Some simple math shows us how it works… Let’s look at a hypothetical investment example.

On December 1st, you structure a “venture capital” portfolio of 12 promising businesses. You hold them for a year. The returns of these 12 stocks are listed below:

In this example, four went up and eight went down. You were right 33% of the time. But because you hit just a few big winners, you made a great average return of 40% across the 12 positions.

Over the past 60 years, the legendary trader George Soros has made more than $20 billion in the financial markets. Soros is a genius at knowing how government actions affect markets. He’s skilled at finding industries poised to boom. But there’s a simple mindset that’s more responsible for Soros’ success than either of those things. Soros once summed it up like this:

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.”

Soros didn’t focus on how often he was right. He focused on making his successes big and meaningful… and making sure his mistakes were small and manageable. That’s what we need to do as well.

I get how people feel the need to be right. I like to be right as much as anyone. In my early years as a stock broker, I had a boss once ask me, “Do you want to be right or rich?” I did not answer him, but I knew immediately what the correct answer was. I try to reduce my downside risk as much as possible. But the simple fact is that early-stage companies carry risk. I know I’m not going to be right 100% of the time.

The good news is, when you make sure to win a lot when you’re right, and only lose a little when you are wrong, you can be right just 33% or 50% of the time… and still make huge profits in early-stage companies.

What’s Included With Your Early Stage Investor Subscription?

Here’s everything you’ll get when you act today:

The Next Nvidia: 7 AI Moonshots With 100X Upside Special Report

You’ll get the names and tickers of these 7 tiny AI Moonshots poised to go exponential BEFORE the AI Turning Point arrives. (Luke’s favorite is 333-times smaller than Nvidia, and you can buy in with just $100 or less.)

A Full Year of Luke Lango’s Early Stage Investor

You’ll get access to all of Luke’s moonshot recommendations for the NEXT phase of the AI boom, giving you a chance to chase 1,000% long term potential. You can expect as many as 24 new recommendations over the course of your membership.

10X Returns In AI Healthcare Bonus Report

You’ll get access to 3 tiny stocks Luke believes have “10X potential” that are transforming the future of healthcare. One trades for just around $2 a share.

The Top 10 Investment Opportunities In AI Startups Bonus Report

In this special report, Luke has identified hidden “loopholes” to buy into the 10 hottest AI startups in the world. You don’t need to be a venture capitalist to take advantage.

SUPRMAN Stocks: 7 Plays for the Coming AI Boom Bonus Report

Luke made his own investing acronym in 2018 with Shopify, Trade Desk, Adobe, Roku, and Square – calling them STARS. Just $10,000 into one of those plays could’ve netted as much as $180,000. Now he’s doing it again.

Discover 7 more bonus moves to make today.

Buy and Sell Alerts

You’ll get alerted the moment Luke is ready to pull the trigger on a new opportunity. And when it’s time to sell, Luke will send you an alert to take potential profits.

Exclusive Members-Only Website

This is where you’ll be able to access all of Luke’s critical alerts, urgent insights, important updates, the members-only model-portfolio and more.

U.S. Based Customer Support

You can get in touch by phone or email any time Monday–Friday, 9 am–5 pm ET.

Early Stage Investor Subscription Fee

Because this AI Turning Point could transform the ENTIRE $15.7 trillion AI boom in just a matter of days…

Luke Lango and his team are temporarily lowering the cost of entry by more than 25%! That means today you can join Early Stage Investor for just $1,799.

Early Stage Investor Refund Policy

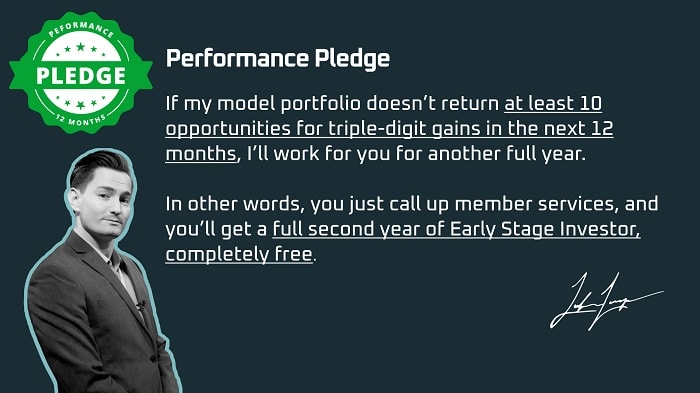

You’ll also be protected by…

AND…

Early Stage Investor Review – Is It Worth It?

Don’t miss this chance to buy all 7 of Luke’s tiny AI Moonshots poised to go exponential when the AI turning point arrives! Luke says we may NEVER see this kind of AI catalyst trigger again in his lifetime.

Luke’s favorite pick is 333-times SMALLER than Nvidia and right now you can accumulate a small position with just $100 or less. It’s a company Luke believes could soar 2,000% or more.

You could be well on your way towards chasing 1,000% profit potential and more as the AI revolution intensifies.

Who is Luke Lango – the man behind Early Stage Investor Newsletter?

As a teenager, he worked with the Philadelphia 76ers’ front office to design advanced data analytics models for analyzing incoming draft prospects.

He was personally asked by the former general manager of the Los Angeles Dodgers to be a founding member of his venture-backed sports data analytics business.

He got a near-perfect score on his SATs and his ACTs.

He founded a popular social media company with backing from one of the great venture capitalists of our day, the legendary Bill Gross.

He was even selected as an NBA Players Association top 100 high school prospect.

But it was when he began making stock market forecasts, out of his dorm room at Caltech, that the world sat up and really took notice of Luke Lango…

He was among the first to call attention to a small $2 company called AMD in 2015.

Shares have since soared to as high as $97,4 giving his followers the chance to see gains as high as 4,855%.

He forecasted the enormous growth of Shopify in 2017.

Shortly after, Shopify became one of the biggest e-commerce success stories… The stock soared as high as 1,394%…5 and made shareholders substantial amounts of money.

He forecasted the rise of in-home “streaming” services and recommended investing in Netflix and Roku before they became household names.

Blink Charging, as high as 3,332%…

Plug Power, as high as 2,513%…

And industry leader Tesla before it shot up as high as 2,215%…

Luke even identified what was probably the biggest story in the stock market over the past few years before just about anyone else…

The meteoric rise of video game retailer GameStop.

Anyone who acted on his recommendation14 had the chance to see 71 times their money in less than 18 months…

All investments carry risk. These are some of Luke’s best calls; his average gain since inception is 136.7%.

All of this helped him achieve a coveted #1 stock picker ranking in 2020 by TipRanks, a leading independent financial accountability group.

Prior to InvestorPlace, Luke was the founding manager at L&F Capital Management, LLC, a boutique investment fund based in San Diego that combined quantitative analysis with behavioral economics to identify long-term growth investments at early stages.

2 thoughts on “Early Stage Investor Review – How’s Luke Lango’s Newsletter?”