Jason Bond Picks Introduction

Jason Bond Picks is a subscription-based trade alerts service. The chatroom offers 10-20 intra-day trade alerts with a daily profit goal of $500 and up to ten weekly swing trade alerts with an annual profit target of $100,000. The Swing & Long-Term Trading newsletter offers a weekly combination of up to two swing trades and up to three long-term trades delivered via e-mail and text messenger. The Millionaire Roadmap service combines all the services in an annual package in addition to special access to the VIP chatroom, special direct access to Jason Bond’s live brokerage platform and mentorship/training webinars.

Jason Bond Picks is a service that provides day trading and swing trading picks. They have a library of training videos and a live chat room with a moderator and members who post their day trades in the chatroom. Jason looks like he has been posting picks for multiple years and he is pretty open about his past trade performance. If you ask, he will provide you a spreadsheet of all his trades in his account.

He trades tocks under $10 and some under $1.00 with a market capitalization focus of $100 million to $2 billion. The focus is on liquid volatile (“high-beta”) LOW Priced stocks and the goal is 5-20% profits in a very short amount of time.

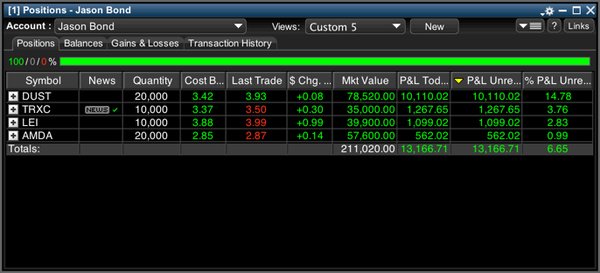

Here is a screenshot of a Profit/Loss from Jason’s account of positions he was holding so you can get an idea of the stocks he is trading.

As you can see from the image above, Jason trades large number of shares on low priced stocks so the % moves can be as little as 5 cents a share.

What do you get for your money with Jason Bond Picks – Swing & Long-Term Trading?

Swing & Long-Term Trading

Whether you’re a trigger-happy trader looking for great profit opportunities, or a busy working professional who wants to lock in steady weekly gains without being chained to a computer all day… my proven, market-tested system will quickly put you on the “fast track” to becoming a winning stock trader!

Get up to 10 swing trade alerts per week via text & email

Prefer to make your trades at a slower pace? If you’re a busy professional looking to make a few trades a week to grow your net worth, or improve your quality of life, then our Swing Trading program is perfectly tailored to fit your needs and goals.

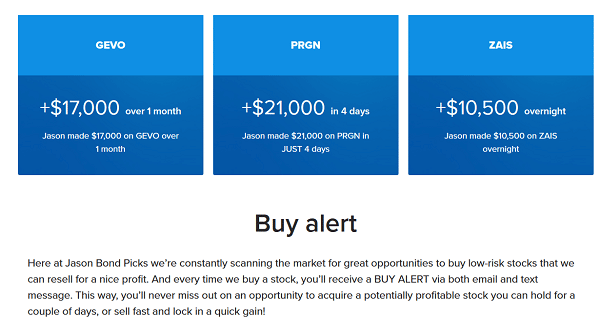

Buy alert

Here at Jason Bond Picks we’re constantly scanning the market for great opportunities to buy low-risk stocks that we can resell for a nice profit. And every time we buy a stock, you’ll receive a BUY ALERT via both email and text message. This way, you’ll never miss out on an opportunity to acquire a potentially profitable stock you can hold for a couple of days, or sell fast and lock in a quick gain!

Sell alert

Every smart trader knows that making big money in the stock market is all about timing. And with today’s high-speed electronic trading, choosing the right time to buy, how long to hold a stock, and when to sell it will be crucial to your success as a trader. And that’s why my team and I will not only send you an alert when we’ve bought a specific stock, we’ll also send you a SELL ALERT via email and text message when we sell. This way you can learn from Jason’s profitable strategies in real-time! We don’t want you to just copy Jason’s trades, though many do, we want to teach you how to make your own amazing trades as well!

Long-Term Trading

Every week, Jason Bond will send you a perfect mix of long-term trades to compliment his swing trades.</p >

These high-octane, high-potential stocks are carefully selected by Jason. These easy-to-follow trades offer excellent profit potential for busy people just like you.

Of course you are free to learn Jason’s strategy, do your own research, and pick your own stocks, but you’ll also have the option to follow Jason’s lead when it comes to selecting the right stocks to trade for maximum ease and profitability!

So why complicate your life?

Now you have a smarter, easier and faster way to get into the long-term trading game, and start profiting from Jason Bond’s expertise and proven track record of consistent BIG GAINS… all for a very special introductory price!

Daily watch list

To make winning trades, you’ll need to follow a system with a proven track record of success. Stock watchlists are one of the key components of the service we provide our members. That’s why I’ll be sending you a daily watch list that’ll help you track the same stocks I’m personally monitoring. My daily watchlist can also help you catch stocks when prices fall, so you’ll have a chance to buy them on the cheap, and take your profits, after prices have increased.

Full access to education suite

One of the best investments you can possibly make as a trader is in your ongoing education and training when it comes to choosing the best stocks to buy, sell or hold in your portfolio for quick profits, or longer-term gains. That’s why we provide our members with unlimited 24-hour access to our highly-acclaimed education suite chock full of videos and other valuable content you can immediately start using to become a more successful trader and investor.

What’s The Cost of Jason Bond Picks – Swing & Long-Term Trading?

The service has a fee of $399 each quarter.

Your Membership Includes BOTH:

Swing Trading:

- Designed to help you make money without being chained to your computer all day

- Perfect for working professionals without the time to day trade but still want to actively trade the market

- 3 – 5 swing trade alerts per week on stocks under $10 with 1 – 4 day hold times

- Conservative 5 – 20%, rinse and repeat

- All entries and exits in real time by email and text

- Works for small accounts but is scalable for fat cats

- Goal is $100,000 a year in profits

- Daily watch list and full access to education suite

Long-Term Trading:

- Designed for the busy professional who wants to make serious money trading and investing in the stock market… but does not have enough time

- An extensive watchlist of carefully-selected stocks with long-term potential for excellent gains

- 3 to 7 open long-term trades each week

- Returns exceeding 100% in just months

- Email & text alerts delivered to you via email and text message every time Jason buys or sells a stock

- ADDED BONUS: JACKPOT penny stocks with ten beggar potential. Full research reports. Watch Jason bet big and win big!

What do you get for your money with Jason Bond Picks – Millionaire Roadmap?

Jason Bond Picks – Millionaire Roadmap

Millionaire Roadmap is Jason Bond Picks premium mentorship program for students willing to spend a staggering $8,000. Jason currently has two millionaire students, Kyle Dennis and Petra Hess who host webinars for mastermind members. Both have gone on to create their own services – Biotech Breakouts – The Nucleus and Petra Picks respectively. Kyle Dennis was the first huge success story as he turned $15,000 into 1,000,000 by applying Jason’s swing trading strategy to biotech’s.

Millionaire Roadmap Benefits:

- Direct access to his team of mentors with different strategies these include; Petra Hass (blue chips), Bart Van (day trading), Jeff Bishop (options) and Alan Marshall (small caps). Apparently these are all self-made millionaire traders. Jeff Bishop was actually Jason’s first mentor.

- Jason live streams from his Etrade and TD Ameritrade brokerage accounts.

- Daily watch lists and video recaps.

- Video lesson library is great for beginners.

- Access to all of Jason’s DVD’s.

- Question and answer sessions for private members.

- Free mastermind meetups at locations such as Las Vegas, Miami and Boston.

- Swing and day alerts right to your email or smart phone.

The Millionaire Roadmap will equip you with The Skills You Need to Succeed

Master the MINDSET

Belong to the only mentoring and mastermind program with the personalized access, guidance and connections you need to become a high-performance stock trader who captures bigger, faster profits… consistently!

Master the METHOD

Get unparalleled VIP access to my proprietary “street-smart” method for locking in massive gains week after week. Learn play-by-play the exact bulletproof strategy and tactics I used to skyrocket my profits past $330K, while exploding my personal etrade account by 330% during 2016.

Master the MARKET

When you develop the winning mindset of top-performing traders, and combine it with my powerful, time-tested method, you’ll have the edge you need to master the market, and potentially double, triple, even 10x your gains. And you can do it, even as a part-time trader.

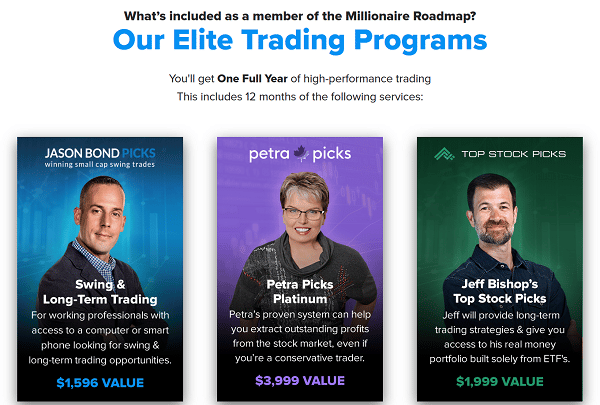

What’s included as a member of the Millionaire Roadmap?

Elite Trading Programs

You’ll get One Full Year of high-performance trading. This includes 12 months of the following services:

Private Millionaire Roadmap

Chat Room

As a member, you can chat directly with Jason Bond, along with his team of high-performance traders in the private Millionaire Roadmap chat room

Live email and Text alerts

Email alerts get sent directly to your inbox and text alerts get sent directly to your mobile device:

Video Watch List

Start each day with a quick video watch list and end each day with a quick video wrap up

All of Jason’s DVD programs

As a MR member, you’ll get complete access to all of Jason’s DVD programs for FREE (a combined $4,996 value!)

What’s The Cost of Jason Bond Picks – Millionaire Roadmap?

The service has a fee of $9,999 yearly.

As a member of Millionaire Roadmap, You will get exclusive access to the following benefits:

– You’ll get a full year of Jason’s Swing & Long-Term Trading, valued at $1,596

– Learn from Jason’s mentor, Jeff Bishop, with a full year of ETF trading at Top Stock Picks, valued at $1,999.

– Behind the scenes access to incredible options trading strategies by Jeff Bishop including live streaming access to his options account

– Look over Jason’s shoulder with live streaming access to his E*TRADE account – watch every single trade he makes in real time

– You’ll get a full year of Petra Picks Platinum, valued at $3,999

– Talk directly to Jason Bond in his private Millionaire Roadmap chat room

– Email and text alerts get sent directly to your inbox and mobile device

– Begin each trading day with a video watch list and end of the day with a quick video wrap up

– Learn how to master Jason’s secret “street-smart” strategies during live trading webinars

– Complete access to ALL of Jason’s DVD programs included for FREE (a combined $4,996 value!)

– Jason will personally challenge and support you in attaining results

– Get serious about taking your income to the next level

– Private members-only Q&A sessions with leading guest experts in stock trading and long-term investing.

– Jason has already awarded a Porsche to his top student who turned $15,000 into well over $1,000,000 in just 2-years with Jason. Will YOU be next?

– Petra’s proven POWER TRADING SYSTEM guides you along the path to higher, more consistent trading profits – while managing risk, valued at $1,999.

– MasterMind MeetUps in Miami, Dallas, Boston and Vegas. Attend any and all conferences held around the country FREE, valued at $999.

The Pros and Cons of Jason Bond Picks Swing Trading

Pros

My favorite part of being a subscriber is benefiting from Jason’s dedication to working one-on-one with people. Although he manages all elements of this service, he still responds directly to emails and direct inquiries, creates helpful videos, and runs weekly webinars.

I have truly never experienced this level of customer service and legitimate dedication to helping clients succeed. He’s hugely qualified for the position, according to both his track record and the reviews left on his website. Another testament to his success is that many of his subscribers have been around for years and have grown their investments and skill with his help.

This is a good sign that Jason’s strategies are working out for his members.

From a practical standpoint, Jason Bond Picks has also reliably and consistently provided me with accurate daily picks. I have benefited a great deal from his daily pick list in addition to all of the supplemental educational material that has taught me more about trading in general.

The videos in particular are excellent, concise, and easy to follow for both beginners and more experienced traders.

The chat room is also a very valuable resource. Even if you are a beginner, this is a friendly environment where one can ask questions and begin to experiment with day trading in a fairly low stakes environment.

The training videos are decent at explaining the types of trades he is looking for and how he scans for stock ideas but there is nothing especially unique about his approach.

The earlier videos were done 3-4 years ago but the content is still relevant.

The videos go through in detail how he finds stocks, what chart patterns to look for, and lots of videos about technical analysis based on trades he did.

Essentially, the stock setups that Jason focuses on are:

- Oversold stocks that have seen a large recent drop and are technically ready to bounce.

- Continuation pattern within an existing trend

- Breakout from current trend

The selection criteria is based on popular chart patterns and candlestick charts.

He emphasizes that you should take the information taught and implement it for your own trades rather than focus on following his trades which I think is good advice since many of his trades would be hard to replicate(small moves and intraday trades).

Cons

Being a subscriber of Jason Bond Picks comes with tons of perks and advantages. That being said, there are a few downsides – and one of them, as with any high-end program, is the cost.

This program is not cheap. It’s a fairly serious investment for some who are just getting started and aren’t sure about their dedication to trading. But as they say, you get what you pay for. And in my experience, that rings true in this case.

However, if you follow Jason’s advice and legitimately invest a reasonable amount of your time, money, and effort into the program, you will see a great and fairly immediate return on investment. It’s worth the risk- I took the leap a few years ago and have not regretted my initial investment once. The cost of membership paid for itself in my first week just by a single trade on Fitbit (FIT).

Who is Jason Bond?

Jason’s story has appeared in Forbes, The Huffington Post and Seeking Alpha. But, until now – very few have been exposed to the strategy behind it. Now you’ve got a chance to peek behind the curtain. Jason has agreed to host a special – one time only – online training event.

In this Exclusive Training you’ll learn:

- The 3 simple profit-hunting chart patterns to pull in 5-20% returns per trade

- How to trade and NOT be chained to desk doing any market research

- Proven geometric formulas to predict high-probability trades (and discover the #1 secret tool he uses to scan for them)

- How to use the 2 most important indicators he uses to buy stocks at the base of the “fish hook” and potentially rake in profits

- How to isolate “resting trends,” buy them, and watch them snap back to life – surging ahead to hand you an extra $2,000-3,000 per month

Since 2013 – Jason has helped train over 5,000 other traders.

George L. writes, “I just broke $100,000 in profits today JB! 6 figures profit with your picks. Thank you so much for the $IWM trade.”

Michael B. says he earned “+$5180 on $SNAP Mar 31 calls from yesterday. Thanks JB!”

Now you’ve got an opportunity to be his next success story…

Jason’s even throwing in a copy of his best selling DVD – “The Secrets of Swing Trading” – to anyone who attends. It normally retails for $999.

You’ll get it absolutely free.