On August 26, 2025, Chaikin Analytics, a prominent name in stock market research, hosted its inaugural “Ask Me Anything” event, featuring Wall Street veteran Marc Chaikin. Broadcast from New York City, just steps from the New York Stock Exchange, the event marked a significant departure from traditional financial webinars. Unlike previous broadcasts that introduced new analysts or strategies, this “Ask Me Anything” event was designed to directly address the concerns and questions of Chaikin Analytics’ followers.

With over a thousand questions submitted since the event’s announcement in July, Chaikin, joined by publisher Victor Lederman, tackled a wide range of topics, from the U.S. dollar’s recent decline to the booming sectors of artificial intelligence (AI) and nuclear energy. The event also introduced an unprecedented “open house” offer, granting access to Chaikin’s premium research services at a significant discount, making it a landmark moment for retail investors.

Below, I’ll dive into the insights shared during the “Ask Me Anything” event, exploring Chaikin’s perspectives on the economy, investment opportunities, and the proprietary Power Gauge system. It also examines the significance of the open house offer and its implications for investors navigating an uncertain market landscape.

The Setting and Purpose of the “Ask Me Anything” event

The “Ask Me Anything” event took place in New York City, a fitting backdrop given Chaikin’s 50-year career on Wall Street, which began in the city. Chaikin, now based in Connecticut, reflected on his early days in New York, emphasizing the nostalgic significance of returning to the financial hub. The event was hosted by Amy, a familiar voice to Chaikin Analytics subscribers, who facilitated the discussion between Chaikin and Lederman, the latter making his first on-camera appearance.

The purpose of the “Ask Me Anything” was clear: to provide clarity and reduce fear among investors facing a volatile market environment in 2025. The event was not about promoting new products or strategies but about answering the most pressing questions submitted by followers. Topics ranged from macroeconomic concerns like the U.S. dollar and Federal Reserve policies to specific investment opportunities in gold, AI, and nuclear energy. The “Ask Me Anything” also included a detailed discussion of the Power Gauge system and a lightning round addressing individual stock queries, culminating in the announcement of the open house offer.

Marc Chaikin: A Wall Street Veteran’s Perspective

Marc Chaikin’s credentials as a 50-year Wall Street veteran lent significant weight to the “Ask Me Anything”. His experience spans multiple market cycles, from the inflationary periods of the 1970s to the tech boom of the 1990s and the post-COVID recovery. Chaikin’s approach is rooted in quantitative analysis, and his Power Gauge system, which evaluates stocks based on 20 factors across Financials, Earnings, Technicals, and Experts, has become a cornerstone of Chaikin Analytics’ offerings. During the “Ask Me Anything” event, Chaikin emphasized the importance of data-driven investing, urging attendees to ignore sensationalist headlines and focus on actionable insights.

Chaikin’s perspective was particularly valuable given the market’s volatility in 2025, driven by tariff policies, inflationary pressures, and geopolitical uncertainties. He drew on historical parallels, such as the dollar’s recovery after the 2018 trade war and the 2022 COVID crisis, to reassure investors of the market’s resilience. His confidence in the Power Gauge’s ability to identify opportunities, even in turbulent times, was a recurring theme throughout the event.

Victor Lederman: The Self-Taught Investor

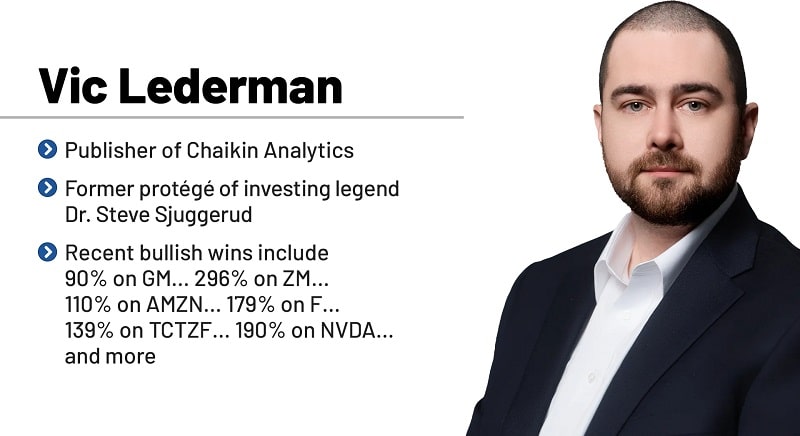

Victor Lederman, Chaikin Analytics’ publisher since 2023, brought a unique perspective to the “Ask Me Anything”. A self-taught investor with no formal financial education, Lederman has achieved remarkable success using the Power Gauge, tripling his portfolio over 18 months and gaining 19% since January 2025, more than double the S&P 500’s 8% return. His market calls, including a 50% rise in the SPDR S&P Homebuilders ETF (XHB), 86% in Amazon, 71% in the SPDR S&P Regional Banking ETF (KRE), and 108% in Walmart, underscored his analytical prowess.

Lederman’s relatable background resonated with retail investors. His story of building custom cooling fans for his home computer and his hands-on approach to improving the Power Gauge’s user experience highlighted his innovative mindset. As the driving force behind the “Ask Me Anything” event’s concept, Lederman’s presence added a layer of authenticity, demonstrating that success in investing is achievable without a privileged background or extensive formal training.

The U.S. Dollar: Resilience Amid Decline

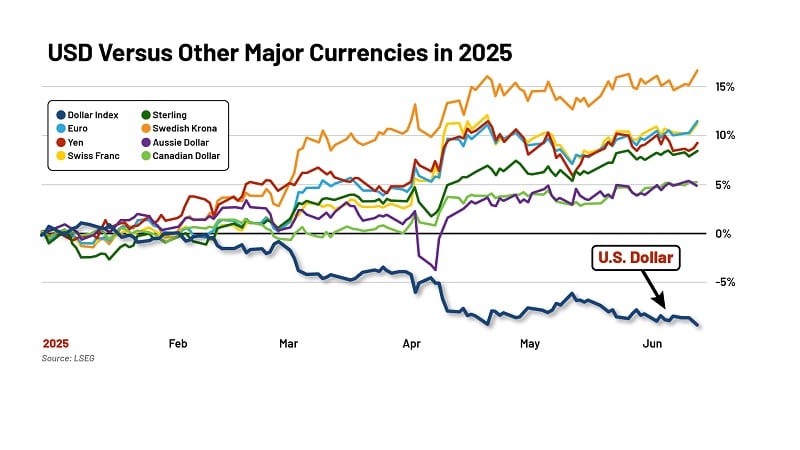

One of the most discussed topics was the U.S. dollar’s 10% decline against other currencies in the first half of 2025. Questions from readers, such as Jim E., reflected concerns about the dollar’s impact on U.S. investments and the broader stock market.

Chaikin addressed these fears by emphasizing the dollar’s historical strength as the world’s reserve currency, responsible for 66% of international transactions and 60% of foreign reserve assets, according to Federal Reserve data. He cited past recoveries, such as the dollar’s rebound to a 20-year high in 2022 after the COVID crisis, to argue that the current decline is not a cause for alarm.

Chaikin attributed the dollar’s recent weakness to uncertainty surrounding the Trump administration’s tariff policies, which have created a volatile market environment. However, he reassured investors that the dollar’s long-term dominance is unlikely to be challenged by currencies from BRICS countries like China, whose yuan lags far behind in global usage. Lederman supported this view with data showing the dollar’s 30% higher value compared to 15 years ago, despite recent fluctuations. Both advised investors to focus on stock market opportunities, using the Power Gauge to identify winners regardless of currency movements.

Tariffs and Market Volatility

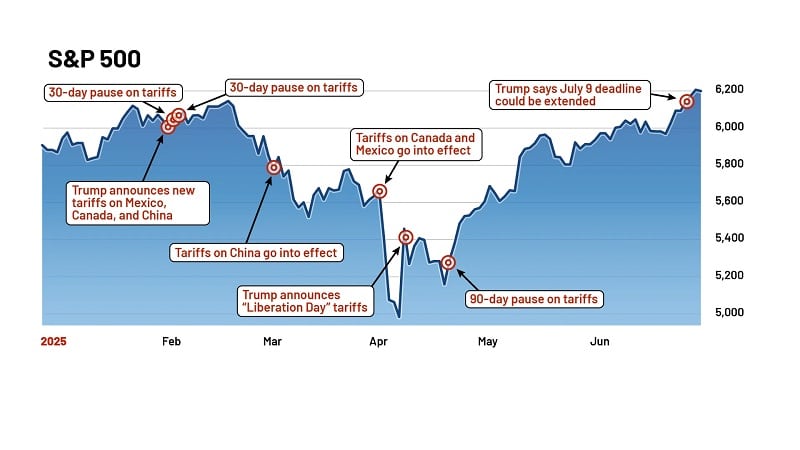

The “Ask Me Anything” event devoted significant time to the impact of tariffs, which have dominated headlines in 2025. The Trump administration’s aggressive tariff policies, including a 10% baseline on all imports and additional levies on targeted regions, led to a nearly 20% S&P 500 drop in spring 2025. However, markets have shown signs of resilience, with only a 2% decline following new tariff announcements in August. Chaikin and Lederman cautioned that a significant new tariff, such as the 15% levy on dozens of countries in August, could trigger further downturns, as evidenced by a 500-point Dow drop and a plunge in copper futures.

Despite these risks, Chaikin emphasized the importance of focusing on controllable factors. He cited examples of Power Gauge successes, such as The Metals Company (TMC), which soared 310% after a bullish signal in April, and Foremost Clean Energy (FMST), up 144% after a similar signal. These gains were linked to executive orders streamlining deep-sea mining permits, demonstrating the Power Gauge’s ability to identify opportunities amid market chaos. Lederman noted that investors have begun to view some tariff threats as bluffs, citing the social media jest “TACO” (Trump Always Chickens Out), but warned that a real escalation could catch Wall Street off guard.

Gold and Precious Metals: A Bullish Sector

Gold’s 30% rise in 2025 and 108% increase over three years prompted numerous questions, including one from Anton U. about its role in portfolios. Chaikin clarified that the Power Gauge does not rate commodities directly but excels at evaluating related stocks. The Metals and Mining subsector is currently “very bullish,” with only one of over 150 stocks rated bearish. Agnico Eagle Mines Limited (AEM), a proxy for gold, yielded 155% gains since a bullish signal in October 2023, outpacing gold’s 65% return. Other mining stocks, such as Trilogy Metals Inc. (TMQ) and Avino Silver and Gold Mines (ASM), saw gains of 304% and 420%, respectively.

Lederman highlighted additional opportunities, such as the VanEck Gold Miners ETF (GDX), which rose 41% after a bullish signal in January 2025, despite media skepticism about gold’s sustainability. Chaikin attributed gold’s rise to the dollar’s decline and central bank buying but emphasized that the Power Gauge’s focus on data over speculation allows investors to capitalize on these trends without needing to predict commodity prices.

Bonds and Interest Rates: A Cautious Outlook

Questions about long-term bonds, such as one from W.J.M. about the iShares 20+ Year Treasury Bond ETF (TLT), reflected interest in locking in 5% yields amid market volatility.

Lederman noted TLT’s “very bearish” rating, with a 10% drop since October 2024 and a 46% decline over several years due to rising interest rates. Chaikin cautioned against expecting significant Federal Reserve rate cuts, citing historical examples of inflation spikes under political pressure, such as during the Nixon and Carter administrations. He highlighted the inflationary risks of tariffs and the $4 trillion deficit increase from the “One Big Beautiful Bill,” suggesting that Fed Chairman Jerome Powell would prioritize price stability over aggressive rate reductions.

Artificial Intelligence: Beyond the Hype

Concerns about an AI bubble, raised by readers like G.K.C., were met with a robust defense from Chaikin. He dismissed claims of overhype by pointing to Nvidia’s 648% gain since a bullish Power Gauge signal in February 2023 and compared its growth to Cisco’s during the 1995 internet boom. Nvidia’s revenue surged 125.85% in 2024 to $60.92 billion and is projected to reach $130.5 billion in 2025. Lederman noted AI’s rapid advancement, with capabilities doubling every six months, surpassing Moore’s Law. The Power Gauge’s early bullish signals on Nvidia, dating back to 2014, and its continued optimism underscore AI’s long-term potential.

Nuclear Energy: Powering the AI Revolution

Nuclear energy’s resurgence, driven by AI’s electricity demands, was a key topic. Chaikin and Lederman highlighted executive orders aiming to quadruple U.S. nuclear capacity and investments by Amazon, Microsoft, and Nvidia in nuclear-powered data centers. The Power Gauge identified opportunities like Constellation Energy Group (CEG), up 38% in two months, and the Global X Uranium ETF (URA), up 28% since October 2024. Stocks like Korea Electric Power Corp. (KEP) and NRG Energy, Inc. (NRG) saw gains of 104% and 375%, respectively, reflecting the sector’s strength.

Marc Chaikin’s Market Outlook: 2025 and Beyond

Chaikin reiterated his January forecast, based on the presidential election cycle, predicting strong stock market gains in 2025, with a 90% historical success rate for the first year of the cycle. He expects volatility through October but anticipates new highs by year-end, with a potential crash in March 2026. Lederman supported this with data showing that similar three-month rallies since 1950 led to 20.2% gains over the following 12 months, suggesting that current gains signal a broader bull market.

The Power Gauge: A Data-Driven Tool

The “Ask Me Anything” event addressed questions about the Power Gauge, such as one from Donoghue about frequent rating changes. Chaikin explained that the system rates stocks daily on a five-point scale, incorporating 20 factors. Temporary adjustments like Neutral+ or Neutral– reflect technical trends without signaling immediate action. Examples like Nvidia’s 648% gain and Carvana’s 4,800% rise since March 2023 demonstrated the system’s effectiveness. The Power Gauge’s ability to identify opportunities across sectors, from mining to AI, was a recurring theme.

Lightning Round: Stock-Specific Insights

In a rapid-fire segment, Chaikin and Lederman provided Power Gauge ratings for reader-requested stocks, including:

-

VanEck High Yield Municipal ETF (HYD): Very Bearish

-

Amazon: Bullish

-

Carvana: Neutral, up 4,800% since March 2023

-

Netflix: Neutral+, up 350% since October 2022

-

Estee Lauder: Neutral–, down 70% since March 2022

-

Tesla: Neutral, fluctuating

-

Microsoft: Very Bullish

-

Energy Transfer: Neutral

-

Archer: Neutral, recently Bullish

-

AMD: Very Bullish

-

Robinhood: Very Bullish

The Open House Offer: A Game-Changer for Investors

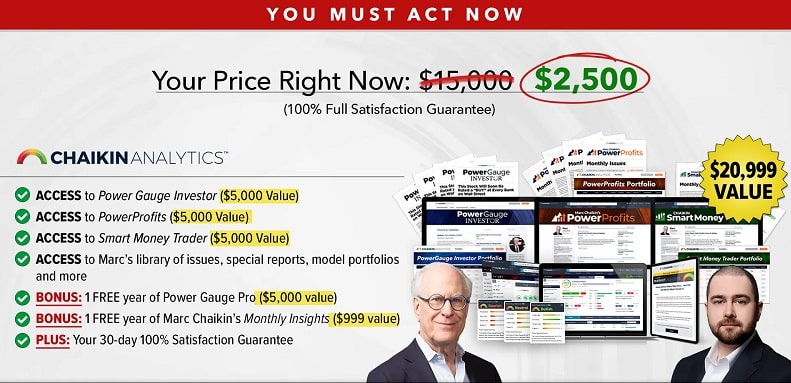

The “Ask Me Anything” event concluded with a groundbreaking offer, dubbed the “open house,” providing 30 days of full access to Chaikin’s three premium research services—Chaikin Power Gauge Investor, PowerProfits, and Smart Money Trader—along with the Power Gauge Pro, valued at over $20,000 annually.

For $2,500, a 50% discount off the cost of a single service, subscribers can explore all services, including model portfolios, special reports, and advanced analytics, and choose one to continue for a 12-month subscription. This offer, described as an experiment, aims to make high-level research accessible to retail investors, allowing them to test strategies suited to their goals.

Subscriber Success Stories

The “Ask Me Anything” highlighted testimonials from Chaikin Analytics subscribers, illustrating the Power Gauge’s impact. Donald H. tripled his 401k over seven years, Ana B. grew her portfolio by $90,000 in 18 months, and Bill E. turned $20,000 into $75,000 in three to four years. Other subscribers, like Chris S., Mike F., and Chuck F., praised the Power Gauge for boosting confidence and reducing reliance on brokers, with gains like 800% on SMCI and 100% on AVGO.

Looking Ahead

The “Ask Me Anything” underscored Chaikin Analytics’ commitment to empowering retail investors with data-driven tools. Chaikin’s promise to answer additional questions via email ensures ongoing engagement, while the open house offer provides a unique opportunity to explore premium research at a reduced cost. As markets face volatility from tariffs, inflation, and geopolitical shifts, the Power Gauge remains a vital resource for navigating uncertainty and seizing opportunities.

For investors interested in the open house offer or more information about Chaikin Analytics, visit their official website here.