Looking for more information about David Weisburd’s Founders & Visionaries? I’ve researched it to find out more and put together an honest David Weisburd’s Founders & Visionaries Review, containing everything you need to know about Angels & Entrepreneurs new initiative.

Who is David Weisburd?

David is NOT a salesman. He’s NOT a showman. He’s NOT even outgoing. But what he is… is an absolute genius, especially when it comes to making BIG money.

David’s family came to this country with $600 to their name. They lived on the ground floor of a government subsidized housing project in Indianapolis. Take a look:

Today, 20 years later, David has his own office on the 85th floor of the New World Trade Center:

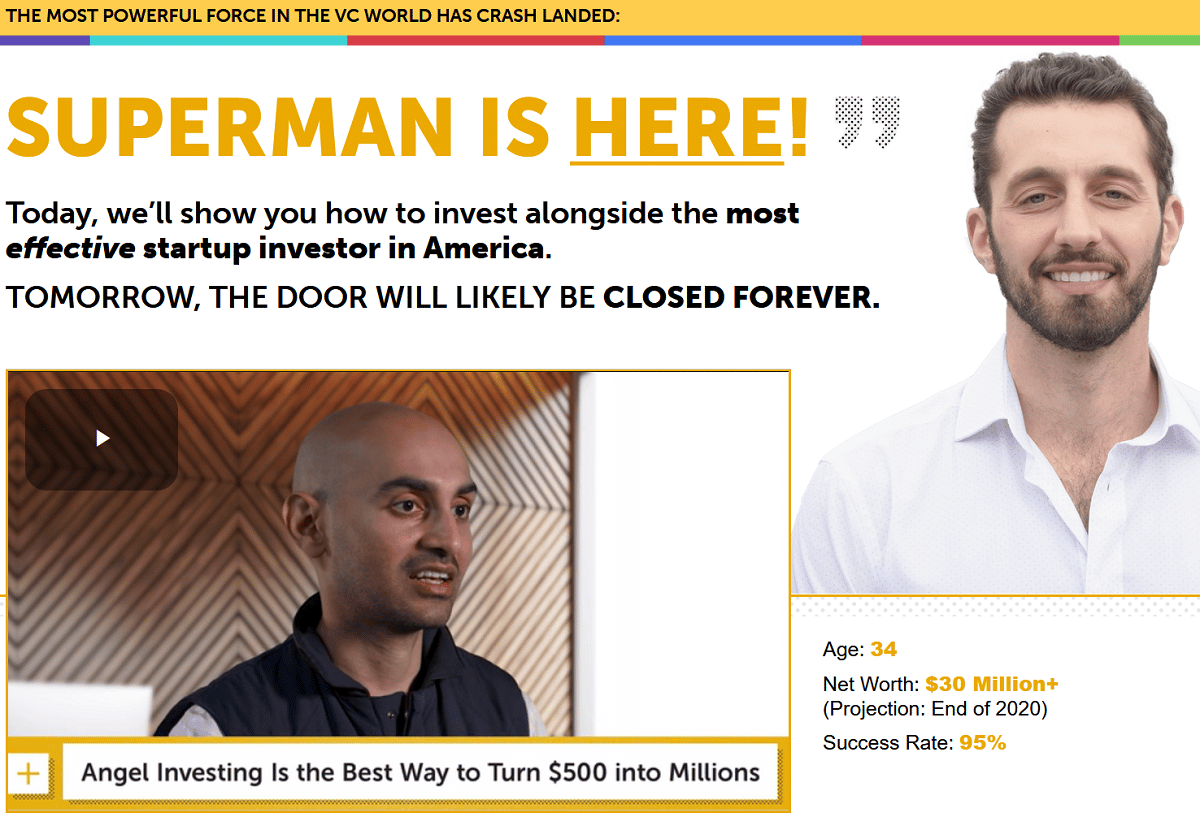

By the end of this year, before he turns 35 years old, he’s projected to have a net worth of $30 million. However, David’s success has NOTHING to do with the stock market. It has everything to do with angel investing.

Of the 55 startups he’s invested in, only two have gone out of business…

This gives David a 95% success rate, which in the world of startup investing is unheard of.

Every venture capitalist is judged by two simple criteria – their number of successful deals and the profits secured via those exits.

David is on track to complete four major exits in 2020.

You may recognize some of the names.

- DraftKings, the fantasy sports and betting site, saw its value explode to $14.7 billion in just the past few months. David was part of the team that took the company public in April via a special purpose acquisition company (SPAC), a vehicle many are calling the new IPO.

- Compass Therapeutics took part in a special deal that closed in June, funding an innovator in today’s most important sector of the market: biotechnology.

- Palantir, one of the most vital cybersecurity companies in America. David invested early, backing Paypal founder Peter Thiel. It will go public in a matter of days.

- And Shift, an emerging e-commerce player simplifying the process of buying a car online, that’s set to go public in Q4.

A small group of wealthy investors, family offices, and institutions secured stakes in these deals through David. Together, these deals generated well over $100 million in profits for those early investors in the last three years…

And increased David’s own personal net worth by more than $10 million. This is the kind of money that only those connected to the right venture capital deals can make.

Today, David Is Opening His New Deals to the Public for the Very First Time.

David is going to share details on the SIX startups he’s investing in right now.

He believes each one of these early-stage opportunities will 5X, 10X, even 100X their valuations in a matter of just one year. Which is why 90% of his own capital is in exactly these kinds of deals.

These new deals come directly from David’s personal portfolio…He will be investing in each one himself.

And access is available only through Angels & Entrepreneurs new initiative, Founders & Visionaries.

Founders & Visionaries Initiative – What Is It?

The Goal of Founders & Visionaries is simple: For you to make as much money as possible from the same deals David puts his own money into.

Inside, you’ll find details on SIX private startups.

David is backing each one of them with his own personal investment. And he only backs companies that he believes have the very real potential to return 10X, 20X, 50X, or more in the next few years.

Angels & Entrepreneurs deal analysis team did a deep dive into each of these companies and feels exactly the same way . These deals give you the potential to see the kind of rare and extraordinary startup gains that most people never experience.

In the next few minutes, you can take the first step to securing a claim in each one:

- Deal #1: The fintech firm working to help solve the $1.6 trillion student debt crisis by funding the tuition of successful college students.

- Deal #2: The digital bank growing like crazy by serving the 89 million underbanked yet credit-worthy borrowers in America.

- Deal #3: The financial innovator returning the power of lending to community banks and giving borrowers access to much lower rates at the same time.

- Deal #4: The software pioneer whose stake in the private money lending business is growing fast – from $33 million two years ago to $250 million last year to projections of $500 million this year and $1.5 billion in 2021.

- Deal #5: The scooter company that cities are actually welcoming. Why? Because these self-driving scooters go back to the docking station and park themselves when the rider is done. Daily revenue is up 6,100% in just the last few months.

- Deal #6: The first U.S. cannabis cultivator given the green light by the SEC to sell stock to anyone for as little as $100.

In fact, three of these deals let you invest starting with as little as $100.

Each of these deals possesses the key to startup success. It’s a win-win for both the business and the customer.

Now there’s typically a high failure percentage among young startups. You can lose your money. It’s something every startup investor expects.

But David Weisburd has a 95% success rate. Of the 55 startups he’s invested in, only two are no longer in business. That means David is highly selective in choosing his deals.

He invests in firms like Wish, the internet retailer with an $11.2 billion valuation, which just announced plans to IPO.

He backs companies like Headspace, the mindfulness app with more than 65 million downloads, whose usage has risen dramatically since the pandemic hit.

And he joins noted venture capital firms such as Sequoia Capital in taking stakes in highly competitive raises like Robinhood, the popular stock-trading app whose valuation recently increased by $2.5 billion in a single month.

Plus the four successful exits he is on track to complete this year.

David Weisburd’s Founders & Visionaries – How it Works?

Here’s How Founders & Visionaries Is Going to Work…

As a new member of Founders & Visionaries, your subscription begins with details on all six of these deals.

And that’s only the beginning of this initiative.

For the next year…

David has agreed to pass along the details on the startups he’s backing with his own personal investment.

He will be sharing his reason for backing the founders, his thoughts on their growth, and why they have the potential to be the kind of rare and extraordinary 10X, 20X, or 50X success he’s after.

Angels & Entrepreneurs team will then review every detail, conduct a thorough review of the business model, and evaluate the key players at the startup. Then and only then, after a deal has passed all these criteria, will you receive a complete Due Diligence Package outlining the entire opportunity.

Inside each package, you will get a FULL breakdown of every startup David has targeted.

Can these startups make you 10,000%, 20,000%, or 50,000% gains if we hit it big? Yes, I ABSOLUTELY believe they have that kind of potential. But again, nothing is guaranteed in the world of angel investing.

These are STILL startups. Many will not make it to the finish line. And they can take years to reach an exit.

These Deals Are Just the Foundation of Your New Angel Portfolio.

Successful angel investing is never about any one particular deal.

- It’s about building a portfolio.

- Spreading your risk capital, and…

- Giving yourself multiple opportunities for major exits.

This way, even if just one company in your portfolio becomes a huge success – You could make enough profit from that one company to turn your original stake into a small fortune in the next few years.

And if you’re like David, you could duplicate that success with multiple, highly profitable exits – just as he’s experienced this year with DraftKings, Compass, Palantir, and Shift.

The Next 12 Months Will Give You Access to Multiple Deals That Could Hand You 10X Returns.

It starts with today’s six deals. Going forward, you will receive one new deal every single month with all the due diligence from Angels & Entrepreneurs deal analysis team.

Remember David’s 95% success rate. He’s highly selective about the companies he targets.

And if the right opportunities present themselves to David and meet all Angels & Entrepreneurs strict criteria, you may even receive a second deal each month.

Inside each and every Founders & Visionaries Due Diligence Package, you will find:

The Founders

As a member of David’s network, you will gain access to every interview that David conducts with EVERY founder of EVERY company Angels & Entrepreneurs team target. During these discussions, he will ask tough questions, raise objections, and evaluate these startups with a highly critical eye.

The Vision

You will also be sent a streamlined, easy-to-read document that explains the VISION behind each of David’s investments. David will show you HOW these businesses plan on thriving in today’s digital economy, WHAT major problem they’re helping to solve, and WHY their business model could be a win-win for everyone.

The Stakes

Lastly, Angels & Entrepreneurs team will break down the recommended deal itself. They will tell you the minimum investment (as little as $100 for three of these deals), explain the current valuation, discuss timetables, and much more. They will also give you a list of any and all venture capital firms who are investing in these startups. This way, you will always know who else has a stake.

The Network

Once you subscribe to Founders & Visionaries, you will get the chance to invest with angel investors from across America (and elsewhere). You’ll get to build relationships with these folks, discuss all of David’s deals, and see who’s interested in investing in each deal.

Founders & Visionaries not only provides you details on top-level, venture capital deals. It also teaches you how to BECOME a successful angel investor. And that means gaining knowledge from a world of well-connected and wealthy individuals.

Pricing

A one-year membership to Founders & Visionaries costs $1,995.

Refund Policy

This offer is nonrefundable. Providing access to all the details for this level of deals and then allowing someone to ask for their money back simply wouldn’t be fair to the other members.

Final Word

You don’t need to be wealthy to be an angel investor.

In fact, you can invest in three of these deals for as little as $100. But you do need to have enough capital to build out your angel portfolio. Keep in mind the potential rewards here are staggering.

David knows firsthand…

This year, he is on track to personally make $10 million from four successful exits. And those who invested alongside him hold stakes valued at over $100 million.