Imagine a Wall Street veteran who’s rubbed elbows with billionaires, called market bottoms on national TV, and turned a kitchen-table dream into a $200 million empire. That’s Whitney Tilson, a 26-year finance pro claiming he’s found a new way to build wealth—one that leaves stocks, bonds, and even Warren Buffett’s Berkshire Hathaway in the dust. His secret? The N.E.W. System, an AI-powered stock-picking tool, paired with StansberryGPT, a chatbot that’s like a market guru on speed dial. With claims of turning $100,000 into $339,000 and beating major crashes, it sounds like a game-changer. But in a world where AI hype is everywhere, is this system legit? Let’s unpack Tilson’s bold pitch and see if it holds up.

Whitney Tilson’s Rise: From Underdog to Market Maven

Whitney Tilson’s story reads like a scrappy underdog tale. Raised by teacher parents working with kids in Tanzania and Nicaragua, he didn’t have a trust fund or a Rolodex of Wall Street bigwigs. In 1999, he started a hedge fund from a tiny Manhattan apartment with just a laptop and a phone. Everyone said he was nuts—no connections, no capital. But Tilson proved them wrong, building a $200 million firm through sheer grit, surviving eight market crashes, from the dot-com bust to the 2008 financial crisis to the COVID sell-off.

His investment calls are the stuff of legend. He jumped into Apple at a split-adjusted 35 cents, a move that’s up over 20,000% today. Amazon at $2.41? That’s a 3,200% gain. Netflix at $7.78? Try 4,200%. He’s been on 60 Minutes twice—first in 2008, calling a market bottom before the biggest bull run in history, then in 2015, exposing Lumber Liquidators’ scandal, which tanked the stock 80% and led to bankruptcy. In 2020, he nailed another market bottom, catching a massive rally. He’s swapped ideas with billionaires like Bill Ackman and David Einhorn and even sends homemade cookies to Warren Buffett every Christmas.

Now, Tilson says the old Wall Street playbook—connections, hustle, gut calls—is outdated. AI is the new king, and his N.E.W. System (New Engine of Wealth) and StansberryGPT are built to let anyone with a smartphone tap into the same edge once reserved for hedge fund elites. Partnered with Stansberry Research, a firm with a 26-year track record, Tilson’s betting big that AI can make wealth-building faster, easier, and fairer. But can it really deliver?

The N.E.W. System: AI Meets Stock Picking

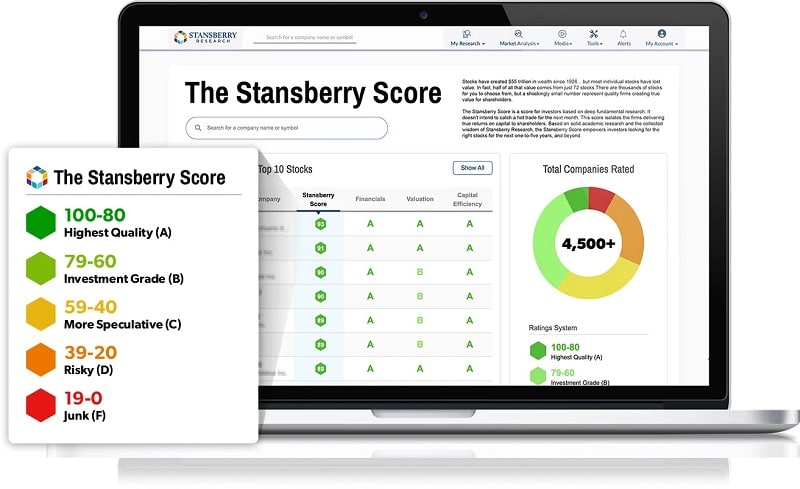

Here’s the pitch: The N.E.W. System is an AI-driven platform that sifts through thousands of stocks—8,000 on the NYSE, 58,000 worldwide—analyzing everything from cash flow to price momentum. It’s like having a Wall Street research team working 24/7, but instead of months of number-crunching, it delivers results in seconds. The system assigns each stock a Stansberry Score from 0 to 100, with higher scores signaling bigger upside. It’s not about chasing crypto or hot tech stocks—it’s a disciplined approach to finding hidden gems.

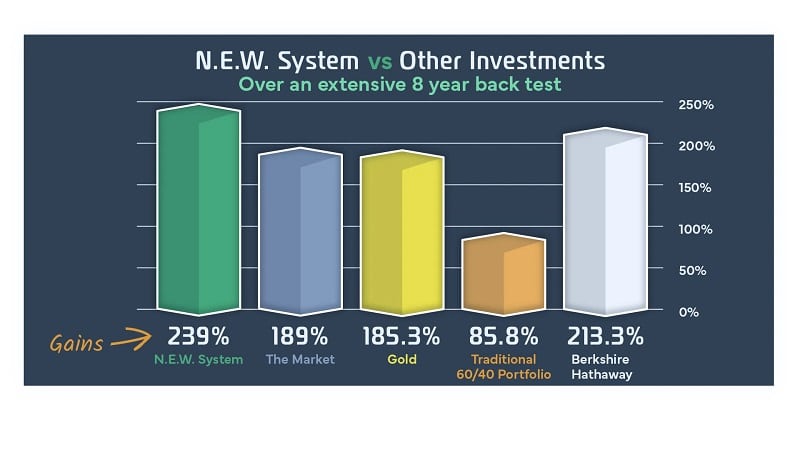

Testing shows some eye-popping results. The system has outgunned stocks, bonds, gold, real estate, and even Buffett’s Berkshire Hathaway. It’s nearly tripled the returns of the classic 60/40 stock-bond mix, with less risk, backed by the Sharpe Ratio, a Nobel Prize-winning measure of bang for your buck. Through the COVID crash, inflation spikes, and three market downturns (2020, 2022, 2025), it could’ve turned $100,000 into $339,000. Specific wins include Nutex Health (NUTX) up 1,100% in under a year, Robinhood (HOOD) up 340%, and AppLovin (APP) up 2,500% in 2023. It also dodged bullets like Rezolve AI (down 70%), Multisensor AI (down 60%), and Jet.AI (nearly wiped out).

Think of it as a high-tech treasure map, scanning a ton of data to spot stocks ready to soar. It’s not magic—it’s built on the same data-driven edge that made Renaissance Technologies’ Medallion Fund turn $1,000 into $46 billion. Tilson’s team spent millions and years building this, with experts in finance, coding, and even astrophysics. Sounds impressive, but is it as good as it claims?

StansberryGPT: A Market Chatbot with Brains

Then there’s StansberryGPT, a tool that’s like having a Wall Street analyst on call. It’s a “Natural Language Screener,” meaning you can ask it questions like, “Which healthcare stocks won’t tank in a volatile market?” or “Who’s got the strongest balance sheets?” Unlike free AIs like ChatGPT, it’s fueled by premium financial data that costs a fortune to access. It’s not here to give you financial advice, but it’s a goldmine for digging into market trends or checking out a stock you heard about at a barbecue.

For market nerds, this thing’s a blast. It’s like chatting with a friend who knows every corner of the market, without the jargon or fluff you’d get from a Google search. Before AI, you’d need a Bloomberg terminal and a big budget to get this kind of insight. Now, it’s as easy as typing a question on your phone. That’s a big leap for regular investors, but does it live up to the hype?

AI’s Takeover: The New Wealth Frontier

This isn’t just about Tilson’s tools—it’s about a bigger shift. AI is rewriting how money is made, and it’s happening fast. Wall Street’s feeling it: Goldman Sachs says tasks that took weeks now take minutes. Hedge fund guru Cliff Asness admits his firm’s gone all-in on machines. JPMorgan and Bridgewater are using AI to find profits humans miss. Over 850 AI patents from financial firms show the industry’s scrambling to keep up, with banks like Morgan Stanley ditching Manhattan offices because AI doesn’t need fancy real estate.

Beyond Wall Street, AI’s creating millionaires at a wild pace—600,000 in 2024 alone, thanks to tools like ChatGPT. It’s powering “solopreneurs” who run million-dollar businesses solo. A college grad’s making $64,000 a month. A new dad pulled in $226,000 monthly during paternity leave. A Navy officer says one person will soon do the work of 40. Sam Altman and Mark Cuban are betting on one-person companies hitting $1 billion, with Cuban predicting the first trillionaire will work from home, not run a mega-corp like Apple.

But there’s a catch: AI’s splitting the world in two. Those riding the wave—like Palantir (up 2,000%), Upstart (up 300%), or Cerence (up 600%)—are getting rich. Those ignoring it? They’re falling behind, just like folks who stuck with Blockbuster as Netflix took over. Zuckerberg’s offering $100 million pay packages for AI talent, dwarfing CEO salaries. This is the new reality, and Tilson’s tools aim to put you on the winning side.

Why Stansberry Research?

Tilson’s teamed up with Stansberry Research, a firm that’s been at it since 1999, helping over a million people in 150 countries make smarter money moves. They called the downfall of Kodak and Sears, warned about Fannie Mae before 2008, spotted Nvidia in 2016 (up 6,000%), and were early on Bitcoin (now past $110,000). Unlike Wall Street’s fee-heavy model, Stansberry doesn’t charge commissions or performance fees—just straightforward research.

Tilson’s mission is to share the wealth, literally. He’s not hoarding AI tools for the elite—he wants regular investors to have the same shot he did. His team, with 76 years of expertise in finance, coding, and physics, spent millions building The N.E.W. System and StansberryGPT. It’s a big swing at making wealth-building accessible, but can it deliver for the average Joe?

How The N.E.W. System Works

Here’s the nuts and bolts: The N.E.W. System scans thousands of stocks, looking at everything from cash flow to dividends to market trends. It crunches a ton of data to find the best stock combos, delivering a model portfolio four times a year. You tell it how much you’re investing—say, $10,000—and it spits out exactly how many shares to buy. No guesswork, just clear instructions.

The Stansberry Score is the heart of it, boiling down complex data into a single number. High scores, like Cadence Design’s 77 or Agnico Eagle Mines’ 90 (up 73%), mean big potential. Low scores, like Jet.AI’s 17, keep you out of trouble. It even flagged Nvidia at 74 back in 2016, way before it was a superstar. This used to take months of analyst work—now it’s a few clicks. That’s powerful, but is it foolproof?

StansberryGPT: Cutting Through the Noise

StansberryGPT is like a market buddy who’s always ready to talk shop. Ask it about fast-growing companies or low-risk stocks, and it pulls answers from premium data sources. It’s not here to tell you what to buy, but it’s a lifesaver for sorting through the flood of tips from news, social media, or that guy who won’t shut up about his “sure thing.” It’s the kind of tool that makes you wonder how investors survived without it.

The Offer: $149 to Try It Out

Here’s the deal: for $149—a steal compared to the usual $499—you get a 30-day risk-free trial to Stansberry’s Investment Advisory, which includes The N.E.W. System, StansberryGPT, and the Stansberry Score. You’ll get:

-

The N.E.W. System: Quarterly portfolios with top-scoring stocks and a calculator for exact buys.

-

Stansberry Score: Check any stock’s potential, spotting winners like Sprott (up 67%) or Howmet Aerospace (up 141%) and avoiding duds like Noodles & Company.

-

StansberryGPT: Instant market insights from high-cost data.

-

Stansberry’s Investment Advisory: Monthly updates with a 21% average gain since 1999, topping the market’s 17%.

If it’s not for you, cancel within 30 days for a full refund. Compare that to Tilson’s hedge fund days, where a “2 and 20” fee structure meant $20,000 in fees for a $500,000 portfolio with a 10% return. At $149, it’s a low-risk way to test-drive AI investing.

The Bigger Picture: AI’s Do-or-Die Moment

The Bigger Picture: AI’s Do-or-Die Moment

AI’s not just changing markets—it’s reshaping society. It minted 600,000 millionaires in 2024, but 339 million Americans are missing out, stuck in fear and anxiety. It’s like the internet’s early days: get in early, like on Amazon or Netflix, and you’re set. Ignore it, like those who clung to Blockbuster, and you’re toast. From healthcare to cars to Social Security, AI’s everywhere, and Tilson’s tools are a bet on staying ahead of the curve.

Solopreneurs are the poster children for this shift. A college grad’s making $64,000 a month. A Navy officer says one person can do the work of 40. Tilson’s system brings that same power to investing, letting you use AI to find winners without Wall Street’s baggage. It’s a bold vision, but does it stack up?

Conclusion: Is StansberryGPT Legit?

So, is StansberryGPT and The N.E.W. System the real deal? The evidence is compelling: a 21% average gain, $100,000 turned into $339,000 through tough markets, and a knack for picking winners like Nutex Health while dodging losers like Jet.AI. Backed by Stansberry Research’s track record and millions in R&D, it’s got serious cred. The $149 trial is a no-brainer to test it out—way cheaper than Wall Street’s fees and with a full refund if it’s not your thing.

AI’s here to stay, and Tilson’s betting it can make you rich if you act now. Whether you’re a market junkie or just tired of missing out, this could be your shot to ride the AI wave. It’s not a magic bullet, but it’s a solid tool in a world where standing still means falling behind.

Give it a spin and see if it’s the edge you’ve been looking for.

FAQ: Understanding Whitney Tilson’s The N.E.W. System and StansberryGPT

<!– wp:wpseopress/faq-block-v2 {"schema":{"@context":"https://schema.org","@type":"FAQPage","url":"https://steadyincomeinvestments.com/whithey-tilson-the-n-e-w-system-stansberrygpt/","@id":"https://steadyincomeinvestments.com/whithey-tilson-the-n-e-w-system-stansberrygpt/","mainEntity":[{"@type":"Question","url":"https://steadyincomeinvestments.com/whithey-tilson-the-n-e-w-system-stansberrygpt/#what-is-the-n-e-w-system-and-how-does-it-work","name":"What is The N.E.W. System, and how does it work?","answerCount":1,"acceptedAnswer":{"@type":"Answer","text":"\u003cp\u003eThe N.E.W. System (New Engine of Wealth) is an AI-powered platform developed by Whitney Tilson and Stansberry Research to identify stocks with high growth potential. It analyzes thousands of securities—8,000 on the NYSE alone—using metrics like cash flow, dividends, and price momentum. The system crunches trillions of data points to assign each stock a Stansberry Score from 0 to 100, with higher scores indicating bigger upside. It delivers a model portfolio four times a year, and users input their investment amount (e.g., $10,000) into a calculator that specifies exact share allocations. Think of it as a high-tech guide to finding market winners without the guesswork.\u003c/p\u003e"}},{"@type":"Question","url":"https://steadyincomeinvestments.com/whithey-tilson-the-n-e-w-system-stansberrygpt/#what-is-stansberrygpt-and-how-is-it-different-from-other-ai-tools","name":"What is StansberryGPT, and how is it different from other AI tools?","answerCount":1,"acceptedAnswer":{"@type":"Answer","text":"\u003cp\u003eStansberryGPT is a proprietary chatbot, or “Natural Language Screener,” that lets users ask questions about the market, like “Which healthcare stocks are least volatile?” or “What companies have strong balance sheets?” Unlike free AIs like ChatGPT, it’s powered by premium financial data that costs Stansberry Research a fortune to access. It’s designed to provide instant, data-driven insights, similar to what you’d get from a pricey Bloomberg terminal, making it a go-to for sorting through market noise.\u003c/p\u003e"}},{"@type":"Question","url":"https://steadyincomeinvestments.com/whithey-tilson-the-n-e-w-system-stansberrygpt/#what-kind-of-results-has-the-n-e-w-system-shown-in-testing","name":"What kind of results has The N.E.W. System shown in testing?","answerCount":1,"acceptedAnswer":{"@type":"Answer","text":"\u003cp\u003eBacktests claim The N.E.W. System has outperformed stocks, bonds, gold, real estate, and Warren Buffett’s Berkshire Hathaway, with less risk based on the Sharpe Ratio, a measure of return per unit of risk. It could have turned $100,000 into $339,000 through the COVID crash, inflation spikes, and three market downturns (2020, 2022, 2025). Specific wins include Nutex Health (up 1,100%), Robinhood (up 340%), and AppLovin (up 2,500%), while it avoided losers like Rezolve AI (down 70%) and Jet.AI (nearly wiped out).\u003c/p\u003e"}},{"@type":"Question","url":"https://steadyincomeinvestments.com/whithey-tilson-the-n-e-w-system-stansberrygpt/#is-the-n-e-w-system-suitable-for-beginner-investors","name":"Is The N.E.W. System suitable for beginner investors?","answerCount":1,"acceptedAnswer":{"@type":"Answer","text":"\u003cp\u003eYes, it’s designed to be user-friendly. You don’t need a finance degree to use it—just a computer or smartphone. The system provides clear instructions, including a calculator that tells you exactly how many shares to buy based on your investment size. Monthly updates from Stansberry Research also explain market trends and recommendations in plain language, making it accessible for newbies and seasoned investors alike.\u003c/p\u003e"}},{"@type":"Question","url":"https://steadyincomeinvestments.com/whithey-tilson-the-n-e-w-system-stansberrygpt/#how-does-the-149-trial-work-and-whats-included","name":"How does the $149 trial work, and what’s included?","answerCount":1,"acceptedAnswer":{"@type":"Answer","text":"\u003cp\u003eFor a promotional price of $149 (down from $499), you get a 30-day risk-free trial to Stansberry’s Investment Advisory, which includes The N.E.W. System, StansberryGPT, and the Stansberry Score. You’ll receive quarterly model portfolios, a tool to check any stock’s score, a chatbot for market queries, and monthly market updates averaging 21% gains since 1999. If it’s not for you, cancel within 30 days for a full refund—no questions asked.\u003c/p\u003e"}},{"@type":"Question","url":"https://steadyincomeinvestments.com/whithey-tilson-the-n-e-w-system-stansberrygpt/#why-is-the-trial-so-affordable-compared-to-wall-street-fees","name":"Why is the trial so affordable compared to Wall Street fees?","answerCount":1,"acceptedAnswer":{"@type":"Answer","text":"\u003cp\u003eTilson’s old hedge fund charged a “2 and 20” fee structure—2% of capital and 20% of profits, which could mean $20,000 in fees on a $500,000 portfolio with a 10% return. Stansberry Research skips performance fees and commissions, focusing on affordable research. The $149 trial reflects their goal to make AI-driven investing accessible, not just for Wall Street’s elite.\u003c/p\u003e"}},{"@type":"Question","url":"https://steadyincomeinvestments.com/whithey-tilson-the-n-e-w-system-stansberrygpt/#can-i-use-stansberrygpt-to-get-personalized-financial-advice","name":"Can I use StansberryGPT to get personalized financial advice?","answerCount":1,"acceptedAnswer":{"@type":"Answer","text":"\u003cp\u003eNo, StansberryGPT isn’t a financial advisor—it’s a research tool. It answers questions with data-driven insights but doesn’t tailor advice to your personal situation. For that, you’d need to consult a licensed financial advisor. Think of it as a super-smart assistant for exploring market ideas, not a replacement for professional guidance.\u003c/p\u003e"}},{"@type":"Question","url":"https://steadyincomeinvestments.com/whithey-tilson-the-n-e-w-system-stansberrygpt/#how-does-the-n-e-w-system-compare-to-owning-ai-stocks-like-nvidia","name":"How does The N.E.W. System compare to owning AI stocks like Nvidia?","answerCount":1,"acceptedAnswer":{"@type":"Answer","text":"\u003cp\u003eOwning AI stocks like Nvidia is about betting on one company’s success. The N.E.W. System uses AI to find the best stocks across all sectors, not just tech. It’s flagged winners like Nutex Health and AppLovin, not just AI darlings, and avoids losers like Jet.AI. It’s less about picking the next big tech stock and more about using AI’s brainpower to spot opportunities everywhere.\u003c/p\u003e”}},{“@type”:”Question”,”url”:”https://steadyincomeinvestments.com/whithey-tilson-the-n-e-w-system-stansberrygpt/#is-stansberry-research-trustworthy”,”name”:”Is Stansberry Research trustworthy?”,”answerCount”:1,”acceptedAnswer”:{“@type”:”Answer”,”text”:”\u003cp\u003eStansberry Research has been around since 1999, serving over a million clients in 150 countries. They’ve called major market shifts, like the collapse of Kodak and Fannie Mae, and were early on Nvidia (up 6,000%) and Bitcoin (now past $120,000). Their track record and no-fee model add credibility, though, like any investment research, results aren’t guaranteed.\u003c/p\u003e”}},{“@type”:”Question”,”url”:”https://steadyincomeinvestments.com/whithey-tilson-the-n-e-w-system-stansberrygpt/#why-does-tilson-say-ai-is-a-do-or-die-moment-for-investors”,”name”:”Why does Tilson say AI is a “do-or-die” moment for investors?”,”answerCount”:1,”acceptedAnswer”:{“@type”:”Answer”,”text”:”\u003cp\u003eTilson sees AI as a game-changer, like the internet in the ‘90s. It’s created 600,000 millionaires in 2024 and is powering solo businesses worth millions. But it’s also widening the wealth gap, with 339 million Americans missing out. He argues that using tools like The N.E.W. System puts you ahead of the curve, while ignoring AI risks leaving you behind, like those who stuck with Blockbuster as Netflix rose.\u003c/p\u003e”}},{“@type”:”Question”,”url”:”https://steadyincomeinvestments.com/whithey-tilson-the-n-e-w-system-stansberrygpt/#whats-the-catch-with-the-risk-free-trial”,”name”:”What’s the catch with the risk-free trial?”,”answerCount”:1,”acceptedAnswer”:{“@type”:”Answer”,”text”:”\u003cp\u003eThere’s no catch—you get 30 days to try everything for $149, and if it’s not your thing, you get a full refund. The low price is meant to make it easy to test the system without committing long-term. Just be aware that investing always carries risk, and past performance (like the $100,000-to-$339,000 claim) doesn’t guarantee future gains.\u003c/p\u003e”}},{“@type”:”Question”,”url”:”https://steadyincomeinvestments.com/whithey-tilson-the-n-e-w-system-stansberrygpt/#how-does-the-n-e-w-system-reduce-risk-compared-to-other-investments”,”name”:”How does The N.E.W. System reduce risk compared to other investments?”,”answerCount”:1,”acceptedAnswer”:{“@type”:”Answer”,”text”:”\u003cp\u003eThe system uses the Sharpe Ratio to show it delivers higher returns per unit of risk than stocks, bonds, or gold. By analyzing thousands of stocks and simulating portfolio outcomes, it picks diversified, high-potential stocks while avoiding risky flops. It’s not risk-free—nothing is—but it aims to stack the odds in your favor with data, not gut feelings.\u003c/p\u003e”}},{“@type”:”Question”,”url”:”https://steadyincomeinvestments.com/whithey-tilson-the-n-e-w-system-stansberrygpt/#can-i-check-the-score-of-any-stock-with-the-n-e-w-system”,”name”:”Can I check the score of any stock with The N.E.W. System?”,”answerCount”:1,”acceptedAnswer”:{“@type”:”Answer”,”text”:”\u003cp\u003eYes, the Stansberry Score lets you type in any stock’s ticker to see its potential, from 0 to 100. It’s helped spot winners like Sprott (up 67%) and dodge losers like Noodles \u0026amp; Company. It’s a quick way to vet stocks you hear about without relying on hype or rumors.\u003c/p\u003e”}},{“@type”:”Question”,”url”:”https://steadyincomeinvestments.com/whithey-tilson-the-n-e-w-system-stansberrygpt/#how-does-this-differ-from-traditional-financial-research”,”name”:”How does this differ from traditional financial research?”,”answerCount”:1,”acceptedAnswer”:{“@type”:”Answer”,”text”:”\u003cp\u003eTraditional research relies on human analysts, long reports, and often hefty fees. The N.E.W. System uses AI to process data instantly, delivering clear, actionable picks. StansberryGPT adds a conversational twist, letting you explore ideas on your terms. It’s faster, cheaper, and cuts through Wall Street’s noise.\u003c/p\u003e”}},{“@type”:”Question”,”url”:”https://steadyincomeinvestments.com/whithey-tilson-the-n-e-w-system-stansberrygpt/#is-this-system-only-for-tech-savvy-investors”,”name”:”Is this system only for tech-savvy investors?”,”answerCount”:1,”acceptedAnswer”:{“@type”:”Answer”,”text”:”\u003cp\u003eNot at all. If you can use a smartphone or computer, you’re set. The system’s calculator and StansberryGPT are designed to be intuitive, and the Quick Start Guide walks you through everything. It’s built for anyone who wants to invest smarter, no tech expertise required.\u003c/p\u003e”}}]}} –>What is The N.E.W. System, and how does it work?

The N.E.W. System (New Engine of Wealth) is an AI-powered platform developed by Whitney Tilson and Stansberry Research to identify stocks with high growth potential. It analyzes thousands of securities—8,000 on the NYSE alone—using metrics like cash flow, dividends, and price momentum. The system crunches trillions of data points to assign each stock a Stansberry Score from 0 to 100, with higher scores indicating bigger upside. It delivers a model portfolio four times a year, and users input their investment amount (e.g., $10,000) into a calculator that specifies exact share allocations. Think of it as a high-tech guide to finding market winners without the guesswork.

What is StansberryGPT, and how is it different from other AI tools?

StansberryGPT is a proprietary chatbot, or “Natural Language Screener,” that lets users ask questions about the market, like “Which healthcare stocks are least volatile?” or “What companies have strong balance sheets?” Unlike free AIs like ChatGPT, it’s powered by premium financial data that costs Stansberry Research a fortune to access. It’s designed to provide instant, data-driven insights, similar to what you’d get from a pricey Bloomberg terminal, making it a go-to for sorting through market noise.

What kind of results has The N.E.W. System shown in testing?

Backtests claim The N.E.W. System has outperformed stocks, bonds, gold, real estate, and Warren Buffett’s Berkshire Hathaway, with less risk based on the Sharpe Ratio, a measure of return per unit of risk. It could have turned $100,000 into $339,000 through the COVID crash, inflation spikes, and three market downturns (2020, 2022, 2025). Specific wins include Nutex Health (up 1,100%), Robinhood (up 340%), and AppLovin (up 2,500%), while it avoided losers like Rezolve AI (down 70%) and Jet.AI (nearly wiped out).

Is The N.E.W. System suitable for beginner investors?

Yes, it’s designed to be user-friendly. You don’t need a finance degree to use it—just a computer or smartphone. The system provides clear instructions, including a calculator that tells you exactly how many shares to buy based on your investment size. Monthly updates from Stansberry Research also explain market trends and recommendations in plain language, making it accessible for newbies and seasoned investors alike.

How does the $149 trial work, and what’s included?

For a promotional price of $149 (down from $499), you get a 30-day risk-free trial to Stansberry’s Investment Advisory, which includes The N.E.W. System, StansberryGPT, and the Stansberry Score. You’ll receive quarterly model portfolios, a tool to check any stock’s score, a chatbot for market queries, and monthly market updates averaging 21% gains since 1999. If it’s not for you, cancel within 30 days for a full refund—no questions asked.

Why is the trial so affordable compared to Wall Street fees?

Tilson’s old hedge fund charged a “2 and 20” fee structure—2% of capital and 20% of profits, which could mean $20,000 in fees on a $500,000 portfolio with a 10% return. Stansberry Research skips performance fees and commissions, focusing on affordable research. The $149 trial reflects their goal to make AI-driven investing accessible, not just for Wall Street’s elite.

Can I use StansberryGPT to get personalized financial advice?

No, StansberryGPT isn’t a financial advisor—it’s a research tool. It answers questions with data-driven insights but doesn’t tailor advice to your personal situation. For that, you’d need to consult a licensed financial advisor. Think of it as a super-smart assistant for exploring market ideas, not a replacement for professional guidance.

How does The N.E.W. System compare to owning AI stocks like Nvidia?

Owning AI stocks like Nvidia is about betting on one company’s success. The N.E.W. System uses AI to find the best stocks across all sectors, not just tech. It’s flagged winners like Nutex Health and AppLovin, not just AI darlings, and avoids losers like Jet.AI. It’s less about picking the next big tech stock and more about using AI’s brainpower to spot opportunities everywhere.

Is Stansberry Research trustworthy?

Stansberry Research has been around since 1999, serving over a million clients in 150 countries. They’ve called major market shifts, like the collapse of Kodak and Fannie Mae, and were early on Nvidia (up 6,000%) and Bitcoin (now past $120,000). Their track record and no-fee model add credibility, though, like any investment research, results aren’t guaranteed.

Why does Tilson say AI is a “do-or-die” moment for investors?

Tilson sees AI as a game-changer, like the internet in the ‘90s. It’s created 600,000 millionaires in 2024 and is powering solo businesses worth millions. But it’s also widening the wealth gap, with 339 million Americans missing out. He argues that using tools like The N.E.W. System puts you ahead of the curve, while ignoring AI risks leaving you behind, like those who stuck with Blockbuster as Netflix rose.

What’s the catch with the risk-free trial?

There’s no catch—you get 30 days to try everything for $149, and if it’s not your thing, you get a full refund. The low price is meant to make it easy to test the system without committing long-term. Just be aware that investing always carries risk, and past performance (like the $100,000-to-$339,000 claim) doesn’t guarantee future gains.

How does The N.E.W. System reduce risk compared to other investments?

The system uses the Sharpe Ratio to show it delivers higher returns per unit of risk than stocks, bonds, or gold. By analyzing thousands of stocks and simulating portfolio outcomes, it picks diversified, high-potential stocks while avoiding risky flops. It’s not risk-free—nothing is—but it aims to stack the odds in your favor with data, not gut feelings.

Can I check the score of any stock with The N.E.W. System?

Yes, the Stansberry Score lets you type in any stock’s ticker to see its potential, from 0 to 100. It’s helped spot winners like Sprott (up 67%) and dodge losers like Noodles & Company. It’s a quick way to vet stocks you hear about without relying on hype or rumors.

How does this differ from traditional financial research?

Traditional research relies on human analysts, long reports, and often hefty fees. The N.E.W. System uses AI to process data instantly, delivering clear, actionable picks. StansberryGPT adds a conversational twist, letting you explore ideas on your terms. It’s faster, cheaper, and cuts through Wall Street’s noise.

Is this system only for tech-savvy investors?

Not at all. If you can use a smartphone or computer, you’re set. The system’s calculator and StansberryGPT are designed to be intuitive, and the Quick Start Guide walks you through everything. It’s built for anyone who wants to invest smarter, no tech expertise required.