In an era of unprecedented economic uncertainty, where the specter of a U.S. debt default looms and market volatility is the new normal, investors face a daunting challenge: how to protect and grow their wealth in a financial landscape fraught with peril.

Porter Stansberry, a renowned financial analyst with a track record of prescient market calls, and Keith Kaplan, the innovative CEO of TradeSmith, recently shared a compelling discussion that not only highlights the dangers ahead but also offers a powerful solution—Trade360. This comprehensive investment platform, built on decades of data-driven research, promises to revolutionize how investors navigate turbulent markets. Here’s why Trade360 is not just a tool but a necessity for anyone serious about safeguarding their financial future.

The Gathering Storm: Porter Stansberry’s Dire Warning

Porter Stansberry, founder of Porter & Co. and a former key figure at Stansberry Research, has built a reputation for anticipating major market shifts. His warnings about the collapse of Fannie Mae, Freddie Mac, General Motors, and General Growth Properties before the Great Recession earned him accolades from outlets like Barron’s, which called his insights “remarkably prescient.” In his latest presentation, Stansberry delivers a chilling forecast: the U.S. is on a collision course with a financial crisis driven by unsustainable government debt and the potential loss of the dollar’s world reserve currency status.

Stansberry points to the staggering $37 trillion U.S. national debt, with interest expenses now surpassing military and healthcare spending. He warns that by 2028, federal spending could balloon to $8.7 trillion annually, fueled by mandatory programs like Social Security ($1.6 trillion), Medicare ($1.1 trillion), and Medicaid, alongside rising interest costs projected to hit $2 trillion. The Congressional Budget Office estimates an additional $8 trillion in borrowing over the next four years, requiring the government to refinance $21 trillion in existing debt at potentially higher rates. This, Stansberry argues, makes a U.S. Treasury default within four years “inevitable.”

The implications are dire. Stansberry compares a potential U.S. default to the Greek debt crisis of 2009, which saw stocks and bonds plummet, unemployment soar to 25%, and widespread economic devastation. He notes that foreign central banks are already divesting from U.S. Treasuries—selling $200 billion in 2024 alone—while stockpiling gold at record levels (over 1,000 tons annually since 2022). Gold prices have surged 65% since early 2024, signaling a loss of confidence in the dollar, which has lost 10% of its value against other currencies in just six months and 92% against gold since 1999.

Stansberry’s critique extends to recent policy moves, particularly President Trump’s tariff proposals, which he calls “the largest tax increase in history” if fully implemented. While acknowledging Trump’s intent to bolster the middle class and curb inflation-driven asset bubbles, Stansberry argues that tariffs are a flawed solution, disrupting global supply chains and exacerbating market volatility. The recent “Liberation Day” tariff announcements triggered a 19% drop in the S&P 500, a 24% plunge in the NASDAQ, and significant declines in high-flying stocks like Nvidia (31%) and MicroStrategy (25%). Although markets have partially recovered, Stansberry warns that this volatility is merely a “taste of what’s to come.”

The Investor’s Dilemma: Where to Turn?

In this precarious environment, traditional safe havens are losing their luster. Cash is eroding, with 20% of its purchasing power gone since the pandemic due to inflation. Long-dated U.S. Treasury bonds, once considered “risk-free,” have plummeted 50% in recent years as interest rates rose. Stansberry advises against holding these bonds, warning that they are tied to a “bankrupt, failing state” addicted to debt and money printing. Even gold, while a hedge against dollar devaluation, lacks the liquidity and growth potential needed for most investors’ portfolios.

Stansberry’s solution? Stay invested in high-quality American businesses, which he calls “the greatest creators of wealth” globally, but with a critical caveat: investors must have a disciplined exit strategy. The emotional pitfalls of investing—holding losers too long and selling winners too soon—can be catastrophic, especially in a market teetering on the edge of collapse. This is where Keith Kaplan’s Trade360 enters the picture, offering a systematic, emotion-free approach to managing investments.

Keith Kaplan and the Power of Trade360

Keith Kaplan, CEO of TradeSmith, brings a unique perspective to the table. Unlike traditional Wall Street insiders, Kaplan’s background is in software, not finance, which he considers an advantage. His outsider’s view led to the creation of Trade360, a suite of tools designed to empower everyday investors to make smarter, data-driven decisions. At the heart of Trade360 is TradeStops, a platform that has transformed the portfolios of over 120,000 users managing $30 billion in assets.

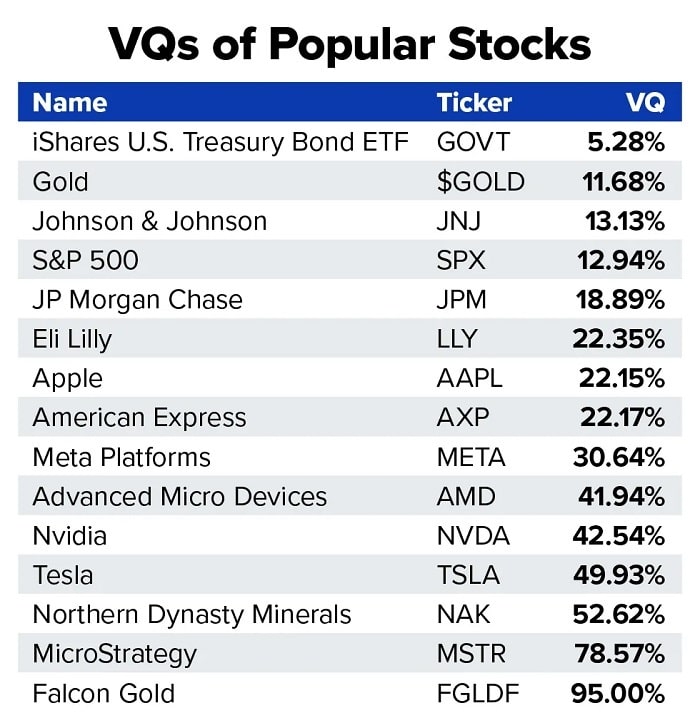

The Volatility Quotient (VQ): A Smarter Trailing Stop

The cornerstone of TradeStops is the Volatility Quotient (VQ), a proprietary metric that calculates a customized trailing stop for every stock, ETF, or mutual fund based on its unique volatility profile. Unlike a standard 25% trailing stop, which applies a one-size-fits-all approach, the VQ tailors exit points to each security’s historical price swings.

For example, a volatile stock like Advanced Micro Devices (AMD), which has fallen 25% or more 72 times since 1980, requires a wider stop (42% VQ), while a stable stock like Johnson & Johnson, with only 13 such drops since 1944, needs a tighter one.

Kaplan’s personal experience underscores the VQ’s value. In 2016, he sold AMD for a 3.5% loss, spooked by early volatility, only to watch it soar over 1,000%. Had he used the VQ, he could have held on for a 1,300% gain by exiting in 2022. Similarly, during the 2020 COVID crash, Kaplan sold nearly all his stocks on February 27, 2020, after a VQ-based alert, avoiding a 30% market plunge. For Delta Air Lines, the VQ triggered an exit on February 26, 2020, limiting losses to 8% instead of the 65% suffered by those who held on.

Backtests demonstrate the VQ’s transformative impact. For Stansberry’s Investment Advisory portfolio, using VQ-based stops and Trade360’s tools boosted returns by 27% over 25 years. Similar enhancements were seen across other MarketWise publications, including True Wealth (nearly doubled returns), Commodity Supercycles (over 4x returns), and Extreme Value. Even billionaire investors like George Soros, Carl Icahn, and Ray Dalio could have improved their performance by 30% to 600% using Trade360, with 15 of 17 billionaires seeing enhanced returns.

Red Light/Green Light System: Timing the Market

Trade360’s red light/green light system simplifies market timing. By scanning thousands of securities daily, it signals when stocks are in “buy” (green), “hold” (yellow), or “sell” (red) mode based on their VQ.

This system flagged buying opportunities like Palantir Technologies (698% gain since 2023), Nvidia (624% gain), and Moderna (2,215% gain pre-COVID), while warning of selloffs before major gage to bear markets. In 2020, it issued a bear market alert on February 27, saving users from the worst of the crash. In 2022 and 2025, similar alerts helped users sidestep significant losses.

Position Size Calculator: Risk-Adjusted Investing

The Position Size Calculator addresses another common mistake: over-allocating to risky stocks. By calculating optimal position sizes based on a stock’s VQ and an investor’s risk tolerance, it ensures safer stocks get larger allocations. Backtests show dramatic results—one investor turned a $600,000 loss into a $1.1 million gain, and another transformed a $36,000 loss into a 56% gain, simply by adjusting position sizes without changing the stocks or timing.

Snapback Strategy: Capitalizing on Volatility

The Snapback Strategy targets “oversold” stocks poised for quick rebounds, ideal for volatile markets. During the 2020 COVID crash, it flagged Humana for a 64% gain in 21 days. In 2022, it identified Caesars Entertainment for a 36% gain, and in 2024, Globe Life for a 60% gain. With a 78% win rate and an average 15% return per trade, Snapback is a powerful tool for capturing short-term opportunities.

Additional Features: Billionaire Portfolios and More

Trade360 includes access to the portfolios of 41 billionaires, allowing users to mirror the moves of investors like Warren Buffett. The Pure Quant Portfolio Builder curates top investment ideas and allocates capital based on risk, quadrupling billionaire portfolio gains in backtests. The risk-rebalancer tool optimizes entire portfolios, and the “My Services” feature integrates newsletter recommendations, sorting them by volatility to align with users’ strategies.

Why Trade360 Is a Must-Have for Investors

The case for Trade360 is compelling in today’s volatile market. Stansberry’s prediction of a looming U.S. debt crisis underscores the need for a disciplined, emotion-free investment strategy.

Trade360’s tools address the emotional pitfalls that plague investors, as evidenced by Kaplan’s own mistakes and the improved performance of even billionaire portfolios. The platform’s ability to enhance returns across diverse investment strategies—by up to 4x in some cases—makes it a universal solution for self-directed investors.

At $2,000 for a one-year subscription (a 60% discount from the regular $5,000 price), Trade360 offers unparalleled value. With a 90-day satisfaction guarantee, users can try it risk-free, and credits can be applied to other TradeSmith or Stansberry Research products if unsatisfied. The platform’s user-friendly interface, supported by video tutorials and a dedicated customer service team, ensures accessibility for all, as testimonials from users like 73-year-old Patricia W. and Hal C. attest.

Conclusion: Secure Your Financial Future with Trade360

The financial world is at a crossroads. With government debt spiraling, the dollar’s value eroding, and market volatility surging, investors cannot afford to rely on outdated strategies like “buy and hold.” Porter Stansberry’s dire warnings and Keith Kaplan’s data-driven solutions paint a clear picture: Trade360 is the ultimate tool for navigating this storm. By providing customized exit strategies, market timing signals, risk-adjusted allocations, and rapid-response opportunities, Trade360 empowers investors to protect their wealth and seize upside potential.

Don’t let emotions derail your financial future. For just $2,000, Trade360 offers a comprehensive suite of tools that could save you from catastrophic losses and amplify your gains. As Stansberry warns, the next crash could wipe out 50% or more of your portfolio. Act now to secure your subscription at this limited-time price and take control of your investments before the storm hits.

Trade360 Frequently Asked Questions (FAQ)

What is Trade360 by TradeSmith?

Trade360 is a comprehensive investment platform by TradeSmith that includes TradeStops and other tools to help investors make data-driven decisions. Key features include the Volatility Quotient (VQ) for tailored trailing stops, a red light/green light system for market timing, a Position Size Calculator, the Snapback Strategy for short-term gains, and access to billionaire portfolios.

How does Trade360 protect my investments?

Trade360 minimizes losses and maximizes gains by:

- Using VQ-based trailing stops to exit stocks at optimal points based on their volatility.

- Providing market timing signals to buy or sell based on market conditions.

- Offering risk-adjusted position sizing to allocate capital safely.

- Identifying short-term opportunities with the Snapback Strategy.

- Optimizing portfolios with tools like the risk-rebalancer and Pure Quant Portfolio Builder.

What is the Volatility Quotient (VQ)?

The VQ is a proprietary metric that sets a custom trailing stop for each stock, ETF, or mutual fund based on its historical price volatility. For example, a volatile stock like Advanced Micro Devices might have a 42% VQ stop, while a stable stock like Johnson & Johnson has a tighter stop, preventing premature sales or prolonged losses.

How does the red light/green light system work?

This system analyzes thousands of securities daily, assigning:

- Green: Buy, indicating a strong entry point.

- Yellow: Hold, suggesting caution.

- Red: Sell, signaling an exit to avoid losses. It has identified winners like Nvidia (624% gain) and issued sell alerts before crashes, such as the 2020 COVID downturn.

What is the Snapback Strategy?

The Snapback Strategy targets oversold stocks likely to rebound quickly. It has a 78% win rate, with examples like Humana (64% gain in 21 days in 2020), Caesars Entertainment (36% gain in 2022), and Globe Life (60% gain in 2024), offering opportunities in volatile markets.

How does the Position Size Calculator help?

The calculator determines optimal investment sizes based on a stock’s VQ and your risk tolerance, allocating more to safer stocks. Backtests show it can turn losses into gains, such as one user converting a $600,000 loss into a $1.1 million gain by adjusting allocations.

Who should use Trade360?

Trade360 suits investors of all levels, from beginners to experts, and works with any stock or fund, whether from newsletters, personal research, or media. Backtests show it improved returns for 15 of 17 billionaires, proving its value for diverse strategies.

How much is Trade360?

Trade360 is currently available for $2,000 per year, a 60% discount from its regular $5,000 price. This limited-time offer includes full access to all tools, with the price reverting to $5,000 after the promotion ends.

Is Trade360 user-friendly?

Yes, Trade360 is designed for ease of use, with a simple interface and the ability to sync brokerage accounts in minutes. It includes video tutorials and U.S.-based customer support. Users like 73-year-old Patricia W. find it accessible, even with minimal tech skills.

What is the Trade360 guarantee?

Trade360 offers a 90-day satisfaction guarantee. If unsatisfied, contact TradeSmith’s customer support for a full $2,000 credit, applicable to other TradeSmith or Stansberry Research products, making the trial risk-free.

Can Trade360 prevent market crash losses?

While no tool eliminates all risk, Trade360’s VQ alerts and bear market signals have helped users avoid major losses, such as during the 2020 COVID crash (30% drop avoided), 2022 bear market, and 2025 tariff selloff (19% drop mitigated).

What are billionaire portfolios?

Trade360 provides access to the stock holdings of 41 billionaires, like Warren Buffett, allowing you to replicate their moves. The Pure Quant Portfolio Builder selects top picks and allocates capital based on risk, quadrupling gains in backtests.

Is Trade360 worth $2,000?

With the potential to boost returns (e.g., 27% for Stansberry’s portfolio, 4x for Commodity Supercycles) and avoid significant losses, Trade360 offers substantial value. Users like Amy K. ($5.3 million portfolio) and Michael (hundreds of thousands saved) highlight its impact, and the 90-day guarantee reduces risk.

How do I start using Trade360?

Visit the TradeSmith website or call their customer support to subscribe for $2,000. You’ll get immediate access to all tools, including TradeStops and Snapback. Sync your portfolio and follow the tutorials to begin optimizing your investments.

Why is Trade360 ideal for volatile markets?

Trade360 thrives in uncertainty, with tools like Snapback capitalizing on volatility, VQ stops protecting against sharp declines, and bear market alerts signaling exits. As Stansberry predicts increased volatility, Trade360 is essential for safeguarding wealth.

Can Trade360 support retirement goals?

Yes, by minimizing losses and optimizing returns, Trade360 helps protect retirement savings. Its risk-focused tools align portfolios with long-term objectives, giving users like Mike O. peace of mind.

Is Trade360 suitable for beginners?

Absolutely. Trade360 simplifies complex decisions with clear signals and support, making it ideal for novices. Its intuitive design and educational resources ensure accessibility for all.

How does Trade360 differ from other tools?

Trade360 stands out with its comprehensive approach, combining VQ stops, market timing, risk sizing, Snapback, and billionaire portfolios. Its proven ability to enhance billionaire performance and newsletter strategies makes it unique.

Why subscribe now?

The $2,000 offer is temporary, and the price will rise to $5,000. With Stansberry’s predicted crisis looming, waiting risks exposure to market declines. The 90-day guarantee allows you to try Trade360 risk-free, making now the ideal time to act.