In the most recent announcement – Stansberry’s CEO, David Eifrig – shared details about Stansberry Research Total Portfolio. This is Stansberry’s new service where you can find their best recommendations gathered in one place.

Some of the readers reported it already have more than doubled their portfolio. It could soon become even more profitable, no matter where stocks are headed next. Read further for all details and how you can also take this opportunity.

The Total Portfolio Review: Overview

The Total Portfolio is an opportunity to significantly grow your wealth, regardless of what happens in the market. It’s made to eliminate the need to continuously monitor your brokerage account and worry about the status of your investments.

It includes the best recommendations from across Stansberry’s research. Together in one perfectly balanced, fully diversified model portfolio built to grow in any market conditions.

As the markets change, it will be adjusted. Adding positions as necessary and taking profits when the time is appropriate. Stansberry’s goal is to manage it just like a hedge fund would manage their portfolios.

If you want to access ALL Stansberry’s best recommendations in one place – The Total Portfolio is the place to go.

This complete portfolio has been meticulously crafted and diversified across different asset classes. Each component works in harmony, using strategies that have been shown to enhance your returns over time.

It’s a traditional 60/40 portfolio – 60% in stocks, 40% in bonds so you get all the upside of stocks, but the protection of bonds.

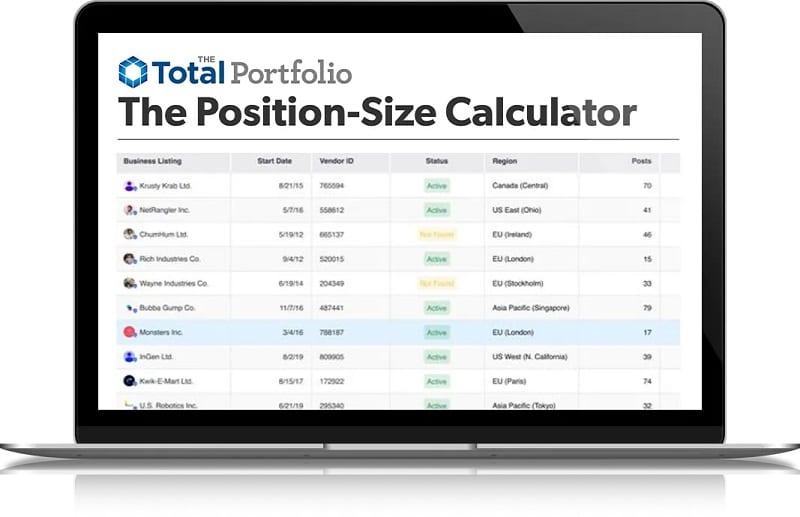

You’ll also have clarity on how much to invest in each asset. Stansberry’s team created an interactive tool that displays the optimal number of shares for every stock, ensuring your portfolio remains balanced no matter how much you can invest. Enter your investment amount, and it will calculate the necessary shares for you. There’s no guessing. Everything is methodically calculated for your convenience.

You will also receive precise sell signals, guiding you on managing your investments effectively. This could involve cashing in some gains or reallocating a portion of your profits into other areas of the portfolio. Once again, the team behind it will handle all the complex details for you.

The Total Portfolio: History of Success

Last year Stansberry Research published 170 buy recommendations across their business. Even if you had access to all the underlying research (unlikely because total price of their Alliance program costs $34,000), you will never be able to invest in all of their recommendations. This means that you can’t take advantage of everything, therefore more recommendations don’t always result in better gains.

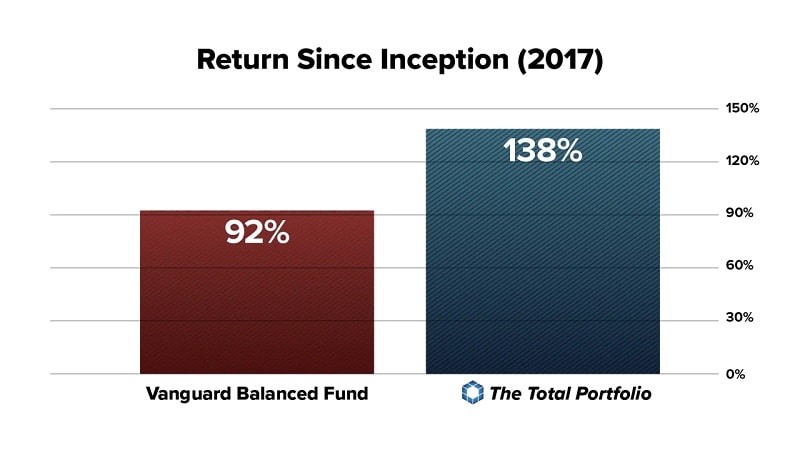

The team behind The Total Portfolio compares it to Vanguard Balanced Fund.

Since Stansberry started this project in 2017 The Vanguard Balanced Fund has returned 92.1%. But The Total Portfolio has outperformed massively – it’s up 138%.

It’s really outstanding to make 138% over eight years, despite two significant crashes and a sharp increase in inflation.

Who’s behind The Total Portfolio?

Every single recommendation in the portfolio has been fully researched and vetted by one of Stansberry’s leading experts, including, Whitney Tilson, Brett Eversole, Eric Wade, Dan Ferris, Greg Diamond, Dr. David Eifrig, etc. They are all behind Total Portfolio. So, you’ll have a really strong team behind you.

Their team includes over 25 analysts, including three CFAs, two chartered market technicians, a certified financial planner, two public accountants, and 11 MBAs.

Take Whitney Tilson, for example—he founded and managed his own hedge fund for almost two decades. Tilson tripled the capital of his clients, outperformed the S&P 500 during both the tech downturn of the early 2000s and the 2008 financial meltdown, and even identified the bottom of the bear market in December 2008 during an appearance on 60 Minutes, just before the start of the longest bull market in history.

Dan Ferris is among the sharpest investors these days. He operates independently and remains completely unaffected by the hot trends and media hype that distracts so many. His performance record is exceptional.

For example, Dan shorted Lehman Brothers FIVE MONTHS before its collapse. He forecasted Bitcoin’s crash in December 2017, just before it plummeted by 80%.

More recently, he has guided his readers to achieve over 100% gains on 19 various stocks.

Now, if the crypto market starts to look promising, just as it does now, Eric Wade, a top crypto investor in the U.S. is also in the team. Eric began mining Bitcoin back in 2013. He has connected with influential figures like Vitalik Buterin, the founder of Ethereum. His recommendations have proven to be extraordinarily lucrative, with over 10 different cryptocurrencies that have appreciated by 1,000% or more.

The Total Portfolio is overseen by a group of five people – Whitney Tilson, Brett Eversole, Matt Weinschenk, Alan Gula, and Dr. David Eifrig.

Once a month, the Total Portfolio investing committee meets to choose suggestions that they deem to be “the best of the best.” That committee has over 60 years of total market expertise and is led by a former Goldman Sachs analyst. They can select the absolute best recommendations from ANY Stansberry Research publication.

How to Access Stansberry’s Best Investment Ideas?

If the growing number of concepts from Stansberry Research is overwhelming you, The Total Portfolio eliminates uncertainty.

The Total Portfolio is a perfect way to learn about Stansberry’s best investment ideas without having to listen to their marketing, which I know some people find annoying.

To gain access to The Total Portfolio, along with premier access to bonus research reports that aren’t available anywhere else, you must become a Total Portfolio member.

What’s Included with Total Portfolio membership?

Sign up before this offer expires and you’ll receive:

- Premier access: The Total Portfolio ($5,000 value).

- Access to the 2025 Total Portfolio – Stansberry’s best recommendations in one fully allocated model portfolio.

- Instant access to the Top Conviction Trades for 2025 ($2,500 value).

Each editor from the entire Stansberry Research company has one unique trade listed therein. This isn’t a portfolio, but it consists of a number of stand-alone, profitable concepts that might all see significant growth in 2025. If one of these trades produced a huge return this year, I wouldn’t be shocked.

- Instant access to The Position-Size Calculator.

- Premier Access to ALL 8 Underlying Publications

Premier Access to all the publications you see below, for as long as they are published ($14,493 value)!

- Premier Access to Stansberrry’s Investment Advisory

- Premier Access to True Wealth

- Premier Access to Retirement Millionaire

- Premier Access to Commodity Supercycles

- Premier Access to Stansberry’s Innovations Report

- Premier Access to The Ferris Report

- Premier Access to DailyWealth Trader

- Premier Access to Extreme Value

The Total Portfolio Pricing

There’s no minimum capital requirement and there are no performance fees. There’s just one flat fee, regardless of how much capital you can invest, if you decide to invest at all.

A subscription to The Total Portfolio costs just $3,000. That’s not an annual fee. It’s a one-time-only payment for as long as they publish it.

It’s kind of a backdoor way to access Stansberry’s best work, at a tiny fraction of the cost of an Alliance membership.

The Total Portfolio Refund Policy

With this offer you are fully protected by 100% Satisfaction Guarantee from Stansberry Research. You’ll have 30 days to review The Total Portfolio along with complete access to all recommendations. Simply give their Member Services staff a call at any time over the following 30 days if you’re not satisfied for any reason. You’ll get a complete refund in the form of Stansberry Research credit.

Please be aware that this deal does not include cash refund.

Conclusion

The team behind The Total Portfolio will not manage your money as the hedge funds do. But they have the same approach. They handle investments similarly to a hedge fund, but without the exorbitant fees or withdrawal limitations.

Chasing the next great stock is a gambler’s mentality. Occasionally, if you’re fortunate enough to purchase something like Nvidia at the ideal time, it will pay off.

However, it is much more likely that chasing that one “dream stock” would land you in hot water, particularly if the market plummets, as it did in 2022.

The team behind The Total Portfolio are far away from gambling. They call themself “wealth compounders.” They aim to preserve capital when the markets are rough and grow it when opportunities emerge. And their track record proves it, especially in 2021, 2022, 2023 and 2024.

>> Join now for one-time fee of $3,000! Limited Time Offer! <<