The gold and silver markets are surging as economic instability, geopolitical conflicts, and rampant inflation drive investors toward safe-haven assets.

While physical gold offers stability, the real opportunity lies in mining stocks, which have historically delivered exponential returns during bull markets. At the forefront of uncovering these opportunities is Sean Brodrick and his premium investment service, Resource Trader.

This review explores the key features of Resource Trader, the current gold bull market, the advantages of mining stocks, and whether this service is worth your investment.

What Is Resource Trader?

Resource Trader is a specialized investment service focusing on high-potential opportunities in the resource sector, particularly gold and silver. Led by Sean Brodrick, a veteran in resource investing, it provides members with actionable insights, stock recommendations, and real-time trade alerts.

Sean Brodrick is not your typical analyst. Known as the “Indiana Jones of Mining,” he takes a hands-on approach, traveling to mines, inspecting ore quality, and meeting with CEOs to identify opportunities before they hit the mainstream.

His three decades of experience in the resource sector have earned him a reputation for accuracy and foresight, making Resource Trader a trusted service for those looking to capitalize on commodity markets.

The Gold Bull Market: Why It Matters

Gold has recently hit record highs, surpassing $2,800 an ounce. This surge is not an isolated event but the result of multiple forces converging to create the perfect storm for the precious metals market.

Reckless Government Spending and Inflation

The U.S. national debt has ballooned to over $35 trillion, driven by unprecedented government spending and money printing.

The Federal Reserve has increased the money supply from $4 trillion to $18 trillion in just four years, triggering inflation levels unseen since the 1970s. Gold, which cannot be printed, thrives in such environments as a hedge against inflation.

— RECOMMENDED —

Protect your savings with gold and silver!

Inside This FREE REPORT, you’ll discover one simple strategy that anyone can use to help protect their retirement savings from market instability!

Request your free guide today and get prepared!

Interest Rate Cuts

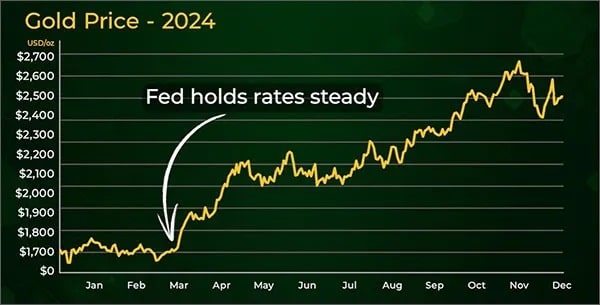

The Federal Reserve has shifted its monetary policy, moving from interest rate hikes to cuts in an attempt to stabilize the economy. Historically, these cycles have been highly favorable for gold.

For instance, in the 1970s, a rate-cutting cycle propelled gold prices up by 262%. A similar scenario unfolded in the 2000s, where gold prices nearly tripled. With further cuts expected, gold prices could soar even higher.

Geopolitical Instability

Ongoing global conflicts, from the war in Ukraine to tensions in the South China Sea, have created a climate of uncertainty. Domestically, fears of civil unrest have been echoed by financial leaders like Ray Dalio and Jamie Dimon.

Central Bank Gold Buying

Central banks worldwide are dumping U.S. dollars and stockpiling gold at unprecedented levels.

Countries like China, Russia, and Saudi Arabia are leading this trend, which further strengthens the bullish case for gold.

Why Mining Stocks Outperform?

While owning physical gold is an excellent way to preserve wealth, it offers limited profit potential. Mining stocks, on the other hand, provide leverage. As gold prices rise, miners’ profit margins expand exponentially, resulting in far greater returns for investors.

Consider this example:

If it costs a mining company $1,200 to produce an ounce of gold, and the market price of gold rises from $2,000 to $3,000, the company’s profits double, even though gold prices increased by only 50%. This leverage effect is why mining stocks often outperform physical gold during bull markets.

There is also enough historical data to support this:

- During the 2000s bull market, gold rose 454%, but mining stocks like International Tower Hill Mines and LKA Gold surged 5,090% and 9,850%, respectively.

- In the 1990s bull market, gold rose modestly by 16%, while mining stocks like Cartaway delivered gains of 26,040%.

- Even during the 1970s, a 264% rise in gold led to mining stock gains as high as 49x.

Sean Brodrick’s Approach

Sean Brodrick’s methodology is rooted in his GOLD Checklist, a framework that evaluates mining companies based on four critical factors:

- Geography: Favorable, mining-friendly jurisdictions with stable political climates.

- Ore Quality: High-grade deposits measured in grams of gold per ton of ore, which directly impacts profitability.

- Leadership: Proven management teams with a track record of success in mining.

- Discovery: Projects with untapped growth potential, often referred to as “blue sky” opportunities.

This rigorous evaluation process ensures that every recommendation aligns with high standards for growth and stability.

Top Stock Picks from Resource Trader

Sean Brodrick leverages decades of experience and his proprietary evaluation framework to identify top-performing opportunities in the gold and silver markets. His recommendations cater to both conservative investors seeking stability and aggressive investors aiming for explosive growth. Here’s a closer look at some of his current top picks.

A High-Grade Miner with Significant Growth Potential

This miner owns some of the richest gold deposits globally, boasting ore grades far above the industry average. With plans to double production from 220,000 ounces to 500,000 ounces annually, this company is well-positioned for substantial gains.

Even if gold prices remain steady, the scalability and operational efficiency of this miner make it a top contender for growth.

A Royalty and Streaming Titan

For investors seeking a low-risk, high-reward model, this company offers a lucrative royalty and streaming business. Unlike traditional miners, it doesn’t operate mines but finances them in exchange for a share of their production.

This minimizes risk while maximizing profits as gold prices climb. Historical precedent highlights the potential — companies like Franco Nevada have turned $5,000 investments into $1.7 million over two decades. This titan is poised to thrive in the current bull market.

A Small-Cap Miner with 10x Upside

With a market cap under $150 million, this junior miner offers exceptional growth potential. Operating in a mining-friendly jurisdiction, the company is on track to triple earnings within two years. For aggressive investors seeking high returns, this under-the-radar play could deliver exponential gains in line with past bull market outperformers.

High-Growth Silver Stocks

Sean’s expertise extends beyond gold, and his focus on silver stocks is equally compelling. Historically, silver lags gold at the beginning of a bull market but often outpaces it later.

With silver prices already up 46% this year, select stocks have delivered triple-digit returns, such as Pantera (+400%) and Silver Dollar (+115%).

Sean’s top three small-cap silver recommendations include companies with robust reserves, low production costs, and high growth trajectories.

Why Timing Is Critical

The Federal Reserve’s anticipated rate cuts on January 28 are expected to act as a major inflection point for gold prices, potentially pushing them past $3,000 and setting the stage for further gains to $6,900.

Historically, mining stocks lag behind physical gold in the early stages of a bull market, presenting a golden opportunity for investors to enter before these stocks experience their full upside potential.

Benefits of Joining Resource Trader

By subscribing to Resource Trader, members receive a comprehensive toolkit to capitalize on the current gold and silver bull markets. Key benefits include:

- Top Stock Recommendations: Sean’s meticulously vetted gold and silver stock picks, tailored for maximum growth.

- Real-Time Alerts: Immediate updates on new opportunities and actionable trade recommendations delivered directly to your inbox.

- Comprehensive Analysis: Detailed reports on resource markets, company fundamentals, and global economic trends.

- Exclusive Bonuses: A Weiss Ratings gold bar (2 grams) for new members, symbolizing the start of their journey into the gold market.

- Year-Round Support: Continuous portfolio updates, trade alerts, and insights into emerging opportunities across the resource sector.

Final Verdict: Is Resource Trader Worth It?

For investors looking to capitalize on the gold and silver bull markets, Resource Trader offers a comprehensive, well-researched approach to the resource sector. Sean Brodrick’s expertise and hands-on methodology provide an edge in identifying high-potential stocks, making this service a valuable resource for those seeking exponential gains. The combination of physical gold, mining stocks, and strategic insights could position you for significant returns in this historic bull market.