Wondering if the InvestorPlace AI Revolution Portfolio is right for you? Read this review to make an informed decision. Get all the facts before you invest.

Have you heard about InvestorPlace AI Impact Event? Some of you might have missed it because in the past three years you’ve watched other events alarming about AI phenomenon.

Legendary investors Louis Navellier, Eric Fry, and Luke Lango have been warning and educating their followers about what is going on and how to protect your family and savings from the consequences.

AI Impact event is important because finally, the day they have been warning for the past three years has arrived. It gives important information on what to expect, what to do and how to do it.

If you don’t pay attention, it could have significant effects on your life, including your career, income, and retirement.

All of this is a result of recent developments in artificial intelligence that accelerate this phenomenon.

— RECOMMENDED —

Must See: Incredible New Stock-Predicting AI System

The financial industry is the next in line to be completely disrupted by artificial intelligence. And leading that charge is a groundbreaking AI algorithm called An-E.

What makes An-E so revolutionary? There are two reasons: 1) An-E can predict stock prices four weeks in the future with incredible accuracy… and 2) It’s specifically designed for the everyday person – NOT Wall Street.

And you can begin using it today on 3,000 stocks.

Click here to see it in action

Table of Contents

- 1 Artificial Intelligence Boom – What To Expect?

- 2 How Technology Is Destroying Stocks?

- 3 Artificial Intelligence Impact on Our Life

- 4 InvestorPlace AI Revolution Portfolio: Grab This Opportunity

- 5 AI Revolution Portfolio Review: How To Spot An AI Winner Stock?

- 6 AI Revolution Portfolio Review: Louis Navellier, Eric Fry, and Luke Lango Favorite AI Stocks

- 7 The AI Revolution Portfolio Review: 9 AI Stocks To Buy Right Away

- 8 AI Revolution Portfolio Membership

- 9 How Much Is AI Revolution Portfolio?

- 10 The AI Revolution Portfolio Review: Is It Worth It?

Artificial Intelligence Boom – What To Expect?

The three experts that talked during the AI Impact event shared their prediction that soon there will be significant waves of economic and societal transformation. They see in the near future record levels of bankruptcies and foreclosures.

In short, these three gentlemen claim that the decisions you make over the next 60 days could determine how much money you’ll make or lose in the next decade.

Eric Fry called this phenomenon the Technochasm. Its name illustrates how technology is dividing the world in half and generating a wide gap between the top 1% of earners and the remaining 99% of people.

This is the main reason why some businesses are expanding more quickly than ever, while others are failing in a matter of days. Some stocks have lost nearly half of their value in a single trading day because of this destructive phenomenon.

How Technology Is Destroying Stocks?

Because technology is developing too quickly, many firms are finding it difficult to survive and remain competitive. The same catastrophic conclusion Eric Fry and Louis Navellier have reached is supported by a recent study.

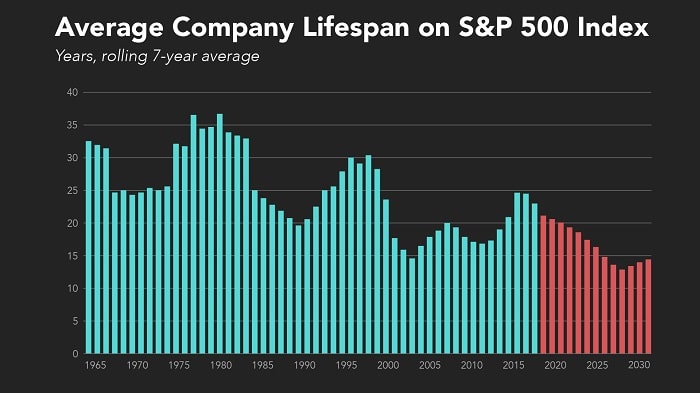

Take a look at this graph depicting the average company longevity on the S&P 500 over the previous 60 years.

Back in 1980, the average time a major firm spent on the S&P 500 was approximately 35 years.

A successful multibillion-dollar company these days can anticipate staying in the S&P 500 for about 20 years or less. This is practically half the time it was only a few decades ago.

The study came to the conclusion that technological changes were the primary cause of this accelerated turnover.

We could see a massive wave of bankruptcies over the next 12 to 24 months. And they are not talking about banks or corporations in the financial sector. That’s because we’ve never experienced this level of change at this rapid rate before… EVER!

For example, ChatGPT, an AI program that can generate humanlike responses to very complex questions in a matter of seconds. It set records for the fastest-growing user base in history. Over 100 million people were using it each month just two months after it launched.

Bottom Line: AI is the fastest-evolving tech in history, and 2023 will go down as the year that everything changed.

— RECOMMENDED —

Legendary Forecaster: “Weird A.I. powered ‘M.A.P.’ going berserk”

Go here and watch the first two minutes of this urgent briefing now.

Because this weird “A.I. powered M.A.P.” has helped legendary forecaster Jason Bodner nail some of the biggest calls of his career.

- Accurately predict every market top and bottom of the last decade (CORRECT)

- Identify the #1 stock of 2022 (CORRECT)

- Pinpoint over 20 triple-digit winners last year (CORRECT)

Jason’s M.A.P. system even pinpointed peak gains of 2,120%, 2,230%, and 5,900%.

But now this system is going berserk over something else entirely.

If you own any stocks (not just A.I. stocks)…

Artificial Intelligence Impact on Our Life

Many experts, including Louis Navellier, Eric Fry, and Luke Lango are talking how this shift will impact your life and what you can do about it. The change is going to happen at a speed that will only make things worse.

Everything you thought you knew is about to change:

- Your job,

- Your earning potential,

- Your retirement,

- Your child’s education,

- Your healthcare,

- How you spend your free time,

- And everything else.

Nothing will be left unaffected by this massive shift. And if we don’t start making changes to the way we think as a community and as individuals, our life, wealth, and the American Dream will be at risk.

In a report released in March, Goldman Sachs predicted that AI would threaten or destroy 300 million jobs over the next few years.

Compare this with the 23 million jobs lost throughout the entirety of the COVID pandemic and economic shutdowns the U.S. The U.S. economy was rocked by this, and many people and companies are still suffering three years later.

However, the number of jobs expected to be destroyed by the technology boom is over ten higher.

In the United States, there are 158 million working adults.

In other words, the number of jobs that will be eliminated is literally twice as large as the adult labor force in this country.

Because of this, it is not surprising that more and more individuals are pushing for some kind of universal basic income, or UBI.

The best part of this rapid change is that we’d also have the chance to make a lot of money in a handful of years.

InvestorPlace AI Revolution Portfolio: Grab This Opportunity

The main idea of The AI Impact Event is that in order to build up wealth in this new stock market, you’ve got to set your sights on the technologies being adopted the fastest.

There is no doubt that artificial intelligence is the fastest adopted technology in our history.

AI Revolution Portfolio Review: How To Spot An AI Winner Stock?

Eric’s advice is the first thing you should know is: It will likely be a company you’ve never heard of.

Look for small and innovative company. Business that is not burdened by debt and don’t require a lot of employees to quickly scale.

Company that relies on artificial intelligence, and applies new business models to old, established industries.

No doubt that Alphabet, Microsoft, and IBM will benefit from the AI Revolution.

Eric is confident that the biggest gains will NOT come from these organizations that are already valued north of a trillion dollars.

The guests at the AI Impact Event believe you want to concentrate your money on two specific groups of stocks:

- the AI innovators and

- the AI suppliers.

Our chances of investing in the upcoming major brand in AI will significantly increase if we concentrate on these two stock baskets.

Read further to get the names.

One of their favorites is IBM with their history of using AI to help them make critical decisions for their business.

On the other side, a company called C3.ai has been quickly growing and making headlines because its AI programs are built better for speed, performance, and scale. These are the requirements for to faster adoption and potentially bigger returns.

While IBM’s stock has been down 10% this year, C3.ai’s stock was up as much as 297% over the same period.

Luke’s point is that both companies are great ways to invest in AI, but C3.ai has WAY more growth potential.

Another great company is BigBear.ai.

Like C3.ai, they’re helping businesses comb through countless reams of data to make better, more informed decision. They have strategic alliances with digital giants like Microsoft and Amazon as well as the U.S. Air Force.

The stock increased by nearly 600% from early January to early February this year.

Another example of an AI pioneer enjoying a successful year is a company called Innodata.

Their AI platform is being leveraged by organizations like Amazon, Microsoft, Apple, Boeing, and Sony. The Innodata’s stock has increased by more than 250% since the year began!

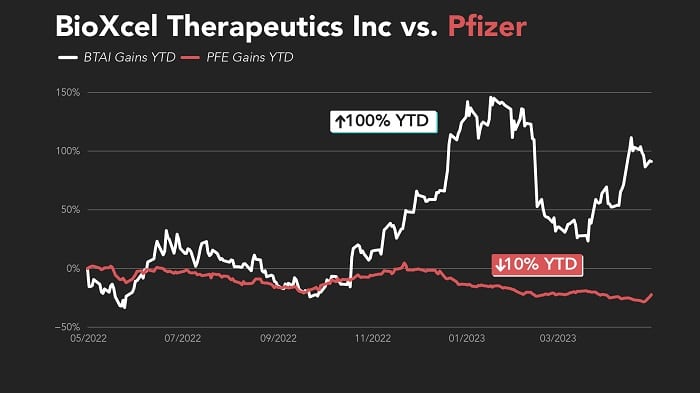

One of the leaders of AI drug discovery is BioXcel Therapeutics.

Over the past year BioXcel’s stock has climbed as much as 100%…

Pfizer has lost roughly 10% of its value over the same time frame.

Schrodinger is yet another business that is using AI to change healthcare. They are battling a variety of cancers with AI.

This program gives an opportunity to many researchers and medical professionals from around the world. They are able to work together and achieve breakthroughs faster.

In fact, clinical trials for a blood cancer medication developed by their AI were launched last summer.

If they succeed, AI will have made huge strides in the battle against cancer. And Schrodinger’s stock price is reflecting all this success and innovation. The stock has increased by as much as 110% since the year’s beginning.

Another multitrillion-dollar sector being disrupted is real estate. Eric shared that he has numerous examples in mind. One of the companies that’s been making strides the past year is Opendoor.

It is changing the entire real estate industry by using AI to streamline the antiquated process of buying and selling real estate.

Luke’s favorite from the financial services sector is a company called Upstart. It has been making huge waves by using a proprietary AI algorithm to revolutionize the multitrillion-dollar credit industry.

Their AI platform goes way beyond a traditional FICO score and quickly scans over 1,000 data points and considers things like schooling and job history.

Their model adds more stability and transparency in a sector of the economy that has lost recently lost the faith of consumers. It explains why Upstarts stock is up as much as 126% this year while bank stocks have been struggling.

Symbotic is the company mentioned as one of the leaders in the charge on warehouse automation and robotics. By combining robotics and a powerful AI system, they’re able to help companies increase efficiency, speed, and flexibility. And its stock has increased by about 300% over the past year!

Information Technology is not very exciting industry, but Saksoft limited is using AI to assist businesses enhance a range of various IT services. And the stock has increased by more than 160% in the last year.

Fortunately, they’ve already determined some of the top stocks to hold during this initial phase of the AI Revolution. Stocks that could 10X your money over the next couple years…

The AI Revolution Portfolio Review: 9 AI Stocks To Buy Right Away

A few months ago, Louis Navellier, Eric Fry, and Luke Lango put their heads together and came up with the next batch of AI innovators to own. They have just announced they finished compiling this list and it is included in a new report called 9 AI Stocks for 10X Gains.

These 9 stocks represent the “best in class” stocks for the first stage of the AI Revolution.

They’ve put all 9 stocks inside the ultimate hypergrowth AI model portfolio, it’s called the AI Revolution Portfolio.

It is part of a brand-new research product that Eric Fry, Louis Navellier and Luke Lango are launching together.

This portfolio is dynamic, so as new opportunities arise. As they seek to realize profits, their plan is to add new recommendations while selling others.

You will have the opportunity to get a hold of this report by becoming a new charter member. Here you can read about all other benefits of this membership.

— RECOMMENDED —

It’s not Nvidia, Meta Platforms, Alphabet, or Amazon. But thanks to a recent major deal, an under-the-radar stock could become the No. 1 winner of the 2023 AI boom. “This company just teamed up with one of the biggest power players in the AI industry… yet you can still buy it for just one-twelfth the price of Nvidia – the time to buy is NOW,” says Marc Chaikin.

Click here for the name and ticker.

AI Revolution Portfolio Membership

Let’s review everything you receive as a charter member of InvestorPlace’s one and only 100% AI-focused research. Here is the list of new member’s benefits:

- One FULL year to The AI Revolution Portfolio (50% OFF the normal price) – This is their first research dedicated exclusively to the incredible AI opportunity. And it’s the one place you’ll get Eric, Louis, and Luke’s best AI recommendations.

- Special Report: 9 AI Stocks for 10X Gains – This report will give you access to the stocks that Eric, Louis, and Luke firmly believe will represent their greatest and most effective recommendations as artificial intelligence (AI) gains momentum.

- Special Report: 10 Stocks that Could Go to Zero – These stocks are household names and held by millions of investors. Currently they are the most dangerous stocks to own.

- Special Report: How to Buy Private Shares of an AI Innovator – This is a rare chance to get into a company that’s on the ground floor. This one of kind report will walk you through how to buy shares of this incredible company.

- Unrestricted Access to the AI hypergrowth model portfolio – You can keep track of all the AI stocks that will emerge as the leaders of the AI Revolution in this model portfolio. You will also get monthly updates and any buy or sell signals from Eric, Luke, and Louis. This is your best chance of learning how to profit TEN TIMES your money or more when AI changes the globe.

- Unrestricted Access to weekly AI briefings – In their other services, they typically communicate with their members just once through their monthly issues and updates. But during AI Revolution now is more important to stay connected and get frequent updates. The best approach to make sure you are up to date and have enough tools to react during the upcoming 12 months is to attend these weekly briefings.

How Much Is AI Revolution Portfolio?

By becoming a Charter Member today, you can receive a full year of access to our AI Revolution Portfolio for just $2,499. Original price is $5,000.

They do not offer cash refunds because new members will get instant access to thousands of dollars of proprietary research.

The AI Revolution Portfolio Review: Is It Worth It?

Do you remember Internet Revolution? If not, maybe you’ve read about this great opportunity that happened three decades ago.

The AI Revolution is very similar to the Internet Revolution. The main difference is that this time, it will develop MUCH more quickly, and AI will generate More wealth than any other invention in human history.

We are lucky we can take action now and the best way to stay on top of this fast-developing story is to become a charter member of AI Revolution Portfolio. You will always have the best guides for your journey.

Good Luck!

Does Amazon have a payment plan that I can purchase AI Revolution Portfolio on a payment plan at no interest??