Imagine sitting in front of your computer, spotting a simple green dot on a chart that could turn $10,000 into $27,000 in just four hours. Sounds like a dream? That’s the kind of promise TradeSmith made during their big T-Day Summit on September 30th. Hosted by longtime journalist Tom Mustin and led by TradeSmith’s own investing expert Keith Kaplan, the event pulled back the curtain on something called “The T-Line.” It’s a new tool that’s part of their Options360 service, and it’s designed to make options trading—usually a scary, complicated thing—feel as easy as buying low and selling high.

I’ve been reviewing trading tools and platforms for years, and I went into this with my eyes wide open. Options have always been for the pros on Wall Street, full of risks and confusing numbers. But the summit talked about real results: a 98.8% win rate on hundreds of trades, stories of people making $1 million in under a year, and ways to grab gains that would take decades the old-fashioned way. In this review, I’ll explain what Options360 really offers, show how The T-Line works with simple examples, and give you the straight talk on if it’s worth your time and money. By the end, you’ll know if this could be the boost your portfolio needs in today’s wild markets.

The summit felt more like a friendly chat than a hard sell. It drew from the ideas of a math whiz named Edward O. Thorp, who made a fortune spotting deals in the markets that others missed. TradeSmith took those old-school smarts and built tools for everyday folks like us. If you’re tired of slow growth from your retirement accounts or just scraping by on Social Security, Options360 might open the door to faster, smarter ways to make money in the stock market.

About Keith Kaplan

Before diving deep into Options360, it’s essential to understand the expertise and background of Keith Kaplan, the expert that helms this system. He has established himself as a trusted voice in the financial community, known for his insightful analyses and practical investment advice.

With robust career-spanning roles such as portfolio manager, financial advisor, and educator, Keith deeply understands market dynamics and options trading strategies. His commitment to educating investors and providing actionable insights makes his Options360 system both credible and valuable.

The Genesis of TradeSmith and Options360: From 2021 Breakthrough to T-Line Glory

TradeSmith didn’t start with fancy options tools—they got their start back in 2005 with something called TradeStops. It’s a simple way to measure how jumpy a stock is, and when they tested it on real people’s portfolios, it showed amazing results. For example, it could turn a $22,000 gain into $141,000 or flip a $2,000 loss into over $90,000 in profit. That got people noticing, but the real excitement kicked off in 2021.

On July 5th of that year, Keith Kaplan—a guy who knows computers and investing inside out—went live on a broadcast that drew over 66,000 viewers. He shared a quick 12-second check he did every Monday to spot trades that could add $500 to $2,000 to his account by Friday. It wasn’t about picking hot stocks; it was a type of quick options trade that most people had never heard of. Keith said he’d been using it since December and was pulling in about $1,388 a week on average. His goal? Help folks heading into retirement get steady cash without relying on low-yield stuff like dividends.

People loved it because their financial advisors weren’t teaching this stuff. Keith even showed how, in tests, it could deliver what would take 28 years in the regular market—all in one week. By the end of 2021, more than 1,000 everyday investors jumped in. A vet named Brad made $4,500 in his first month with no losers. A surgeon from California, Ron, turned the last six months of the year into $1.1 million. And the trades kept winning: 884 so far, with a 98.8% success rate that feels like finding the secret sauce to investing.

Now, fast forward to today. Keith’s back with Options360, a full package that builds on that 2021 success. For a special price of just $2,000 a year (that’s 87% off the regular $15,596 value), you get everything: trade ideas, smart tools, and lessons to get you started. The big new addition is The T-Line, named after Edward Thorp. It’s a visual guide that shows you exactly when to buy or sell options based on their true worth. No more guessing—it’s like having a cheat sheet from the pros.

Why is this a game-changer? Markets today are full of surprises—think AI stocks soaring one day and energy prices flipping the next. Holding stocks for years can leave you exposed to big drops.

Options360 focuses on short moves, where you put money in for hours or days, grab your win, and move on. Keith puts it plainly: “In this uncertain world, quick trades are what’s paying off.” And with built-in checks like the Probability of Profit (or POP), you only go for trades with an 85% or better shot at working.

TradeSmith’s whole vibe is about giving outsiders a fair shot. Keith grew up in a regular family in Baltimore, not some Wall Street dynasty. Just like Thorp, who started as a card counter in blackjack and ended up running a hedge fund that beat the market by five times over 30 years—turning $10,000 into $283,400—Keith’s team spent five years and millions building tools that were once locked away for the rich. Now, it’s out there for anyone.

Options360 is more than gadgets; it’s helped real people change their lives. Take Patrick, a retired consultant from Minnesota. Before 2021, he lost money six out of nine years. After joining, he hit $58,000 the first year, $99,000 the next, and six figures the last two. Now he’s planning a family cruise for his 50th anniversary. Or Rich, who didn’t start investing until retirement and has already banked $1 million since April using these short options plays. Stories like these aren’t luck—they’re what happens when you get a real edge. Of course, they add the usual note: These results aren’t typical, and trading can mean losing money. But with thousands of users since 2021, it’s hard to ignore the pattern.

Demystifying Options: Why They’re Safer Than You Think

If you’ve ever looked at options trading and thought, “That’s way too complicated for me,” you’re not alone. Most trading apps throw a wall of numbers at you, like on ThinkorSwim, where it’s hard to even figure out what to click. Tom Mustin calls it “instructions for a chemistry experiment.” But here’s the good news: Options360 makes it straightforward, and surprisingly, options can actually be less risky than just buying stocks if you use them right.

Think of options like a bet on where a stock is headed, but with a safety net. A “call” option is your way to profit if the stock goes up; a “put” if it goes down. You pay a small fee (the premium) for the right to make that bet, and if you’re wrong, you only lose that fee—not your whole investment like with stocks. Warren Buffett, the king of simple investing, made billions this way. He once pocketed $7.5 million in under five minutes on an options deal. Most folks don’t know that side of him because he keeps it quiet.

In Options360, Keith Kaplan breaks it down into three easy steps anyone can follow:

- Check the Direction: Use their “Stoplight System.” It’s like a traffic light for stocks—green means it’s steadily climbing with good momentum, red means it’s dropping. Their computers watch over 160,000 stocks and funds around the world, all day every day. So, you pick a green stock if you want to bet up, or red for down. No crystal ball needed; you’re going with what’s already happening.

- Find the Best Deal: Look for trades that give you big potential wins without tying up much cash. This is called “asymmetrical risk”—small cost, huge upside. The system shows you the return you could get, so you pick the one with the most bang, like a 200% possible gain on a tiny investment.

- See Your Odds: Before you click “buy,” check the Probability of Profit, or POP. It’s a percentage based on tons of past market data telling you how likely the trade is to win. Say it’s 88%—that’s way better than a 50/50 guess. Most traders are basically rolling dice, but here you know the odds upfront.

Want steady cash without the ups and downs? Try selling options. You collect money right away when someone buys your “bet” from you. If the stock doesn’t move against you, the option expires worthless, and you keep the cash. Keith shared how he made $4,004 in one day selling options on Spotify, Chipotle, and Netflix—just enough for a Peloton bike his wife wanted. Another user, Bruce, has pulled in $21,000 over three years doing this with almost no losses.

The risks? They’re clear and capped. When you buy an option, your max loss is what you paid—maybe $250. Selling has a bit more to it, but POP helps you avoid bad spots. In today’s market, with options that expire every single day on big indexes like the S&P 500, you can aim for quick wins, like 20-50% in an hour, and free up your money fast.

To make sure you’re comfortable, Options360 throws in a free MasterClass worth $599. It covers basics like starting with just $100, making money even if the market crashes, and their top low-risk strategy. Plus, you get unlimited one-on-one help from their team—no extra charge. One guy named Steve, who’d given up on options years ago, says joining was “the best decision ever.” Another, Don, calls it a breath of fresh air after years of searching for something that actually works.

The T-Line Unveiled: Thorp’s Legacy Meets Modern Quants

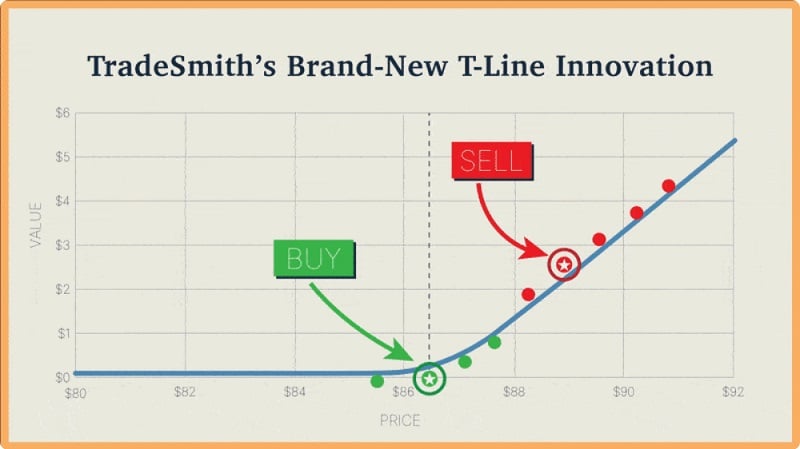

At the heart of the summit was The T-Line, and it’s the tool that’s got everyone buzzing. Forget complicated charts—this is a simple line on a screen that acts like a guide: Anything below it is a good buy because it’s priced too low; anything above is a good sell because it’s priced too high. The dots on the chart show different options trades, and the green ones below the line scream “undervalued—grab it!” Red ones above? “Overpriced—cash in by selling.”

The name comes from Edward O. Thorp, a math genius who shook up Wall Street in the 1960s and ’70s. He wasn’t from money or fancy schools; he was an outsider who figured out how to spot when markets were getting prices wrong—especially for options, which were brand new and confusing back then. Thorp used his smarts to build a hedge fund that crushed the market, making steady 25% gains a year with almost no bad months. He kept his best tricks secret because they were his edge. TradeSmith’s team—full of engineers and number crunchers—picked up where he left off. After five years and a ton of investment, they made The T-Line: the first time this kind of insight is available to regular investors.

How does it work in real life? You pull up a stock or fund, and the chart shows options plotted against the T-Line. There’s a marker for the stock’s current price—stay near that for the best plays. If a green dot is hugging the line, buy it; the price should climb back to where it “should” be. Sell a red one, and you get paid upfront, hoping it drops to fair value (or expires worthless). It’s buy low, sell high, but for options.

Keith walked through some eye-opening examples from recent months:

- On Nvidia, a green dot pointed to a trade that jumped 63% in seven hours.

- First Solar saw an 85% gain in just one hour on a put option (betting the stock would dip a bit).

- Intel delivered 112% in an hour—turning $10,000 into $21,707. To get that from holding Intel stock? You’d have waited over 25 years.

- The XLE energy fund, which was flat all year, had a trade that soared 519% in four hours—$10,000 became $60,000.

- Back on August 8th, META’s chart showed a cheap put option. Buy at $250, sell at close for $682—a 173% win in four hours. That’s five years of META stock gains squeezed into an afternoon.

- For the S&P 500’s daily options on August 18th, a green dot meant buying at $108; it hit $135 in an hour (16% gain), with a 75% POP to boot.

- Same day vibe for QQQ (Nasdaq tracker): Half off fair value, up 50% in 60 minutes—$10,000 to $14,240.

Selling examples were just as strong:

- Enphase Energy: A red dot an hour from expiring let you collect $242 per option sold. It went to zero, so full profit.

- Kratos Defense: Overpriced by six times—grab $45 each, or $4,500 for a batch of 100.

- A META put sell: 136% overvalued, 81% POP. Get cash now, watch it fade away.

Keith stresses it’s not perfect—the market can be stubborn, and not every trade snaps back right away. Always check your own homework and only risk what you can afford to lose. But pairing it with POP (aim for 85%+) is why their overall win rate is 98.8%. Since daily options launched after 2021, you can hunt these chances Monday through Friday, often tying up cash for just an hour or two.

In short, The T-Line turns options into something as basic as shopping for a deal. You see the value mismatch at a glance, make your move, and let the math do the rest. It’s like Thorp’s secret formula, but now it’s yours.

Tools in Action: Trade Builder, Screeners, and Beyond

Options360 shines because it’s not just one tool—it’s a whole toolbox that fits together. Log into the dashboard, and everything’s at your fingertips. You can even link your brokerage account or favorite investment newsletters to make it personal.

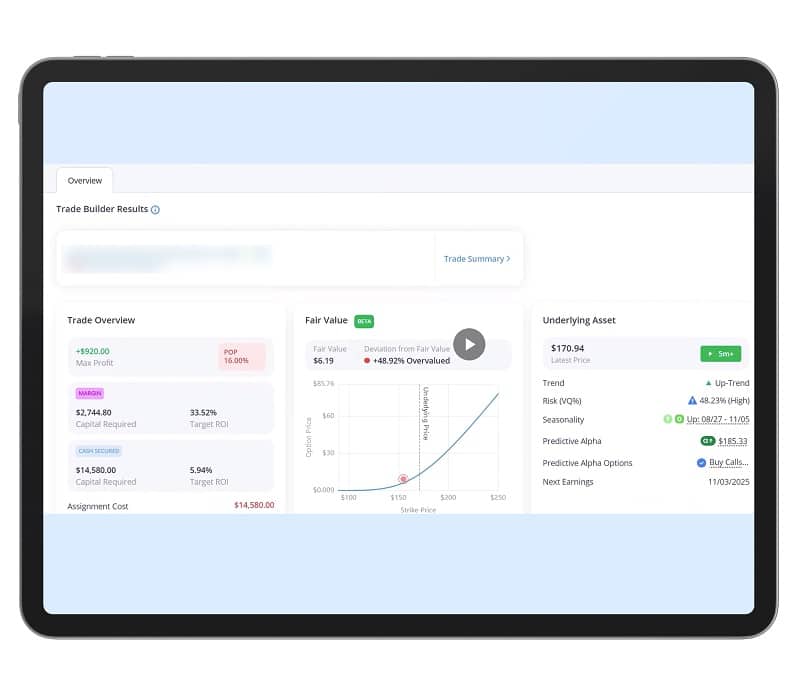

Start with the Trade Builder, worth $1,000 on its own. It’s like having a personal assistant. Tell it a stock you like (say, Palantir), how long you want to play (two months for earnings season), and if you’re betting up or down. Hit “analyze,” and in 30 seconds, it scans The T-Line for the best option—highest reward with solid odds. No more hours of staring at screens; it’s done-for-you smarts.

Then there’s the Options Screener, a $2,000 powerhouse. It’s super flexible—you set filters for what you want, like high returns or safe POP levels. Got stock picks from newsletters like Stansberry or InvestorPlace? Plug them in, and it spits out the top options ways to play them. The Newsletter Center even builds virtual portfolios from those recs, suggesting tweaks for better wins.

If you hold stocks long-term, the Covered Call Builder helps you add extra income without selling. Just pick your holdings, and it finds ways to rent them out via options for steady payouts.

Core helpers like the Stoplight System and POP are always there—green/red for direction, percentages for your win chance. Constant Cash Flow (free, normally $3,000) sends daily put-selling ideas. Their computers run two big checks: one for top-quality stocks, another for the sweetest option. You get 365 chances a year, plus tips from income pro Mike Burnick. One 80-year-old user closes 30+ a month at nearly 100% wins for 25% returns. “It’s like a money machine,” he says.

Weekly emails round it out: “Best Trade Opportunities” sorts ideas into easy buckets like income plays or high-reward shots. The “My Service Income” section ties in your trusted analysts’ picks for bonus trades. Patrick credits $120,000 of his $915,000 total to these alone.

Bonuses make it sweeter: A full MasterClass on options basics, a special Q&A on The T-Line with experts Marina Stroud and Mike Carr, a printable calendar to track alerts, and a mystery gift worth $3,000 (hinted as something big like extra coaching—revealed when you sign up). Plus, Infinite Income Loop ($499 value) for more strategies.

They spend $725,000 a month keeping this running—data, updates, the works. No skimping. Big names back it: MarketWise’s Doc Eifrig calls it a “total game-changer.” Louis Navellier says it’s an edge like no other. Eric Fry praises how it levels the field for regular folks.

Deep Dive: How It All Fits Together in Everyday Trading

Let’s talk about what Options360 feels like to use day-to-day. It’s built to fit your life, whether you’re busy with a job or easing into retirement.

First, the basics: Options are just contracts on stocks. You bet on up, down, or sideways for a set time. The magic is leverage—small money in, big potential out. But without guidance, it’s overwhelming. Options360 fixes that by showing you the “fair price” of every option, so you buy cheap ones that should rise and sell expensive ones for quick cash.

The T-Line makes this visual and simple. Picture a line splitting the chart: Below means the option’s a bargain (buy it, wait for the price to catch up). Above? It’s overpriced (sell it, pocket the difference). You focus on options near the stock’s current price for the tightest opportunities. Their system calculates that fair price using smart math from years of market history—no need to understand the formulas; you just see the signal.

POP adds the safety net. Before trading, it tells you the odds, like “88% chance this wins.” It’s based on what similar situations did before, so you’re not guessing. Combine that with the Stoplight for direction, and you’re set.

In 2025’s market, this shines. AI stocks like Nvidia or Palantir can spike fast—The T-Line catches undervalued options during those runs. Energy like XLE stays choppy, but short trades grab the pops without holding through slumps. Even in down years like 2022, put options (betting down) profited big. Daily options on the S&P or Nasdaq let you play five days a week, often closing in hours.

Scaling it? Start small—$100 trades via the MasterClass. Build up as you get comfy. The dashboard tracks everything, syncing your accounts so you see real-time fits. Taxes are straightforward (short gains taxed like income), but chat with your advisor.

It’s flexible: Aggressive? Chase 100%+ days. Steady? Sell puts daily for $600-ish. The calendar bonus keeps you organized—mark alerts, never miss a beat.

Pros, Cons, and Who It’s For

What works great:

- That sky-high 98.8% win rate gives real confidence.

- The T-Line’s secret-weapon feel—most folks don’t have this insight.

- One-stop shop: Ideas, tools, lessons—all user-friendly.

- Promo price locks in huge savings; 90-day swap-anything guarantee.

- Fits any schedule: Daily cash or weekly plays.

- Great for beginners with free hand-holding.

What to watch:

- Options can wipe out your bet fast—100% loss per trade possible.

- Takes time to learn (but they make it easy).

- No cash refunds, just credits.

- Deal’s limited; prices may rise.

Perfect for retirees wanting extra income, hobby traders seeking thrills, or newsletter fans amping picks. Skip if you’re super conservative or starting with pocket change.

The Offer and Guarantee: Worth the Leap?

For $2,000, you get a year’s access to it all: T-Line, Trade Builder, screeners, Constant Cash Flow, bonuses galore—total value $15,596. Mystery gift? Something premium like VIP sessions.

The guarantee: Try for 90 days. Love it? Great. Not? Swap credits for any TradeSmith stuff, no limits. Low pressure.

Compared to free apps (clunky) or pricier courses (less integrated), this stands out. It’s hedge-fund power without the suit.

Conclusion: Your Ticket to Trading Freedom?

Options360 boils down to this: Smart tools + real guidance = better odds in a tough market. The T-Line isn’t hype—it’s a fresh way to see deals others miss, backed by wins and stories that stick. In 2025, when everything’s volatile, this could be your path to quicker cash flow.

My take: Go for it if you’re ready to step up. The summit’s energy says it’s built for people like you.