Nathan Bear LottoX Review – What Is It?

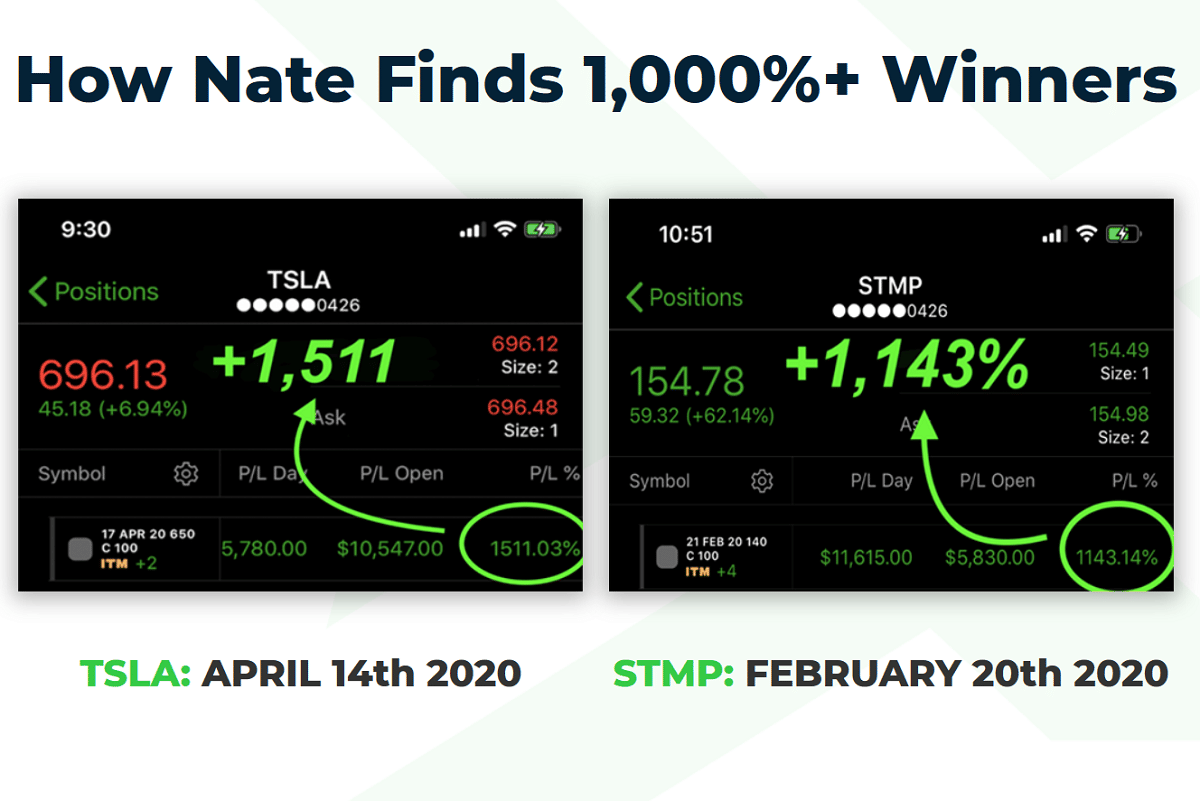

Nathan Bear LottoX Indicator teaches you to identify when stocks are going to pop, and how to time your entry and exits for maximum profit-taking. In fact, just in the last few months, this indicator has alerted to 300%, 600%, even 1,000%+ winners. These opportunities are everywhere and with Nathan Bear LottoX Indicator, they’ve never been easier to spot.

Nathan Bear LottoX Trades – How does it work?

Just a few months ago, Nathan Bear released his LottoX indicator to the world.

We knew it was going to be big, but we didn’t realize just how big.

If you’re not caught up, LottoX is one stupidly simple, proprietary indicator that allows Nathan…

Flawlessly Timed Trades

100%…200%…Even 1,000%+ Winners

Profits in 3 Days or Less

Yeah, you heard me… 1,000% winners!

Let’s go deep into how exactly Nathan did that?

Nathan Bear LottoX 3 Trades Examples

Before the markets opened Thursday, I got a suspicion.

Market futures rallied after the jobs report at 8:30 a.m. the past few Thursdays…except this one.

First thing out of the gate, I lightened up my long holdings. In hindsight, that seems pretty fortuitous. I took some pretty hefty losses. But that’s trading. You can’t win them all.

Overall, I did pretty darn well on the week.

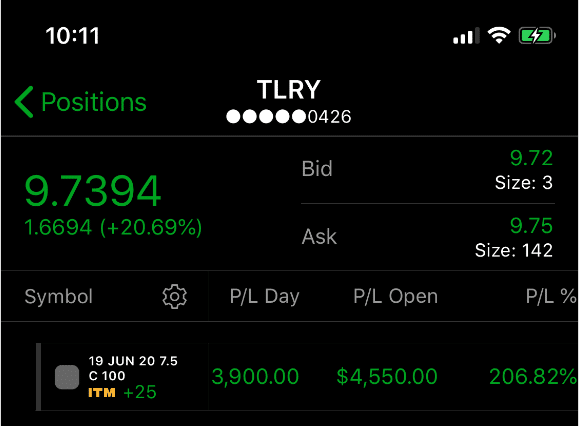

One of my best trades came with my LottoX account, turning over a whopper on Tilray (TLRY).

This week, I’m eying three charts that set up nicely, even with what I see as a bearish backdrop.

So pull up a chair and grab a pencil, as we start with DocuSign.

Nathan Bear LottoX Trade #1 – DocuSign (DOCU)

One of my favorite ways to play this choppy market is with stocks that tend to do their own thing. Recent initial public offerings (IPOs) fall into this category.

DocuSign also has the luxury of falling into the work-from-home category, as they enable remote document signing. Much like Telodoc (TDOC) and Zoom Communications (ZM), DOCU tends to do well even when the market is falling.

Now, what I really like about the stock for next week is its TPS setup. Let’s take a look.

DOCU 130-Minute Chart

Using the 130-Minute chart, we have a pure setup that has all three of the key TPS ingredients.

- Trend – DOCU pushed off the bottom like most stocks (or at least not the airlines). That gave it a nice upward bias over the last few weeks,

- Pattern – The chart has made a nice sideways consolidation pattern. You can see this with the orange trendlines that connect the tops and bottoms of the candlesticks. That’s a bit different than some of the stocks that started to roll over at the end of last week.

- Squeeze – At the bottom, you can see the red dots indicating a squeeze. The squeeze occurs when the Bollinger Bands trade inside of the Keltner Channel. That indicates that price is about to make an explosive move.

Since this is a longer timeframe, I expect a swing trade could take several days to a week to play out. I’ve already started to dip in with call options that go out a few weeks.

However, I wouldn’t be opposed to playing a put credit spread on this stock. With markets possibly going haywire, a put credit spread reduces my volatility when trading this stock.

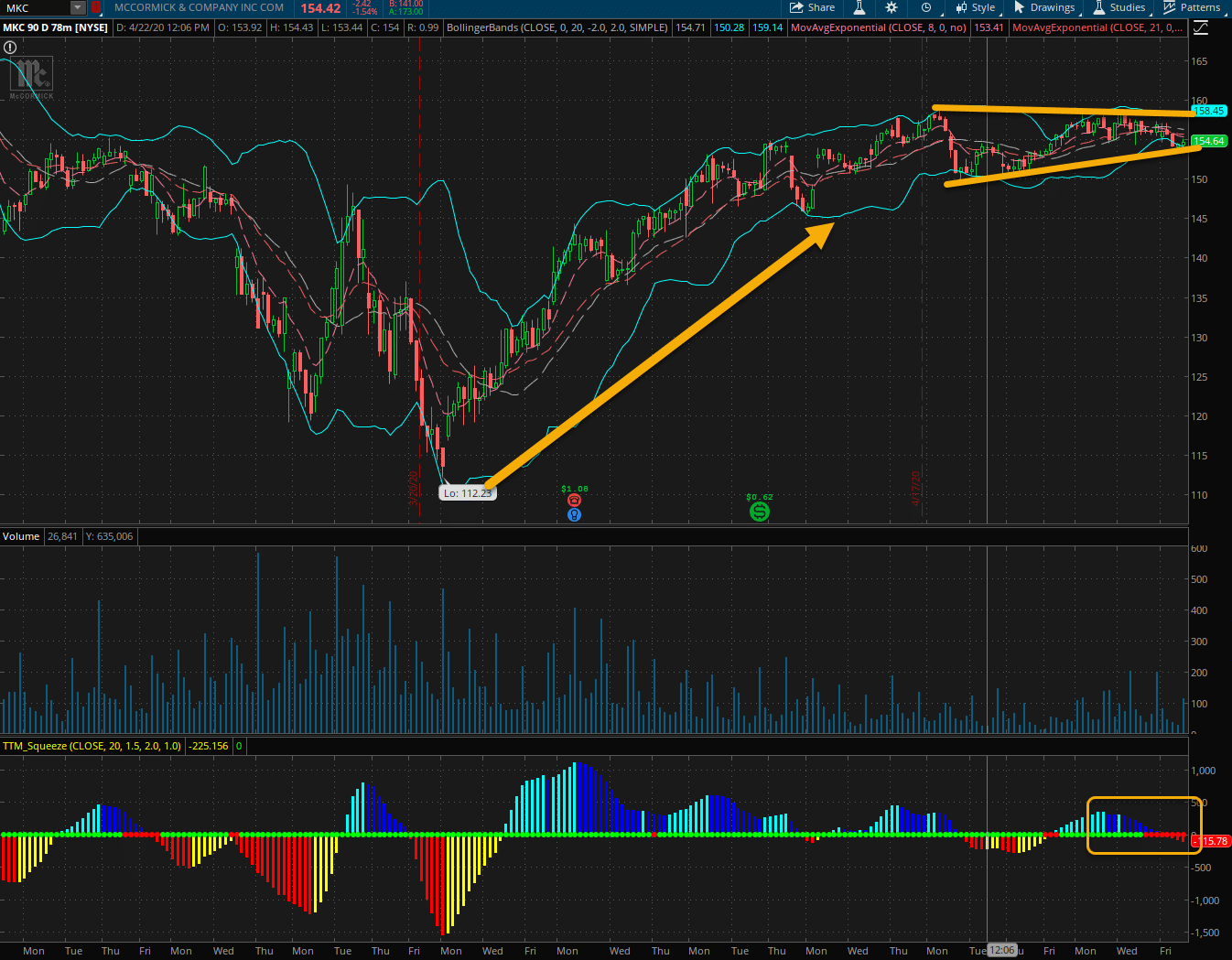

Nathan Bear LottoX Trade #2 – McCormick (MKC)

One sector that’s held up well in this market is the consumer staples. When you look at the performance of the XLP S&P Consumer Staples ETF, you’ll note that it’s outperformed the broader market since the top in February.

McCormick isn’t one of those names that trades a lot of options volume, nor moves around a lot. However, there’s still a great chart setup here that is worth noting.

MKC 78-Minute Chart

When I check out the 78-minute chart, I notice a small squeeze starting to form. The uptrend here is established, although it appears to be losing strength. In fact, you can see that the momentum may have shifted lower as depicted in the histogram bars at the bottom.

However, the setup still contains all three TPS elements: uptrend, consolidation pattern, and squeeze.

Given the amount of sideways action this stock has had, I’d prefer to play it with a put credit spread rather than a call option. If it drops, then I can cut the trade for less than maximum potential loss.

Also, with the stock trading in a narrow range, I’d prefer to grab it closer to the lower Bollinger Band to limit my risk in case it falls with the rest of the market.

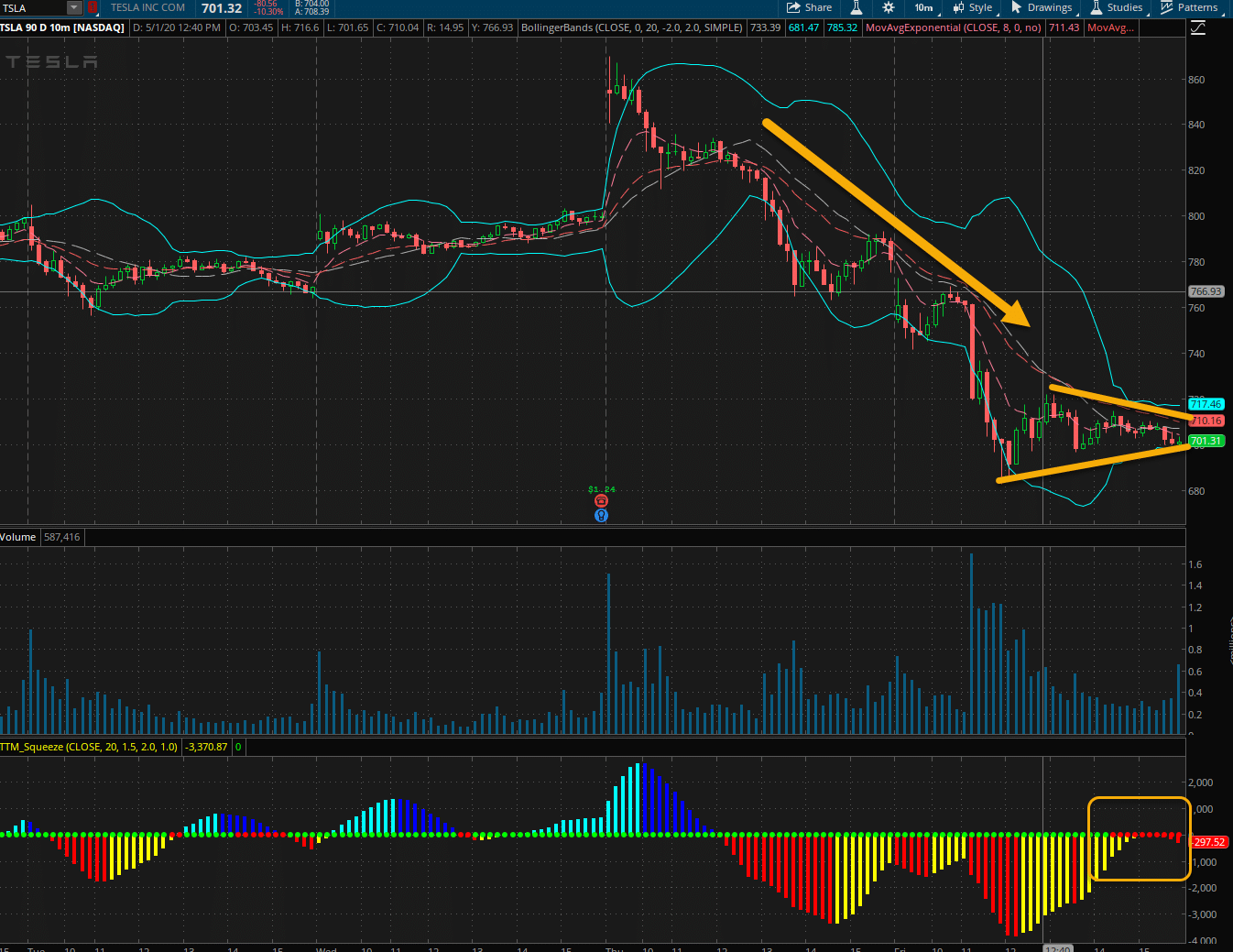

Nathan Bear LottoX Trade #3 – Tesla (TSLA)

Sometimes they say it best when they say nothing at all. Apparently Elon Musk doesn’t agree.

Friday, he unleashed a tweetstorm that I can only describe as self-defeating. Within moments of his words hitting the ned, the stock took a nosedive. That’s after it already sold off rapidly post-earnings.

Heading into the weekend, price created a bearish TPS setup that I expect might push hard to the downside.

Take a look.

TSLA 10-Minute Chart

The squeeze on this one has only just started with the 10-minute chart. However, I don’t need more evidence to believe that Tesla’s stock might head lower early next week.

Believe it or not, the TPS setup works on bearish setups as well. In this case, we have a downtrend, consolidation pattern, and a squeeze.

The difference here is that when it fires (red dots turn green), I expect it to push the stock lower.

Now, since this is a 10-minute chart, it could play out at the open on Monday. I’ll be looking for a quick trade in the call opinions, possibly Friday expirations.

So what is the TPS Setup?

Great question!

The TPS Setup is a strategy I developed after sifting through tons of trades and information. After nearly 8 years, I finally created this strategy that helped me turn $38,000 into over $2,000,000 in just two years.

You can learn all about it in my free upcoming webinar. I explain how I learned to ‘cut the crap’ and focus on the setups and skills that worked best for me as a trader.

What Do You Get For Your Money with Nathan Bear LottoX?

As of moment of writing there are two available options to subscribe for this service:

Unlimited Plan Subscription

PAY ONCE, then lock in your LottoX trades year after year – $2,499

What’s included here:

- 5+ LottoX Alerts Each Week

- 100%+ Profit Potential on Each Trade

- Real Time Buy + Sell Alerts

- Weekly LottoX Video Recaps

- Daily Portfolio Updates

- Nathan’s Exclusive Educational Suite

- 100+ Hours of Training Materials

PLUS:

– Unlimited Plan BONUS #1 –

LottoX Live Streaming Portfolio

– Unlimited Plan BONUS #2 –

LottoX Trade Tracker

– Unlimited Plan BONUS #3 –

Get Started Video Series

Annual Plan Subscription

You pay $1,499 yearly. Here’s what’s inside:

- 5+ LottoX Alerts Each Week

- 100%+ Profit Potential on Each Trade

- Real Time Buy + Sell Alerts

- Weekly LottoX Video Recaps

- Daily Portfolio Updates

- Nathan’s Exclusive Educational Suite

- 100+ Hours of Training Materials