In a year marked by unprecedented market volatility, political uncertainties, and economic shifts, investors are grappling with how to navigate the financial landscape. The S&P 500 has experienced remarkable growth, averaging nearly 20% annual returns over the past five years—almost double its long-term average. However, mainstream financial media is sounding alarms, drawing parallels to the dot-com bubble of the early 2000s. Amidst this backdrop, Marc Chaikin, a 50-year Wall Street veteran and founder of Chaikin Analytics, is stepping into the spotlight to address these concerns. On Tuesday, August 26, 2025, Chaikin will host his first-ever “Ask Me Anything” event, a unique opportunity for investors to gain insights directly from a seasoned expert.

Watch Marc Chaikin’s “Ask Me Anything” Event here

Learn more about Marc Chaikin’s Open House Offer here

The Current Market Landscape

A Historic Bull Run

The past five years have been a rollercoaster for the stock market, with the S&P 500 delivering an average annual return of nearly 20%. This performance is extraordinary, nearly doubling the long-term average of approximately 10%. Such gains have fueled optimism among investors, but they have also raised concerns about sustainability. The mainstream financial media has not hesitated to draw comparisons to the dot-com bubble, a period characterized by rampant speculation and an eventual market crash. Headlines warning of a “historic bubble” have become commonplace, amplifying investor anxiety.

Triggers of Uncertainty

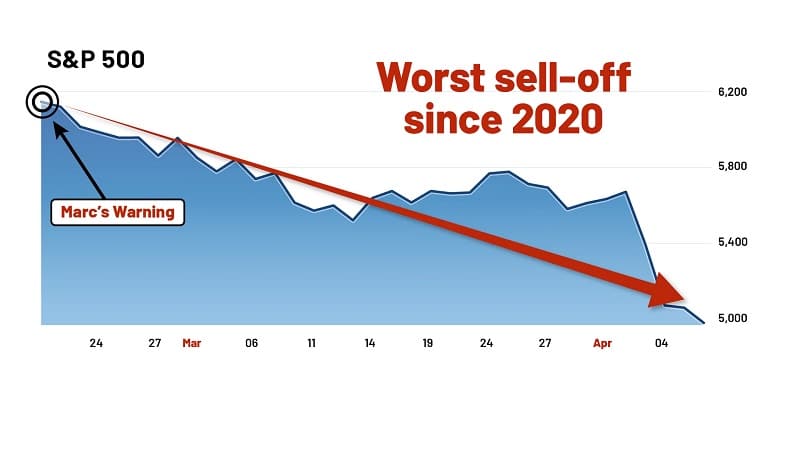

Several factors contribute to the current sense of unease in the markets. Political uncertainties, including shifting policies and tariff implementations, have created volatility. Geopolitical conflicts have added another layer of complexity, making it difficult for investors to predict market movements. Most notably, a market crash in 2025, referenced in Chaikin’s announcement, has heightened fears. This crash, reportedly triggered by tariff policies, underscores the fragility of the current market environment. Additionally, the rapid rise of artificial intelligence (AI) has transformed the investment landscape, creating both opportunities and concerns about overvaluation in certain sectors.

Investor Questions and Concerns

With over 1,000 questions pouring in from readers, it’s clear that investors are seeking guidance. Common concerns include how to interpret market signals, whether to hold or sell stocks, and how to capitalize on emerging trends like AI. Questions about specific asset classes, such as gold, bonds, and tariffs, reflect the diverse challenges investors face. Chaikin’s “Ask Me Anything” event aims to address these pressing issues, offering clarity in a time of confusion.

Marc Chaikin: A Wall Street Legend

A Storied Career

Marc Chaikin’s 50-year career on Wall Street has established him as a trusted voice in the financial world. His expertise as a quantitative analyst, or “quant,” has enabled him to develop sophisticated tools for navigating complex markets. Chaikin’s insights are grounded in decades of experience, during which he has witnessed and analyzed numerous market cycles, from bull markets to devastating crashes.

The Power Gauge System

At the heart of Chaikin’s approach is the Power Gauge system, an algorithm that distills his extensive knowledge into actionable investment signals. The Power Gauge evaluates over 5,000 stocks, ETFs, mutual funds, and other securities, issuing “Bullish” or “Bearish” signals based on a proprietary methodology. This system has earned the trust of over 600,000 investors, who rely on its timely and accurate forecasts to make informed decisions.

The Power Gauge’s track record speaks for itself. In 2020, it signaled investors to exit stocks before the COVID-19 crash, protecting them from significant losses. In 2021, when skepticism about the market’s V-shaped recovery was widespread, Chaikin urged investors to stay invested, a call that proved prescient as the market continued to climb. In 2022, the Power Gauge warned of an impending downturn, enabling investors to avoid the worst year for stocks since 2008. More recently, it accurately predicted the bull markets of 2023 and 2024, which saw gains of 24% and 22%, respectively.

A Proven Track Record

Chaikin’s predictive accuracy is not limited to broad market trends. On March 25, 2025, he warned of an impending “crash of epic proportions” driven by tariff policies. Less than three weeks later, on April 14, he identified specific buying opportunities, recommending stocks in sectors such as cloud-based software, finance, manufacturing, and nuclear energy. These recommendations delivered impressive returns, with gains of up to 32%, 40%, 58%, and 80% for the respective companies. Such precision underscores the value of Chaikin’s insights and the Power Gauge system.

The “Ask Me Anything” Event: A Unique Opportunity

Breaking New Ground

Marc Chaikin’s decision to host an “Ask Me Anything” event on August 26, 2025, at 10 a.m. Eastern time marks a departure from his usual approach. Typically focused on specific investment opportunities, Chaikin is dedicating this event to answering investor questions directly. This format allows him to address a wide range of topics, from broad market trends to specific asset classes, without introducing new strategies or analysts. The event is designed to provide clarity and actionable insights for investors navigating a turbulent market.

Topics to Be Covered

Chaikin plans to tackle some of the most pressing issues facing investors today. These include:

-

Gold: For the first time, Chaikin will share his views on gold, an asset often seen as a safe haven during times of uncertainty.

-

Tariffs: With tariffs playing a significant role in the 2025 market crash, Chaikin will discuss their implications for investors.

-

Bonds: As interest rates and inflation fluctuate, bonds remain a critical component of many portfolios.

-

AI: The AI boom has created significant wealth but also raised concerns about overvaluation. Chaikin will address how investors can navigate this transformative sector.

-

Inflation: Persistent inflationary pressures continue to shape market dynamics, and Chaikin will offer insights on managing this risk.

-

2025 Market Forecast: Perhaps the most anticipated segment of the event, Chaikin will provide an urgent update on his 2025 market forecast, including the exact day and month he expects the next crash to occur.

Power Gauge Insights

In addition to addressing market trends, Chaikin will explain how to leverage the Power Gauge system effectively. Key topics include:

-

Interpreting Power Gauge Ratings: Understanding whether a stock is rated as “Bullish” or “Bearish” and what these ratings mean for investment decisions.

-

Finding Winners: Strategies for identifying high-potential stocks, regardless of market conditions.

-

Managing Overbought or Oversold Stocks: Guidance on what to do when the Power Gauge indicates a stock is overbought or oversold.

Why This Event Matters

The “Ask Me Anything” event is a rare opportunity to hear directly from a Wall Street legend at a pivotal moment in the markets. With stocks hitting all-time highs despite significant uncertainty, investors are grappling with whether to stay invested or take profits. Chaikin’s insights, backed by the Power Gauge’s proven track record, could provide the clarity needed to make informed decisions. Moreover, the event’s interactive format allows investors to submit their questions, ensuring that Chaikin addresses their most pressing concerns.

The Power Gauge in Action

A History of Accurate Predictions

The Power Gauge’s success lies in its ability to anticipate market shifts with remarkable precision. In January 2025, Chaikin predicted that the S&P 500 would rebound by more than 10% over the next six months, reaching the 6,500-to-6,700 range. This forecast aligned closely with the market’s actual performance, reinforcing the system’s reliability. Over the past five years, the Power Gauge has guided investors through every major market twist and turn, from the COVID crash to the bull markets of 2023 and 2024.

Adapting to Market Challenges

The Power Gauge’s algorithmic approach allows it to adapt to a wide range of market conditions. By analyzing thousands of securities, it identifies opportunities and risks that might otherwise go unnoticed. For example, in 2023, the system signaled the start of a new bull market, enabling investors to capitalize on a 24% surge in stocks. Similarly, in 2024, it predicted a 22% market rally, further solidifying its reputation as a trusted tool.

Real-World Results

Chaikin’s stock recommendations demonstrate the Power Gauge’s practical value. In April 2025, amidst market turmoil, he identified a short list of stocks poised for growth. These included a cloud-based software firm that rose 32%, a financial giant that gained 40%, a manufacturing company that surged 58%, and a nuclear energy producer that soared 80%. These results highlight the system’s ability to pinpoint high-potential investments even in challenging conditions.

Addressing Investor Fears

The Temptation to Exit the Market

Given the market’s volatility, many investors are tempted to “take their chips off the table” and move to cash. This sentiment is reflected in the numerous questions Chaikin has received about whether to sell stocks. The fear of an imminent crash, coupled with comparisons to the dot-com bubble, has made caution an appealing option. However, Chaikin’s track record suggests that strategic investing, guided by tools like the Power Gauge, can yield significant rewards even in uncertain times.

The AI Boom and Missed Opportunities

The rise of AI has been a defining feature of the market in recent years, reportedly creating over 600,000 new millionaires in 2025 alone. For investors on the sidelines, the fear of missing out (FOMO) is palpable. Questions about whether it’s too late to benefit from the AI boom are common, and Chaikin plans to address these concerns during the “Ask Me Anything” event. By providing insights into AI’s role in the market, he aims to help investors make informed decisions about this transformative sector.

Balancing Risk and Reward

Chaikin’s approach emphasizes balancing risk and reward. While the Power Gauge identifies opportunities for significant gains, it also helps investors avoid potential pitfalls. For example, its “Bearish” signals in 2020 and 2022 protected investors from major downturns. By combining these signals with Chaikin’s market insights, investors can navigate the current environment with greater confidence.

Preparing for the Next Crash

An Urgent 2025 Forecast

One of the most anticipated aspects of the “Ask Me Anything” event is Chaikin’s urgent update on his 2025 market forecast. He has already warned of a crash expected to occur on a specific day and month, though the exact details will be revealed during the event. This forecast is particularly significant given the market’s current highs and the lingering effects of the 2025 crash triggered by tariffs. Chaikin’s ability to pinpoint market turning points, as demonstrated by his March 25 warning, makes this update a must-hear for investors.

Strategies for the Months Ahead

Chaikin’s forecast will provide actionable guidance for navigating the market between August and October 2025. Whether the outlook is bullish or bearish, his insights will help investors position their portfolios to maximize gains and minimize losses. By addressing questions about specific asset classes and market trends, Chaikin will offer a roadmap for the months ahead.

Why Investors Trust Chaikin Analytics

A Commitment to Guidance

Chaikin Analytics is committed to helping investors navigate challenging markets. The firm’s emphasis on transparency and accessibility is evident in the “Ask Me Anything” event, which allows investors to engage directly with Chaikin. By addressing over 1,000 reader questions, Chaikin Analytics demonstrates its dedication to providing timely and relevant insights.

A Community of Investors

With over 600,000 users relying on the Power Gauge, Chaikin Analytics has built a community of investors who trust its tools and expertise. The influx of questions reflects the shared concerns of this community, from fears of a market crash to excitement about emerging opportunities. Chaikin’s willingness to address these concerns head-on reinforces the firm’s role as a trusted partner.

A Legacy of Success

Chaikin’s 50-year career and the Power Gauge’s proven track record form the foundation of Chaikin Analytics’ credibility. From navigating the COVID crash to capitalizing on the AI boom, Chaikin has consistently delivered results. His ability to predict market movements and identify winning stocks has earned him a loyal following, making the “Ask Me Anything” event a highly anticipated occasion.

How to Participate

Saving Your Spot

Investors interested in attending the “Ask Me Anything” event can reserve their spot by submitting their email through the Chaikin Analytics website. This registration also provides an opportunity to submit questions for Chaikin to address during the event. The process is straightforward, with a privacy policy ensuring that users can unsubscribe at any time.

Submitting Questions

The interactive nature of the “Ask Me Anything” allows investors to submit their most pressing questions, whether about specific stocks, market trends, or the Power Gauge system itself. With the event scheduled for August 26, 2025, at 10 a.m. Eastern time, there is still time to participate and gain insights directly from Chaikin.

A One-Time Opportunity

Chaikin has never hosted an event like this before, and he may not do so again. For investors seeking clarity in a confusing market, this is a unique chance to hear from a Wall Street legend. Whether you’re concerned about an imminent crash, curious about AI’s potential, or eager to understand the Power Gauge, the “Ask Me Anything” offers a rare opportunity to gain expert guidance.

Conclusion

As the stock market navigates a period of historic highs and unprecedented uncertainty, Marc Chaikin’s first-ever “Ask Me Anything” event on August 26, 2025, offers a beacon of clarity for investors. With a 50-year career on Wall Street and the Power Gauge system as his foundation, Chaikin is uniquely positioned to address the challenges and opportunities facing investors today. From gold and tariffs to AI and inflation, he will tackle the topics that matter most, providing actionable insights and an urgent update on his 2025 market forecast. For investors seeking to navigate the complexities of the current market, this event is an unmissable opportunity to learn from one of the industry’s most trusted voices. By leveraging the Power Gauge and Chaikin’s expertise, investors can approach the months ahead with confidence, ready to seize opportunities and mitigate risks in an ever-changing financial landscape.