In the ever-evolving landscape of investment opportunities, few voices carry as much weight as Larry Benedict. A seasoned trader with over 35 years of experience in financial markets, Benedict has earned his reputation as a “Market Wizard,” featured alongside legends like Paul Tudor Jones and Ray Dalio in Jack Schwager’s acclaimed book series. Starting his career as a market maker at the Chicago Board Options Exchange in 1984, he rose to manage nearly a billion dollars at his hedge fund, Banyan Equity Management, after a successful stint at Spear, Leeds & Kellogg (later acquired by Goldman Sachs). His track record includes a remarkable 20-year winning streak, managing funds for high-profile clients, including Saudi royalty.

Today, Benedict focuses on helping everyday Americans build wealth through his “One Ticker Retirement Plan,” a strategy that emphasizes focused, high-potential trades rather than diversified portfolios. In a recent interview, he unveiled what he calls the “#1 Retirement Play in U.S. Energy”—an alternative investment poised to capitalize on a hidden bull market in American energy, driven by the insatiable power demands of artificial intelligence (AI). This isn’t about stocks, bonds, or royalties; it’s about natural gas options, offering potential returns up to 10x greater than traditional energy investments.

As the U.S. cements its position as the world’s top energy producer, with record outputs in oil, natural gas, and renewables, Benedict predicts a seismic shift. He argues that while oil dominated past booms, natural gas will fuel the next era, thanks to AI’s exponential growth. Below we’ll dive deep into Benedict’s insights, exploring why this opportunity could transform retirement planning for savvy investors.

The Surge in U.S. Energy: A New Boom on the Horizon

The United States is experiencing an energy renaissance. Last year alone, U.S. crude oil production hit 14.8 million barrels per day, valued at over $322 billion at current prices, supplying 20% of global demand—nearly double that of Russia or Saudi Arabia. But Benedict sees beyond the headlines. He points to a “hidden bull market” in energy, where institutional giants like Warren Buffett’s Berkshire Hathaway (with $31 billion in energy stocks), Citadel, and BlackRock ($225 billion invested) are quietly amassing positions.

Pension funds managing trillions, including those from Michigan, Ontario, and Canada, are also betting big on U.S. energy. Even President Trump highlighted the sector’s importance at the Pennsylvania Energy Summit, where Google announced a $25 billion investment in AI-powered energy solutions. Benedict warns that while Main Street frets over market volatility and inflation, elite investors are “backing up the truck” on energy.

What sets this boom apart? It’s not just traditional demand; it’s the AI revolution. AI tools like ChatGPT and Grok consume massive energy—up to 40 watt-hours per query, equivalent to leaving household lights on for hours. With billions of daily interactions across platforms, data centers’ energy use reached 200 terawatt-hours last year and could triple by 2030, surpassing California’s total consumption.

Experts agree: Natural gas is the only viable fuel for this surge. Renewable sources can’t yet meet the baseload requirements, and oil isn’t as efficient for power generation. Benedict likens this to the Industrial Revolution, where oil made John D. Rockefeller the richest man alive. Now, natural gas will power AI, creating unprecedented wealth opportunities.

Why Natural Gas? The Fuel of the Future

Benedict’s bold prediction: We’re entering the greatest energy bull market in a century, centered on natural gas, not oil. In May 2022, he accurately called the peak of oil prices, which crashed 50% thereafter. Now, he sees signals of a natural gas surge, driven by AI’s power hunger.

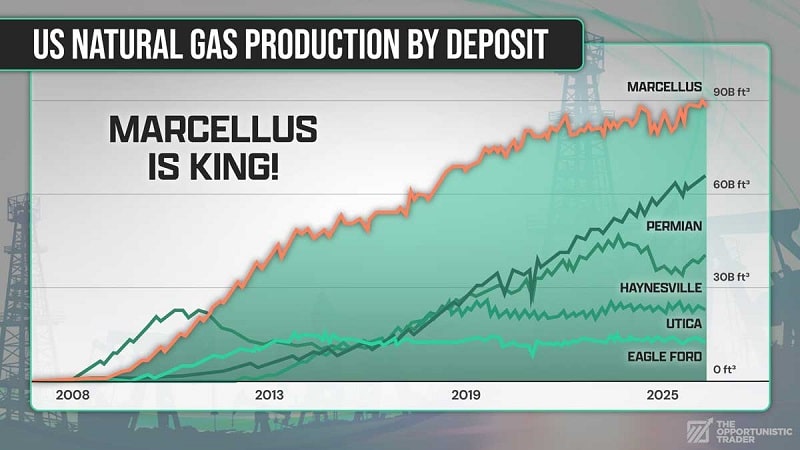

Natural gas prices are poised to soar as demand skyrockets. Data centers alone could require energy equivalent to tripling California’s size overnight. Reuters forecasts continuous growth, with natural gas as the “only real option.” The Marcellus Shale, a 400-million-year-old formation spanning Pennsylvania, West Virginia, and Ohio, holds 262 trillion cubic feet of recoverable gas—outproducing all other U.S. sources.

Dubbed the “Saudi Arabia of Natural Gas” by CNBC, the Marcellus yields 25 billion cubic feet daily, worth $112 million. Experts predict output could reach 40 billion cubic feet per day in the next decade, potentially tripling with more wells. AI giants like CoreWeave ($6 billion), Google ($25 billion), and Blackstone ($85 billion) are investing heavily in Marcellus infrastructure.

BlackRock’s Larry Fink has invested in companies with vast Marcellus acreage, signaling smart money’s confidence. Benedict highlights one company with a strategic edge: control over key infrastructure, including direct supplies to AI data centers like the $10 billion Homer City project (665 million cubic feet daily) and Shippingport AI Power Station (850 million cubic feet).

The AI-Energy Nexus: A Generational Opportunity

Artificial intelligence isn’t just a tech trend; it’s an industrial revolution comparable to the wheel or the original Industrial Revolution, according to experts like Google researchers and Nobel Prize winners. McKinsey warns that laggards will be left behind. Chevron’s CEO sums it up: It all comes back to power.

AI’s energy footprint is staggering. Global data center consumption is forecast to break 1 petawatt-hour by 2026, with AI driving the bulk. In the U.S., where AI innovation thrives, natural gas from regions like Marcellus will fill the gap. Benedict sees this as a once-in-a-generation chance, especially for retirement investors seeking high returns with managed risk.

Traditional energy investments like stocks or royalties are vulnerable to boom-bust cycles. Exploration stocks can plummet if wells dry up, and royalties yield low returns. Benedict’s alternative: Options trading, which allows investors to profit from price movements without owning assets, reducing exposure to operational risks.

Larry Benedict’s #1 Retirement Play: Natural Gas Options

At the heart of Benedict’s strategy is options trading on natural gas plays. Options provide leverage, controlling large positions with minimal capital—starting as low as $300. Unlike stocks, options limit risk to the premium paid and allow profits in both rising and falling markets.

During the 2020-2022 oil boom, perfect timing yielded 357% on oil investments. But Benedict’s options plays delivered 79%, 121%, 100%, and 74% in shorter periods. Post-peak, when oil dropped 33%, options scored 12% in four days, 38% in a week, and 128% in eight days.

This year, the top energy stock, San Juan Basin Royalty Trust (SJT), gained 51%, beating the Magnificent 7. Yet Benedict’s options play turned $1,000 into $6,999 in 23 days—seven times the return with less market exposure. Compared to gold (15x better), silver (14x), and Bitcoin (27x), options shine.

Benedict emphasizes: Options insulate from energy’s volatility. You don’t bear drilling costs ($60 million per well) or maintenance. Instead, you control shares at a fraction of the price, exiting quickly to minimize risk.

Lessons from T. Boone Pickens: From Bankruptcy to Billionaire

Benedict draws inspiration from T. Boone Pickens, who at 67 faced bankruptcy after selling his company. By 2002, Pickens’ hedge fund struggled until an employee introduced natural gas options. This “retirement play” yielded 330% in two months, propelling him to $1.1 billion in earnings by 2006.

Pickens’ quote resonates: Options allow control of huge assets without ownership risk. Benedict echoes this, calling options the “ultimate retirement investment”—profiting from booms and busts without the “young man’s game” of direct energy involvement.

Pickens spent his prime drilling and raiding companies but didn’t amass his fortune until options. Benedict urges retirees to let “young bucks” take risks while reaping rewards through leveraged trades.

Advantages of Options Over Traditional Investments

Options trading offers surgical precision. In bull markets, call options amplify gains; in bears, puts profit from declines. Leverage means a 5% move in natural gas can yield 10% or more. Inverse options double profits on downturns, as seen in a 43% gain during a 22% crude drop.

No accreditation needed; a standard brokerage suffices. Benedict’s service provides guidance, avoiding common pitfalls. Risks exist—options can expire worthless—but limited downside and short holding periods reduce exposure compared to stocks.

For retirement, this means steady growth without tying up capital long-term. Benedict’s 87% win rate this year underscores the potential, with members reporting triple-digit gains.

The Epicenter: Marcellus Shale and Key Infrastructure

The Marcellus Shale is Benedict’s focus—the “gift that keeps on giving.” With advanced fracking, it dominates U.S. production. The New York Times calls it a “fuel bonanza,” and Congressman Glenn Thompson predicts massive wealth creation.

AI investments exceed $100 billion here, centering on Marcellus. Benedict spotlights a fully integrated company controlling the Mountain Valley Pipeline (MVP)—a 303-mile artery linking Marcellus to southeast data centers. This pipeline, operational since 2024, positions the company as the premier supplier.

Smart money is piling in: Slate Path Capital ($120 million stake), Castle Hook (tripling holdings), and Vanguard ($4 billion) are betting on this company’s dominance. Benedict recommends options on this stock to maximize returns.

How to Get Started: One Ticker Trader and Exclusive Reports

Benedict’s “One Ticker Trader” service offers access to his portfolio, real-time trade alerts, and hedge fund-level analysis for just $79/year (down from $499), with a 30-day risk-free trial. Subscribers receive five bonuses valued at $696:

- The #1 Retirement Play in U.S. Energy: Details the top natural gas options play.

- Drill Baby Drill: Explores leveraged energy investments traded like stocks.

- The Gold Multiplier: Targets gold options for additional profits.

- Larry’s Guide to Options: A comprehensive guide to options trading.

- The One Ticker Retirement Plan: Benedict’s life’s work, distilling 40 years of strategies.

Members praise the results: One averaged 32.4% on 11 trades; another gained 122% in 24 hours. Benedict’s mission is to guide you toward a dream retirement.

Conclusion: Don’t Miss the AI-Powered Energy Boom

Larry Benedict’s #1 retirement play—natural gas options tied to a leading Marcellus Shale company—offers a path to significant wealth with managed risk. As AI drives unprecedented energy demand, this is a generational opportunity. Subscribe to One Ticker Trader to uncover the specific company and start your journey to a secure retirement.

FAQ: Larry Benedict’s #1 Retirement Play in U.S. Energy

What is Larry Benedict’s #1 Retirement Play in U.S. Energy?

Larry Benedict’s #1 Retirement Play is an alternative investment strategy centered on natural gas options, targeting a hidden bull market in American energy driven by the surging power demands of artificial intelligence (AI). Unlike traditional investments like stocks, bonds, or royalties, this approach leverages options to potentially deliver returns up to 10x higher than the U.S. energy market, with the ability to profit in both rising and falling markets.

Why is natural gas the focus of this investment opportunity?

Natural gas is poised to dominate due to the massive energy demands of AI data centers. Experts predict data center energy consumption could triple by 2030, surpassing California’s total usage. Natural gas is the only viable fuel to meet this baseload demand, unlike renewables or oil, which are less efficient for power generation. The Marcellus Shale, a key U.S. natural gas reserve, is at the heart of this boom, producing 25 billion cubic feet daily and projected to grow significantly.

What makes options different from traditional energy investments?

Options allow investors to control large positions in natural gas assets without owning them, reducing exposure to the operational risks of energy companies, such as drilling costs ($60 million per well) or maintenance expenses. With options, your risk is limited to the premium paid, and you can profit from both price increases (call options) and decreases (put options). Benedict’s strategy has delivered gains like 128% in eight days, compared to a 51% annual return for the top energy stock.

How does the AI boom relate to this investment?

AI technologies, like ChatGPT and Grok, require immense power—up to 40 watt-hours per query, multiplied by billions of daily interactions. Data centers consumed 200 terawatt-hours last year, with projections of over 1 petawatt-hour by 2026. Major AI players, including Google ($25 billion) and CoreWeave ($6 billion), are investing heavily in natural gas infrastructure, particularly in the Marcellus Shale, to fuel this growth, driving demand and prices higher.

What is the Marcellus Shale, and why is it important?

The Marcellus Shale is a 400-million-year-old rock formation spanning Pennsylvania, West Virginia, and Ohio, holding 262 trillion cubic feet of recoverable natural gas. It’s the most productive U.S. natural gas source, dubbed the “Saudi Arabia of Natural Gas” by CNBC. Its output, worth $112 million daily, could triple with more wells, making it a prime target for AI-driven energy investments.

What is the Mountain Valley Pipeline, and why does it matter?

The Mountain Valley Pipeline (MVP) is a 303-mile pipeline connecting the Marcellus Shale to southeast U.S. data centers, operational since 2024. The company Benedict highlights controls this pipeline, positioning it as a key supplier for AI data centers like the $10 billion Homer City project and Shippingport AI Power Station. This infrastructure advantage makes it a critical player in the energy boom.

Who is Larry Benedict, and why should I trust his strategy?

Larry Benedict is a veteran trader with over 35 years of experience, known as a “Market Wizard” alongside Paul Tudor Jones and Ray Dalio. He managed nearly a billion dollars at his hedge fund, Banyan Equity Management, and served clients like Saudi royalty. His 20-year winning streak and accurate calls, like the 2022 oil price peak, demonstrate his expertise. His One Ticker Trader service has an 87% win rate this year, with members reporting gains up to 122% in 24 hours.

What is the One Ticker Retirement Plan?

The One Ticker Retirement Plan is Benedict’s strategy to help everyday investors build wealth by focusing on high-potential, low-risk trades, primarily through options. It’s designed to maximize returns in any market condition, helping over 60,000 people on their retirement journey. The plan emphasizes quick, decisive trades to minimize market exposure, as detailed in his exclusive report available through One Ticker Trader.

What is One Ticker Trader, and what does it offer?

One Ticker Trader is Benedict’s research service, providing subscribers with access to his model portfolio, real-time trade alerts, hedge fund-level market analysis, and a weekly “Ask Larry Anything” session (not personalized advice). For $79/year (discounted from $499), members receive five bonus reports valued at $696, including “The #1 Retirement Play in U.S. Energy,” “Drill Baby Drill,” “The Gold Multiplier,” “Larry’s Guide to Options,” and “The One Ticker Retirement Plan.” A 30-day risk-free trial ensures no financial risk.

How much capital is needed to start with this investment?

You can start trading options with as little as $300, making it accessible to most investors. No special accreditation or brokerage account is required; a standard brokerage will suffice. Benedict’s guidance through One Ticker Trader helps you navigate these trades to maximize potential returns while managing risk.

What are the risks of trading options?

Options carry risks, as they can expire worthless, limiting losses to the premium paid. However, Benedict’s strategy minimizes exposure by focusing on short holding periods (e.g., 23 days for a $6,999 gain from $1,000). Unlike stocks, options avoid operational risks like drilling failures. Benedict’s 87% win rate and detailed guidance help mitigate risks, though past performance doesn’t guarantee future results.

Why should I act now?

The AI-driven natural gas boom is in its early stages, offering a window for outsized returns. As more investors recognize this opportunity, prices could rise, reducing potential gains. Benedict emphasizes that acting early is critical, as T. Boone Pickens did to turn bankruptcy into billions. Delaying could mean missing this generational wealth-building chance.

How do I learn the specific company Benedict recommends?

To discover the company with a strategic hold on the Marcellus Shale and the Mountain Valley Pipeline, you must subscribe to One Ticker Trader. The company’s identity and detailed options strategy are revealed in the report “The #1 Retirement Play in U.S. Energy,” included with your subscription. This exclusivity ensures subscribers get Benedict’s full expertise and timely recommendations.

What other opportunities does Benedict offer?

Beyond natural gas options, Benedict provides two additional reports:

- “Drill Baby Drill”: Details a leveraged energy investment traded like a stock, doubling returns on a 5% oil price move and profiting in booms or busts.

- “The Gold Multiplier”: Targets gold options, leveraging a market anomaly for gains like 157% in a week. These reports, plus “Larry’s Guide to Options” and “The One Ticker Retirement Plan,” enhance your investment arsenal.

What if I’m not satisfied with One Ticker Trader?

The service comes with a 30-day risk-free guarantee. If you’re unsatisfied, contact Benedict’s team for a full, no-questions-asked refund. You’ll keep all bonus reports, valued at $696, ensuring no financial loss for trying the service.

Can beginners participate in this investment strategy?

Yes, Benedict’s service is designed for all experience levels. “Larry’s Guide to Options” provides a step-by-step guide, from setting up a brokerage account to executing trades. His clear recommendations and real-time alerts make it accessible for beginners, while his hedge fund-level analysis benefits seasoned investors.

How does this compare to other investments like stocks or crypto?

Benedict’s options play outperformed the top energy stock (51% annual return) by turning $1,000 into $6,999 in 23 days. It also beat gold (15x), silver (14x), and Bitcoin (27x) in return potential.2 Unlike stocks, options avoid operational risks, and unlike crypto, they’re tied to tangible assets like natural gas, offering a more stable foundation for retirement planning.

How do I get started?

To join One Ticker Trader, click here. For $79/year, you’ll gain immediate access to the portfolio, trade alerts, and all five bonus reports. The 30-day risk-free trial lets you explore the service without commitment.