Investing today feels like navigating a storm: new technologies, volatile markets, and an endless stream of news make it hard to know which stocks to pick confidently.

Key Takeaways

-

Investors often struggle with information overload and lack a clear system to identify high-potential stocks.

-

Tools like Joel Litman’s Breakout Profits help cut through market noise and analyze opportunities systematically.

-

Even in volatile markets, having a structured approach allows investors to make more informed, confident decisions.

Why Stock Picking Feels Overwhelming Today

If you’ve ever opened a brokerage app, scrolled through dozens of tickers, and just felt your brain shut down, you’re not alone. Today’s market is not just volatile — it’s saturated. Every day, thousands of companies release earnings reports, press releases, and product announcements, while social media and financial news outlets amplify every rumor and trend. For investors, the result is sensory overload.

Even experienced investors admit that staying on top of everything is a full-time job. I’ve spent decades following companies, analyzing SEC filings, and meeting management teams, and yet there are days when the sheer volume of information makes me pause. The problem isn’t lack of intelligence — it’s lack of structure. Without a systematic approach, it’s impossible to separate signal from noise.

Take the tech sector, for instance. AI, semiconductors, cybersecurity, and emerging software companies are all booming at once. Headlines scream about “the next Nvidia” or “AI startups poised to disrupt markets.” A casual glance at a portfolio app might tempt you to chase the biggest movers, but the reality is far trickier. Stocks that double in a month aren’t necessarily the right buy for the next 12 months. Some are hype-driven, others are fundamentally weak, and a few are genuine breakout opportunities that only disciplined analysis will reveal.

Another factor: cognitive bias. Investors, even seasoned ones, are prone to emotional reactions. Fear of missing out (FOMO) pushes many to buy at peaks, while loss aversion encourages holding on to declining positions too long. Social media and forums exacerbate these biases, creating herd behavior that can be devastating if you don’t have a methodical approach.

The information explosion isn’t limited to headlines. Regulatory filings, patent applications, analyst research, and macroeconomic data are all part of the puzzle. For an investor without a clear framework, it’s easy to feel paralyzed. How do you know which AI startup is a fad and which has sustainable growth? Which defense contractor is positioned to benefit from government funding cycles? Which undervalued company has strong fundamentals but is flying under the radar?

This is where Breakout Profits becomes relevant. Joel Litman designed it to organize this chaos into a repeatable, disciplined process. Rather than guessing which stock will perform, the system filters through companies based on criteria that historically correlate with success. It helps investors focus on opportunities backed by real, measurable indicators rather than hype or speculation.

Consider a scenario: a biotech stock doubles overnight after announcing a promising trial. Without a structured system, an investor might panic-buy, only to watch volatility wipe out potential gains. With a method like Litman’s, that same investor evaluates whether the company’s underlying metrics support sustained growth — earnings potential, market positioning, regulatory risks — and decides confidently whether to enter, wait, or skip the trade entirely.

Even outside biotech, the principle applies broadly. Technology, consumer goods, energy, industrials — every sector has noise and signals. Investors who lack a filter often make impulsive trades, chasing gains that evaporate quickly. The mental toll of constant decision-making without structure is immense. You end up reacting, not investing.

In essence, stock picking today isn’t about access to information — we all have that. It’s about how you process information, discern meaningful patterns, and act with confidence. Structured systems, like Joel Litman’s Breakout Profits, give investors the tools to approach the market methodically, reducing stress and improving the odds of finding true opportunities.

Even experienced investors sometimes underestimate this. I’ve spoken with colleagues who have decades of market experience yet admit they occasionally make emotional trades. Systems aren’t about replacing intelligence — they enhance it, giving your experience and judgment a framework.

And here’s a key point: structured systems also save time. Instead of spending hours poring over financial statements, news alerts, and social chatter, a well-designed framework surfaces the most relevant opportunities, letting investors focus on evaluating quality trades rather than chasing every headline.

By understanding why stock picking feels overwhelming, you can see the value of a repeatable, disciplined system. It transforms stock selection from a stressful guessing game into a structured, strategic process. In the next section, we’ll explore how disciplined investors identify breakout stocks — the kind of insights Joel Litman’s system is designed to provide.

How to Identify Breakout Stocks Without Guessing

Breakout stocks are the ones that capture headlines: the tech startup that doubles in a month, the biotech firm with a surprise FDA approval, or the semiconductor company riding a global chip shortage. Everyone wants in, but here’s the truth: most investors approach these opportunities blindly. They see a chart move or a news spike and buy impulsively. That’s guessing.

Seasoned investors know the difference between a genuine breakout and a fleeting spike. It’s not magic — it’s methodical analysis. You don’t simply rely on past price performance. Instead, you evaluate a combination of fundamental, technical, and contextual factors. Let’s break these down:

Fundamental Signals

At the core, strong fundamentals are non-negotiable. Earnings growth, profit margins, revenue consistency, and cash flow are indicators of whether a company can sustain its momentum. Take a hypothetical AI startup: it may attract media attention, but if its revenue growth is inconsistent or its operating cash flow is negative, the “breakout” is likely temporary.

Disciplined investors look for companies with:

-

Revenue growth accelerating over multiple quarters.

-

Positive earnings per share trends, even if small.

-

Manageable debt relative to cash flow.

-

A defensible market position or unique competitive advantage.

These metrics filter out companies that spike on hype but can’t sustain their valuation.

Technical Signals

Charts tell a story that fundamentals can’t always capture immediately. Technical indicators like volume surges, support/resistance levels, and moving averages help investors gauge market sentiment. For instance, a stock breaking through a historical resistance level on strong volume is more likely to sustain upward momentum than one that spikes on low interest.

Consider a semiconductor stock that jumps after a government contract announcement. Observing the trading volume and relative strength index (RSI) helps differentiate between a strong trend and a short-lived pump.

Contextual Signals

Context matters. Macro trends, regulatory changes, or industry cycles can transform a small player into a breakout candidate. For example:

-

Government AI funding creating a surge in related software or chip companies.

-

A supply chain disruption giving a niche manufacturer leverage over competitors.

-

Industry consolidation increasing market share for a mid-tier player.

Seasoned investors combine these contextual insights with fundamental and technical signals to assess whether a stock has true breakout potential.

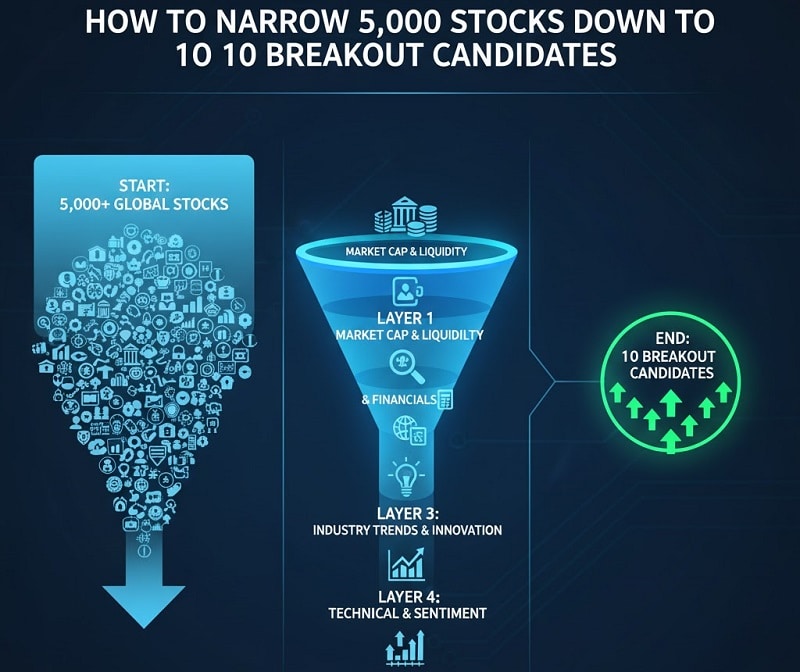

How Structured Systems Remove Guesswork

This is where systems like Joel Litman’s Breakout Profits shine. They automate much of the filtering process, applying consistent criteria to a universe of stocks. Rather than manually checking each balance sheet or chart, the system surfaces candidates that meet rigorous standards across multiple dimensions: fundamentals, technical patterns, and context.

For example, a biotech stock might meet the system’s criteria if it:

-

Shows three consecutive quarters of accelerating revenue growth.

-

Breaks a 52-week high on above-average volume.

-

Operates in a sector benefiting from regulatory tailwinds.

The investor doesn’t guess. They examine a curated list of opportunities that have historically aligned with successful breakouts.

Real-World Example

I remember a colleague analyzing a mid-cap cybersecurity company last year. On paper, it had doubled in price over three months. Most would shy away, thinking it was too late. But a deeper look — revenue growth was accelerating, contract wins were consistent, and new AI-driven products were being adopted faster than competitors — indicated the momentum was sustainable.

Using a structured system, the company scored high across fundamental, technical, and contextual criteria. The result? Another 60% gain over the next six months. Without a systematic approach, this opportunity might have been overlooked or dismissed as a “late-stage spike.”

Why Many Investors Fail

The challenge is simple: without a disciplined framework, human bias dominates. Fear, greed, and information overload lead to impulsive decisions. Investors often miss breakout opportunities or enter too late, chasing peaks. Systems like Breakout Profits provide a repeatable process, so decisions are data-driven rather than emotional.

Common Pitfalls When Chasing High-Flying Stocks

The allure of a stock that doubles in weeks or months is irresistible. It’s easy to get caught up in the headlines: “This company soared 150%!” or “Experts call it the next big thing!” But for every story of explosive gains, there are countless investors who entered too late or misread the signals. Understanding these pitfalls is critical to avoiding costly mistakes.

Emotional Investing

Fear and greed are the most common culprits. A stock spikes 50% in a week, and suddenly everyone wants in. Conversely, when a stock dips 20% after a hype-driven rally, panic selling kicks in. Emotional investing leads to buying high and selling low — the opposite of sound strategy.

I’ve seen this firsthand. Early in my career, a biotech stock I followed announced promising trial results. The price doubled overnight. My gut reaction was “I need to get in now,” without examining the underlying metrics. Within a month, a minor regulatory delay caused a 30% drop, highlighting the risk of chasing without analysis.

Structured systems, like Breakout Profits, mitigate this by evaluating each candidate against consistent criteria. The decision isn’t about hype or headlines — it’s about objective signals.

Ignoring Fundamentals

Many investors focus solely on price action, forgetting why the stock is moving. A spike in share price doesn’t always indicate a breakout; it may signal overvaluation or short-term speculation. Without understanding revenue, profit margins, cash flow, or competitive positioning, investors expose themselves to sudden reversals.

Consider a hypothetical tech company riding a viral product trend. Its stock doubles in two months. Yet the company’s earnings are flat, debt is rising, and competitors are catching up. Without a fundamental check, what looked like a promising opportunity could quickly turn into a loss.

Breakout Profits incorporates fundamental analysis into its workflow, highlighting stocks with sustainable growth potential rather than transient hype.

Overlooking Contextual Factors

Context is often the silent differentiator between a short-lived spike and a sustainable breakout. Industry trends, regulatory changes, and macroeconomic shifts can dramatically influence a stock’s trajectory.

For instance:

-

A mid-cap semiconductor stock might surge because of global chip shortages. But if supply chains normalize or competitors scale up, the rally could reverse.

-

Biotech firms often experience volatility around FDA announcements. A small favorable news item may create a temporary spike without long-term momentum.

Ignoring these factors can turn a promising breakout into a frustrating loss. Structured systems scan these contextual indicators automatically, ensuring investors account for more than just price movement.

Timing Mistakes

Timing a breakout perfectly is nearly impossible. Jumping in too late risks buying near a peak; waiting too long risks missing the initial run. Many investors fall into the trap of “fear of missing out” (FOMO) or “waiting for confirmation,” which can both backfire.

I recall a colleague hesitant to enter a cybersecurity stock that had already doubled. He waited for a “pullback” that never came, and the stock continued to rally for another 80%. Systems like Breakout Profits address timing by flagging potential breakout candidates early based on multiple indicators — a combination of fundamental strength, technical signals, and market context.

Chasing Too Many Opportunities

Diversification is essential, but spreading attention across too many high-flying stocks can dilute focus and increase risk. Investors often chase multiple double-digit winners simultaneously, leading to mistakes in monitoring, evaluation, and timing.

A disciplined approach, like that offered by structured systems, provides a curated list of the most promising candidates. Investors can focus on analyzing a manageable set of opportunities rather than chasing every headline-grabbing stock.

Real-World Illustration

Take a mid-cap AI software firm from last year. It doubled in six weeks. Investors without a systematic approach either missed it or bought impulsively after the spike. Those who evaluated its fundamentals, market positioning, and technical indicators recognized that the momentum was backed by actual growth in client adoption and recurring revenue. They continued to hold through minor pullbacks and captured another 70% upside over the following months.

The difference is clear: structured, disciplined evaluation reduces the risk of late entry and maximizes the potential for sustainable gains.

Building a Repeatable Breakout Strategy

Identifying a breakout stock once is luck. Doing it consistently is skill — or, increasingly, a system. Investors who rely solely on instinct or news headlines often find themselves chasing fleeting opportunities. The key to repeatable success lies in process, not emotion.

Define Clear Criteria

Before considering any stock, define what “breakout” means for your portfolio. Some investors focus on price movement — a double in six months, for instance. Others look for sector leadership, high revenue growth, or recurring revenue.

A repeatable strategy begins with clarity. Ask yourself:

-

How much price appreciation qualifies as a breakout?

-

What fundamental metrics must align?

-

Are there specific sectors I prefer due to expertise or risk tolerance?

Breakout Profits codifies these criteria, giving investors a structured way to screen thousands of stocks and focus only on those that meet all the benchmarks.

Combine Fundamental and Technical Analysis

A stock can spike without solid fundamentals, and a fundamentally strong stock can stagnate without market recognition. The sweet spot lies in convergence: solid financials plus supportive technical signals.

Fundamental indicators include:

-

Revenue and profit growth

-

Cash flow stability

-

Competitive positioning in the industry

-

Insider ownership and institutional backing

Technical indicators include:

-

Momentum trends

-

Moving averages

-

Volume spikes during upward price moves

-

Relative strength compared to peers

When these align, the probability of a sustained breakout increases. Breakout Profits integrates both dimensions, helping investors identify candidates with true staying power rather than hype-driven spikes.

Monitor Market Context

Even the best candidate can falter if external factors are ignored. Sector trends, macroeconomic shifts, and regulatory changes play a huge role in a stock’s breakout potential.

For example:

-

Renewable energy firms surged in response to government incentives. Ignoring policy signals would have missed the broader context.

-

Biotech stocks often jump on trial results; yet broader FDA scrutiny or competitor advances can affect sustainability.

Structured systems automatically flag context-sensitive variables, allowing investors to make informed decisions without endless manual research.

Positioning and Risk Management

Breakouts are volatile. Even the most promising stocks experience pullbacks. Position sizing and risk management are crucial.

-

Avoid allocating too much capital to a single breakout candidate.

-

Consider stop-loss thresholds or hedging strategies.

-

Re-evaluate positions periodically, even if the stock continues to climb.

Breakout Profits offers built-in risk management frameworks, helping investors navigate volatility while staying committed to the best opportunities.

Track and Refine

A repeatable strategy isn’t static. Investors should track outcomes, refine criteria, and adjust based on evolving markets. Over time, patterns emerge, and the system becomes self-improving.

For instance, tracking a stock that doubled but then stalled can reveal sector-specific signals or technical indicators that are unique to that type of breakout. Learning from both wins and losses is essential.

Real-Life Illustration

Consider a software-as-a-service company that doubled in three months. Investors who relied solely on headlines might have bought late. Those following a repeatable strategy:

-

Observed increasing customer retention

-

Confirmed technical indicators supported momentum

They allocated capital gradually, monitored sector trends, and captured not only the initial spike but the subsequent 60% growth over the next quarter.

Tools and Systems to Identify Breakout Stocks

Even seasoned investors can struggle to track hundreds or thousands of potential breakout opportunities. The solution isn’t working harder; it’s using smarter tools that provide data-driven insights.

Why Systems Matter

The market moves quickly. By the time you manually review quarterly reports, technical charts, and sector trends, opportunities may have passed. A repeatable system reduces noise, accelerates research, and ensures consistency.

Investors face three main challenges:

-

Information Overload – Too many stocks, too many metrics, too many conflicting signals.

-

Emotional Bias – Fear of missing out or chasing hype can override rational decision-making.

-

Timing Issues – Breakouts can occur in days or hours; delays can drastically reduce returns.

A systematic approach addresses all three. Instead of guesswork, you’re following data-backed criteria.

Core Features Investors Need

When evaluating tools or systems, consider these features:

-

Automated Screening – The system scans thousands of stocks and flags those that meet predefined breakout criteria.

-

Integration of Fundamentals and Technicals – Combines growth metrics, cash flow, and profit trends with momentum, volume, and technical indicators.

-

Risk Management Guidance – Alerts about position sizing, stop-loss thresholds, and portfolio diversification.

-

Trend Alerts – Notifies investors when sector trends or macro conditions shift, helping time entries and exits.

These features save time and reduce mistakes caused by human limitations.

Introducing Breakout Profits

Joel Litman’s Breakout Profits is designed to address these exact pain points. It helps investors:

-

Identify breakout candidates that meet strict fundamental and technical standards

-

Prioritize stocks positioned to double again, not just repeat past gains

-

Filter out noise and reduce emotional trading decisions

-

Access actionable insights faster than traditional research methods

For example, the system can flag a semiconductor stock showing strong quarterly earnings, rising institutional interest, and a momentum pattern suggesting another surge. Without a system like this, many investors would only notice the price after the breakout began.

Case Study: From Data to Decision

Imagine an investor tracking emerging AI companies. Manually reviewing dozens of reports and charts is overwhelming. Using Breakout Profits:

-

The system scans 500+ companies in the AI sector.

-

It flags 12 that meet strict financial and technical criteria.

-

The investor narrows the list to 3, evaluates risk, and invests strategically.

The result: focused effort, reduced emotional stress, and better positioning to capture multi-fold gains.

The Role of AI and Automation

Modern breakout systems increasingly leverage AI to:

-

Recognize patterns humans might miss

-

Adjust screening thresholds based on market shifts

-

Predict short-term momentum based on historical analogs

Breakout Profits incorporates predictive algorithms that learn from market outcomes, making it a tool that evolves as the market evolves.

Beyond Individual Stocks

Systems like this also help investors evaluate sector rotation, macro trends, and emerging market opportunities. Breakouts aren’t just about one stock; they often cluster in sectors or technologies experiencing accelerated growth.

Using a system ensures you aren’t just reacting to headlines; you’re identifying opportunities ahead of the curve.

Real-Life Applications and Success Stories

Systems and tools are only valuable if they translate into actionable results. Let’s explore how investors use structured approaches like Breakout Profits to make confident stock decisions and capture meaningful gains.

Turning Research into Action

Many investors spend hours analyzing charts, reading earnings reports, and tracking news — yet still feel uncertain about when to buy. Systems like Breakout Profits bridge the gap between raw data and actionable insights.

For example, an investor tracking cloud-computing startups might see 30 companies with impressive growth metrics. The system highlights those showing true breakout potential based on combined financial and technical indicators, prioritizing 5–6 names worth evaluating more deeply. Without this structured approach, the investor would risk spreading attention too thin or chasing past winners.

Case Study 1: AI Sector Breakouts

Consider a real-life application in the AI sector.

-

Scenario: An investor monitors emerging AI companies but struggles to differentiate genuine growth from hype.

-

System Use: Breakout Profits flags a mid-cap AI firm with rising institutional ownership, accelerating revenue growth, and an upward momentum pattern on technical charts.

-

Outcome: By following the system’s recommendations, the investor entered early, capturing gains as the stock doubled over several months.

This illustrates how combining fundamental strength with technical confirmation can pinpoint high-potential breakout stocks.

Case Study 2: Semiconductors and Defense Technology

Another example comes from defense tech and semiconductor companies. These sectors are highly cyclical, and timing is critical:

-

Scenario: A trader notices a surge in government funding announcements for semiconductor manufacturers.

-

System Use: Using Breakout Profits, the investor identifies small-cap suppliers poised to benefit most, based on earnings trends, product pipelines, and technical momentum.

-

Outcome: Instead of chasing headline giants, the investor targets under-the-radar companies that see multi-fold returns in months, demonstrating the advantage of a system that filters opportunity from noise.

Long-Term Portfolio Integration

While breakout systems are often associated with short-term gains, they can also inform long-term strategy:

-

Trend Analysis: Identify sectors consistently producing breakout candidates, which can guide portfolio allocation decisions.

-

Risk Management: Use system alerts to adjust exposure if a stock’s momentum fades or fundamentals weaken.

-

Rebalancing Strategy: Prioritize high-probability breakouts while maintaining diversification.

In practice, combining Breakout Profits with a broader portfolio strategy allows investors to stay opportunistic without over-concentrating in volatile names.

User Experiences and Testimonials

Multiple users report that structured systems improve confidence and reduce decision fatigue:

-

One investor highlighted how the system allowed them to quickly filter hundreds of stocks, focusing only on those likely to “double again.”

-

Another shared that it helped avoid chasing headline-fueled surges, preventing emotional losses and improving consistency.

These stories reinforce that actionable systems can be more valuable than raw market knowledge alone, particularly in sectors like AI, defense tech, or emerging growth companies.

Lessons from Real Applications

From these examples, several lessons emerge for investors:

-

Filter First, Analyze Second: Use a structured system to narrow the opportunity set.

-

Combine Fundamentals and Technicals: True breakouts often require both strong business performance and market momentum.

-

Stay Ahead of Headlines: Systems allow proactive positioning, not reactive chasing.

-

Adapt Over Time: Markets evolve, and systems that learn and adjust provide a competitive edge.

By integrating these lessons, investors position themselves to capture meaningful gains while reducing stress and decision fatigue.

Is This System Really for You?

Investors often hesitate before adopting any new strategy. Questions like “Can I trust this system?” or “Is it too late to act?” are natural. Let’s tackle the most common objections head-on.

“What If I Missed the Big Gains?”

Many investors fear that by the time they discover a breakout system, the best opportunities are already gone. It’s a valid concern.

Reality: Markets are dynamic. Breakouts happen continuously across sectors. Breakout Profits doesn’t rely on hindsight; it identifies actionable trends in real time. For example, just because a headline AI stock has doubled doesn’t mean there aren’t smaller-cap companies showing the next surge.

How the System Helps: By combining fundamental signals with technical momentum, the system highlights high-potential stocks before the broader market notices. This proactive filtering ensures you’re positioned for potential “second waves” rather than chasing peaks.

“Systems Can’t Predict the Market”

Some investors believe that no system can beat human intuition. Markets are unpredictable, right?

Reality: While no tool can guarantee success, structured systems reduce emotional errors and provide a repeatable framework. Breakout Profits helps investors focus on key metrics that historically correlate with sustained growth.

Example: In sectors like semiconductors, defense tech, or AI, the system identifies companies with rising institutional ownership, strong cash flow, and accelerating revenue. By filtering noise, it makes probability-based decisions, not guesses.

“I Don’t Have Time to Track Hundreds of Stocks”

Time scarcity is a common challenge. Investors often feel overwhelmed trying to evaluate every potential opportunity.

Reality: Breakout Profits acts as a force multiplier. Instead of manually reviewing hundreds of companies, the system distills the universe down to a manageable set of high-potential candidates.

Example: One user reported narrowing 200 AI and tech companies to just six actionable opportunities. This streamlined approach frees time for deeper due diligence and strategic portfolio planning.

“What If the System Picks a Stock That Falls?”

No system is immune to risk. Losses are part of investing. The key is managing exposure.

Reality: Breakout Profits emphasizes risk-adjusted returns. Each recommendation includes insight into potential upside and downside, helping investors size positions appropriately.

Example: Investors using the system for mid-cap AI stocks could enter with smaller positions while monitoring performance trends, reducing the chance of significant losses while staying positioned for upside.

“I Prefer My Own Research”

Experienced investors may worry that a system will override their judgment.

Reality: Breakout Profits is a tool, not a replacement. It complements human analysis. By highlighting trends, signaling early breakouts, and ranking opportunities, it allows investors to apply their own experience and risk tolerance intelligently.

Takeaway: Think of it as a co-pilot — guiding decisions, filtering noise, and helping you act on high-probability opportunities while retaining full control over your strategy.

Key Lessons

-

Timing Isn’t Everything: Systems identify ongoing opportunities, not just past winners.

-

Structured Decisions Beat Guesswork: Consistency matters more than intuition alone.

-

Efficiency Matters: Streamlined workflows prevent missed opportunities and reduce fatigue.

-

Risk Management is Built In: Tools provide context for informed position sizing.

-

Human Insight Remains Essential: Systems augment, not replace, investor judgment.

By addressing these objections, investors can approach Breakout Profits with confidence, understanding both its potential and its limits.

How to Put Breakout Profits to Work

After understanding how Breakout Profits works and addressing common objections, the next step is action. This isn’t about theory anymore — it’s about positioning yourself to capture opportunities in today’s market.

Get Access to Breakout Profits

The first step is simple: subscribe to Joel Litman’s Breakout Profits. Access provides you with a structured workflow, pre-screened stock opportunities, and actionable insights for emerging trends.

Why Now Matters: Markets move fast. Sectors like AI, green energy, and advanced semiconductors are evolving daily. Early access means you can spot breakout opportunities before the broader market catches on. Waiting too long often means chasing gains rather than leading them.

Use the System to Filter Opportunities

Once subscribed, start by exploring the system’s curated stock lists. The platform ranks companies based on growth potential, momentum, and risk-adjusted metrics.

Example: You may discover a mid-cap AI firm with accelerating revenue, growing institutional ownership, and strong technical momentum. Instead of spending hours analyzing hundreds of stocks, the system surfaces a handful of actionable ideas — the ones that meet multiple high-probability criteria.

Tip: Treat these recommendations as starting points. Perform your own due diligence while using the system’s insights to guide timing, position size, and entry points.

Integrate with Your Portfolio Strategy

Breakout Profits isn’t a standalone magic bullet — it’s a complement to your existing strategy. Use it to identify potential breakout stocks and integrate them with your broader portfolio goals.

Example: If you already have exposure to large-cap tech, consider using the system to find smaller emerging players in adjacent sectors. This diversification allows you to capture upside in trends that may be overlooked by the broader market.

Monitor, Adjust, and Stay Informed

Markets change rapidly, and no strategy works on autopilot. The system includes tools for monitoring performance, tracking trends, and updating positions.

Best Practices:

-

Review the system’s recommendations weekly.

-

Adjust position sizes based on market conditions and your risk tolerance.

-

Use alerts to stay ahead of emerging opportunities.

Benefit: By staying disciplined and informed, you turn the system into a dynamic tool that helps you act decisively rather than react emotionally.

Leverage Educational Resources

Subscribers gain access not only to the system but also to educational materials. These explain the logic behind each recommendation, helping you understand why certain stocks are flagged as potential breakouts.

Outcome: You don’t just follow the system blindly; you learn how to interpret market signals, identify patterns, and make smarter investment decisions long-term.

Take Action Now

Every day you delay is a day the market moves without you. Joel Litman’s Breakout Profits equips investors to:

-

Spot emerging growth trends early.

-

Filter opportunities with precision.

-

Make decisions confidently based on structured data and expert insights.

Don’t wait for the next breakout to pass you by. Subscribe to Breakout Profits today and start positioning your portfolio for high-probability growth opportunities.