If you are concerned about current inflation and want to learn more about precious metal investment opportunities, you are in the right place.

Precious metals like gold and silver already have reputation for maintaining their value during difficult economic times. They may serve as a hedge against economic decline, market volatility, or political insecurity.

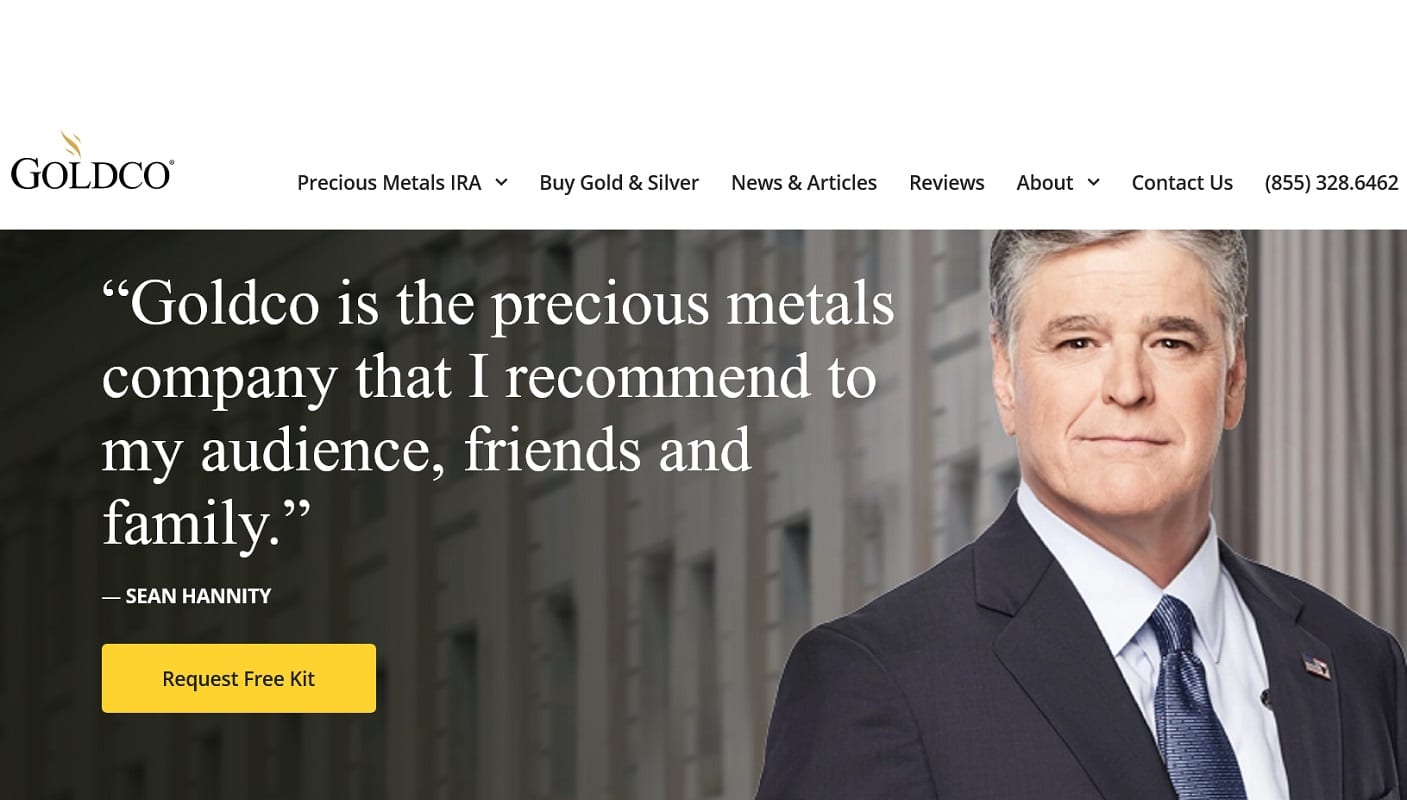

Goldco is a California-based precious metal investment company. With over a decade of experience helping consumers preserve their retirement savings, Goldco is a leader in the precious metals market.

Affiliate Disclosure:

The links contained in this product review may result in a small commission if you opt to purchase the product recommended at no additional cost to you. This goes towards supporting our research and editorial team. Please know we only recommend high-quality products.

Who can use Goldco services?

If you already have an IRA, 401(k), 403(b), TSP, savings, or other tax-advantaged retirement account, Goldco can help you preserve your assets with a Precious Metals IRA.

The company also sells gold and silver directly to their customers. Their specialists can help you diversify your savings account with precious metals.

Goldco offers a buyback program that guarantees the best possible price, providing better security with your purchase.

How to invest in Gold or Silver for retirement?

A Precious Metals IRA could be the answer if you are looking for a safe way to invest for retirement. Anyone who has earned income can be eligible for a Precious Metals IRA.

Unlike the US dollar, which has lost 98 percent of its value since 1971, gold has maintained its purchase power throughout time.

Silver is not corelated to stock market performance. With its growing industrial usage and declining supply, the price of silver can significantly grow in the next years.

The team that stays behind Goldco believe that owning precious metals is an integral part of the strong retirement savings strategy.

Here are the three simple steps to a Gold or Silver IRA:

Open IRA

A Goldco representative will guide you through each step of this process.

Fund your self-directed IRA

Rolling over assets from other retirement accounts can be used to fund your Precious Metals IRA. For example, you can use your 401(k), 403(b), 457, Pensions and TSP accounts. You can use funds from a Roth retirement account into Roth Precious Metals IRA. Another option is conversion by rolling over from a 401(k) or similar into a Roth Precious Metals IRA.

These rollovers and transfers are usually without tax consequences. There are no penalties, and you don’t need to invest additional money.

Purchase your precious metals

Once funded, Goldco will provide resources so you can choose which precious metals you’d like to have as part of your Precious Metals IRA.

Not all gold or silver coins are eligible for investment through a Gold or Silver IRA. Gold coins must meet minimum fineness requirement of .995. Silver coins must meet a minimum fineness requirement of .999.

Goldco works with mints all over the world to acquire high-quality coins that are eligible for investment through a Gold or Silver IRA. Company provides Goldco BuyBack Guarantee that BUYS BACK your IRA-approved Gold or Silver Coins at the highest price.

Here you can find some of the numerous coins eligible for GOLD IRA that they offer to their customers.

How long does it take to roll over to Precious Metals IRA?

Typically, it takes less than two weeks to complete the process. Keep in mind that each application is unique, and the exact time varies. Goldco specialists will assist you to gather and complete all documents. At that time, they will give you an estimate for how long your rollover will take.

What fees are associated with Precious Metals IRA?

Goldco charges one flat fee per year, rather than percentage of your assets. This means that the more precious metals you own, the lower the fees are as percentage of your assets.

Make sure you ask them for current promotions that include annual fees reimbursements.

Bottom line: Before committing to invest, you should have a thorough understanding of the fees involved with any transaction.

Where is the physical storage of the metals?

As long as IRA owns the metals, they are stored in a secure vault at an insured depository. The IRS requires a custodian to administer and track assets in the Precious Metals IRA. Goldco works with all major Self-Directed IRA custodians.

You will be eligible to start taking distributions at age 59 ½. At that time, you’ll be able to choose how to take your distribution. There are two options:

- cash payment or

- in the form of precious metals, including gold, silver, platinum, or palladium, depending on what metals are in your account.

If you do not want to open a Precious Metals IRA, you can still take advantage of the benefits of owning precious metals.

How To Buy Gold & Silver Coins?

Another way to prepare for future uncertainties is buying Gold & Silver coins. Both metals may provide a hedge during sustained periods of rising inflation, as well as economic and market downturn.

Buying gold and silver coins from Goldco can offer great advantages. Coins can be sent to your house or to a depository of your choice. You could even be eligible for free storage.

When you are ready to sell, Goldco will even BUY BACK your coins at the highest price. You can get more info by reading more about their BuyBack Guarantee.

Coldco has established long-term relationships with mints around the world. They offer some of the most common coins, or they can help you to find exactly the precious metals you are looking for.

What are the risks of owning precious metals?

Don’t forget that all investments carry risk. Here are only some of the risks. Make sure to do additional research.

Precious metals price may rise and fall. This means that with the time passing by you may sell for more or less than you originally paid.

Also, don’t forget that precious metals do not yield income.

Past performance does not guarantee future results. There is no certain prediction about future value of precious metals.

Bottom line: You can trust Goldco to help you to protect your retirement savings, or to diversify your savings account. They are rated A+ by the Better Business Bureau and Triple A by Business Consumer Alliance. Here you can read their customers reviews about their quality service, and ethical business practices.