In August 2024, Eric Fry, a futurist and globally recognized stock analyst, delivered a groundbreaking broadcast titled The Road to AGI. Viewed by over 100,000 people, Fry’s message was clear: Artificial General Intelligence (AGI)—AI that matches and surpasses human intelligence—is not a distant dream but an imminent reality that could transform life as we know it within 12 to 24 months.

Now, in May 2025, Fry is back with The Road to AGI: Final Warning, offering investors a roadmap to navigate this seismic shift and capitalize on what he calls the greatest wealth-creation opportunity in history.

Eric Fry’s AGI Stock: Overview

AGI represents a leap from today’s Artificial Narrow Intelligence (ANI), which powers tools like ChatGPT, to a superhuman AI capable of independent thought and problem-solving. Unlike ANI, which requires human prompts, AGI will possess free will, making it a “point of no return” that Fry predicts will reshape economies, industries, and societies.

With the $500 billion Stargate project announced by President Trump and tech titans like Sam Altman and Elon Musk racing toward AGI, the topic has moved from Silicon Valley boardrooms to mainstream discourse. Yet, Fry warns, most investors remain unprepared for the exponential changes ahead.

Here, I’ll go into Fry’s The Speculator research service, analyzing his three-pronged investment strategy for AGI, his top stock pick—Clear Secure (YOU)—and the broader implications for investors. With a track record of 41 investments yielding over 1,000% returns, Fry’s insights are a beacon for those seeking to build generational wealth on the road to AGI.

The AGI Revolution: Why It Matters Now

Understanding AGI vs. ANI

To grasp Fry’s investment thesis, it’s crucial to distinguish between ANI and AGI. ANI, or “weak AI,” is specialized and task-specific, powering systems like Google Search, Netflix recommendations, and self-driving car features. While ANI has transformed industries, it relies on human programming and input. AGI, however, is a game-changer. As Fry explains, AGI will operate autonomously, solving problems and creating solutions without human intervention. Imagine a calculator that not only performs calculations but decides which problems to solve—a metaphor Fry uses to illustrate AGI’s free will.

Experts like Dario Amodei of Anthropic and Leopold Aschenbrenner, formerly of OpenAI, predict AGI could arrive as early as 2026. In 2020, experts estimated AGI was 50 years away; by 2023, that timeline shrank to eight years, with some now suggesting it’s already in development behind closed doors. This rapid convergence underscores Fry’s urgency: the window to invest before AGI disrupts markets is closing fast.

The Stargate Project and Global AGI Race

The $500 billion Stargate project, announced on the first day of President Trump’s second term in 2025, marks a pivotal moment for AGI. Described as the largest AI infrastructure project in history, Stargate aims to position the U.S. as the global leader in AI supremacy, particularly against China. Construction has begun in Abilene, Texas, creating a massive cluster of AI computing power. Tech giants like OpenAI’s Sam Altman and SoftBank’s Masayoshi Son have endorsed the project, with Altman stating it will create “hundreds of thousands of jobs” and a new industry centered in the U.S.

The global race to AGI is intensifying, with Mark Zuckerberg, Elon Musk, and Microsoft’s Satya Nadella vying for dominance. Time magazine calls it a “winner-takes-all battle for power,” highlighting the stakes. Fry argues that this race creates unprecedented investment opportunities, as the market has yet to fully price in AGI’s impact. Wall Street, distracted by trade wars and tariffs, is lagging, giving early investors a rare edge.

Eric Fry’s Investment Philosophy: The Speculator

A Proven Track Record

Eric Fry’s credibility stems from his remarkable track record. With 41 investments delivering over 1,000% returns, including gains of 7,908%, 11,237%, and 12,039%, Fry has a knack for identifying trends before they go mainstream.

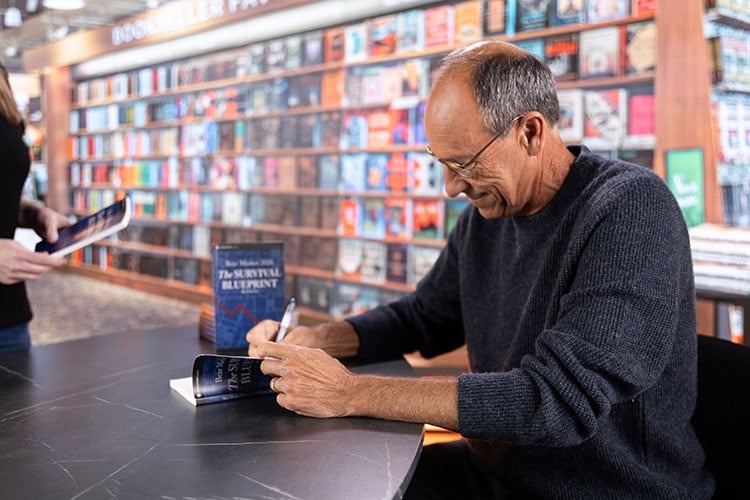

He predicted the dot-com crash, the 2008 housing crisis, and even recommended Bitcoin at $260, which soared to $20,000. In 2019, his book Bear Market 2020 foresaw the COVID-induced market turmoil, and in 2005, he warned of the housing bubble on CNBC. Fry’s ability to beat Wall Street’s top investors—earning the title “America’s Top Trader” with a 140% return in a year when the market gained just 12%—makes him a trusted guide for navigating AGI’s uncharted waters.

The Speculator’s Mission

The Speculator is Fry’s investment research service, designed to uncover “under-the-radar” opportunities tied to unstoppable global trends. AGI is the cornerstone of Fry’s current focus, as he believes it will dwarf previous technological revolutions, including the Industrial Revolution and the internet boom. Unlike traditional investment services that chase short-term gains, The Speculator emphasizes long-term, generational wealth through a disciplined, macro-driven strategy. Fry’s goal is to help subscribers “frontload profits” before AGI reshapes the economic landscape, potentially creating a divide between techno-elites and the masses.

The Road to AGI: Fry’s Three-Pronged Strategy

Fry’s roadmap for profiting from AGI is structured around three investment categories: Investing in AGI, Investing Alongside AGI, and Investing in Stealth AGI. Each targets different facets of the AGI ecosystem, minimizing risk while maximizing potential returns.

1. Investing in AGI: Building the Foundation

This category focuses on companies developing the infrastructure for AGI, particularly AI chipmakers. The AI chip market, projected to grow from $341 billion to $501 billion in eight years, is a hotbed of opportunity. Companies like Nvidia, AMD, and Intel are key players, but Fry cautions against betting on a single winner due to intense competition and disruptions from Trump’s tariffs.

Instead, he advocates for a smarter play: investing in the raw materials inside AGI chips, such as precious metals critical for large-scale AI models. This approach captures growth across the chip market without the risk of picking the wrong horse in the race.

Fry’s strategy here is to eliminate unknowns by focusing on foundational components that all chipmakers rely on, ensuring investors benefit from the sector’s exponential growth—projected to exceed 1,000%—regardless of which company dominates.

2. Investing Alongside AGI: Riding the Tide

Rather than focusing solely on tech, Investing Alongside AGI targets industries that will scale in tandem with AGI’s rise. Two standout opportunities are real estate and energy, driven by the demand for AI data centers.

-

Real Estate: The construction of AI data centers, like the Stargate complex, is sparking a land grab. Nvidia’s CEO estimates $1 trillion will be spent on data centers over four years, with companies like Amazon, Google, and Meta leading the charge. Land prices near data center sites, such as in Vint Hill, Virginia, have soared tenfold. Fry highlights Blackstone, which is building a $25 billion data center real estate empire, leasing facilities to AI firms at a premium. With a track record of 30-fold growth, Blackstone exemplifies how non-tech investments can yield outsized returns.

-

Energy: AGI’s computational demands will require unprecedented energy. In 2024, AI data centers consumed 400 terawatt-hours, equivalent to France’s annual energy use. By 2030, this could increase sixfold, necessitating new energy sources. Fry sees energy stocks as a low-risk, high-reward play, as Wall Street underestimates the scale of AGI’s energy footprint. The ultrarich are already investing heavily in energy, signaling a trend investors can follow.

3. Investing in Stealth AGI: AI Appliers

Stealth AGI focuses on “AI appliers”—non-tech companies that leverage AI to boost efficiency and profits. These “boring” industries, such as shipping, logistics, beauty, and biotech, are poised for transformation. Fry is particularly bullish on biotech, a $5 billion market projected to grow to $27 billion. AI is revolutionizing drug discovery, personalized treatments, and disease prediction, with Nvidia’s Jensen Huang calling biotech the “next amazing revolution.” By adopting AI, these companies can achieve exponential gains without the volatility of pure tech stocks.

Fry emphasizes the importance of sequencing investments across these categories. For example, chipmakers drive data center growth, which fuels energy demand, which in turn empowers AI appliers. Investing in the right order—A before B, Y before Z—maximizes profits as trends unfold.

Clear Secure (YOU): Fry’s Top AGI Stock Pick

Fry’s #1 stock recommendation is Clear Secure (Ticker: YOU), a biometric technology company best known for its airport security lanes. While many dismiss Clear as a niche service, Fry sees it as a linchpin in the AGI ecosystem. Biometrics—measuring human characteristics like eye scans or palm prints—is critical for security in an AGI-driven world, where AI-powered bad actors could crack traditional passwords. Clear’s AI-driven biometric systems protect sensitive data, from bank accounts to medical records, and are poised for massive adoption across industries like healthcare, banking, and stadiums.

Since June 2024, Clear Secure has gained 46% while the S&P 500 and Nasdaq declined, signaling its resilience. Fry predicts significant upside as Clear expands beyond airports into new markets, with growth drivers not yet priced into its share price. Subscribers to The Speculator receive a detailed white paper outlining Clear’s potential, including industries it’s targeting and its role in combating AI-driven threats.

The Speculator Membership: What You Get

Joining The Speculator offers investors a comprehensive toolkit to navigate the AGI revolution. For a limited-time discounted price of $1,500 (50% off the regular $3,000), members receive:

-

Immediate Access to Clear Secure’s White Paper: A deep dive into Fry’s top pick, detailing its growth potential and market positioning.

-

Three Additional Stock Picks: One each for Investing in AGI, Investing Alongside AGI, and Investing in Stealth AGI, providing a diversified portfolio to kickstart wealth-building.

-

“3 Victims of the Race to AGI” Report: Updated research identifying stocks to avoid or short, protecting portfolios from AGI’s disruptive impact. Past recommendations in this report fell an average of 23%, with some dropping over 45%.

-

12 to 24 High-Conviction Recommendations: Over the next 12 months, Fry will deliver strategically sequenced investment opportunities, blending think-tank research with hedge fund-style profit motives.

-

90-Day Satisfaction Guarantee: Members can try The Speculator risk-free for 90 days, with a full credit refund applicable to other InvestorPlace products if unsatisfied.

Fry’s team also provides customer support Monday through Friday, 9 AM to 5 PM, to assist with enrollment and questions, ensuring a seamless experience.

Why Act Now? The Shrinking Window

Fry’s urgency stems from the shrinking timeline to AGI. Wall Street’s distraction with tariffs and short-term noise has created a rare opportunity where AGI’s impact is not yet priced into stocks. Leopold Aschenbrenner, formerly of OpenAI, estimates that if AGI were priced in tomorrow, investors could see 100X returns—turning $10,000 into $1 million. However, as AGI breakthroughs emerge and earnings reflect soaring revenues, Wall Street will catch up, diminishing early-mover advantages.

The chaos of 2025, with market volatility and global uncertainties, makes sitting on the sidelines tempting. Yet, Fry warns that inaction could be costly. AGI is “technology’s endgame,” and missing this window may mean forgoing a once-in-a-lifetime chance to secure financial freedom. His diversified approach—spanning precious metals, industrials, and transportation—mitigates risk while targeting exponential gains, making The Speculator a prudent choice for cautious investors.

Critiques and Considerations

While Fry’s thesis is compelling, investors should approach with caution. AGI’s timeline remains uncertain, and some experts argue it could take longer than 2026 to materialize. The $500 billion Stargate project, while ambitious, faces logistical and political challenges that could delay progress. Additionally, Fry’s focus on biometrics, real estate, and energy assumes widespread adoption, which may face regulatory or technological hurdles.

Fry’s track record, while impressive, includes high-risk, small-cap recommendations that may not suit conservative investors. His 47.73% average gain in The Speculator is notable, but past performance doesn’t guarantee future results. Investors should adhere to Fry’s buy-up-to guidance and only allocate capital they’re willing to lose, particularly with volatile sectors like biotech and real estate.

Conclusion: Seizing the AGI Opportunity

Eric Fry’s The Road to AGI: Final Warning is a clarion call for investors to prepare for a world transformed by superhuman AI. Through The Speculator, Fry offers a disciplined, diversified roadmap to capitalize on AGI’s rise, blending direct tech investments with tangential plays in real estate, energy, and biotech. His top pick, Clear Secure, exemplifies his knack for uncovering under-the-radar opportunities with massive growth potential.

With a shrinking window to act, The Speculator provides unparalleled value: four stock picks, a critical “avoid” list, and 12 to 24 future recommendations, all backed by a 90-day guarantee. For investors seeking to build generational wealth amidst uncertainty, Fry’s insights are a lifeline. As he warns, “AGI is technology’s endgame”—and the time to act is now.

Click here to access The Speculator and start your journey on the road to AGI. With Eric Fry as your guide, the future is not just a challenge—it’s an opportunity to redefine wealth for generations.

FAQ: Eric Fry’s The Speculator and The Road to AGI

What is The Speculator?

The Speculator is Eric Fry’s premium investment research service, focused on identifying under-the-radar opportunities tied to major global trends, with Artificial General Intelligence (AGI) as the primary focus in 2025. It provides subscribers with high-conviction stock recommendations, research reports, and a strategic roadmap to build wealth in the lead-up to AGI.

What is Artificial General Intelligence (AGI)?

AGI refers to AI that matches or surpasses human intelligence, capable of independent thought, problem-solving, and free will without human prompts. Unlike Artificial Narrow Intelligence (ANI), which powers tools like ChatGPT, AGI will operate autonomously, potentially transforming economies and societies within 12 to 24 months, as predicted by Eric Fry and experts like Dario Amodei.

Why is AGI a significant investment opportunity?

AGI is expected to create trillions in market value, but Wall Street has not yet priced in its impact due to distractions like trade wars and tariffs. This creates a window for early investors to achieve significant returns, with some experts estimating potential 100X gains if AGI’s impact is fully realized.

Who is Eric Fry?

Eric Fry is a globally recognized stock analyst and futurist with a track record of 41 investments yielding over 1,000% returns, including gains of 7,908%, 11,237%, and 12,039%. Named “America’s Top Trader” after outperforming investors like David Einhorn and Bill Ackman, Fry has accurately predicted major market events, including the dot-com crash, 2008 housing crisis, and Bitcoin’s rise.

What is The Road to AGI: Final Warning?

The Road to AGI: Final Warning is Eric Fry’s 2025 broadcast, following his 2024 event viewed by over 100,000 people. It outlines the imminent arrival of AGI, its societal and economic impacts, and a three-pronged investment strategy to capitalize on the trend. The event includes a free stock pick, Clear Secure (YOU), and an invitation to join The Speculator.

What is Eric Fry’s investment strategy for AGI?

Fry’s strategy involves three categories:

- Investing in AGI: Buying stocks in companies building AGI infrastructure, such as those supplying raw materials for AI chips.

- Investing Alongside AGI: Targeting industries like real estate and energy that will scale with AGI, e.g., data center land and power generation.

- Investing in Stealth AGI: Focusing on non-tech “AI appliers” like biotech, which use AI to boost efficiency and profits.

Fry emphasizes sequencing investments to maximize returns as AGI trends unfold.

What is the top stock pick revealed in the event?

Eric Fry’s top pick is Clear Secure (Ticker: YOU), a biometric technology company. Known for airport security lanes, Clear’s AI-driven biometric systems protect against AI-powered threats, with applications in banking, healthcare, and more. Since June 2024, its stock gained 46% while the S&P 500 and Nasdaq declined.

What do I receive by joining The Speculator?

For a limited-time discounted price of $1,500 (50% off the regular $3,000), members receive:

- A detailed white paper on Clear Secure, outlining its growth potential.

- Three additional stock picks for Investing in AGI, Investing Alongside AGI, and Investing in Stealth AGI.

- The “3 Victims of the Race to AGI” report, identifying stocks to avoid or short.

- 12 to 24 high-conviction recommendations over the next 12 months, strategically sequenced.

- A 90-day satisfaction guarantee, offering a full credit refund for other InvestorPlace products if unsatisfied.

How much does The Speculator cost, and is there a guarantee?

The Speculator retails for $3,000 per year, but event viewers can join for $1,500. It includes a 90-day satisfaction guarantee: if you’re not satisfied, contact member services within 90 days for a full credit refund applicable to any InvestorPlace product.

How does the 90-day satisfaction guarantee work?

If you’re unhappy with The Speculator within the first 90 days, contact the customer service team (available Monday through Friday, 9 AM to 5 PM) to request a full credit refund. This credit can be applied to any of InvestorPlace’s two dozen products, ensuring a risk-free trial.

What is the “3 Victims of the Race to AGI” report?

This report identifies three stocks likely to underperform or fail due to AGI’s disruptive impact. The 2024 version saw an average 23% decline in recommended stocks, with some dropping over 45%. The updated 2025 report helps investors avoid portfolio pitfalls or consider short-selling opportunities.

How many stock recommendations will I receive in The Speculator?

Over the next 12 months, Fry commits to delivering 12 to 24 high-conviction stock picks, strategically timed to align with AGI’s progression. If additional high-potential opportunities arise, Fry may include more, as The Speculator prioritizes member value over arbitrary limits.

Why is there urgency to join now?

The window to invest before AGI’s impact is priced into the market is shrinking. Experts predict AGI could arrive by 2026, and Wall Street’s current distraction creates a rare opportunity for early movers. Delaying could mean missing out on significant gains, as stocks like Clear Secure may soar as AGI nears.

Is investing in AGI risky?

All investments carry risk, particularly in volatile sectors like technology and small-cap stocks, which Fry sometimes recommends. He advises only investing what you’re willing to lose and following buy-up-to guidance to minimize risk. His diversified approach across tech, real estate, energy, and biotech aims to balance risk and reward.

How can I join The Speculator?

Click the “Join Now” button displayed during the The Road to AGI: Final Warning event or on related promotional materials. Complete the enrollment form, and you’ll gain immediate access to all member benefits, including the Clear Secure white paper and additional stock picks.

What support is available after joining?

Fry’s customer service team is available Monday through Friday, 9 AM to 5 PM, to answer questions about membership, enrollment, or investment strategies. Contact details are provided upon joining, ensuring personalized support without pressure.

Can I trust Eric Fry’s predictions about AGI?

Fry’s track record of predicting major market events, coupled with endorsements from outlets like The Wall Street Journal and Barron’s, lends credibility to his AGI thesis. However, AGI’s timeline and impact remain uncertain. Fry’s strategy is informed by experts like Sam Altman and Leopold Aschenbrenner, but investors should conduct their own due diligence.

What if I miss the discounted offer?

The $1,500 discounted price is a limited-time offer for The Road to AGI: Final Warning viewers. If missed, the regular $3,000 price applies. Contact InvestorPlace to inquire about future promotions, but acting now ensures the best value and immediate access to Fry’s recommendations.

Is The Speculator suitable for beginners?

The Speculator is designed for investors seeking long-term, high-conviction opportunities, but some recommendations involve small-cap or volatile stocks, which may require experience. Fry’s clear guidance and diversified approach make it accessible, but beginners should start with conservative allocations and consult a financial advisor.

Why is Clear Secure a good investment for AGI?

Clear Secure’s biometric technology addresses the growing need for secure identity verification as AI becomes more advanced and accessible to bad actors. Its expansion beyond airports into banking, healthcare, and other sectors positions it for significant growth, with AI enhancing its systems’ efficiency and scalability.