Discovering top-notch AI stocks under $10 can be a game-changer for savvy investors aiming to tap into cutting-edge technology markets without breaking the bank. With artificial intelligence reshaping industries, from healthcare to finance, finding affordable stocks with high growth potential is crucial. Whether you’re a seasoned investor or just starting, these budget-friendly stocks offer exciting opportunities for substantial returns. Explore our curated list of AI gems that combine innovation with affordability. Begin your investment journey into the future of technology and see how these promising companies stand to transform the AI landscape in the years to come.

Key Highlights

- Investing in AI stocks under $10 offers growth opportunities without significant financial risk.

- These stocks provide accessible entry into booming technology sectors for diverse portfolios.

- AI stocks are tied to innovation, promising substantial financial returns despite market volatility.

- Rigetti Computing and Rekor Systems are promising players with growth potential in the AI sector.

- Understanding AI fundamentals aids investors in leveraging tech advancements for profitable investing.

Why Invest in Artificial Intelligence Stocks Under $10?

Investing in AI stocks under $10 offers a unique avenue for investors to tap into the growth potential of cutting-edge technology without a significant financial commitment. These low-priced stocks come with the allure of high returns, appealing to both seasoned investors and newcomers eager to diversify their portfolios. While these investments present impressive upside potential, they also pose risks related to market volatility and company-specific challenges. By understanding both the growth opportunities and the associated risks, investors can make informed stock picks, unleashing the realm of low-cost investing in the AI market.

Understanding the Growth Potential

Artificial intelligence is revolutionizing various industries, making AI stocks a hot topic for investors seeking growth potential. Companies focusing on AI are consistently innovating, increasing the value of their stocks and making them attractive investments. Buying AI stocks under $10 allows investors to enter this booming sector without risking large sums of capital. As AI technology continues to advance, these companies can see significant development, which could translate to considerable financial returns for investors. Low-priced stocks in the AI sector often represent startups or small companies poised for rapid expansion, presenting an opportunity for traders to capitalize on market trends early.

The technological advancements driving AI innovation ensure steady growth. Companies specializing in AI aim to improve their algorithms and integrate more seamlessly across various applications, enhancing their market positions. For investors, this means the chance to tap into potentially high-reward investments while benefiting from low entry stock prices. However, it’s essential to research thoroughly and identify strong contenders with viable business models and growth strategies. Understanding market dynamics and competitive landscapes can help investors make informed decisions about which AI stocks to buy, balancing the thrills of financial growth with the realities of market fluctuations.

Risks and Rewards of Low-Cost AI Stocks

While the potential rewards of investing in low-cost AI stocks are appealing, it’s crucial to weigh these against the inherent risks involved. Low-priced stocks are often volatiles, and AI stocks are no exception. Companies in this sector might face financial challenges, technological pitfalls, or competitive pressures, all of which can impact stock prices. As such, investors should perform due diligence, reviewing financial health, market strategies, and growth capabilities of these AI firms before making investment decisions.

On the flip side, when these stocks do perform well, the rewards can be substantial. Small wins in technological breakthroughs, partnerships, or expanding market reach can cause stock prices to surge, reflecting their fundamental growth. By investing in AI stocks under $10, you tap into the long-term trends of AI adoption across sectors. These stocks often fly under the radar of major investors, offering a prime opportunity for sharp-eyed traders to gain from their upward trajectory.

For those with an adventurous spirit and a keen interest in technology, the appeal of AI stocks is undeniable. While it’s necessary to be mindful of risks, the potential for rewarding growth and the satisfaction of being part of technological progress can make the investment journey both exciting and lucrative. Approach with strategy, and you might just find the best AI stocks under $10 that align with your financial goals.

The Appeal of Intelligence Stocks in the Current Market

Intelligence stocks have become a focal point for investors looking to capitalize on emerging technological trends. These stocks, especially those priced under $10, offer accessibility and potential for substantial returns. As technology progresses, particularly within the AI sector, the demand for intelligent solutions continues to rise, driving stock values upward. This market evolution presents not only short-term excitement but also long-term investment benefits, making it an intriguing opportunity for both seasoned investors and newcomers. With companies like Rekor Systems leading the way in innovative tech solutions, the allure of investing in these stocks remains strong.

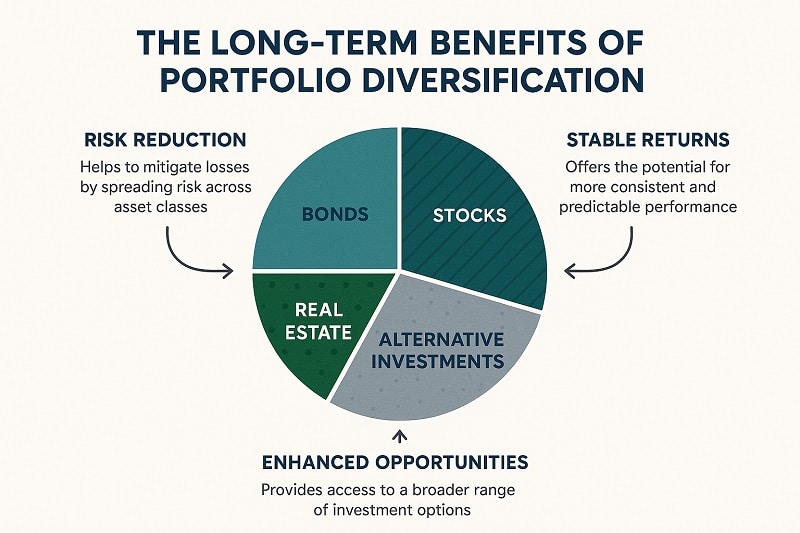

Long-term Benefits for Portfolio Diversification

Investing in intelligence stocks, particularly AI stocks under $10, offers significant potential for long-term portfolio diversification. These stocks can often be volatile, presenting challenges, but also opportunities for substantial growth. Diversifying your investment portfolio with AI stocks exposes you to cutting-edge technology that’s reshaping industries. Companies like Rekor Systems are developing innovative AI solutions, and by including them in your portfolio, you benefit from their growth journey. Diversification helps protect against market fluctuations, balancing the risks with companies that show consistent innovation and strategic advancements. Moreover, buying these stocks allows investors to access high-growth segments of the market, reducing the reliance on traditional sectors alone.

For those keen on technology investing, incorporating AI stocks into your financial strategy ensures that you’re not missing out on the transformative impact of technology. As AI continues to penetrate different market segments, these stocks can provide exposure to new revenue streams. The financial upside of tech-driven growth models presents attractive diversification benefits. Analysts suggest that as technology becomes more integrated into business infrastructure, the demand for AI solutions will skyrocket, potentially increasing stock value significantly.

Furthermore, investing in these stocks aids in achieving a balanced investment approach that leverages both high-growth potential and the excitement of participating in technological evolution. It’s about crafting a portfolio that’s ready for both current market scenarios and future tech breakthroughs. By holding a variety of AI stocks, especially those priced competitively, investors are well-positioned to enjoy the rewards of technological advancements without a disproportionate risk, creating a sustainable investment strategy.

Trends Driving Growth in Intelligence Stocks

The current trends driving growth in intelligence stocks are largely tied to the ongoing advancements in technology and the increasing need for AI solutions across industries. AI stocks benefit from technological trends like machine learning, data processing, and automation. Companies at the forefront of these technologies are managing to capture significant market share and investor interest. The rapid technological evolution ensures that companies are constantly innovating, which in turn drives their stock prices upward.

For investors, one of the exciting trends is the broad application of AI in various sectors including healthcare, automotive, and finance. The widespread adoption and integration of AI technology mean that intelligence stocks are likely to see sustained growth. As technology continues to evolve, intelligence stocks could outperform traditional stock categories, offering immense growth potential to investors poised to capitalize on the next wave of innovation.

Market dynamics suggest that intelligence stocks under $10 are often associated with smaller tech companies or startups. These companies are typically agile, capable of quickly adapting to changes and innovations in technology. As a result, they offer a unique growth trajectory not typically seen with more established companies. Staying ahead of the trends, understanding market needs, and investing in startups could yield substantial profits for investors adept at navigating these dynamics.

Moreover, the tech industry is seeing increased funding and investment, further bolstering the prospects of AI companies. As market sentiment continues to favor technology-driven growth, AI stocks remain a crucial part of an investor’s strategic arsenal. By focusing on companies with manageable stock prices and high growth potential, like those in the AI sector, traders can align themselves with future market leaders, optimizing their financial outcomes.

Delving into artificial intelligence (AI) investments offers a glimpse into the rapidly evolving tech landscape packed with growth potential and innovation. Investors eyeing ai stocks under $10 can benefit from understanding essential AI concepts and recognizing how technology is reshaping markets.

This foundation enables smarter investment decisions, ensuring that individuals can identify promising companies in this dynamic sector. By grasping the essentials and observing technological impacts on markets, investors can position themselves advantageously within the financial realm, ready to capitalize on emerging trends and opportunities in AI investing.

Essential AI Concepts for Investors

Understanding the core concepts of artificial intelligence is pivotal for investors looking to capitalize on this booming industry. AI isn’t just about robots or high-tech gadgets; it’s about systems and technologies that mimic human behavior and improve business processes. For investors interested in ai stocks, grasping the fundamental principles can aid in recognizing potential investments with longevity and growth.

The growth potential in this sector often hinges on the ability of companies to integrate AI into various applications efficiently, driving company value and stock prices upward in competitive markets. Learning about machine learning, neural networks, and data processing can provide a competitive edge when selecting stocks for your portfolio. These are the engines behind many AI initiatives, improving market positioning and creating financial ventures that are both promising and innovative.

For those ready to dive deep into AI stocks, it’s crucial to stay informed about the latest advancements. Staying ahead in this field not only involves tracking technological innovations but also understanding the marketplace dynamics that influence stock performance. These essential concepts are the backbone of informed investing, allowing investors to strategically navigate the complexities of the AI investment landscape.

How Technology is Reshaping Markets

The transformative power of technology is undeniably reshaping markets, making AI an exciting pivot for financial growth and investment opportunities. AI is not just a buzzword; it’s a driving force in market dynamics, influencing sectors from healthcare to finance.

The impact on markets comes from AI’s ability to streamline processes, reduce costs, and introduce innovative solutions, which in turn raises the stock value of companies leading these technological advancements. For investors, recognizing these shifts offers a chance to invest in ai stocks at pivotal moments of industry change. As technology evolves, agile companies with advanced AI capabilities often experience rapid stock growth due to increased operational efficiency and marketplace influence.

This evolution requires investors to be keenly aware of tech trends and the potential for market disruptions. By investing in the right companies, those with not only strategic foresight but also the technological backbone to deliver groundbreaking AI solutions, investors can align themselves with future market leaders.

he financial upside is clear; investing strategically in AI-focused companies can yield considerable rewards as these firms push the envelope of what’s possible, capturing significant market share and redefining industry standards. As such, foresighted investors can leverage the ongoing tech revolution to bolster their portfolios, ensuring sustainable financial growth built on the bedrock of innovation.

Exploring Rigetti Computing’s Potential

Rigetti Computing, a key player in the quantum computing landscape, offers investors intriguing opportunities within the AI stock market. As quantum computing edges closer to mainstream adoption, Rigetti is positioned as a frontrunner in this technological revolution. With its competitive edge in both quantum and AI domains, Rigetti provides a compelling blend of innovation and potential financial gain. Investors interested in AI stocks under $10 could find Rigetti a promising addition to their portfolios, capitalizing on the company’s growth and the anticipated rise in market demand for quantum solutions.

Key Investment Opportunities with Rigetti Computing

Investing in Rigetti Computing presents a unique opportunity to dive into the burgeoning field of quantum computing. As a company at the forefront of this technological frontier, Rigetti is poised to capture substantial market share in the AI sector. The competitive edge Rigetti holds comes from its rigorous focus on developing scalable quantum computers that integrate seamlessly with existing AI frameworks. This integration is key for investors, as the synergy between quantum computing and AI could lead to significant advancements in data processing and problem-solving capabilities, driving up stock value.

Rigetti Computing’s stock, priced under $10, offers a low-cost entry point with high growth potential. The company’s innovative approach positions it as a disruptive force within the tech market, particularly as more industries begin to adopt quantum solutions. As investors consider stocks, the allure of Rigetti lies in its ability to leverage quantum advantages for AI application enhancements, positioning itself as a leader amidst competition.

Additionally, the growth trajectory for Rigetti is supported by increasing interest and investment in quantum computing from both private and government sectors. This backing could fuel Rigetti’s expansion efforts, enhancing both technological developments and market influence. For those looking to invest in high-potential AI stocks, Rigetti Computing not only embodies the future of quantum solutions but also represents an incredible investment opportunity poised for substantial market growth. Purchasing Rigetti stocks could mean aligning with not just an innovative tech company, but also a potential leader in transforming AI capabilities across various sectors.

Potential of Rekor Systems in the AI Landscape

Rekor Systems stands out in the evolving landscape of AI stocks, offering compelling investment opportunities for those looking at low-cost entries with significant growth potential. Known for its technological prowess in the AI sector, Rekor Systems is making substantial strides in both market presence and innovation.

Investors keen on capitalizing on AI technology will find Rekor Systems’ approach to modern challenges particularly attractive, as the company continues to enhance its capabilities and expand its market share. Beyond its promising technology, Rekor Systems presents solid growth prospects, making it an appealing choice for investors aiming to spot potential leaders in the AI market.

Analyzing Market Position and Growth Prospects

Diving into Rekor Systems’ market position reveals a company strategically navigating the AI landscape with a strong foothold in intelligent infrastructure solutions. Their focus on AI-driven technologies positions them among promising ai stocks for investors seeking both innovation and financial growth. With a robust product lineup addressing the needs of varied market segments, Rekor Systems leverages technology to optimize infrastructure management, enhance data-driven decision-making, and improve operational efficiencies. This unique market niche not only differentiates the company but also underpins its potential for sustained growth in a competitive arena.

For investors, Rekor Systems’ market strategy highlights significant growth prospects rooted in expanding technology applications and increasing demand for intelligent solutions. The company’s forward-thinking approach in deploying AI to address contemporary challenges presents numerous opportunities. By continuously refining their technologies, Rekor Systems aims to capture a larger share of the AI stock market, attracting attention from both institutional and individual investors. This potential is buttressed by the company’s financial strategies, which aim to ensure stable revenue inflow while supporting innovative expansions.

Investing in Rekor Systems offers traders an avenue to explore the future of AI stocks, particularly those priced competitively. The company’s trajectory suggests not just fleeting success but long-term market influence. As investors examine growth prospects and stock metrics, Rekor Systems stands out as a beacon of resilient growth and technological advancement, fostering confidence in its capacity to maintain and enhance its market viability. Engaging with Rekor Systems could open doors to significant investment returns, riding the waves of AI innovation and market adaptation.

Understanding the Impact of Nasdaq Riot on AI Stocks

The Nasdaq Riot, a term used to describe sudden fluctuations in the stock market driven by tech sector volatility, holds significant implications for AI stocks, which are often susceptible to abrupt market changes. For investors, observing how these fluctuations impact AI company valuations can provide critical insights for strategic investing. This volatility primarily affects low-priced stocks, a category that AI stocks under $10 frequently belong to, making them particularly sensitive to such market dynamics. Understanding these shifts is crucial for traders hoping to capitalize on promising opportunities amidst high-risk environments.

Market conditions like the Nasdaq Riot can influence the financial trajectory of AI stocks, but they also offer potential growth opportunities amid the chaos. Often, these abrupt changes arise from trading trends or tech sector developments, catching investors off guard. However, seasoned investors can navigate through these by focusing on AI companies with robust growth strategies and solid financials. This approach helps minimize risks while maximizing potential returns, turning market fluctuations to their advantage. Companies that stand resilient amid market turbulence often secure improved positions when conditions stabilize, offering lucrative growth potential for those who invested wisely during the downturns.

Investment in AI stocks requires not only a keen eye for market trends but also a strategic approach to company selection. With the Nasdaq Riot, it becomes more imperative than ever for investors to identify AI tech firms capable of sustaining growth despite market volatility. Trading AI stocks under $10 during these tumultuous times calls for a thorough assessment of the company’s market positioning and future prospects. Embracing this challenge will not only enhance portfolio diversification but potentially unlock substantial financial benefits as the market recovers and adjusts to new technological innovations.

Investing in AI stocks under $10 presents a compelling opportunity for those looking to enter the market without a hefty upfront cost. These stocks not only offer accessibility but also hold the promise of significant growth as the AI industry evolves. By focusing on companies with promising technologies and market strategies, investors can potentially capitalize on future trends. As always, it’s crucial to conduct thorough research and consider diversification to manage risks. Dive into the world of AI investments today and explore the possibilities that the tech revolution has to offer, aligning your portfolio with tomorrow’s innovations.

FAQs: Best AI Stocks Under $10: Top Artificial Intelligence Stocks to Watch

What are the potential benefits of investing in AI stocks under $10?

Investing in AI stocks under $10 allows investors to tap into significant growth prospects with minimal financial risk. These stocks offer an affordable way to participate in the evolving tech sector and capitalize on the transformative power of AI technology.

Why are AI stocks under $10 considered appealing to investors?

AI stocks under $10 are appealing because they offer high returns while providing an accessible entry point into cutting-edge sectors. They attract both experienced investors looking to diversify their portfolios and newcomers eager for value-driven investments.

What risks should be considered when investing in low-priced AI stocks?

Investing in low-priced AI stocks comes with risks such as market volatility, company-specific challenges, and financial instability. Thorough research and due diligence are crucial to identifying strong contenders, ensuring a balanced approach between risk and reward.

How does AI innovation affect stock value?

AI innovation can significantly enhance stock value by boosting a company’s market position, operational efficiency, and competitive edge. Successful AI integration across applications can lead to substantial improvements in financial performance and investor interest.

Why are companies like Rigetti Computing and Rekor Systems noteworthy in the AI stock market?

Companies like Rigetti Computing and Rekor Systems are noteworthy because they are positioned at the forefront of AI and tech innovations. They leverage unique technological advancements in quantum computing and intelligent solutions, offering investors potential growth and market leadership opportunities.