In a bold and unprecedented move, President Donald Trump is poised to transform the financial landscape of the United States by unlocking an estimated $100 trillion in federal assets through what Whitney Tilson, a seasoned Wall Street veteran, has dubbed the “US IPO.” This initiative, rooted in Executive Order 14196 signed in February 2025, aims to establish the first-ever federal sovereign wealth fund, designed to harness the nation’s vast untapped resources for the benefit of American citizens.

Tilson, with 35 years of experience in finance, argues that this could be one of the most significant wealth-building opportunities in modern history, potentially rivaling the dot-com boom or the shale revolution.

Below, I’ll go into the details of this transformative plan, explore the assets involved, identify the companies likely to benefit, and provide actionable insights for investors looking to capitalize on this historic moment.

The Genesis of the “US IPO”

Executive Order 14196: A Game-Changer

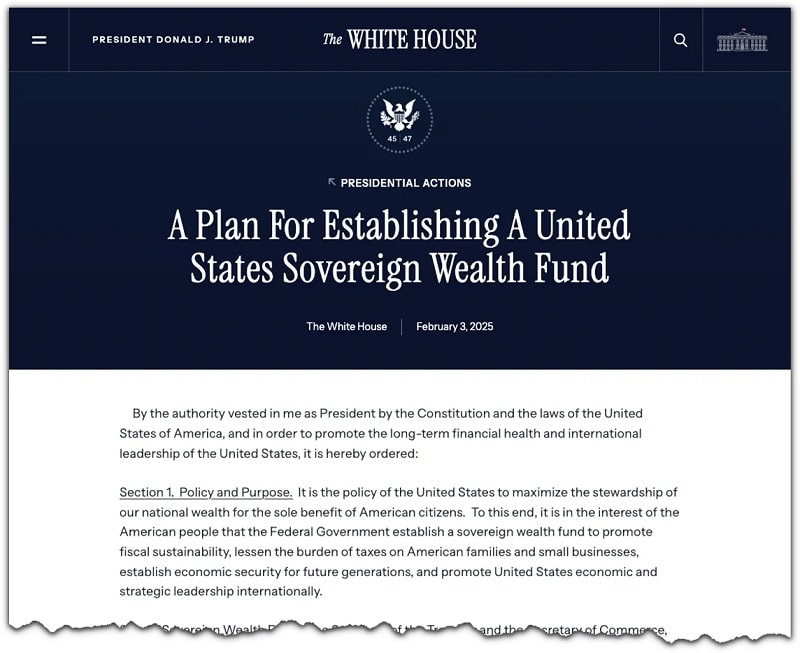

On February 2025, President Trump signed Executive Order 14196, a directive that has largely flown under the radar amidst the flurry of 142 executive orders issued in his first 100 days. This order lays the groundwork for a federal sovereign wealth fund, a mechanism traditionally used by resource-rich nations like Norway and Saudi Arabia to manage and grow national wealth. Unlike state-level funds in places like Alaska, which paid residents $1,700 each in 2024, or Texas, which funds education, the federal fund would operate on an unprecedented scale, leveraging the United States’ vast federal assets to generate wealth for future generations.

Tilson emphasizes that this is not a conventional approach to managing national debt, which currently stands at $36 trillion and grows by approximately $1 trillion every six months. Instead of austerity measures or tax hikes, Trump, thinking like a businessman, aims to “take America public” by monetizing the country’s untapped resources. This strategy involves transferring federal assets—ranging from oil and natural gas reserves to critical minerals like lithium—onto the stock market, potentially creating a massive economic boom.

The Scale of Federal Assets

The United States government owns an extraordinary amount of land and resources, much of which remains underutilized. According to Tilson, federal assets include:

-

Oil Reserves: 69 billion barrels in the outer continental shelf of the lower 48 states, 896 million barrels in Alaska’s Naval Petroleum Reserve, 25 billion barrels in Alaska’s outer continental shelf, and 90 billion barrels north of the Arctic Circle. At $62 per barrel, these reserves alone are worth trillions.

-

Natural Gas: 229 trillion cubic feet in the outer continental shelf and 53 trillion cubic feet in Alaska, valued at $3.70 per cubic foot.

-

Oil Shale: 982 billion barrels in the Green River Formation across Colorado, Utah, and Wyoming.

-

Lithium: A deposit in southeast Oregon estimated at $1.5 trillion.

-

Gold: Over 10 million ounces in Cortez, Nevada, potentially worth $30 billion at current prices.

-

Land: 245 million acres of surface land (28% of the U.S. land base) and 700 million acres of subsurface land, including 60% of Nevada and 40% of Utah.

These assets, collectively valued at over $100 trillion—more than double the national debt—are owned by the federal government and, by extension, the American people. Yet, as Tilson points out, only a fraction (2% of offshore and 6% of onshore lands) is currently leased for resource extraction, representing a colossal missed opportunity.

The Mechanics of the “US IPO”

Monetizing Federal Assets

Trump’s plan, as outlined by Tilson, is not to simply sell off these assets in a fire sale but to strategically lease or transfer them to public companies, effectively listing them on the stock market. This approach mirrors an initial public offering (IPO), where a company’s shares are offered to the public for the first time, but on a national scale. The U.S. Department of the Interior, under Secretary Doug Burgum, is tasked with appraising and evaluating these assets, with a leaked list from the U.S. General Services Administration identifying over 400 federal properties for potential sale or auction.

Key initiatives include:

-

Leasing Federal Land: Within Trump’s first 100 days, 45 oil and gas leases covering 29,000 acres were signed in states like Montana, North Dakota, New Mexico, Wyoming, and Nevada. Additional deals support geothermal energy, transmission lines, renewable energy, pipelines, mineral extraction, and timber production.

-

Strategic Partnerships: Companies involved in these leases stand to gain significantly, with Tilson citing a deal near Mountain Pass, California, that led to a 3,700% stock surge for one company since early 2025.

-

Critical Minerals and Energy: The Department of the Interior’s four-year plan, with a deadline of October 1, 2025, prioritizes opening Alaska and other federal lands for mineral extraction, increasing revenue from non-energy sources like grazing and timber, and boosting clean coal, oil, and gas production through streamlined permitting.

The Role of Key Players

Trump has assembled a formidable team to execute this vision, including:

-

Scott Bessent, Treasury Secretary: Known for his role in George Soros’ $10 billion trade against the Bank of England, Bessent is focused on monetizing U.S. assets to benefit the American people.

-

Howard Lutnick, Commerce Secretary: A billionaire who has proposed renaming the Department of the Interior the “Department of American Assets,” signaling a shift toward asset-driven economic policy.

-

Doug Burgum, Interior Secretary: As former governor of North Dakota, Burgum oversaw a successful state sovereign wealth fund and now leads efforts to catalog and monetize federal assets. He emphasizes the potential for cleaner, smarter resource extraction that creates jobs and reduces reliance on foreign minerals.

These leaders, combined with Trump’s business acumen, form the first catalyst for the “US IPO,” ensuring that the initiative is driven by experienced financial and political heavyweights.

The Economic Tailwinds

Catalyst 1: Leadership and Execution

The involvement of Bessent, Lutnick, and Burgum underscores the seriousness of this initiative. Their track records in finance and governance, coupled with Trump’s deal-making prowess, suggest that the sovereign wealth fund is not a speculative venture but a well-orchestrated plan. Burgum’s experience in North Dakota, where the state’s fund contributed to clean water, air, and soil while boosting energy production, serves as a model for the federal approach.

Catalyst 2: The AI Energy Crisis

The second catalyst is the surging demand for energy driven by artificial intelligence (AI). AI data centers consume vast amounts of electricity, equivalent to entire cities, and the U.S. currently lacks the power infrastructure to support widespread AI adoption. This energy crunch is not just a tech issue but a national security concern, as Burgum notes: “We don’t have enough power to win the AI arms race… You can’t have defense without AI.”

Major tech firms like Amazon, Microsoft, and Google are scrambling to secure energy supplies, signing deals with providers like Talen Energy ($650 million, doubling its share price) and Constellation Energy (450% share price increase). The Department of Energy’s plan to build 16 new data centers on public lands further amplifies this trend, with companies like Palantir Technologies (up 422% after a $178 million AI contract) and BigBear.ai (up 690% after defense contracts) already benefiting.

Catalyst 3: The October 1 Deadline

The third and most urgent catalyst is the October 1, 2025, deadline outlined in the Department of the Interior’s leaked strategic plan. This 23-page document sets clear goals for restoring American prosperity through resource monetization, with specific timelines for opening federal lands and streamlining permits. Tilson warns that after this date, media coverage will likely intensify, driving up stock prices and reducing the window for early investors to secure the highest gains.

Investment Opportunities

Historical Precedents

History offers compelling evidence of the wealth-building potential of federal land deals:

-

Leland Stanford: Used federal land grants to build the Central Pacific Railroad, selling surplus land to fund Stanford University and a lavish lifestyle.

-

George Hearst: Amassed a fortune through gold and silver mines on federal lands, founding one of America’s wealthiest dynasties.

-

J. Paul Getty: Turned a $500 investment in a federal oil lease into Getty Oil, with a net worth exceeding $6 billion.

These examples illustrate how access to federal resources has historically created generational wealth, a pattern Tilson believes is repeating with the “US IPO.”

Companies to Watch

Tilson identifies several companies poised to benefit from this initiative, emphasizing those with diversified revenue streams and low-risk profiles. Key recommendations include:

-

Fannie Mae (FNMA): Currently under government conservatorship, Fannie Mae is a government-owned asset that Trump has confirmed plans to take public. A billionaire investor, holding 220 million shares, predicts a potential 250% spike, making it a low-cost entry point at $10 per share.

-

Oil and Gas Operator: A company operating on hundreds of thousands of acres of federal land, with a $900 million project backlog in 2024. Its expertise in navigating regulations positions it to dominate future deals.

-

Permian Basin Company: Owns 270,000 acres in Texas’ resource-rich Permian Basin, generating revenue from oil, gas, minerals, data centers, sand, water, and even cryptocurrencies. A developer paid $8 million just to analyze its land, highlighting its profitability.

-

Rare Earth Company: A $6 stock in discussions with the government to build U.S.-based facilities, reducing reliance on Chinese minerals.

-

Critical Resource Miner: Holds a permit for a major mine on federal land, with an $80 million government contract to stockpile resources.

These companies, detailed in Tilson’s reports—How to Get YOUR Share of the US: IPO, The US: IPO Cash Machine, and America’s Mineral Powerhouses—offer diversified exposure to the resource boom without the high risks of traditional mining ventures.

Past Performance

Tilson’s track record at Stansberry Research bolsters his credibility. Since 1999, his Investment Advisory has delivered an average annual return of 20%, outperforming the broader market. Notable wins include:

-

Microsoft (MSFT): 1,199% gain

-

Hershey (HSY): 425% gain

-

Texas Pacific Land Corp. (TPL): 439% gain

-

W.R. Berkley (WRB): 523% gain

His Commodity Supercycles service has also yielded significant returns, such as 339% on Silver Wheaton and 330% on Northern Dynasty, demonstrating his expertise in resource-based investments.

Risks and Considerations

While the “US IPO” presents a compelling opportunity, it is not without risks. The volatility of resource stocks, regulatory uncertainties, and potential environmental concerns could impact returns. Tilson advises focusing on companies with diversified revenue streams and established operations to mitigate these risks. Additionally, the October 1 deadline underscores the need for timely action, as latecomers may miss the initial surge in stock prices.

Investors should also consider the broader economic context. The national debt, geopolitical tensions, and fluctuations in commodity prices could influence the success of the sovereign wealth fund. However, the involvement of seasoned leaders like Bessent, Lutnick, and Burgum, combined with the insatiable energy demands of AI, suggests a robust foundation for this initiative.

How to Get Started

Tilson’s strategy is accessible to all Americans, requiring as little as a few hundred dollars to invest in the recommended stocks. His reports, available exclusively through Stansberry Research, provide detailed analyses, ticker symbols, and buying instructions. The Investment Advisory and Commodity Supercycles subscriptions offer ongoing updates, ensuring investors stay informed as the “US IPO” unfolds.

To encourage participation, Tilson offers a discounted package, reducing the usual $1,000 cost for both publications to a fraction of that price, backed by a 30-day money-back guarantee. This low-risk entry point allows investors to test the strategy without significant financial commitment.

The Broader Implications

Beyond individual wealth-building, the “US IPO” has profound implications for the U.S. economy. By monetizing federal assets, the government could reduce its debt burden, fund infrastructure, and create jobs. Burgum’s vision of cleaner, smarter resource extraction aligns with national priorities, reducing reliance on foreign minerals and bolstering industries like AI and defense. The initiative also democratizes access to America’s wealth, allowing everyday citizens to benefit from assets they technically own as taxpayers.

Conclusion

Whitney Tilson’s “US IPO” thesis represents a once-in-a-generation opportunity to capitalize on the monetization of $100 trillion in federal assets. Backed by President Trump’s Executive Order 14196 and driven by economic tailwinds like AI energy demands and strategic leadership, this initiative could reshape the financial landscape.

By investing in carefully selected companies before October 1, 2025, individuals can position themselves for significant gains, echoing the wealth-building successes of historical figures like Stanford, Hearst, and Getty. With Tilson’s proven track record and accessible research, now is the time to act on this unprecedented opportunity.