Martin Weiss and Sean Brodrick from Weiss Ratings have new promo for their financial newsletter Wealth Megatrends. The new video and their new e-book feature “Financial Judgment Day” or “Countdown to Armageddon.”

In this review you will find out everything you need to know about Financial Judgment Day and is it worth to become a subscriber to Wealth Megatrends from Weiss Ratings.

Countdown to Armageddon or what is Financial Judgment Day?

In a few weeks, the strongest historical cycles that science is aware of will combine to generate a massive 5-year super cycle.

The rising cycle of war will be combined with four other strong financial cycles. And Weiss Ratings team believe this will have a major impact.

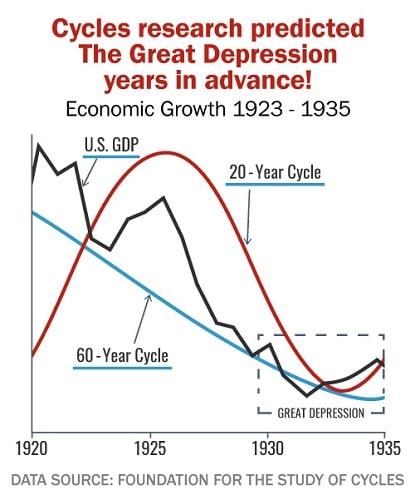

In the early 1930s, cycles like this merged, causing the world to experience a Great Depression that lasted more than ten years.

Martin Weiss and Sean Brodrick admit this is the most severe warning they have ever issued:

We are in for five years of chaos in the global economy and global conflicts. They will impact our investments and personal lives. The wealth and retirement savings of generations will be vaporized. Angry citizens will take to the streets. No man’s life or property will be safe.

Martin and Sean are saying they have no interest in frightening anyone. They are simply following their research.

Weiss Ratings forecasting tools or The Proven Power of Cycles

The forecasting tools Weiss Ratings use are the same that have enabled them to accurately predict the stock market crash well in advance and nearly all major moves in U.S. stocks since then.

The power of the cycles was discovered back in 1932 when Edward R. Dewey tried to determine what caused the Great Depression.

Dewey found that all of creation moves in cycles – from lifecycle of stars, changing of the seasons, our beating hearts and many more.

The same cycles that control the physical universe and our bodies also control human affairs. Like the emergence and dissolution of empires, countries, communities, economies, currencies, and stock markets.

The shocking conclusion reached by Dewey was that anyone who looked at the charts showing these cycles could have predicted the coming Great Depression months in advance.

The Depression occurred because it was DEFINITELY TIME for it to.

Sean was the first person at Weiss Ratings who introduced The Great Super cycle. He has followed and predicted cycles with amazing accuracy.

If you would like to learn more about their predictions, click here to read their e-book.

Here we would like to introduce you to the message Weiss Ratings team would like to spread. A message about four cyclical megatrends that no wage-earner, retiree, or investor can afford to ignore:

Four Horseman of the Economic Apocalypse

Each horseman represents a powerful megatrend with proven disruptive capacity in the past. What we want to point is that now all four are coming together in the five-year time horizon.

- The First Horseman: Biggest Debts Ever Known to Man. No country has ever triumphed in history by plunging itself into a huge debt hole. Each debt crisis is more severe than the previous one.

- The Second Horseman: Out of control inflation. Most Americans have never experienced anything like this in their lifetime.

- The Third Horseman: The Tsunami of Flight Capital. When times are bad or violence breaks out, people migrate in mass and move their money to safer places with better income. It already happened twice in Europe just in the last few years – first from Middle East, now from Ukraine. Weiss’ cycle research tells them that waves we’ve seen so far are very small compared with the tsunami that will come in the next phase of this 5-year super cycle.

- The Fourth Horseman: The Rising Cycle of War. Global war today can take a variety of shapes: Trade wars, cyberwars, financial wars, etc.

Why U.S. is the safest place….for now?

Weiss and his team predict that EU will not survive all those factors that are driving the European Union toward the brink. This will be a big blow to Japan, one of Europe’s biggest trading partners. Japan’s already-bulging budget deficit will explode. Debt burden will choke the economy, and the bond market will collapse.

The troubles in Europe, Asia, and other hot spots around the world have prompted wealthy investors to seek safe places, like U.S.A.

That’s why savvy European and Japanese investors recently bought trillions of dollars to buy stocks, real estate, etc.

Four Distinct Fortunes

This crisis has provided, and continues to provide, the opportunity to build four fortunes:

Fortune 1: Governments spends money, borrows money, and prints money. This has given investors the opportunity to build a great fortune in stocks.

Fortune 2: Inflation surges out of control in United States and even greater inflation overseas. The stocks that benefit from inflation soar the most.

Fortune 3: Europe and Japan implode. As the waves of capital rush to safer place become a tsunami, driving U.S. asset prices even higher.

Fortune 4: When the crisis come to America. This is the time when United States pays the price of the largest debt and money printing in 5,000 years of human history.

Weiss believes that the same fate suffered by Europe and Japan awaits us as well.

How to shield your wealth and make profit?

As we are getting closer to the fourth phase when the crisis will come to America, Weiss Ratings recommend investing in the following assets:

Category A – Assets that cannot be confiscated by the government like U.S. stocks. Weiss Ratings made a buy-rated list of stocks that have great potential.

Category B – Alternative assets that are excellent hedges against a government crisis like gold and silver. When bullion prices skyrocket, the shares of companies that produce them go even higher.

Metals used for energy have even greater potential. Lithium and cobalt are integral components of the EV batteries. Rising demand is expected to drive the price of these metals to the roof.

Category C – Leveraged Investments.

Leveraged ETFs are relatively less risky, and investors could triple the profits.

For more aggressive investors, Weiss Ratings recommend buying call options on select U.S. stocks that they expect foreign investors will want to own. And, ETFs that own those stocks.

All investments involve risk. With options your profit potential is unlimited, and your risk is strictly limited to the amounts you invest.

Sean’s third recommendation in this category is buying small-cap mining shares. These companies’ values are tied at the hip to the price of the metal they produce.

14 Super cycle Investment Opportunities for 2022-2027

Weiss Ratings believe the next five years are going to be a speculator’s dream for any investor with knowledge.

Their cycle analysis shows that these megatrends are really just getting started. Phases 2, 3, and 4 of these crisis will bring in the highest profits!

Additionally, because the timing of these megatrends is based on foreseeable cycles, they are confident in their ability to apply judicious leverage and aim for the highest gains.

Here is the list of opportunities for the next two cycles of the crisis:

- Debt and war crisis will drive up blue-chip companies.

- Leaders of sweeping megatrends like defense, electric cars and the U.S. energy boom.

- The euro and the Japanese yen fall

- And as European and Japanese stocks follow

Then, in Phase Four more opportunities will rise as:

- The U.S. dollar crashes

- Many U.S. stocks collapse

- U.S. corporate bonds implode.

The massive wave of flight capital will drive precious metals and commodity prices higher. At that time great investments will be:

- Gold (Target price: $7,000 per ounce)

- Silver (Target price: $150 per ounce)

- Platinum (Target price: $9,000 per ounce)

- Palladium (Target price: $4,000 per ounce)

- Oil and energy (Crude oil target: $250 per barrel)

- Energy metals like nickel, cobalt, lithium, and uranium

- Food, especially wheat

Here are two EFTs that can get you started right away:

Commodity Index Tracking Fund by Invesco, with 5.7 million shares traded each day, it is an extremely liquid fund. It invests in a variety of commodities, with energy accounting for 56% of the portfolio, agricultural for 22%, and metals for the remainder.

With a nice mix of maize, soybeans, wheat, sugar, cocoa, coffee, cotton, cattle, and hogs, the Invesco DB Agriculture Fund is also quite liquid.

These are quite many investment opportunities. If you would like to go to the next level and become Weiss Ratings subscriber, here are details about their research service Wealth Megatrends:

What to expect from Wealth Megatrends?

Wealth Megatrends is private research service provided by Weiss Research. It is focused on identifying the major economic trends unfolding in the markets. Here is a list of 10 wealth-building benefits included in the risk-free trial:

- FREE report – The Inflation Survival Guide ($79 value). Includes step-by-step blueprint on how to safeguard your wealth and retirement from inflation.

Here you will find seven little known investment opportunities. Plus, the investments you should sell immediately.

- Free report: The 12 Inflation Beating Stocks for the Next 12 Months ($79 value)

Weiss Ratings team have analyzed practically every stock on the markets to uncover the healthiest in the world. In this report you will get 12 stocks for preserving and growing your wealth.

- FREE report – Bloodbath in Bonds ($79 value)

Inflation could transform one of the safest investments into one of the riskiest. If you have any money in federal, state, county or municipal bonds, read this report as soon as possible.

- FREE Report – The New Precious Metals ($79 value)

Owning gold or silver is a wise decision at a time when inflation is causing chaos on the markets. Inside this bonus report you will learn about 17 lesser-known resources that could be even more profitable.

- 12 Issues of digital newsletter Wealth Megatrends ($129 value). As a member you will receive 12 monthly issues that will keep you on top of the major trends and how to profit from them.

- Weekly wealth wave newsletter with new investment opportunities.

- Urgent trade alerts whenever Sean and his team of analysts determine you need to take fast action.

- Huge savings on Wealth Megatrends. You will get an entire year’s membership plus four bonus reports (total value $445) for as little as $39. This will save you up to $406.

- Lifetime savings with guaranteed lowest renewals.

- 365-day money back guarantee. You can keep all bonuses, reports, and privileges.

Wealth Megatrends Price

New subscribers can choose their membership:

- Standard membership for $39

- Premium membership for $59 that includes everything from standard plus 12 monthly issues of Wealth Management print newsletter ($39 value)

Should You Join Wealth Megatrends?

By taking few steps today, you have the chance to protect and grow your wealth – even during inflation and market crashes.

Sean’s promise is that with Wealth Megatrends you will have the potential to watch your portfolio grow.