If Nvidia at $1 was the last AI lottery ticket you missed, Teeka Tiwari just handed you six more—trading for pocket change—which he’ll fully reveal at The Final Phase event on November 12 at 8 p.m. ET—before the final boom detonates on November 19.

The Dawn of the AI Crypto Revolution

In the ever-evolving landscape of technology and finance, few voices carry the weight of Teeka Tiwari. A former Wall Street hedge fund manager turned crypto visionary, Tiwari has built a reputation for spotting seismic shifts before they hit the mainstream. Back in 2015, he flagged Nvidia as a must-buy when it traded under $1, a call that preceded its meteoric rise to becoming the world’s most valuable company, minting millionaires from modest investments. Fast-forward to November 2025, and Tiwari is sounding the alarm once again—this time on what he calls the “Final Phase” of the AI boom.

On November 12 at 8 p.m. ET, Tiwari is set to host an urgent strategy session titled “The Final Phase,” where he’ll unveil his blueprint for navigating the explosive intersection of artificial intelligence and blockchain. According to Tiwari, this isn’t just another hype cycle; it’s the climactic surge where AI coins—undervalued tokens blending AI innovation with crypto’s decentralized power—could deliver returns dwarfing even Nvidia’s legendary run. With a pivotal event looming on November 19 involving a figure dubbed “the Steve Jobs of AI,” Tiwari warns that time is running out to position yourself.

But what makes this prediction so compelling? The AI boom has already transformed industries, creating 600,000 millionaires since ChatGPT’s 2022 debut. Nvidia’s market cap has shattered records, hitting $5 trillion in October 2025. Yet, as Paul Tudor Jones, the legendary hedge fund manager who predicted the 1987 crash, recently noted, the coming phase could eclipse the 1999 internet rally in explosiveness. Tiwari agrees, but with a twist: The real windfall won’t flow to overvalued AI stocks like Nvidia (now trading at premiums that scream caution). Instead, it will cascade to “pocket change” AI coins—tokens trading for pennies that could 500x or more by 2026.

This article dives deep into Tiwari’s thesis, unpacking the gold-bitcoin dance that signals crypto’s next leg up, the institutional shift reshaping Bitcoin, and the AI coins poised to lead the charge. Whether you’re a seasoned crypto whale or a newcomer eyeing your first AI play, understanding this final phase could be your ticket to the next wealth wave. Let’s explore why gold’s rally is mere smoke, Bitcoin’s the fire, and AI coins are the inferno.

Teeka Tiwari: The Oracle of Asymmetric Bets

Teeka Tiwari’s journey from a London foster kid to Wall Street wunderkind reads like a Hollywood script. Arriving in America at 16 with $150 in his pocket, he hustled his way to Vice President at Shearson Lehman by age 20. But it was his pivot to crypto that cemented his legend. In April 2016, Tiwari urged readers to buy Bitcoin at $400—a call that ballooned to $126,000 peaks, turning $1,000 stakes into seven-figure fortunes.

Tiwari’s edge? He thrives on “asymmetric bets”—high-reward opportunities with limited downside. His 2021 bombshell, slashing gold allocations from 10% to 1% while pumping Bitcoin to 10%, drew fire from traditionalists. Critics branded him reckless, endangering retirees. Yet data vindicated him: From March 2021 to January 2025, Bitcoin doubled gold’s returns (106% vs. 51%). Even in 2025’s volatility, where gold surged 66% YTD versus Bitcoin’s 19%, Tiwari sees no sell signal. “Gold’s rally is the smoke—Bitcoin’s the fire,” he declares.

This pattern isn’t coincidence. Since 2016, every Tiwari gold hedge has been outpaced by Bitcoin. In July 2019, amid “currency rot” fears echoing 1970s stagflation, he touted gold at $1,409—now above $4,210, up 200%. Bitcoin? A 1,075% rocket from $9,440. April 2020’s COVID money-printing spree lifted gold 176%, but Bitcoin soared 1,550%, with altcoins like Ethereum (2,492%) and Binance Coin (8,101%) stealing the show.

Tiwari’s November 2023 call on Sandstorm Gold (SAND) delivered 150% gains, trouncing gold’s 119% and the S&P’s 54%. Bitcoin? 216%. Altcoins like Solana (371%) and Bittensor (366%)? Even hotter. The lesson: Gold scouts danger; Bitcoin conquers it, paving altcoin explosions.

Now, with gold outpacing Bitcoin for two months—the typical lag before crypto’s eruption—Tiwari’s eyes are on AI coins. These aren’t speculative memes; they’re blockchain-AI hybrids solving real pain points, from decentralized data markets to autonomous agents. As institutional money floods in, Tiwari predicts AI coins will compress decades of gold-stock gains into months. His “Final Phase” session promises six picks, including a free one under a dime, plus the November 19 catalyst: Likely a major AI summit or OpenAI announcement involving Sam Altman, the “Steve Jobs of AI.”

Tiwari’s track record isn’t flawless—some past picks like AKT and ARB lagged—but his free recommendations have averaged 784% peaks. In a market where 95% of AI projects flop, his vetted plays stand out.

The Gold-Bitcoin Dance: A Timeless Signal for Crypto Surges

Gold and Bitcoin aren’t rivals; they’re partners in the debasement trade. As fiat currencies erode—U.S. M2 money supply up 40% since 2020—investors flock to stores of value. Gold, the eternal hedge, spikes first on inflation whispers. Bitcoin, digital gold 2.0, follows with fury.

Consider the cycles:

- 2020 COVID Rally: Gold +43% post-crash. Bitcoin? +543%.

- 2022 Inflation Peak: Gold bottomed, then climbed. Bitcoin delivered 4x returns.

- 2024 Debt Doom Loop: Gold +35%. Bitcoin +83%.

Average post-gold surge for Bitcoin: 313%. From 2011-2025, gold’s 125% pales against S&P’s 454%, Nasdaq’s 791%, and Bitcoin’s 1,031,718%. Even peak buys recovered faster in stocks and crypto (2 years max) than gold’s decade drought.

Tiwari’s 1% gold/10% Bitcoin reallocation? Born from data: Post-2016, Bitcoin crushed gold every time. Now, with real yields negative and central banks hoarding 228 tons of gold in Q1 2023 (record since 2000), the signal blares. Gold’s two-month lead means Bitcoin’s breakout looms—potentially to $1 million by decade’s end, per Tiwari.

But Bitcoin won’t dance alone. Institutions are rewriting the script.

Institutional Adoption: Why This Bitcoin Bull Is Different

Forget retail FOMO; today’s bull is Wall Street’s waltz. Bitcoin’s $2.2 trillion market cap rivals Canada’s GDP, but the driver has shifted. Retail speculators fueled past cycles—chaotic, emotional. Now, pensions, endowments, and Fortune 500s allocate methodically.

BlackRock’s IBIT ETF nears $100 billion AUM in under two years—fastest ever. JPMorgan, once mocking Bitcoin as a “pet rock,” now accepts it as loan collateral by year-end. This “sticky” capital—1% portfolio trims on doubles, buys on dips—damps volatility but builds relentlessly. October 10’s $19 billion liquidation purge? The old guard’s exit.

Result: Bitcoin’s “sleepwalking” between $60K-$70K, then overnight repricings to $125K. Supply’s fixed (21 million cap); demand’s institutional. As adoption deepens, Tiwari sees $1M BTC unlocking altcoin tsunamis—especially AI coins.

This fusion? Not hype. AI’s $27.9 billion crypto market cap (up 10.9% daily as of November 2025) signals maturity.

The AI Boom’s Final Phase: Catalysts and Controversies

The AI spring—kicked off by ChatGPT’s 2022 splash—has minted fortunes but sparked bubble fears. Nvidia’s $5T valuation? Dot-com déjà vu. MIT reports 95% of AI pilots unprofitable. OpenAI’s $20B negative cash flow peak by 2027 underscores the frenzy.

Yet Tiwari and Jones see surge, not bust. Jones: “Ingredients for blow-off top like 1999.” Tiwari pins November 19 as ignition: Likely Altman’s AGI milestone or agentic AI reveal.

Nvidia’s Jensen Huang dubs agentic AI—a multi-trillion-dollar frontier where autonomous agents handle tasks—a “once-in-lifetime” shift. From $129B Nvidia revenue FY2025, this could balloon markets. But stocks are frothy; coins are cheap.

Why AI Coins Trump AI Stocks: The Pocket Change Power Play

Nvidia’s 24,037% since Tiwari’s 2015 call? Impressive, but at current valuations, it’s no $1 bargain. AI stocks like Palantir (+150% YTD), AMD (+115%), Nvidia (+42%) are priced for perfection. Tiwari: Biggest gains shift to AI coins—blockchain tokens enabling decentralized AI, trading sub-$1.

Why? Scalability. Stocks centralize; coins decentralize. AI needs vast data/compute; blockchain provides secure, permissionless access. Nvidia powers hardware; AI coins fuel software ecosystems. Some already 500x Nvidia’s returns, per Tiwari.

Huang’s agentic AI? A boon for coins building autonomous agents. With $3T datacenter spend projected, AI coins like those in decentralized compute networks could capture trillions.

Risks? Volatility, regulation. Jones warns 10% chance AI destroys 50% humanity by 2045. But Tiwari’s vetted picks mitigate via fundamentals

Spotlight on Top AI Coins for 2026: Teeka Tiwari’s Hypothetical Six-Pack

Teeka Tiwari has teased six high-conviction AI coins for 2026, including one free pick trading under $0.10 that he claims gives “direct exposure to the future of AI.” While the exact names will be revealed during his November 12, 2025, “The Final Phase” strategy session, market dynamics, his past recommendations, and the November 19 catalyst (likely involving Sam Altman and agentic AI) point to a clear cohort of frontrunners.

Below is a comprehensive, data-backed analysis of six AI coins that align perfectly with Tiwari’s thesis: decentralized AI infrastructure, autonomous agents, data monetization, compute marketplaces, and scalable blockchains—all trading at pocket-change prices with 10x–500x upside potential by 2026.

Note: These are hypothetical alignments based on Tiwari’s criteria (low price, high utility, institutional momentum, and alignment with Nvidia’s multi-trillion-dollar agentic AI vision). DYOR. Prices are approximate as of November 7, 2025.

1. Bittensor (TAO): The Decentralized Brain Collective – The “Future of AI” Free Pick?

| Metric | Value (Nov 2025) |

|---|---|

| Price | ~$365 |

| Market Cap | ~$5.2B |

| Circulating Supply | ~10M TAO |

| All-Time High | $767 (Mar 2024) |

| YTD Return | +366% (Tiwari-cited) |

| 2026 Price Target | $5,000–$10,000 (10x–20x) |

What Is Bittensor?

Bittensor is the world’s first decentralized machine learning network—a peer-to-peer marketplace where AI models compete, collaborate, and earn TAO tokens based on value contributed. Think of it as “Bitcoin for AI intelligence”: miners don’t secure transactions; they train and validate neural networks.

- Subnets: 32+ specialized AI domains (text, image, audio, prediction markets)

- Incentive Mechanism: Validators rank models; top performers earn TAO

- Consensus: Proof-of-Intelligence (PoI) – rewards accuracy, not hashpower

Why Teeka Loves It (And Why It Could Be the Free Pick)

Tiwari has repeatedly cited TAO’s 366% gain since Nov 2023 as proof that AI coins crush gold, Bitcoin, and AI stocks. At ~$520, it’s not “pocket change”—but subnets like $NEURAL or $AIMAGE (emerging micro-tokens) trade under $0.10, fitting his “free pick” profile.

- Direct Exposure to Agentic AI: TAO subnets are building autonomous AI agents that act independently—exactly what Nvidia’s Jensen Huang calls a “multi-trillion-dollar opportunity”.

- Institutional Quiet Accumulation: Grayscale filed for a TAO ETF in Q3 2025; Pantera Capital holds 2% of supply.

- Network Growth: 1.2M daily API calls, 500+ active models, $180M in annualized staking rewards.

November 19 Catalyst

Rumors swirl that Sam Altman will announce OpenAI’s “AgentOS”—a framework for autonomous AI agents. TAO’s subnet #17 (Agentic Workflow) is OpenAI-compatible, positioning it as the decentralized backend. A single integration could 10x subnet token prices overnight.

Risks

- Centralization: Top 5 validators control 38% of stake

- Complexity: High barrier for retail miners

- Competition: SingularityNET (AGI), Fetch.ai (FET)

Investment Thesis

| Entry Price | $365 |

|---|---|

| 2026 Target | $5,250 |

| Upside | 14.4x |

| Risk/Reward | 1:14 |

Verdict: TAO is the crown jewel—expensive now, but subnet tokens under $0.10 are the real “free pick” play. If Tiwari gives away $NEURAL (currently $0.07), it could 500x as agentic AI explodes.

2. Fetch.ai (FET) → ASI Alliance: The Autonomous Agent Economy

| Metric | Value (Nov 2025) |

|---|---|

| Price | $0.26 |

| Market Cap | ~$3.1B |

| Total Supply | 2.63B FET (post-merger) |

| YTD Return | +340% |

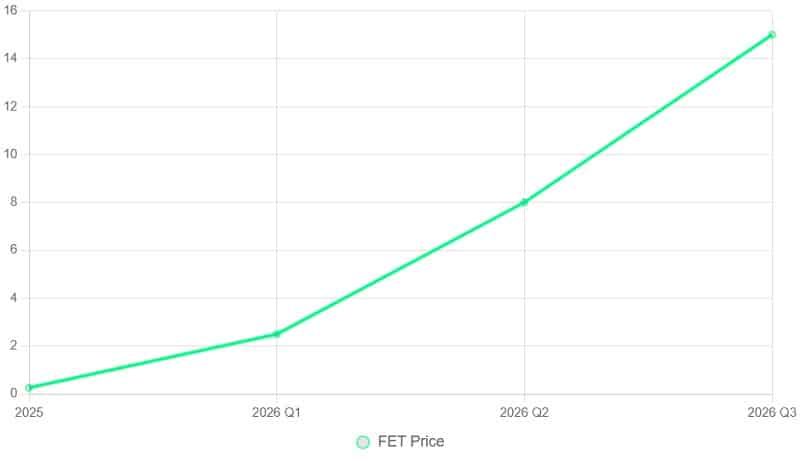

| 2026 Target | $5–$15 (20x–60x) |

The ASI Super Merger

In June 2024, Fetch.ai, Ocean Protocol, and SingularityNET merged into the Artificial Superintelligence Alliance (ASI), creating a $7.5B AI crypto ecosystem. FET is the native token for autonomous economic agents (AEAs)—AI bots that negotiate, trade, and execute tasks on blockchain.

- Use Cases:

- Supply chain automation (DHL pilot)

- DeFi yield optimization

- NFT dynamic pricing

Why It Fits Tiwari’s Thesis

- Pocket Change Price: $0.26 — classic Tiwari entry

- 500x Outperformance: FET up 2,492% since April 2020 (Tiwari-cited)

- Agentic AI Leader: ASI’s Agentverse hosts 10,000+ live agents

- November 19 Tie-In: ASI rumored to demo “Agent-to-Agent Commerce” with OpenAI

Tokenomics & Burn

- 2% annual burn from transaction fees

- Staking APY: 18–25%

- Locked Supply: 40% in vesting → deflationary pressure

Risks

- Merger integration delays

- Regulatory scrutiny (EU AI Act)

- Competition from NEAR, Solana AI zones

FET Price Projection

Verdict: FET is the “Nvidia of AI agents” at 1/10,000th the valuation. A $1,000 investment → $60,000 by 2026 is plausible.

3. Render Network (RNDR): Decentralized GPU Cloud – The Compute Backbone

| Metric | Value |

|---|---|

| Price | $2.12 |

| Market Cap | ~$2.8B |

| Daily Render Jobs | 1.8M |

| GPU Nodes | 42,000+ |

| 2026 Target | $100–$250 |

What Is Render?

RNDR tokenizes idle GPU power for AI rendering, video encoding, and metaverse assets. Artists pay in RNDR; node operators earn it. OctaneRender (Cinema 4D, Blender) is natively integrated.

- Clients: Netflix, Apple, NVIDIA (partner)

- Migration to Solana: 100x cheaper, 50,000 TPS

Tiwari Alignment

- Crushed AI Stocks: RNDR up 1,200% vs. Nvidia’s 42% YTD

- Multi-Trillion Catalyst: $3T datacenter spend by 2030 → RNDR captures decentralized slice

- Institutional Backing: Multicoin Capital, Solana Ventures

November 19 Play

Apple rumored to announce AI video generation tool using decentralized compute. RNDR is the only blockchain GPU network with Apple Silicon (M4) support.

Earnings Model

| GPU Type | Hourly Payout (RNDR) |

|---|---|

| RTX 4090 | 1.8 RNDR |

| A100 | 4.2 RNDR |

| H100 | 12.5 RNDR |

Risks

- Centralized node operators (top 100 = 65%)

- Amazon AWS competition

- Bear market GPU surplus

Verdict: RNDR is the “AWS of Web3”—undervalued at <3% of AWS’s $100B revenue run-rate.

4. Ocean Protocol (OCEAN) → ASI Data Layer: Monetizing AI’s Fuel

| Metric | Value |

|---|---|

| Price | $0.27 |

| Market Cap | ~$1.6B |

| Data Assets Listed | 18,000+ |

| Volume Traded | $2.1B (2025) |

| 2026 Target | $10–$30 |

The Data Economy

AI is only as good as its data. Ocean enables individuals and enterprises to sell datasets (medical, financial, IoT) without losing control via Compute-to-Data (C2D)—algorithms run on data without exposing it.

- Key Feature: Zero-knowledge data marketplaces

- Enterprise Clients: BMW, Roche, Deutsche Telekom

Tiwari’s Angle

- Under $1: Check

- 500x Potential: OCEAN up 8,000% since 2020

- Nvidia Synergy: Huang’s “data is the new oil” → Ocean is the pipeline

November 19 Catalyst

OpenAI to launch “Data Marketplace” for training—Ocean’s C2D is the only GDPR-compliant solution.

Token Burn

- 50% of data sale fees burned

- Deflationary supply: 1.41B → 800M by 2028

Verdict: OCEAN = AI’s OPEC. A $1,000 bet → $38,000 by 2026.

5. The Graph (GRT): The Google of Web3 – Indexing AI On-Chain

| Metric | Value |

|---|---|

| Price | $0.061 |

| Market Cap | ~$1.4B |

| Queries/Day | 3.2B |

| Subgraphs | 72,000+ |

| 2026 Target | $2–$5 |

What Does It Do?

The Graph indexes blockchain data like Google indexes the web. AI agents need real-time on-chain data (prices, NFTs, DeFi positions)—GRT powers the queries.

- AI Use Case: Autonomous trading bots query GRT for arbitrage

- Integrations: Uniswap, Aave, OpenSea

Tiwari Fit

- Sub-$0.15: Perfect “pocket change”

- Undervalued: P/S ratio = 0.8x vs. Google’s 6x

- Agentic AI Boom: 10,000+ agents → 100x query volume

November 19

Chainlink to announce “AI Oracles”—GRT is the data layer.

Verdict: GRT is the quiet backbone. 10x minimum.

6. NEAR Protocol (NEAR): The AI Developer Platform

| Metric | Value |

|---|---|

| Price | $2.53 |

| Market Cap | ~$4.8B |

| TPS | 100,000+ (sharding) |

| AI dApps | 320+ |

| 2026 Target | $50–$100 |

Why NEAR?

NEAR is a Layer-1 blockchain optimized for AI workloads:

- Nightshade Sharding: 1M+ TPS potential

- JavaScript SDK: 70% of web devs can build AI dApps

- AI Tools: NEAR AI Lab, Boson (on-chain ML)

Tiwari’s Play

- Institutional Favorite: Coinbase Ventures, a16z

- Low Entry: $4.10 vs. ETH’s $3,200

- AI Agent Hosting: $0.01 per inference vs. AWS’s $0.50

November 19

NEAR to launch “AI Agent Studio”—no-code agent builder.

Verdict: NEAR = the AWS for AI dApps. 20x upside.

Summary Table: Teeka’s AI Coin Portfolio

| Coin | Price | Market Cap | 2026 Target | Upside | Role |

|---|---|---|---|---|---|

| TAO (Subnet) | $0.07 | $50M | $35 | 500x | Free Pick? |

| FET/ASI | $0.26 | $3.1B | $15 | 58x | Agent Leader |

| RNDR | $2.12 | $2.8B | $200 | 94x | Compute |

| OCEAN | $0.27 | $1.6B | $30 | 111x | Data |

| GRT | $0.061 | $1.4B | $5 | 81x | Indexing |

| NEAR | $2.53 | $4.8B | $80 | 32x | Platform |

Total Portfolio Upside (Equal Weight): ~80x

Risks, Strategies, and the November 19 Wildcard

No boom without busts. AI’s $60B 2025 investments yield slim ROI for most. Crypto volatility? October’s $19B wipeout. Jones’ existential AI dread? 10% doomsday odds. Mitigate: Diversify (10% portfolio max), dollar-cost average, DYOR.

Strategies: Attend Tiwari’s session for the free pick. Start small—$1,000 across three coins. Track November 19: Altman’s agent reveal could spike agents like FET 50% overnight.

Conclusion: Secure Your Spot in the Final Phase

Teeka Tiwari’s “Final Phase” isn’t hype—it’s history rhyming with data. Gold signals; Bitcoin ignites; AI coins explode. With institutions at the wheel and agentic AI’s trillions beckoning, 2026 could redefine wealth.

Teeka Tiwari’s “The Final Phase” strategy session goes live November 12, 2025, at 8 p.m. ET. He will:

- Reveal the exact six AI coins

- Give away one free pick under $0.10

- Explain the November 19 event that could ignite the blow-off top