The next time you see one of your small-town banks replaced by a big bank like Truist or Chase, know that someone just became a millionaire. That’s because someone knew to buy stock in that bank before they made such a big move…and that someone could be you. Tim Melvin has a list of 5 more banks on the verge of acquisition and there’s still time for you to stake their claim before these moves produce massive profits.

— RECOMMENDED —

The Man Who Nailed the 2022 Crash Issues a NEW Prediction

The Man Who Nailed the 2022 Crash Issues a NEW Prediction

Get out of cash and back into the market. But it’s important you do this in a very particular way – which has nothing to do with buying stocks, bonds, cryptos, or any conventional investment. Ignore us, if you’d like… But this prediction comes from the man who called the 2022 crash a day before it began.

Tim Melvin Bank Consolidation – What Is All About?

Every year, an average of 117 banks are acquired in the United States.

In the 1980s… over 18,000 banks existed here.

Today?

4,700.

And that number will likely keep shrinking, on average, for the next 37 years.

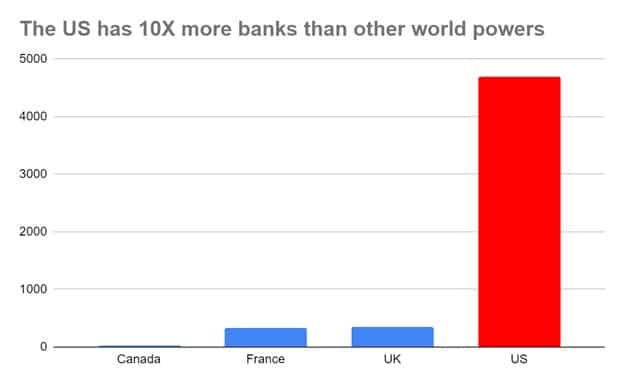

The US currently has 10X more banks than other major countries.

Canada only has 35 banks…

France 337…

UK 344…

With over 4,700 banks… we’re still due for massive consolidation.

At the pace of 117 consolidations per year…

We still have another 37 years to go before we get down to prudent numbers in the 300-500 range.

And that pace could move even faster.

Because we’re in the middle of the biggest consolidation of an industry in history.

Meaning… more and more banks will be acquired in the next year.

Tim Melvin identified (with a 98.6% win rate) which banks will be acquired next.

And he’s releasing 5 of those bank stock tickers to the public right now.

Listen, 32% of Tim Melvin’s bank takeover recommendations have posted 100%+ gains.

Meaning, historically, out of these 5 stocks, 2 of these banks could end up doubling your money.

— RECOMMENDED —

Wealth has evaporated. Companies are announcing salary freezes and unpaid furloughs. The price of everything keeps climbing while the values of our most precious assets, like our homes and investment accounts, are depreciating. There’s a strange reason why, but Wall Street won’t tell you about it.

Click here to get the full story.

How To Invest into Tim Melvin’s Bank Takeover top 5 stocks?

So far, Tim Melvin have recommended 65 bank takeovers…

64 were profitable.

And now it’s your turn to profit.

Today, you’ll get access to Tim Melvin’s top 5 banks set to be acquired.

They check all of Tim’s criteria and trade at a steep discount.

They aren’t huge either…

And you would likely never notice them ever.

- One of them has just 6 branch locations spread across Michigan.

- Another has just 2 branches in Massachusetts.

- A third also just has 2 locations sprinkled in Illinois.

All of these bank stocks are now available to you.

But you can only access them in one place.

You can get access to Tim Melvin’s 5 bank takeover targets in his brand-new product, Bank Takeover Letter.

Tim Melvin’s goal with this service is straightforward: Buy stock in banks with the potential to be acquired for 100%+ gains. That’s how you’ll average 50% gains per year.

Bank Takeover Letter Review – What Is It?

The consolidation in the banking industry over the past four decades has created a special class of investors, the Bank Stock Activist. These individuals buy a significant stake in target banks and try to pressure management into selling the bank to unlock the value of the shares for outside investors.

Tim Melvin personally keep track of who the activists are and which banks they are targeting. A known activist working to force a deal can often bring us faster profit. With Bank Takeover Letter Tim Melvin rides the coattails of these activists and pick up the big returns. It’s not a hard strategy, but it’s one that requires a lot of research, deep understanding of banks, and patience.

Buying underperforming banks that are financially strong below book value making them ripe takeover targets and then letting the ongoing consolidation trend work to attract a buyer and selling into a takeover offer is a simple idea.

The profits generated by this strategy should be taken seriously because they can be enormous.

What’s the goal of the Bank Takeover Letter?

To buy bank stocks that are takeover targets. The timeframe could be 12 months or a few years. There’s no telling as the banking industry moves slowly.

Tim Melvin have made 65 recommendations over the past decade… 64 were profitable.

32% went for 100%+ gains. Meaning, every three picks doubled your money.

That’s the goal of the Bank Takeover Letter.

— RECOMMENDED —

Amid today’s market turmoil, THIS is one of the biggest and most bullish opportunities today: a red-hot sector with almost unlimited pricing power and a history of outperforming in recessions. It’s also the sector where our good friend Dr. David Eifrig spent half his professional life – meaning he’s extremely qualified to spot world-class opportunities today.

Take a look at the evidence here.

Who Is Tim Melvin?

Tim Melvin is a 30 year plus veteran of financial markets. He is also the editor of Underground Income, The 20% Letter, Bank Takeover Letter, and 2023 Turn-Around Project – a special situations investing research project for the coming market rebound.

For Underground Income Tim uses rigorous quantitative analysis based on the principles used in deep value and private equity styles of investing to help investors compound their wealth using strategies designed to maximize profits and minimize risk. He uses in-depth research efforts to uncover special situation opportunities that can profit regardless of market direction. He has also developed models for building alternative income portfolio that can help individual investors uses income producing portfolios previously available only to individuals.

The 20% Letter focuses on the growth and income opportunities from REITs and bank stocks. These are two sectors that profit from a rising interest rate environment just like we’re in right now.

And his Bank Takeover Letter brings readers opportunities with banking acquisition targets fueled by “Bank Activist Investors.”

Tim believes that individuals have powerful advantages over institutions but are not taught how to use them. He wants to be the one who help individual investors stop taking entirely too much risk for too little return.

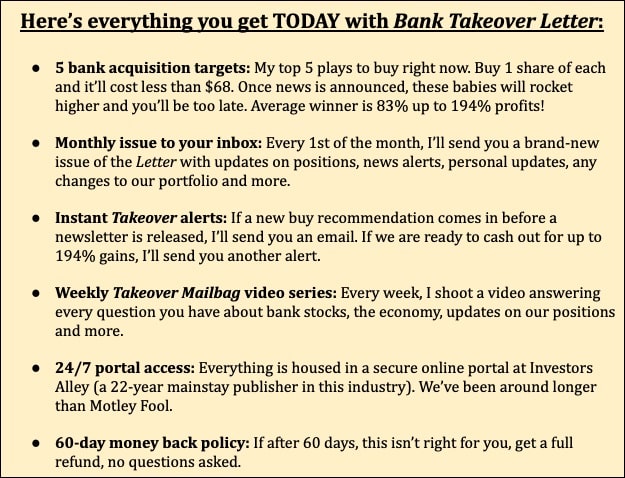

What’s Included With Your Bank Takeover Letter Subscription?

Tim Melvin Bank Takeover Letter Subscription Fee

You can get 1 year of Bank Takeover Letter for $1497.

How much do I need to invest today?

To buy the bank stocks? As little as $68 to get one share of each of these 5 stocks.

To invest in the Bank Takeover Letter? $1497.

Tim Melvin Bank Takeover Letter Refund Policy

For the next 60 days, if at any time you feel Bank Takeover Letter is not for you, Tim Melvin will give you a full refund. No questions asked.

Why join Bank Takeover Letter today?

You’ll get Tim Melvin’s 5 top banks about to be acquired. There are only 500 spots. This bank consolidation trend is proven and is “accelerating” according to the Cleveland Federal Reserve. Not to mention, Tim has a 98% success rate recommending bank takeovers.

Meaning, all 5 of these banks should be profitable picks. Nothing is guaranteed, of course, but Tim Melvin’s track record is there. No one else can match it.