Is Whitney Tilson’s Quant Investing worth the hype? Find out in this comprehensive The Quant Portfolio review that covers all the pros and cons of this trading program.

The Quant Portfolio – See it today live in action!

The Quant Portfolio – What Is It?

The world premiere The Quant Portfolio, Stansberry Research brand new service was earlier today at the Stansberry Breakthrough event.

Wall Street legend Whitney Tilson (who called the 2008 crisis on 60 Minutes, and has met Presidents Obama, Clinton, and Biden) shared a completely new way of investing in today’s tricky market.

Along with an ugly new prediction 2024, and how this breakthrough will be critical to making the most money.

You don’t want to miss this.

It’s unlike anything Whitney and Stansberry Research team have shared in their 25-year history, and the results are spectacular. It’s already crushed bitcoin’s performance by up to 1,000%.

Click here to access the broadcast (airing now).

Let’s take a closer look at Whitney’s assertions and you can then decide whether his advice is worthwhile.

Whitney Tilson Prediction

When I heard this piece of investing wisdom today, I knew I needed to share it…

It comes from our friend and Stansberry’s Investment Advisory lead editor Whitney Tilson in the brand-new free presentation that we debuted today. He said…

This is what all of the best investors do: find situations in which their downside risk is low, yet the upside is uncapped.

It takes some people who invest in the stock market many years, and painful losses, to learn this lesson… if they aren’t scared out of the market first.

And even if you already understand the value of this lesson, it’s still not an easy plan to execute and then stick to. What Whitney unveiled in his presentation, a breakthrough from Stansberry Research years in the making, offers a simple solution.

But let me back up for a second… What Whitney said probably doesn’t sound as sexy as “buy AI stocks!” or any other popular trend of the moment. But it’s an essential framework to understand if you want to truly make money in the markets over the long run…

What all the best multibillion-dollar hedge funds do?

They don’t try to just get lucky only once, like winning the lottery. They don’t just buy something that “sounds good” but that keeps them up at night because they don’t really understand it. (Well, some might try, but they don’t stay in business long.)

No, that’s not the way to do things, as folks who have been successful in the markets for a long time will tell you…

Put the odds in your favor – over and over again.

Whitney, a former hedge-fund manager himself with decades of Wall Street experience, talked about it during the free presentation that debuted today. We urge you to check it out.

In short, Whitney revealed details about what may be the biggest development in the 25-year history of Stansberry Research. It allows individual investors to put this essential lesson into action, again and again, over the long term, with market-beating results.

This strategy has outperformed the market by up to 10-fold since going live behind the scenes at Stansberry company – even through the 2022 sell-off.

Even during last year’s rally, it crushed the S&P 500 Index, gold, bitcoin, and some of the most popular stocks like Apple, Netflix, Alphabet, and Amazon by a wide margin…

About Stansberry Breakthrough

It might feel like there’s no way for the regular Joes and Janes to get an edge on the fast-moving market these days, especially as rapid developments in technology let Wall Street firms employ ever more powerful algorithmic systems.

Well, the team at Stansberry research has spent years coming up with a solution for the everyday investor to even the playing field…

This breakthrough analyzes nearly 5,000 stocks, simulates 1,000 different portfolios, and computes 161 trillion outcomes. Using filters developed by their editors and analysts dating back two decades, it determines precisely which stocks are most likely to double your money, with limited downside risk, and how much of each to buy.

This is stuff that is simply impossible for most people to do on their own.

Wall Street firms spend millions of dollars to develop similar tools, and you might ordinarily need as much as $2 million to access them. Over the past several years, they’ve invested in creating their version… They’ve tested and fine-tuned it… and the results have been astonishing.

As Whitney said during the free broadcast, which you can watch a replay of here…

There’s simply nothing like this available anywhere else in our industry.

Porter Stansberry also joined the broadcast…

This breakthrough really started with him years ago, though he didn’t know it at the time. It builds on his research into the best “capital efficient” companies that can compound your wealth over time with relatively low risk. As Porter said…

I think the dream of every investor is to figure out why some stocks go up so much and others inevitably don’t, or worse, go down. And how can you tell which one that’s going to be?…

This is one way of studying the market to find the high-quality businesses that are trading at the most attractive prices. From there, your job as an analyst or investor gets a lot easier…

Check out the presentation for yourself right here.

Just for tuning in, you’ll get a pair of free recommendations… more details on what Whitney calls our stock “X-ray”… his newest prediction for 2024… and information on how to access this hedge-fund-quality research – The Quant Portfolio – that’s usually only available to Wall Steet firms’ multimillion-dollar clients.

What Do You Get For Your Money With The Quant Portfolio?

Here’s everything you’ll receive today:

One full year of The Quant Portfolio

You’ll see exactly which stocks to buy now, and exactly how much cash to allocate to each, depending on your portfolio size, for the chance to double your money with the least amount of risk. Chosen and vetted by Stansberry’s Investment Committee – which consists of Whitney Tilson and a handful of their best analysts – the model portfolio is designed to crush the S&P 500, gold, bitcoin, and popular stocks, as their live test has shown. It’s all driven by a system you’d normally need $2 million to access at a hedge fund.

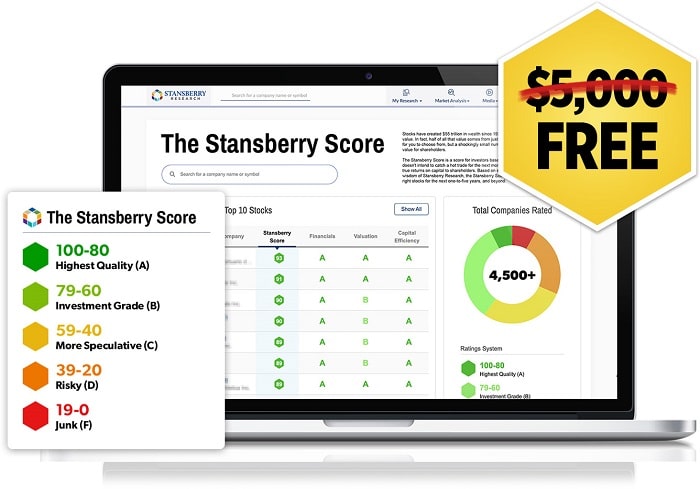

The Stansberry Score system

Where you can type in any of 4,817 different stocks and run your own analysis. With one button, the system shows you which stocks have the highest chance of rising or falling, by posting an up-to-the-minute rating between 0 and 100, including a 4-factor breakdown of exactly how the system evaluates the stock.

The Quant Master Class

A step-by-step guide on how to use the Stansberry Score system to evaluate any of 4,817 different stocks. With one click, you can see the highest-scoring stocks… worst-scoring stocks… the best dividend payers… and more.

Special Report: Top 3 Quant Stocks for 2024

This new report names the top 3 companies going quant to boost their profits… like buying Netflix back in 2007 – when they first went digital – before the stock rose 12,000%.

Special Report: Top 5 Stocks to Avoid in 2024

The Quant Portfolio system warned about 12 stocks that fell over 80%, and two that went bankrupt. This new report names 5 companies that are huge traps right now.

Research Report: Quant Investing: How to Double Your Money By Seeing The Future Outcomes of 4,817 Stocks

Inside, you’ll learn:

- How to allocate your money into a portfolio of stocks chosen by the quant system…

- Why the portfolio updates every month or so to help you potentially double your money or better, with the least amount of risk…

- What goes into the quant system secret algorithm… and more.

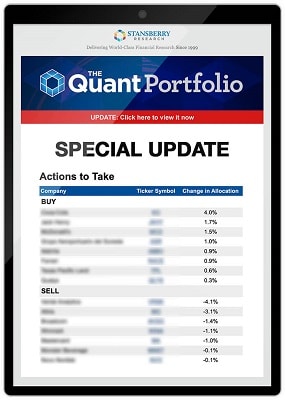

Special Updates

Each month, you’ll receive a new briefing detailing the state of the market and the current positions. The portfolio will periodically shuffle. When it does, you’ll receive an alert on new stocks to buy, which stocks to sell, and when to change your position size.

Whitney Tilson’s warnings and predictions

He nailed the dot-com bottom, recommending Tractor Supply, before it rose 29,973%… AutoZone, before it rose 8,311%… Ross Stores, before it rose 7,968%… Predicted the 2008 housing crisis and the bottom of the market in 2009, both on 60 Minutes… The collapse of Bear Stearns and Lehman Brothers… Exposed a fraud at Lumber Liquidators… Called the bubbles in bitcoin (to the day), marijuana (to the hour), 3D printing stocks… the bottom of the Covid crash (to the day)… Warned about the 2022 sell-off… Warned about 12 stocks in 2022 that fell 60% on average… And has booked multiple gains of 100+% in his research, which five different billionaires have subscribed to.

Whitney Tilson’s Private Briefing

It cost $32,000 to attend an exclusive Las Vegas conference where previous guests include 12-term U.S. Congressman Ron Paul, NY Times bestselling author Michael Lewis, and 7-time Tour De France winner Lance Armstrong. Here’s what Whitney recently told this audience of high-net-worth investors about how to manage their money.

The Quant Portfolio Pricing

The Quant Portfolio normally costs $5,000 for one full year.

But If you get in today, you’ll receive 50% OFF, and a suite of bonuses.

That means you can receive one full year of The Quant Portfolio at the special price of $2,500.

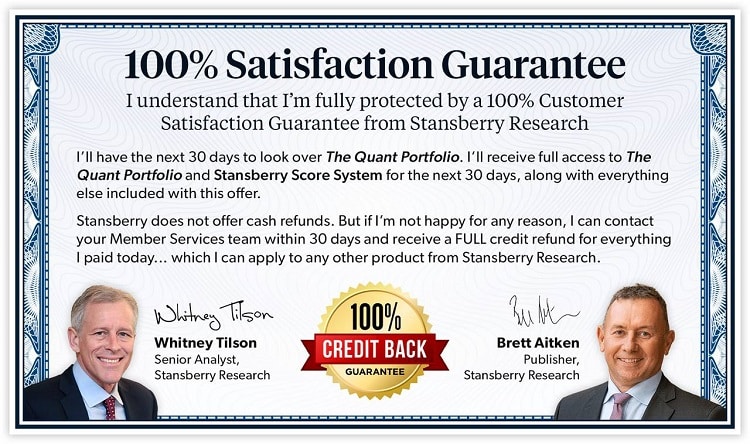

The Quant Portfolio Refund Policy

You’ll have the next 30 days to look over The Quant Portfolio. You’ll receive full access to The Quant Portfolio and Stansberry Score System for the next 30 days, along with everything else included with this offer.

Stansberry does not offer cash refunds. But if you’re not happy for any reason, you can contact their Member Services team within 30 days and receive a FULL credit refund for everything you paid, which you can apply to any other product from Stansberry Research.