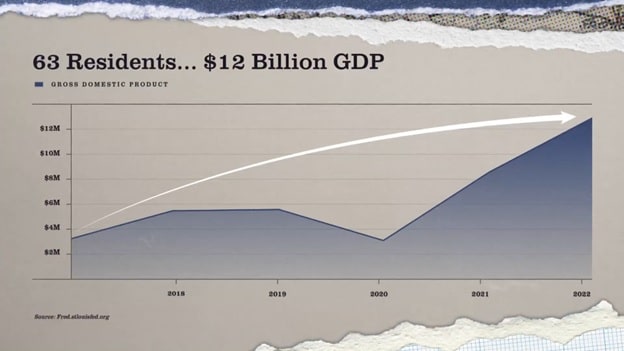

Nestled in the vast expanse of West Texas lies Loving County, a place often dubbed “the loneliest spot on Earth.” With a population of just 63 residents, crumbling buildings, and no hospitals or schools, it appears to be another forgotten relic of America’s past. Yet beneath its desolate surface lies one of the most lucrative financial secrets in U.S. history—a story of mineral rights, perpetual royalties, and a corporation that has quietly generated staggering wealth for over a century.

This is the tale of the Texas Pacific Land Corporation (TPL) by Porter Stansberry, who leads a financial research firm, Porter & Co that provides exclusive investment research through its newsletter, The Big Secret on Wall Street.

The Birth of a Financial Juggernaut

The origins of TPL trace back to 1888, when the Texas and Pacific Railway Company went bankrupt. The failed railroad left behind 3.5 million acres of land in West Texas, which were placed into a trust to repay bondholders. At the time, the arid landscape was deemed worthless—valued at roughly $5 per acre—and the trustees faced a near-impossible task: selling land nobody wanted.

Their solution was patience. Over decades, the trust sold parcels near growing towns while retaining most of its holdings. The turning point came in 1923, when oil was discovered in the Permian Basin, a geological formation spanning West Texas and southeastern New Mexico. Suddenly, the trust’s land became a goldmine. Today, the Permian Basin produces 25% of America’s oil, with Loving County sitting atop the Delaware Basin, its most prolific sub-region.

TPL, which evolved from the original trust, owns approximately 900,000 acres in the Permian, including surface and mineral rights. This means it earns royalties not just on oil and gas extracted from its land, but also on infrastructure, water usage, and even renewable energy projects.

A Business Model Built on Autopilot

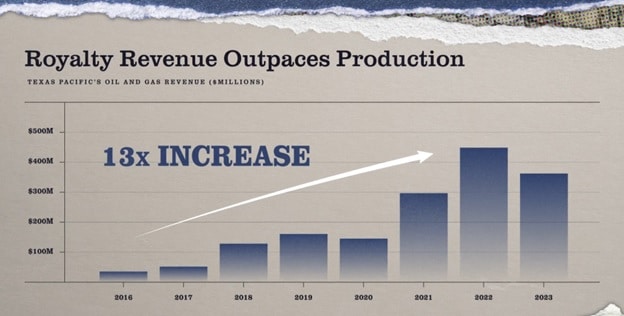

Unlike traditional energy companies, TPL does not drill, refine, or transport resources. Instead, it operates as a passive royalty collector. Drillers lease its land, pay upfront fees, and commit to perpetual royalties on every barrel of oil, cubic foot of gas, or gallon of water used. TPL’s expenses are minimal—no rigs, engineers, or debt—and its gross margins hover around 90%.

The numbers speak for themselves:

- Royalties: TPL earns a 6.25% royalty on 28,000 barrels of oil per day (at $70/barrel, this amounts to nearly $2 million daily).

- Water Sales: Fracking requires massive water volumes (72 billion gallons annually in the Permian). TPL’s subsidiary, Texas Pacific Water Resources, sells water and processes wastewater, generating $200 million in annual revenue.

- Infrastructure: Pipelines, solar farms, and power lines crossing TPL’s land require easements, adding millions in fees.

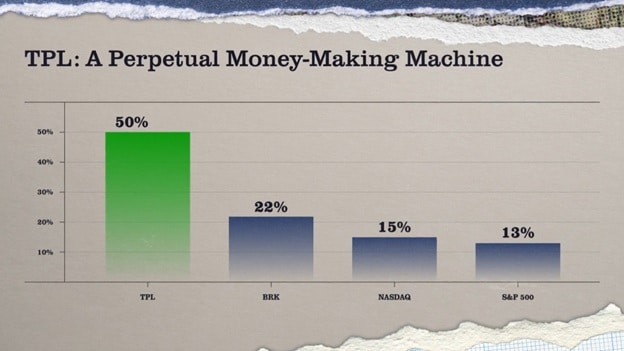

Since transitioning from a trust to a corporation in 2021, TPL has reinvested profits into share buybacks, reducing outstanding shares by 66% since 1980. This strategy has fueled annualized returns of nearly 50% for shareholders over the past decade.

The Permian Basin: America’s Energy Engine

The Permian Basin is central to U.S. energy dominance. Production here has surged from 1 million barrels per day in 2010 to 6 million today, offsetting declines in other shale regions like the Bakken and Eagle Ford. The basin’s “layer cake” geology—stacked hydrocarbon-bearing zones—ensures decades of untapped reserves.

TPL’s land sits at the heart of this boom. Its acreage includes not just oil-rich zones but also critical infrastructure corridors. As Permian output grows, so do TPL’s royalties. Even during oil price crashes, its diversified revenue streams—particularly water—provide resilience. In 2023, while oil royalties dipped 20%, water sales limited overall revenue decline to just 5%.

Political Winds and Energy Futures

Energy policy shifts under the Trump administration have further bolstered TPL’s prospects. The 2024 election, positioning Trump as the 47th president, signals potential deregulation, expanded LNG exports, and accelerated infrastructure permits. TPL stands to benefit from:

- LNG Expansion: Plans to replace Russian gas in Europe could increase U.S. exports by 40%, driving demand for Permian gas.

- Infrastructure Growth: Pipelines and power lines crossing TPL’s land generate recurring easement fees.

- Water Demand: Fracking’s reliance on water ensures steady cash flow regardless of oil prices.

Beyond TPL: The Rise of Royalty Companies

TPL is not alone in capitalizing on passive income models. Two other entities exemplify this trend:

- Permian Royalty Collectors: One company owns mineral rights on 9,000 wells, earning royalties on 31,000 daily barrels without employees or debt. Recent acquisitions in the Midland and Delaware Basins have driven 70% stock surges.

- LNG-Focused Landowners: A second firm holds 20 million acres in gas-rich regions like the Haynesville Basin. With Europe aiming to cut Russian gas by 2030, its royalties could skyrocket as U.S. LNG exports expand.

These companies mirror TPL’s strengths: zero operational risk, high margins, and exposure to global energy trends.

Sustainability and Scrutiny

While TPL’s model is lucrative, it raises questions. Environmental concerns over fracking’s water usage and emissions persist, though TPL mitigates risks by monetizing water recycling. Additionally, its “hidden” status—no Wall Street coverage, minimal public disclosure—invites skepticism. Critics argue that the lack of transparency could mask vulnerabilities, such as over-reliance on fossil fuels amid the energy transition.

Yet TPL’s recent moves suggest adaptability. Investments in water infrastructure and renewable energy easements position it to profit from multiple energy futures. As CEO Tyler Glover noted, “We get paid whether it’s oil, gas, wind, or solar.”

Introduction to The Big Secret on Wall Street

The Big Secret on Wall Street is a premium investment research service offered by Porter & Company. Designed to help investors uncover hidden opportunities, the service provides exclusive insights, special reports, and portfolio recommendations.

It’s especially valuable for those interested in oil and gas royalties, energy markets, and high-potential sectors like gold and natural resources.

Special Reports

As part of the membership, subscribers gain access to four in-depth special reports, each focusing on lucrative investment opportunities:

- The 100-Year Old Money Machine: Focuses on a company benefiting from oil and gas royalties across 20 million acres of land.

- Cold War 2.0: Details opportunities tied to the global energy crisis and natural gas exports.

- Energy Royalties: Highlights a company with interests in the Permian Basin and daily oil production.

- The Ultimate Gold Stock: Uncovers a company profiting from royalties on gold mining ventures.

These reports provide critical information on how to profit from sectors with strong growth potential, including the Permian Basin and natural gas.

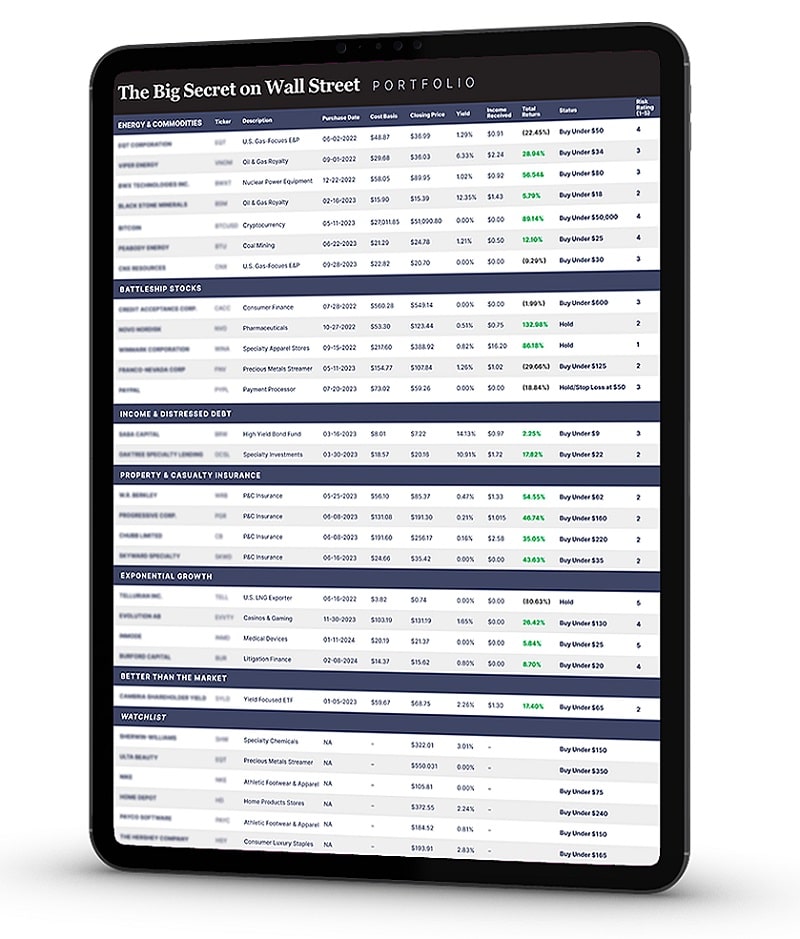

Model Portfolio and Investment Ideas

Members receive access to a model portfolio containing over two dozen investment ideas. These recommendations are supported by in-depth company analysis, ongoing research, and buy-up-to price targets. The portfolio serves as a guide to high-return investments, particularly within the energy and resources sectors.

Additional Member Benefits

Beyond special reports and portfolio recommendations, members also enjoy:

- Porter’s Daily Journal: Unfiltered insights into business, finance, and life, delivered three times a week.

- Annual Conference Recordings: Digital access to presentations from the Porter & Co. annual conference, valued at $2,500.

- Spotlight Series: Exclusive interviews and research from leading financial thinkers and analysts.

- The Permanent Portfolio: A diversified portfolio model designed for long-term wealth preservation, balanced across stocks, gold/Bitcoin, cash, and insurance.

Money-Back Guarantee

The service comes with a “Triple-Promise” money-back guarantee, ensuring that members are satisfied with their subscription. If the service doesn’t meet expectations, a full refund is available within 30 days, minus a small cancellation fee.

Final Words

In conclusion, The Big Secret on Wall Street offers an exclusive and compelling opportunity for investors looking to tap into some of the most lucrative, hidden financial strategies available today.

Through its in-depth research and carefully curated stock recommendations, including the remarkable story of Texas Pacific Land Corporation (TPL) and its royalty-based business model, the service equips investors with the tools to capitalize on growth sectors such as energy, natural resources, and even gold.

The combination of TPL’s passive income from mineral rights, water sales, and infrastructure easements makes it a standout in today’s market, especially in light of the ongoing energy demands and political shifts under the Trump administration.