Discover how to get in Teeka’s first-ever pre-IPO tech recommendation BEFORE it goes public. Already, three legendary VCs have bought shares and you can get yours for just $0.50 a piece.

The Blueprint for Choosing the Right IPO

By Teeka Tiwari, editor, Palm Beach Daily

Everyone knows the IPO market is on fire… What they don’t know is they’re about to be skinned alive.

But first, let me step back and tell you what an IPO is.

An IPO is an initial public offering. That’s when a company lists shares on a public market like the New York Stock Exchange.

And last January, I predicted we’d see a megawave of IPOs in 2020. I said it’d be even bigger than the number of companies that went public during the 1990s dot-com boom.

And according to the latest data, we saw a record 552 new IPOs last year – just as I had predicted. Of course, the mainstream media is officially on the bandwagon now. They’re calling this IPO boom:

- A “frenzy” – that’s from Bloomberg.

- A “bonanza” – that’s from The Economist.

- And here’s Reuters – a “stampede.”

Now, you’re not going to want to hear this. But you’re being fattened-up for the kill.

All these headlines you see day after day – they’re leading you down what I call the “Hype Hole.”

The Hype Hole is the wrong path for entering the IPO market. This path could see you working 20 years longer before you hit your “Freedom Number.”

That’s the amount of wealth you need to achieve to live the life you want… and the wrong IPOs can push your dreams out for decades.

Fortunately, there’s another path to the IPO market… What I call the “Blueprint” path. The smartest moneymakers on the planet use the Blueprint path to buy their IPOs.

And when you use this path, the results can be life-changing. The Blueprint path has the potential to get you to your Freedom Number in 2021.

Today, I’m going to show you how the Hype Hole path can wreck your retirement plans… while the Blueprint path could potentially change your life this year.

Don’t Get Eaten Alive

If you want to move the needle on your net worth, you need to know the difference between a Hype Hole IPO and a Blueprint IPO…

The Hype Hole path is when you buy a private company on the day it goes public – or IPO day.

The Blueprint path is when you buy a private company before it goes public – sometimes called a pre-IPO deal.

The Hype Hole path is the one most retail investors are sucked into. The Blueprint path is the one Wall Street elites and well-connected Silicon Valley insiders use to make their fortunes.

Choosing the right IPO path can mean the difference between total financial freedom and staying a wage slave for another 20 years.

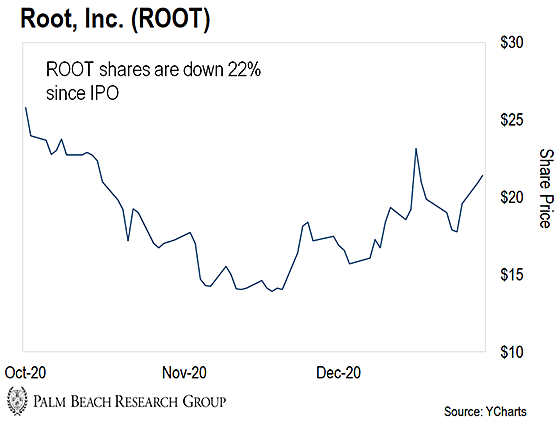

Take tech stock Root, for example.

When Root went public last year, the media had retail investors falling down the Hype Hole. They said Root was “disruptive.” They said its IPO was “exceeding all expectations.”

You know what this was… this was retail investors being fattened-up for the kill.

After all the hype died down, Root’s shares collapsed, and IPO-day investors lost 24%.

Now, what about the second path – the Blueprint path?

Get this… pre-IPO investors on the Blueprint path saw a 7,141% gain in Root.

One stock. Two paths. Two completely different outcomes.

The Hype Hole path sets you up for a 24% loss. No profit. The Blueprint path sets you up for a 7,141% gain.

The difference here is worlds apart. Again, it’s the difference between potentially reaching your Freedom Number this year… or never reaching it at all.

But even when Hype Hole IPOs deliver gains for mom-and-pop investors… they’re just table scraps Wall Street throws at you to make you feel like you’re a winner.

We saw this last year in the biotech sector. Companies like Forma Therapeutics, Black Diamond Therapeutics, and Inari Medical returned 95%, 108%, and 124%, respectively, on IPO day.

But if you had bought those biotech firms when they were still private… your gains would’ve been 3,356%, 4,652%, and 4,342% respectively.

That’s the difference between buying at the Hype Hole IPO price (retail) and the Blueprint pre-IPO price (wholesale).

Showing You the Blueprint

Friends, Blueprint IPO investors are making vast fortunes. Meanwhile, uninformed Hype Hole IPO investors are getting peanuts – if they’re lucky.

I want to change that…

That’s why last night, I held my first big event of the year, Freedom 2021.

More than 30,000 people attended this free event, and I gave the exact training you need to instantly tell the difference between Hype Hole and Blueprint IPOs.

Not only that… I also shared details about my first ever pre-IPO tech deal…

Shares in this Blueprint IPO are priced at just 50 cents each. So with a $500 grubstake, you’d own 1,000 shares.

But here’s what has me really excited…

I’ve just gotten word the Blueprint IPO I shared is attracting serious interest from a handful of elite VCs… So this is your chance to potentially invest alongside insiders.

Now, if you missed last night’s event, don’t worry. For a limited time, you can catch a replay of my presentation right here… but you need to act fast.

Federal law limits the number of people that can participate in this Blueprint IPO opportunity… so once it’s full, that’s it.