In a market where inflation silently devours savings and Wall Street’s old rules no longer apply, one breakthrough system is quietly handing everyday investors the power to double their money—again and again—before the masses even notice.

The Ultimate Stock Strategy That Could Double Your Money by Christmas

Imagine waking up one morning to check your brokerage account and discovering that your portfolio has just doubled overnight. Not once, but potentially every six trading days, thanks to a revolutionary stock-picking system that’s turning heads on Wall Street and Main Street alike. This isn’t some pie-in-the-sky fantasy—it’s the reality promised by the Swan Brothers MegaTrends service, now fused with investing legend Louis Navellier’s unbeatable quantitative prowess in their brand-new Ultimate Stock Strategy Portfolio.

As of today, October 29, 2025—just one day after their explosive October 28 webinar—this powerhouse collaboration is offering an unprecedented 50% off launch deal on MegaTrends, dropping the price to just $1,997 while stacking on over $12,000 in free bonuses. If you’re still sitting on the sidelines while inflation eats away at your savings and the market swings wildly, this could be the wake-up call you need to take control of your financial future.

In this comprehensive Swan Brothers MegaTrends review, we pull back the curtain on everything you need to know about this game-changing service. We’ll dive deep into the rags-to-riches backstory of brothers Andy and Landon Swan, who transformed childhood racetrack bets into a multimillion-dollar fintech empire. We’ll unpack their proprietary Social Heat Score, a real-time consumer sentiment engine that’s spotted monsters like 556% gains in Robinhood (HOOD) and 461% in Oklo (OKLO). Then, we’ll spotlight Louis Navellier, the “King of Quants” whose Stock Grader has nailed 676 stocks that doubled—including early calls on Apple, Amazon, Netflix, and Nvidia.

But the real magic? Their Ultimate Stock Strategy, which backtested to deliver over 240 doubles with an average 244% gain over five years, rain or shine. And yes, we’ll reveal the free webinar picks—Kinross Gold (KGC) and Uber (UBER) as buys, Ulta Beauty (ULTA) to avoid—plus why at least one stock in their new model portfolio could double by Christmas.

This isn’t just another newsletter pitch. In a world where Washington’s debt binge and a weakening dollar are distorting everything, Swan Brothers MegaTrends arms you with hedge-fund-level insights at a fraction of the cost. With weekly alerts, instant stock grading, and email trade notifications, you’ll never miss a beat.

Backed by a 100% satisfaction guarantee, this limited-time offer—tied to a massive market shift looming on November 4—won’t last. If you’re ready to turn defense into offense and build life-changing wealth, read on. Your portfolio’s ultimate upgrade starts here.

Who Are the Swan Brothers? From Racetrack Kids to Fintech Visionaries

The story of Andy and Landon Swan begins not in a Wall Street boardroom, but under the Kentucky sun at Ellis Park Racetrack in Henderson, Kentucky—one of America’s oldest thoroughbred racing venues.

It’s 1989, and a family snapshot freezes a moment in time: nine-year-old Landon Swan stands in the middle, pumping his fist with a triumphant “We’re No. 1!” sign for the camera. To his left towers his taller older brother, Andy Swan, both boys beaming with the kind of joy only childhood adventure can bring. Behind them, Mom smiles warmly, Dad stands tall in a striped yellow sports shirt, and center stage is Grandpa Rock—hat, suspenders, pocket protector—the proud racehorse owner who made it all possible.

Growing up in Evansville, Indiana, just a 30-minute drive from the track, the Swan brothers led a typical Midwestern life—except for those magical racetrack outings. Every visit, their parents handed each boy $2 to bet, but with a strict condition: the money had to go on Grandpa Rock’s horse. The choice, however, was theirs—win, place, or show—a simple decision that planted the seeds of risk versus reward in their young minds.

For Landon, then just nine years old, those bets sparked a lifelong obsession with statistics, probabilities, forecasting, and handicapping. “It ignited everything,” Landon later reflected. “It was the inspiration for the consumer insights engine that Andy and I went on to create.” Andy felt the same pull—the thrill of crunching numbers to beat the odds, the rush of seeing a calculated risk pay off. These early lessons weren’t just games; they were the foundation of a future empire.

Fast-forward to college at Bellarmine University in Louisville, Kentucky. The inseparable brothers shared a dorm room, where nights were spent trading penny stocks instead of cramming for exams. While most students partied or studied, Andy and Landon were glued to screens, analyzing charts and chasing gains. Andy briefly veered toward law school at Boston University, but the pull of the markets was too strong. He dropped out to join Landon in launching their first fintech venture—a video streaming service tailored for traders.

Success bred ambition. They followed with two more startups, including an online financial services platform that birthed their eureka moment: an exclusive Twitter feed for investors. Scouring millions of social media posts, they noticed something profound—everyday people were buzzing about brands they loved, hated, or planned to buy—before sales data ever hit Wall Street. Consumer chatter predicted purchases. This revelation became the cornerstone of LikeFolio, founded in 2013—a consumer insights engine so powerful that Georgetown University endorsed it for its predictive accuracy.

Partnering with TradeSmith, the Swans democratized their technology, bringing Main Street momentum to retail investors through MegaTrends.

Today, LikeFolio processes 1,230,030 items daily from Reddit alone—nearly 30 million data points monthly across X, Reddit, YouTube, Google, web traffic, app usage, search trends, and AI queries. Every mention, every search, every post is tied back to publicly traded stocks, distilled into a crystal-clear Social Heat Score (0-100): higher scores signal surging brand enthusiasm ripe for explosive gains.

What Is the Social Heat Score? The X-Ray into Consumer Behavior

Forget lagging earnings reports and analyst guesses. The Social Heat Score gives investors an X-ray view into consumer wallets—long before Wall Street catches on. This isn’t sentiment analysis; it’s real-time behavioral forecasting powered by billions of data points.

Every day, LikeFolio captures millions of consumer interactions across the internet:

- Social media posts on X, Reddit, YouTube, and Google

- Company-level web traffic trends and app usage

- Search trends and AI-powered queries

From Reddit alone, the system processes 1.23 million items per day. That’s nearly 30 million data points a month—just from one source. Every time a consumer talks about a product, searches for it, or engages with a brand online, LikeFolio captures it in real time. That data is then mapped to publicly traded companies and distilled into a simple 0 to 100 Social Heat Score.

The higher the score, the stronger the consumer momentum. It’s not just about volume—it’s about intent, happiness, and macro alignment. The system looks for three key factors:

- Strong consumer demand—are people talking about buying?

- High consumer happiness—are they recommending it to friends?

- Macro trend tailwinds—is the brand riding a larger wave like AI, remote work, or sustainability?

When these align, the result is explosive stock performance. Over the past 12 months, Social Heat delivered:

- 92% gain on Magnite (MGNI) as digital advertising surged

- 145% on Stride (LRN) amid the online learning boom

- 461% on Oklo (OKLO), the under-the-radar nuclear energy play

- 556% on Robinhood (HOOD) during the retail trading frenzy

And that’s not cherry-picking. The open positions in the MegaTrends model portfolio currently show an average gain of 83%, with 26 double-your-money wins delivered to subscribers over the past five years. This is Main Street momentum meeting Wall Street execution—and it’s about to get even stronger.

If the Swan brothers represent the new world of data-driven investing, Louis Navellier is the old master—a 45-year Wall Street veteran whose quantitative approach has redefined growth investing. Dubbed the “King of Quants” and an “icon among growth investors” by The New York Times, Louis launched his first investment newsletter in 1980—nearly a decade before that racetrack photo of the Swan boys.

Over his career, Louis has:

- Recommended 676 stocks that doubled your money or more

- Identified 22 stocks that soared over 100-fold

- Managed $1.5 billion in private accounts and $125 million in mutual funds

- Earned #1 rankings from Morningstar and The Wall Street Journal for his ETFs and funds

His secret? Pure quantitative discipline. No emotions. No hunches. Just data, math, and momentum.

Louis was an early pioneer in computerized stock analysis, building models when most analysts still relied on gut instinct. His approach focuses on fundamental strength (earnings, sales, growth) combined with institutional momentum (big money buying). The result? A system that consistently finds the next Apple, Amazon, Netflix, or Nvidia—before the crowd.

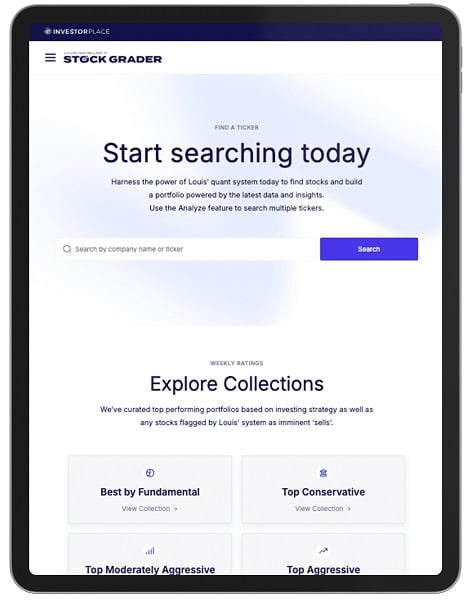

Stock Grader: The A-to-F Report Card for 6,000+ Stocks

At the heart of Louis Navellier’s empire is the Stock Grader—a proprietary system that assigns A, B, C, D, or F grades to over 6,000 publicly traded stocks in seconds. Just type in a ticker, and you get an instant verdict:

- A Grade: Buy now—top-tier fundamentals and momentum

- F Grade: Sell or avoid—serious trouble ahead

The grading is based on eight key factors, including:

- Earnings growth

- Sales growth

- Operating margins

- Institutional buying activity

- Price momentum

The results are staggering. The Stock Grader has identified 676 stocks that doubled, including 22 that went up 100X or more. It’s the same system Louis has used for nearly five decades to deliver monstrous gains to his followers.

And now? You get full access for FREE when you join MegaTrends.

The Ultimate Stock Strategy Portfolio: Where Social Heat Meets Stock Grader

What happens when you combine LikeFolio’s real-time consumer data with Navellier’s quantitative firepower? You get the Ultimate Stock Strategy Portfolio—a brand-new model portfolio that targets the elite 2% of stocks passing both systems.

Here’s how it works:

- Start with Louis’s A-graded stocks—only the strongest fundamentally

- Layer on high Social Heat Scores—only those with surging consumer momentum

- The overlap? Pure alpha

Backtested over five years, this strategy delivered:

- More than 240 double-your-money opportunities

- An average gain of 244%

- One double every six trading days

- Profitable in up, down, and flat markets

This isn’t theory. It’s verified performance. And the brand-new Ultimate Stock Strategy Portfolio—launched yesterday—is already live with hand-picked stocks. The team believes at least one has the potential to double by Christmas.

Free Webinar Picks Revealed: KGC, UBER, and Why to Avoid ULTA

During the October 28 Ultimate Stock Strategy Event, Louis, Andy, and Landon went live for nearly two hours, walking through the system step-by-step. They even gave away three free stock ideas:

- Kinross Gold (KGC) – BUY: A gold miner with strong fundamentals and inflation-hedge appeal

- Uber Technologies (UBER) – BUY: Surging ride-sharing and delivery demand, validated by Social Heat

- Ulta Beauty (ULTA) – AVOID: Low Social Heat + poor Stock Grader = imminent pain

One attendee on StockGumshoe noted: “UBER seemed worthy of a small stake after running it through my own TradeSmith package.” The webinar replay is still available for a limited time—and it’s 100% free.

The Unbeatable Launch Offer: $1,997 for Over $12,000 in Value

Here’s the deal that’s stopping investors in their tracks:

Join MegaTrends TODAY and get:

- 50% OFF one year of MegaTrends ($4,000 → $1,997)

- 1 FREE year of Breakthrough Stocks ($4,000 value) – Louis’s small-cap growth rocket

- 1 FREE year of The Ultimate Stock Strategy Portfolio ($1,000 value) – your 244% gain machine

- 1 FREE year of Social Heat Score ($1,000 value) – type any ticker, get instant momentum

- 1 FREE year of Stock Grader ($1,000 value) – A-F grades on 6,000+ stocks

- BONUS REPORT: 7 Lousy Stocks That Are Doomed to Crash

- BONUS REPORT: The Insiders’ Guide to Our Social Heat Score Strategy

- BONUS REPORT: Breakthrough Stocks Owner’s Manual

- Monthly email updates and trade alerts

That’s over $12,000 in value for just $1,997—and it’s backed by a 100% satisfaction guarantee. Try it risk-free. Cancel anytime and get a full refund (credit redeemable within one year).

But this offer expires forever after launch. Once it’s gone, it’s gone.

Why MegaTrends Is Worth Every Penny (And Then Some)

Let’s be real: $1,997 is not pocket change. But when you consider:

- Hedge funds pay millions for similar data

- Past winners include 556% on HOOD, 461% on OKLO

- You get five premium services for the price of one

- At least one Christmas doubler in the new portfolio

- Full risk-free trial

…it’s not an expense. It’s an investment in your financial future.

How to Claim Your Spot Before the Offer Vanishes

- Go Here To Claim Your MegaTrends Subscription

- Fill out the secure order form

- Get instant access to all tools, reports, and the model portfolio

- Start receiving weekly alerts and email trade notifications

Don’t wait. The November 4 market shift is coming. Inflation is rising. Cash is dying. The time to go on offense is now.

Conclusion: Your Wealth Revolution Starts Today

The Swan Brothers MegaTrends service—now supercharged with Louis Navellier’s Ultimate Stock Strategy—isn’t just another investment newsletter. It’s a financial self-defense system for a world gone mad with debt, inflation, and distortion.

From racetrack bets in 1989 to 244% average gains in 2025, Andy and Landon Swan have built a consumer prediction engine that sees tomorrow’s winners today. Paired with Navellier’s 45-year quant mastery, it’s the closest thing to a crystal ball retail investors will ever get.

Act now. Watch the replay. Claim your 50% off deal. And get ready to double your money—again and again.

Your portfolio deserves the Ultimate Stock Strategy.

FAQ: Swan Brothers MegaTrends & Ultimate Stock Strategy – Your Questions Answered

What exactly is Swan Brothers MegaTrends?

MegaTrends is the flagship research service from Andy and Landon Swan of LikeFolio, powered by their proprietary Social Heat Score system. It identifies high-momentum growth stocks by analyzing real-time consumer behavior across social media, web traffic, search trends, and app usage. The service delivers weekly research, email trade alerts, and access to a model portfolio that has produced 26 double-your-money winners in five years and currently holds open positions with an average gain of 83%.

Who are Andy and Landon Swan?

The Swan brothers are fintech entrepreneurs from Evansville, Indiana. Inspired by childhood racetrack bets with Grandpa Rock, they built LikeFolio in 2013—a consumer-intelligence platform endorsed by Georgetown University. They’ve launched three successful startups, including a trader-focused video streaming service and an exclusive investor Twitter feed, before partnering with TradeSmith to bring Social Heat to retail investors.

What is Stock Grader?

Stock Grader is Louis Navellier’s proprietary system that assigns A–F grades to over 6,000 stocks based on eight fundamental and momentum factors. A grades signal strong buy; F grades warn of imminent declines. It’s the same tool behind 676 doubles and 22 100-baggers.

What is the Ultimate Stock Strategy Portfolio?

This brand-new model portfolio combines Navellier’s A-graded stocks with Swan’s high Social Heat Scores—targeting the top 2% of opportunities. Backtested over five years, it delivered:

- 240+ doubles

- 244% average gain

- One double every six trading days

- Profits in all market conditions

The team believes at least one current holding could double by Christmas.

What were the free picks from the October 28 webinar?

- BUY: Kinross Gold (KGC) – Strong fundamentals + inflation hedge

- BUY: Uber (UBER) – Surging consumer demand via ride-sharing and delivery

- AVOID: Ulta Beauty (ULTA) – Low Social Heat + failing Stock Grader = crash risk

Is the webinar replay still available?

Yes—for a limited time. The two-hour Ultimate Stock Strategy Event is 100% free and includes full system walkthroughs, live Q&A, and the three stock reveals. Watch here.

What’s included in the $1,997 launch offer?

You get 50% OFF MegaTrends plus $12,000+ in FREE bonuses:

- 1 Year Breakthrough Stocks ($4,000 value)

- 1 Year Ultimate Stock Strategy Portfolio ($1,000)

- 1 Year Social Heat Score ($1,000)

- 1 Year Stock Grader ($1,000)

- 3 Bonus Reports: 7 Lousy Stocks, Social Heat Guide, Breakthrough Manual

- Weekly research + email trade alerts

Is there a money-back guarantee?

Yes—100% satisfaction guarantee. Cancel anytime within the year for a full refund (credit redeemable within 12 months of cancellation).

How soon will I get access?

Instantly. Upon completing the secure order form, you’ll receive:

- Login credentials

- All bonus reports

- Full model portfolio

- Tools (Social Heat + Stock Grader)

When does this offer expire?

Permanently—after the launch window closes. The 50% discount and free bonuses will never be repeated. Act before the November 4 market shift for maximum advantage.

Can I use this in any market condition?

Yes. The Ultimate Stock Strategy has been backtested and proven profitable in bull, bear, and sideways markets—thanks to its dual-layer filter of consumer momentum + institutional strength.

Is this suitable for beginners?

Absolutely. The systems are user-friendly:

- Type a ticker → get A–F grade or Heat Score

- Follow email alerts for buys/sells

- No advanced math required

Experienced traders love the edge; beginners love the simplicity.

What if I already own KGC or UBER?

Great! The free picks validate the system. Use Social Heat Score and Stock Grader (included free) to:

- Confirm entry/exit timing

- Monitor momentum

- Scale in/out profitably

I’m still on the fence. Why act now?

Because:

- Offer expires forever

- November 4 market shift could ignite the next leg up

- At least one stock in the new portfolio is poised to double by Christmas

- 100% risk-free trial

Worst case? You get a full credit. Best case? You double your money—multiple times.