Jim Rickards, a renowned economist, lawyer, and financial strategist, has consistently warned of significant shifts in the global economy and their implications for individual freedoms. In his Strategic Intelligence newsletter, Rickards provides a detailed analysis of Executive Order 14067, its ties to Central Bank Digital Currencies (CBDCs), and actionable strategies for safeguarding personal wealth. This article examines the key points of his service, evaluating its value to investors and freedom-conscious individuals.

Introduction to Executive Order 14067

Signed by President Biden, Executive Order 14067 has sparked heated debate. At its heart, the order mandates research into a digital dollar, signaling a monumental shift in the U.S. monetary system.

While proponents argue it’s a step toward modernization, critics like Jim Rickards view it as a direct threat to privacy, individual freedoms, and economic stability.

Section 4: The Controversial Core

A key part of the order, Section 4, prioritizes the development of a U.S. Central Bank Digital Currency (CBDC), or digital dollar.

Rickards has referred to this initiative as the “most treacherous act” in U.S. history, warning that it opens the door to unparalleled government control over individual finances. He believes this could transform the monetary system into a tool of surveillance and coercion.

Understanding the Shift to Digital Currency- What Are CBDCs?

CBDCs, or Central Bank Digital Currencies, are centralized digital currencies issued by governments or central banks. Unlike decentralized cryptocurrencies such as Bitcoin, which prioritize privacy and autonomy, CBDCs are programmable, giving governments the ability to impose restrictions on their use.

CBDCs vs. Cryptocurrencies

Here is the key difference between CBDCs and cryptocurrencies:

- Bitcoin and Other Cryptos: Decentralized, offering users privacy and resistance to censorship.

- CBDCs: Centralized, allowing governments to track, monitor, and control transactions. The proposed U.S. digital dollar, nicknamed “Biden Bucks”, would grant authorities sweeping oversight of personal finances.

Risks and Concerns with CBDCs

Rickards highlights several profound risks posed by CBDCs. Let’s go through them in detail.

Government Surveillance

CBDCs would enable complete monitoring of individual financial transactions, transforming cash’s anonymity into a system of constant surveillance. Every purchase, transfer, or investment could be scrutinized and stored by the government.

Social Credit Systems

Rickards warns of a potential social credit system, akin to China’s. In such a system, dissenting behavior could lead to punitive measures like freezing accounts or limiting access to funds.

Financial Control

A digital dollar could be weaponized to suppress dissent. For example, Rickards references the Canadian government’s freezing of truckers’ bank accounts during recent protests, a chilling demonstration of how financial systems can be used to silence opposition.

Economic Manipulation

CBDCs could introduce negative interest rates, a scenario where account balances shrink unless money is spent. This could effectively erode savings and force spending, leaving individuals vulnerable to inflation and economic instability.

The Global Context

The U.S. isn’t alone in exploring digital currencies. Over 50% of countries and nearly 90% of central banks are investigating or piloting CBDCs. Some notable developments include:

- China: The e-yuan has facilitated billions of dollars in transactions and is positioned as a challenge to the global dominance of the U.S. dollar.

- Russia: Exploring digital currency options to circumvent international sanctions.

- Japan and India: Actively testing CBDCs, signaling a global monetary shift.

Rickards warns that if the U.S. delays implementation, it risks losing its global financial dominance, further threatening the dollar’s status as the world’s reserve currency.

Historical Parallels and Lessons

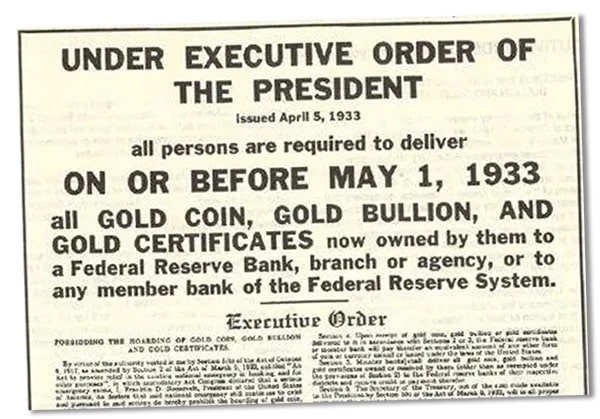

Rickards draws on historical examples to highlight the risks of government overreach in financial systems:

- Gold Confiscation Act of 1934: Americans were required to surrender their gold to the government, showcasing how monetary policy can infringe on personal freedoms.

- End of the Gold Standard (1971): President Nixon’s decision to abandon the gold standard led to inflation and increased Federal Reserve power.

- Canada’s Trucker Protest Crackdown: The freezing of protestors’ bank accounts demonstrated the power governments have over centralized financial systems.

Rickards’ Asset Emancipation Strategy

To counter these risks, Rickards offers a comprehensive framework for safeguarding personal wealth, which he calls the Asset Emancipation Strategy.

Here are some of its key components:

- Off-the-Grid Wealth: Establishing a private, untraceable wealth reserve, such as holding physical assets like gold.

- Liquidity Outside CBDCs: Maintaining access to funds independent of government-controlled digital currencies.

- Investment Opportunities: Capitalizing on unique financial opportunities during times of economic turmoil.

- Wealth Security: Ensuring long-term protection against inflation and government confiscation.

America’s Secret Currency

Gold remains a cornerstone of Jim Rickards’ strategy due to its historical reliability as a store of value. Immune to the surveillance risks posed by digital assets, gold provides a tangible safeguard against economic instability and government overreach.

However, Rickards goes beyond traditional assets to introduce what he terms America’s Secret Currency. This lesser-known asset offers significant benefits, including privacy, liquidity, and consistent value growth over time.

Unlike the proposed digital dollar, this asset ensures financial independence and protection from government surveillance.

Rickards’ Strategic Intelligence includes a detailed report on how to acquire and effectively integrate this asset into a diversified financial portfolio, providing a practical roadmap for maintaining financial security.

Profiting from Chaos

While Rickards emphasizes the risks posed by Central Bank Digital Currencies (CBDCs), he also identifies lucrative opportunities for savvy investors during this economic transition. His service highlights three companies that are integral to the development of digital currency infrastructure, positioning them for substantial growth as the adoption of CBDCs accelerates. Rickards provides detailed guidance on:

- When to Invest: Helping investors identify optimal entry points to maximize returns.

- When to Exit: Advising on exit strategies to avoid risks associated with market volatility or overreach.

This dual approach—protecting assets while leveraging emerging opportunities—ensures that investors can thrive even in uncertain times.

The Value of Strategic Intelligence

Subscribers to Jim Rickards’ Strategic Intelligence gain access to an extensive suite of resources designed to navigate the challenges of an evolving financial landscape. Key benefits include:

- Monthly Updates: Insights into financial markets, geopolitical risks, and investment opportunities related to CBDCs and other trends.

- Exclusive Reports: Subscribers receive four comprehensive reports:

- The Asset Emancipation System: A guide to legally securing wealth while avoiding government surveillance.

- The Perfect Physical Gold Portfolio: Detailed advice on investing in and safely storing gold.

- America’s Secret Currency: Insights into acquiring a private, untraceable asset with proven value growth.

- How to Profit from Chaos: Analysis of three companies leading the digital currency infrastructure revolution.

Subscribers also receive access to a private model portfolio, regularly updated to reflect current market conditions, and invitations to live intelligence sessions with Rickards, where they can directly engage with his insights.

Additional Perks and Bonuses

To add further value, subscribers benefit from:

- Access to Live Events: Opportunities to interact with leading financial experts, such as Robert Kiyosaki and James Altucher.

- Fast Action Bonus: A special report by former CIA Officer Jason Hanson, How to Make Your Home Your Personal Fortress, offering actionable steps to secure your family and property against potential societal disruptions.

- Lifetime Discount Lock-In: The $49 annual subscription (discounted from $299) is guaranteed for the lifetime of the membership.

- Daily Financial Insights: Subscriptions to Paradigm Press’ daily e-letters, providing regular updates on market developments.

Is It Worth It?

Jim Rickards’ Strategic Intelligence offers substantial value for its $49 introductory price, particularly considering the extensive resources provided.

Why Act Now?

Rickards stresses the urgency of preparing for the rollout of the digital dollar, or “Biden Bucks,” which he predicts is imminent. The government’s ability to monitor, restrict, and manipulate individual finances through programmable CBDCs poses a significant threat to financial freedom.

By following Rickards’ Asset Emancipation System, individuals can legally secure their wealth and ensure long-term financial independence.

The subscription’s additional features, including live events, exclusive reports, and a private portfolio, make it a comprehensive resource for navigating this challenging economic shift.

With a six-month satisfaction guarantee, subscribers can explore the service risk-free while retaining access to all reports and resources.

In a time of increasing financial uncertainty, Strategic Intelligence offers both a defensive and opportunistic approach to safeguarding assets and capitalizing on emerging trends, making it a compelling option for proactive investors.

Conclusion

Jim Rickards’ Strategic Intelligence provides a comprehensive guide to navigating the challenges posed by Executive Order 14067 and the rise of CBDCs. By combining historical context, financial analysis, and actionable strategies, Rickards equips subscribers with the tools to safeguard their wealth and autonomy.

For those concerned about financial independence in an era of increasing government control, the Strategic Intelligence offers valuable insights at a reasonable cost. Whether or not all of Rickards’ predictions come to pass, his emphasis on preparation, diversification, and vigilance makes his service a worthwhile resource for forward-thinking investors.