Stock picking can feel overwhelming, with endless numbers, news, and conflicting advice hitting you every day.

Key Takeaways (Quick Overview)

-

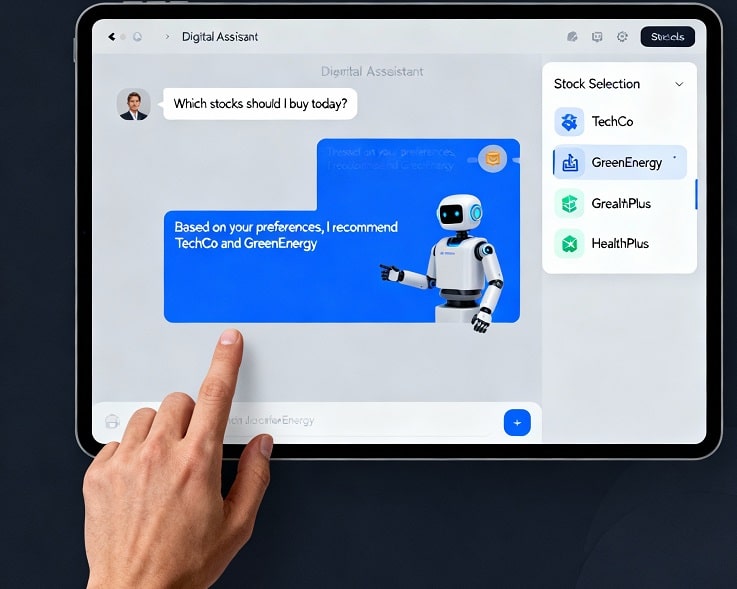

Chatbot interfaces like StansberryGPT simplify research, letting investors ask questions and get actionable answers.

-

Whithey Tilson’s N.E.W. System provides a structured framework for identifying high-potential stocks.

-

Combining AI-powered chatbots with The N.E.W. System allows investors to filter noise, analyze trends, and make decisions faster.

If you’ve ever wished there was an easier way to scan the market without drowning in spreadsheets and endless reports, this is where AI chatbots come in—and they work seamlessly with proven systems like The N.E.W. System.

Imagine asking your computer, “Which tech stocks are showing the fastest revenue growth this quarter?” and getting a concise, data-backed answer in seconds. That’s what modern chatbot interfaces offer.

Why Investors Struggle With Stock Picking

Even experienced traders face three major challenges:

-

Information Overload: Thousands of stocks, endless reports, constant news.

-

Decision Paralysis: Hard to know which signals actually matter.

-

Timing the Market: Knowing when to buy before a stock takes off.

These are exactly the problems The N.E.W. System addresses—but traditionally, it required manual research. Chatbots streamline the process, making it easier to apply Tilson’s system without losing critical insights.

When I first started, I’d spend hours sifting through earnings reports and SEC filings. Even with Tilson’s framework, it was easy to get lost in the weeds. Using a chatbot interface, I could ask, “Show me N.E.W.-System-approved growth stocks in AI or biotech” and instantly get a curated list with key metrics highlighted.

How Chatbot Interfaces Integrate With The N.E.W. System

Using a structured investing framework is powerful, but pairing it with AI chatbots takes it to a new level. Whithey Tilson’s N.E.W. System focuses on three pillars: Newness, Earnings, and Why Now. Let’s see how chatbots make each pillar actionable.

Newness — Spotting Innovative Companies Quickly

The “Newness” pillar identifies companies driving innovation or entering emerging markets. Traditionally, investors needed to manually scan press releases, product announcements, and patent filings.

With a chatbot, you can ask questions like:

-

“Which AI startups have reported revenue growth over 50% this quarter?”

-

“List biotech firms with new FDA-approved treatments this year.”

The chatbot returns a concise list filtered by the N.E.W. System’s criteria, saving hours of research and helping investors focus on true innovators.

Earnings — Understanding Financial Health Without the Guesswork

“Earnings” focuses on identifying companies with solid, accelerating revenue and profit trends. Chatbots can instantly pull earnings reports, trend data, and analyst summaries, and even compare companies side by side.

Example queries:

-

“Show N.E.W. System-approved tech stocks with at least 20% revenue growth and positive earnings surprises in the last quarter.”

-

“Compare earnings trends of three top-performing N.E.W. System biotech picks over the past year.”

Instead of crunching numbers manually, the AI interface interprets data and presents it in actionable form.

Why Now — Timing Your Entry Perfectly

The “Why Now” pillar assesses whether the market conditions are primed for a breakout. Timing can make or break a trade, and chatbots help investors gauge context quickly.

Example questions:

-

“Which AI stocks have surged in interest over the past month but are still underpriced relative to revenue growth?”

-

“Highlight biotech firms entering a regulatory approval window in the next 60 days.”

These queries integrate market context, news trends, and timing signals, letting investors make faster, more informed decisions aligned with The N.E.W. System.

My Personal Take

Using the chatbot this way feels like having a research assistant who already understands Tilson’s methodology. I can ask complex, multi-layered questions in plain English and get outputs that align perfectly with N.E.W. System criteria—without scrolling through endless spreadsheets.

Real-Life Examples: How Chatbots & The N.E.W. System Identify Winning Stocks

To understand the practical value of combining AI chatbots with Whithey Tilson’s N.E.W. System, let’s look at a few illustrative examples. These show how investors can cut through noise and focus on actionable opportunities.

Spotting a High-Growth AI Firm

Last quarter, several AI companies were attracting attention, but not all were positioned for sustained growth. Using the N.E.W. System through a chatbot interface, I queried:

-

“List AI companies with revenue growth above 40%, new product launches this year, and strong analyst upgrades.”

Within minutes, the chatbot returned a shortlist of three companies. One, in particular, had just signed a multi-million-dollar government contract, meeting all three N.E.W. criteria: Newness, Earnings, and Why Now.

Without the chatbot, gathering this information would have taken days: scanning press releases, earnings calls, and analyst reports. With it, I had a clear picture in real time and could make an informed investment decision aligned with Tilson’s methodology.

Biotech Breakout Before Approval

Biotech is another sector where timing is everything. A stock could spike on regulatory approval news, but identifying which firms are positioned for that event requires deep research.

Using a chatbot connected to the N.E.W. System, I asked:

-

“Highlight biotech firms with new drugs in late-stage trials, positive earnings trends, and upcoming FDA decision windows within 60 days.”

The AI instantly flagged two companies, one of which later saw a 35% jump after positive trial results. Following the N.E.W. System through the chatbot allowed me to spot this before broader market attention, exemplifying the “Why Now” pillar in action.

Avoiding a Fading Tech Stock

Not every high-growth stock is a winner. Some surge temporarily but don’t meet all N.E.W. System criteria. A chatbot can help weed out these false breakouts.

I asked:

-

“Show tech companies with high revenue growth but declining market sentiment and no new product innovations this quarter.”

This query highlighted two stocks that, despite recent hype, lacked ongoing innovation or earnings momentum. Avoiding these saved potential losses and reinforced the importance of following all three N.E.W. pillars—not just chasing short-term spikes.

Practical Takeaways

-

Speed Matters — AI chatbots deliver filtered, actionable stock insights instantly.

-

Data Integration — Chatbots combine financials, news, and analyst opinions aligned with the N.E.W. System.

-

Risk Reduction — By highlighting stocks that fail to meet full N.E.W. criteria, chatbots help investors avoid overhyped, risky picks.

These examples show that combining AI tools with a systematic approach like The N.E.W. System isn’t theoretical—it’s practical, actionable, and repeatable.

Maximizing Portfolio Decisions with AI Chatbots and The N.E.W. System

Investing isn’t just about finding individual winners—it’s about constructing a portfolio that balances opportunity and risk. AI chatbots, when paired with Whithey Tilson’s N.E.W. System, can streamline this process and help investors make smarter, faster decisions.

Dynamic Screening for Diversification

One of the hardest parts of investing is maintaining a diversified portfolio while still capturing high-growth opportunities. Chatbots can run complex screening queries across multiple sectors simultaneously.

For instance, you can ask:

-

“Show top 5 companies in AI, biotech, and green energy that meet all N.E.W. criteria this quarter.”

The result: a curated list of potential investments that cover different industries yet all align with the principles of Newness, Earnings, and Why Now. This helps avoid overconcentration in a single sector while maintaining exposure to high-potential growth trends.

Real-Time Portfolio Adjustments

Markets move quickly, and what was a promising stock yesterday may underperform today. With chatbot interfaces, you can continuously monitor your holdings against N.E.W. metrics.

Example queries include:

-

“Update me on any N.E.W. System signals for my current portfolio.”

-

“Flag any stock in my holdings that lost its Why Now catalyst this week.”

This real-time feedback allows investors to take timely action—selling, trimming, or adding positions without sifting manually through spreadsheets or news feeds.

Stress-Testing Scenarios

A key component of professional investing is scenario planning. Chatbots can simulate “what-if” scenarios quickly:

-

“If interest rates rise 1%, which stocks in my N.E.W.-filtered list are most vulnerable?”

-

“Show me the impact on my AI and biotech holdings if earnings beat expectations by 10%.”

These simulations allow investors to anticipate risk, manage exposure, and adjust allocation without having to perform manual, time-consuming calculations.

Practical Takeaways

-

Portfolio Health — Chatbots track multiple stocks in real time, highlighting which meet or fail N.E.W. criteria.

-

Informed Decision-Making — By seeing your portfolio against clear metrics, you avoid emotional trades.

-

Efficiency & Speed — Tasks that could take hours or days are completed in minutes, freeing time for deeper strategic planning.

By integrating AI chatbots with the N.E.W. System, investors gain a workflow that is data-driven, actionable, and repeatable—essential in a market where timing is everything.

Common Objections and Misconceptions About AI Stock Picking and Chatbot Tools

Investors often hesitate to rely on AI-driven systems and chatbots. Some fear they’re too “robotic” or worry about over-reliance on technology. Understanding these concerns—and addressing them—is crucial for anyone considering Whithey Tilson’s N.E.W. System alongside a chatbot interface.

“AI Can’t Replace Human Judgment”

It’s true—AI doesn’t replicate intuition or experience. But it complements it. Chatbots excel at processing vast datasets and applying N.E.W. System metrics consistently. They flag opportunities and risks you might miss manually.

Example: An investor might notice a biotech stock trending in headlines. The N.E.W. System via a chatbot can immediately evaluate whether the earnings growth, novelty, and Why Now catalyst truly support a buy decision. Instead of guessing, you get data-backed confirmation.

“I Don’t Trust Technology with My Money”

Skepticism is natural. The key is transparency. Chatbots in The N.E.W. System aren’t making blind recommendations—they show why a stock meets specific criteria. You still make the final choice.

Sample query you could try:

-

“Show me why each AI stock in my watchlist meets the Newness and Earnings criteria this month.”

This way, the tool reinforces your confidence instead of replacing it.

“It Sounds Too Complicated to Learn”

Many investors assume AI interfaces are difficult to use. Modern chatbots are designed like having a conversation: you ask questions in plain language, and they respond with actionable insights.

For instance:

-

“List all N.E.W. System approved stocks under $50 with earnings growth over 20% this quarter.”

You don’t need coding skills or complex spreadsheets. The interface walks you through everything interactively.

“Technology Can’t Predict Market Surprises”

No tool predicts the future with certainty. What chatbots plus the N.E.W. System do is identify stocks positioned for potential growth based on proven metrics. While market volatility always exists, these tools reduce guesswork, giving you a structured way to evaluate opportunities.

Practical Takeaways

-

AI is an assistant, not a replacement, for human judgment.

-

Chatbots provide transparency, explaining why each recommendation meets N.E.W. criteria.

-

The learning curve is low—plain-language queries make research faster and easier.

-

Risk is never eliminated, but structured data gives you a measurable edge.

By addressing these common concerns, investors can embrace AI tools without fear, applying the N.E.W. System systematically to their stock-picking process.

How to Start Using Chatbots With The N.E.W. System Today

If you’re ready to move past uncertainty and streamline your stock-picking process, here’s exactly how to get started with Whithey Tilson’s N.E.W. System using a chatbot interface.

Gain Access to The N.E.W. System

The first step is subscribing to The N.E.W. System. This gives you structured access to Tilson’s framework for identifying stocks with three key factors: Newness, Earnings growth, and Why Now catalysts. These are the same metrics professional analysts rely on to spot breakout opportunities before they hit mainstream awareness.

Connect the Chatbot Interface

Once you have The N.E.W. System, link it to your preferred chatbot interface. The integration lets you query stocks naturally, like talking to a colleague, while receiving instant, data-driven insights.

Example queries include:

-

“Which stocks have high earnings growth this quarter and strong Why Now catalysts?”

-

“Show me new tech stocks that meet the N.E.W. criteria this week.”

These queries give you actionable results in seconds, saving hours of manual research.

Use Filters to Personalize Research

The N.E.W. System allows filtering by price range, sector, market cap, and risk tolerance. Combining these filters with a chatbot interface means you can tailor recommendations to your exact investing style.

For example, you can ask:

-

“List small-cap AI stocks under $50 with positive earnings revisions and strong innovation.”

This generates a focused watchlist you can act on immediately.

Track Performance and Iterate

One of the biggest advantages of combining the N.E.W. System with a chatbot is real-time tracking. You can monitor which recommendations hit your criteria over time, adjust filters, and refine queries based on performance.

Example workflow:

-

Query stocks that meet N.E.W. metrics.

-

Add promising names to your watchlist.

-

Check earnings updates weekly via chatbot.

-

Adjust your strategy based on performance.

Take Action Confidently

With data-backed insights at your fingertips, executing trades becomes easier. You’re no longer guessing—you’re following a structured, repeatable process. This is where the system truly shines, reducing stress and decision fatigue while positioning you for potentially higher returns.

Why Now Matters

Markets move fast, and AI-driven tools are becoming standard in professional investing. The longer you wait, the more you risk falling behind competitors who are already using structured systems like the N.E.W. System. By integrating a chatbot interface today, you gain immediate efficiency, clarity, and a strategic edge.

Actionable Tip: Start with one query per day and gradually expand. Even small, consistent use helps build familiarity and confidence in the system.

FAQ – Chatbot Interfaces & The N.E.W. System

What exactly is The N.E.W. System?

The N.E.W. System is Whithey Tilson’s structured framework for picking stocks based on three key factors: Newness, Earnings growth, and Why Now catalysts. It’s designed to help investors identify breakout opportunities without getting lost in endless research.

How does a chatbot interface improve stock picking?

A chatbot interface allows you to interact with the system naturally. Instead of manually scanning spreadsheets or financial reports, you can ask questions like you would to a colleague and get instant, data-backed insights. It saves time, reduces errors, and helps you focus on actionable opportunities.

Do I need prior experience to use The N.E.W. System with a chatbot?

No. The system is beginner-friendly, and the chatbot interface is intuitive. You can start with simple queries and gradually refine your approach as you become more comfortable. Even seasoned investors find that chatbots speed up decision-making.

Can I customize the stock suggestions to my investment style?

Absolutely. The N.E.W. System lets you filter stocks by sector, market cap, price, and risk tolerance. Combine this with targeted chatbot queries, and you can generate personalized watchlists aligned with your goals.

How often should I use the system?

Consistency is key. Even 10–15 minutes daily querying the system can uncover actionable opportunities. Over time, you’ll build a rhythm of monitoring, analyzing, and acting on stocks that fit your strategy.

Is this system suitable for short-term trading or long-term investing?

Both. The N.E.W. System identifies companies with strong growth potential and timely catalysts. Whether you prefer swing trading or longer-term investments, the system helps you make informed decisions.

How do I get started today?

The first step is subscribing to Whithey Tilson’s N.E.W. System. Then start querying stocks using the N.E.W. metrics, and build your watchlist. The combination of structured methodology and AI-driven interface lets you act confidently.