Artificial intelligence isn’t just reshaping the way we work, play, and invest—it’s also rewriting the rules of American capitalism itself. With the U.S. government taking an increasingly activist role in picking winners, massive contracts, strategic spending, and direct investments now determine which companies will lead for decades. And no one is ahead of this trend more than tech analyst and investing expert Luke Lango. With Luke Lango’s U.S. Government AI Shortlist Stocks, investors gain ground-floor access to the most promising companies positioned to win big as federal spending floods select industries.

In this definitive guide, you’ll explore how this new paradigm works, why Lango’s insight into the AI supply chain sets him apart, and how you—as a subscriber to his Early Stage Investor research—can catch triple and quadruple digit returns in America’s government-powered AI supercycle.

Why The Government’s AI Picks Matter

For years, market forces were left to decide which tech innovators would become tomorrow’s leaders. Today, it’s government agencies, the Pentagon’s Office of Strategic Capital, and presidential executive orders channeling billions to those they deem mission-critical. In recent months, these moves have become turbocharged.

Consider a few examples:

-

Intel : Soared 70% after a government stake and multi-billion CHIPS Act funding.

-

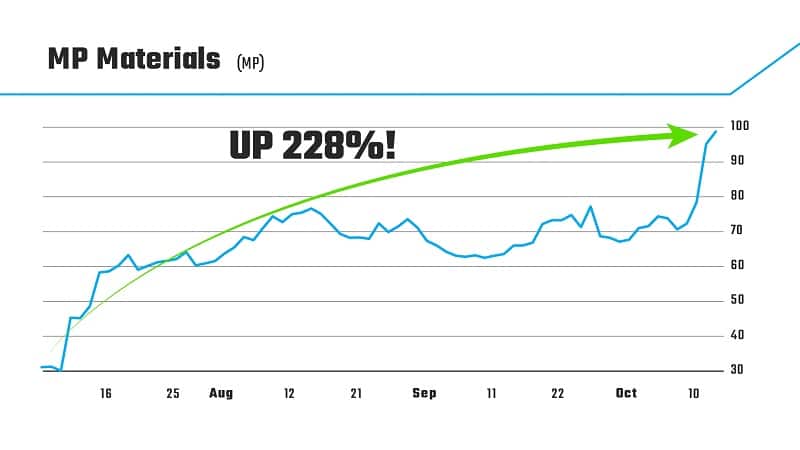

MP Materials : Tripled within months as the Pentagon became the largest shareholder.

-

Lithium Americas : Rocketed 227% in three weeks after receiving strategic federal support.

-

Trilogy Metals : Surged 400% in a single week on federal investment.

Luke Lango’s AI Shortlist identifies where these next deals will fall—often before the market even realizes government contracts are coming.

Behind the Boom: The Quiet Revolution in AI Hardware

Luke Lango’s analysis sees beyond generic “AI” enthusiasm. He’s pinpointed a pivotal shift most investors missed: the move from AI training (dominated by GPUs, especially from Nvidia ) to inferencing, which demands a new kind of chip.

GPUs excel at training AI models—but TPUs, which only Google manufactures at scale, now dominate inferencing as AI moves into real-world deployment.

Lango called this turn early: invest in Google ’s TPU supply chain, not simply the existing GPU names.

His June 2025 prediction gets validated daily. Since his email issuing this alert, Google gained 93%, a near quadrupling of Nvidia ’s 24% return over the same stretch.

It’s a sign of how Lango consistently spots material changes—long before Wall Street catches up.

Success Stories: From MP Materials to CrowdStrike

Being ahead of federal priorities has paid off handsomely for Early Stage Investor members. Consider MP Materials. Dead money for nearly three years, it underperformed despite the AI boom lifting the S&P 500 and Nasdaq. After Lango’s prescient call—the government’s $400 million stake under President Trump—the stock exploded, delivering 3X returns in just weeks.

Other landmark calls:

-

Symbotic: Picked before mainstream coverage, soared as it signed Walmart deals.

-

Rocket Lab : Lango saw the government contracts coming—subscribers saw up to 1600% returns.

-

IonQ and Axon : Flagged before state and local adoption and contracts sent shares flying.

-

Palantir Technologies : Early recommendation as its software became essential to multiple federal agencies.

-

Oklo: Chosen for defense nuclear contracts, identified before Wall Street.

The Secret to Lango’s Method: The Three-Part Screen

What’s the recipe behind these blockbuster picks? Lango’s system works as follows:

-

Right Industry: Must be on Washington’s “critical” list—AI, semiconductors, critical minerals, nuclear reactors, drones, robotics, cybersecurity, and advanced software.

-

Right Company: The leader or only viable solution to a key national-security threat.

-

Right People/Relationships: Operations in the U.S., D.C. ties, or evidence of strategic partnerships with government or credible backers.

“Find all three,” Lango says, “and you’re one contract away from hundreds, sometimes thousands, of percent returns.”

Act 2: What’s Next—and Why Timing Is Now

Lango’s research suggests MP Materials and similar stocks were just the opening act. Now comes Act 2, as trillions in government spending go after the rest of the AI supply chain: rare earths, chip design, small nuclear reactors, robotics, and advanced software.

Many stocks in these sectors have yet to receive federal backing. Buying before Washington strikes is key—because those deals often send shares soaring overnight, leaving latecomers holding less upside.

Tactical Advantage: Inferencing, TPUs, and the AI Supply Chain

Lango’s greatest strength isn’t just picking “AI winners”—it’s knowing when the tech cycle itself is changing.

The shift from GPU-dominated training to TPU-led inferencing marks another quiet but decisive pivot. As AI deepens its reach, chips customized for deployment (TPUs) become more essential—and Google suddenly sits at the heart of America’s AI defense and government contracts.

Investors who follow Lango into this supply chain—not just chase the old leaders—are gaining ground while mainstream coverage lags.

Luke Lango’s U.S. Govt’s AI Shortlist Report

After months of boots-on-the-ground research as a well-connected Silicon Valley insider, Luke Lango has pinpointed six AI companies that every forward-looking investor should consider owning right now—before the next wave of government deals hits.

In this exclusive report, Lango delivers a deep dive into the select businesses that Washington has already flagged as critical for U.S. victory in the global AI race.

You’ll get in-depth analysis on why these companies are poised for extraordinary growth, how each plays a vital role in American AI infrastructure, and the government backing that could send their shares on a 10x run over the coming years.

If you want a firsthand look at the stocks most likely to surge as the government unleashes trillions in strategic capital, Lango’s U.S. Govt’s AI Shortlist is the essential guide to positioning yourself ahead of the biggest AI opportunity of the decade.

Early Stage Investor: What You Get with the AI Shortlist

Joining Early Stage Investor means instant access to the U.S. Government AI Shortlist—a full breakdown of seven companies dominating the high-probability pool for government contracts and federal support. But that’s just the start:

-

In-depth analysis, with sector, competitive edge, and buy guidance for each stock

-

Model portfolio access with ongoing updates, alerts, and recommended diversification

-

Bonus reports: Custom chip makers, AI moonshots with 100X upside, and 35 additional stocks forecasted to lead the next surge

-

Monthly market briefings, podcasts, and direct updates on new trends and timing windows

-

Risk management tools: Position sizing, volatility alerts, and actionable instructions to protect profits in rapid-moving sectors

-

90-day satisfaction guarantee

Why This AI Cycle Is Different: The Role of Washington

What makes this boom unique? The sheer weight of government funding, direction, and executive vision.

President Trump’s Executive Order 14179 directs the entire federal machine to prioritize AI leadership—and the CHIPS Act plus direct Pentagon contracts ensure money flows to those deemed critical to national security.

It’s the new “Manhattan Project” for the 21st century. America is building out AI hardware, software, minerals, and infrastructure for military, energy, and economic dominance. And the stocks picked as partners are erupting, not simply rallying.

Not Just Tech—Minerals Are the Backbone of AI

Lango’s research debunks the myth that AI is only about chips and algorithms. Mineral companies—from rare earths to advanced nuclear materials—now form the hidden backbone of the AI economy. When the Pentagon and Department of Energy announce deals, stocks like MP Materials , Oklo, and Ucore go vertical.

As tech supply chains shift away from China (which controls 80% of rare earths needed for next-gen electronics, robotics, and defense), American companies in these spaces are getting billions in government support.

Real Results & Testimonials: Subscriber Success Stories

Early Stage Investor members share regular stories of six-figure windfalls, timely exits on drawdowns, and high-confidence moves thanks to Lango’s headline and buy-alert system.

-

Many caught AI moonshots before mainstream coverage—tripling their positions in days.

-

Others used Lango’s risk management to avoid costly mistakes plaguing less selective investors.

-

The community features ongoing strategy podcasts, market notes, and member dialogue about sector rotation, risk, and cash management.

Lango’s Latest Blueprint: How to Spot the Next Federal-Picked “Winner”

The essence of Lango’s AI Shortlist screening boils down to a repeatable process:

-

Look for a critical sector prioritized by Washington

-

Identify the clear leader (in scale, technology, or government relationships)

-

Vet for strategic ties, U.S. presence, and credible partners

As soon as companies check those boxes, their odds of receiving the next federal infusion skyrocket. The AI boom, supply chain reconstruction, and defense priorities mean new deals could be announced monthly.

Volatility, Risks, and the Benefits of Being Early

While returns are outsized, many government-related plays can be volatile before contracts are secured. Lango’s reports advise disciplined entry prices, diversification, and frequent review of news, sector trends, and model portfolio allocations.

Avoid chasing hype; focus on stocks with substantive Washington ties, major sector positions, and technical/strategic advantages.

Final Guidance: Why “Luke Lango’s U.S. Government AI Shortlist” Is the Play for Serious Investors

With the government “actively picking and funding the companies it deems crucial to winning the 21st-century tech race,” as Lango writes, investors who recognize this inflection point will be those who get rich from it.

The AI boom isn’t over—it’s accelerating. According to Lango, sentiment is turning, the Fed is shifting, and the next leg of the run is being set up by direct government engagement in the sector.

For anyone seeking actionable, next-generation intelligence—not just generic “AI exposure”—Luke Lango’s U.S. Government AI Shortlist, delivered to Early Stage Investor subscribers, is the single most powerful guide to the current tech supercycle, federal contract windfalls, and the new paradigm of market-driven government investing.

FAQ: Luke Lango’s U.S. Govt’s AI Shortlist

What is Luke Lango’s U.S. Government AI Shortlist?

It’s a research-backed list of six AI-related companies that America’s top policymakers consider mission-critical for winning the global AI race. The report explains why these companies are poised for rapid growth and how investors can get in before the next wave of government-backed funding or contracts.

How does the government impact the value of these AI stocks?

When Washington designates a tech or resource company as “critical,” it can lead to massive investments, strategic contracts, and regulatory tailwinds—often sparking major stock surges, sometimes overnight.

How does Luke Lango select companies for the shortlist?

Lango uses a proprietary three-part screening system: targeting sectors on Washington’s priority list, identifying industry leaders, and confirming key relationships with U.S. agencies and decision-makers.

What kind of gains have previous picks produced?

Recent recommendations that benefited from government backing—like MP Materials , Palantir Technologies , and Rocket Lab —have delivered triple- and quadruple-digit returns to early investors.

Isn’t this trend already played out? Am I too late?

According to Lango, we’re entering “Act 2” of America’s AI supercycle, with fresh sectors and lesser-known companies next in line for federal deals. There is still ample time to position yourself before these opportunities become mainstream.

What exactly do I receive when I join Early Stage Investor?

Members get immediate access to the U.S. Government AI Shortlist report, the model portfolio, ongoing alerts and buy recommendations, in-depth sector analysis, bonus moonshot reports, and dedicated risk management insights.

How risky are these government-aligned AI stocks?

While the upside is substantial, many are small-to-mid-cap companies subject to volatility. The Early Stage Investor service provides entry points, suggested allocation, and ongoing risk guidance.

Can I follow these picks using a regular brokerage account?

Yes. All recommended stocks are actively traded U.S. equities or funds available through standard online brokerages.

Will I be updated on new opportunities and when to sell?

Absolutely. Early Stage Investor includes ongoing buy alerts, sell guidance, market timing commentary, and regular email and/or app notifications to keep you in control.

Is there a guarantee if I’m not satisfied with the service?

Yes. There’s a 90-day satisfaction guarantee—if the research and results don’t meet your expectations, you’ll receive full credit to use on other premium research services.