Louis Navellier Reveals his #1 Oil Stock For 2022. You can find the name, ticker symbol and key details below.

Louis Navellier #1 Oil Stock For 2022 – Name and ticker here

Investor Place and experts are warning us that oil shock is coming.

Here is link to Investor Place’s new presentation where Wall Street legend Louis Navellier reveals his #1 Oil play for 2022. Louis Navellier looks confident that if you buy this single stock right now, you could easily gain 3 to 5 times your money in the days ahead.

Let’s dig further into key business details and figure out if it makes sense in the current market conditions.

Is Oil in A Bull Market?

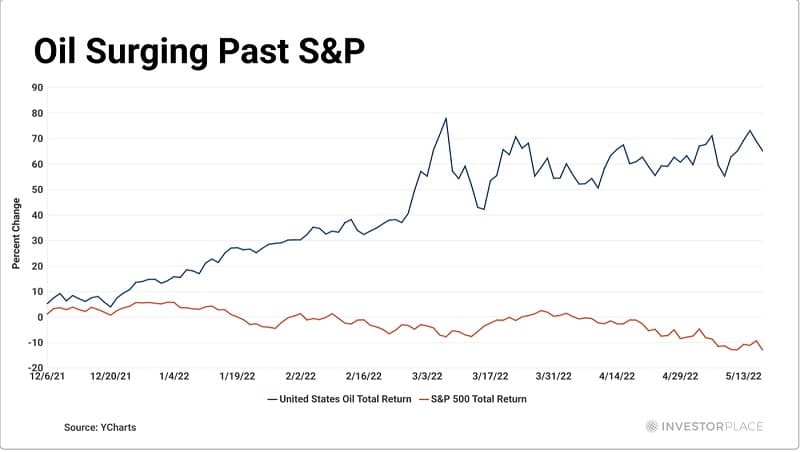

Oil is once again in a huge bull market, after years of going nowhere. And some people are making a lot of money. Over the past 6 months, oil has surged past the S&P 500.

Results are similar if we compare US oil total return vs. Dow Jones composite average total return or Nasdaq composite total return. Oil is surpassing even Bitcoin.

Where is the oil price heading?

Louis believes that those gains are nothing compared to what’s coming next. According to his research, we are still in the early stages and oil prices will continue to rise wildly in 2022. This unprecedented move could turn many oil companies into incredible cash machines.

His prediction is the price of oil could spike to $180 a barrel. And Louis is not the only one saying this.

One of the top oil research companies in the world, Rystad Energy, predicts that oil might reach $200 per barrel.

According to Goldman Sachs, Brent oil could reach $200 per barrel.

One of Wall Street’s top investment managers and energy expert, Pierre Andurand, recently announced he believes that oil may soon reach $240 per barrel.

I do not blame you if you think these numbers are shocking.

The bottom line is, we have never seen oil prices go that high. This means if you lost money in tech stocks this year, oil could be your chance to make up those losses.

In fact, a hefty position in oil stocks could make 2022 the most profitable year of your life.

In the times ahead, people can’t afford to think just about profit. We need to prepare ourselves to safeguard our finances.

Imagine, oil price rising to around $200 a barrel. What would be the massive implication for the society?

This also means utilities, groceries, and electronics will also be twice as expensive as they are today.

Therefore, Louis Navellier and his team have put together a comprehensive analysis. It includes information not only how to survive, but also to thrive in the times ahead.

If you understand a few key principles which he explains in this presentation, you can emerge on the other side of this oil surge unscathed. You could have also the chance to be much wealthier than you were at the beginning.

If you are retired, looking to retire soon, or if you are living on a fixed income, this research is for you.

In any case Louis Navellier can help you to navigate the coming surge in oil prices successfully. He does some of the best research in America when it comes to retirement and investing.

Sharing some of his latest research for FREE is how Navellier builds some of the world’s longest running financial research advisories.

His services help over 460,000 readers worldwide.

This is how he earned his reputation as “one of the most important money managers of our time”.

You probably know him from Fox Business, Yahoo Finance, and Bloomberg.

Our Green Future Postponed

Over the last few years, we’ve been told we are hurtling toward an entirely green future. Future based on solar and wind power with battery-powered electric cars.

Yes, we’ll get to this future someday. But right now, no matter how hard lawmakers push the “green energy” revolution, oil is still king.

And Louis Navellier’s prediction is it is going to remain king for at least the next two decades.

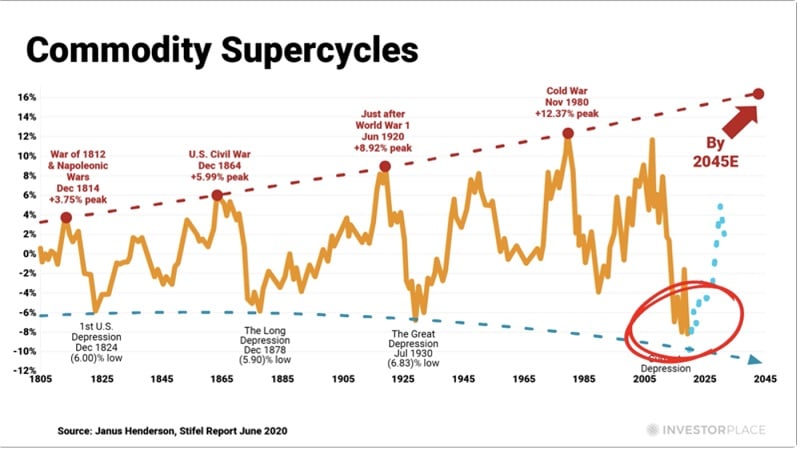

The oil industry, like everything else, runs in cycles. We are here marked with the red circle.

We are right at the start of a new oil bull market. Louis Navellier’s research tells him that the bull market that’s coming is going to be the biggest one to date.

To prove his point Louis Navellier is talking about oil price catalysts.

Oil Catalysts

Oil Super Catalyst #1 -The Environmental, Social, Governance (ESG) Delusion

The goal behind ESG movement is the big companies to decrease their investment in fossil fuels. And reward them for long-term “climate-friendly” solutions.

In reality, the plan is to stop investing in new oil production.

ESG is the reason of all the recent “rebranding” in the oil industry, as you may have seen.

Some of the recent ventures of the biggest oil companies like Exxon, Shell, BP and Chevron make them look more like “green energy” companies.

BP invested $200 million into solar projects throughout United States.

Shell bought Australian wind farm developer.

British Petroleum rebrand itself as Beyond Petroleum.

Today, more than half of Fortune 500 companies are involved in major ESG initiatives.

But the matter-of-fact oil is still the most important commodity in the world.

Nowadays, 97% of American automobiles run on gasoline. Even if EV adoption continues at its current rate, it will not have meaningful impact at least another 15 years.

And even if EV adoption accelerates, EVs will continue using oil. Up to 50% of EVs are made of plastic, a byproduct of oil.

Aviation, trucking, and shipping industries are also relying on oil. Even our utilities are still tied to oil.

Louis Navellier’s point is that transitioning the world to green energy is not going to happen overnight. It will take lots of time and energy.

Louis is emphasizing that every dollar big oil companies spend on switching to renewable energy is money NOT spent securing the #1 Energy source in America.

And that has led to a major supply shortage – the first key catalyst in an oil price spike.

Oil Catalyst #2 American’s going “out of jail”

The last two years on “house arrest” people saved a lot. Over the course of the pandemic, Americans added $4 trillion to their savings.

With current inflation, experts believe that Americans are spending $765 more a month compared to 2020.

People are eager to resume their normal lives and travel. In January 2022, air travel demand was up more than 80% over the same time last year.

This means that aviation, an industry still 100% reliant on oil is about to go into overdrive.

85% of people in United States have plans to travel in 2022. Most of them plan to travel by car.

The prices we are seeing at the pump are just the start. With restricted supply, experts believe we could soon see gas prices at $7 a gallon.

Louis Navellier believes there is one other factor driving oil bull market. A factor that will also change the shape of the energy industry forever. America will once again become the world’s dominant energy exporter.

Oil Catalyst #3 – The New American Oil Age

What is happening in Ukraine today is much larger than just another geopolitical conflict.

It created the largest humanitarian crisis that Europe has seen in 70 years.

Over the last 10 years American leaders wanted to invest in renewables. The only way to meet the renewable goals and keep the lights on was to let someone else do the drilling, refining, and transporting.

That strategy has made us energy-reliant on other nations. More than 60% of the oil used in the United States comes from foreign countries.

In Europe it is even worse – they import 80% of all their crude oil from foreign powers, allowing Russia to build its own oil empire.

Renewables as they are today can’t replace the oil we need.

If we want to be energy independent, we need to start drilling.

Russia has proven itself untrustworthy. European countries are going to rush to the United States, preferring a reliable, time tested partner over Putin.

The main reason of Louis’s presentation is to show his point that many American businesses, from semiconductors to medicines, will come back in the future years.

Now you can see the potential billion-dollar movement.

Just make sure that you are holding on to the right stocks for the oil bull market ahead.

Many people think that the best way to play during rising oil prices is to own the commodity.

Louis Navellier believes that buying crude in this bull market would be a mistake.

His #1 way to profit in an oil bull market is to buy oils stocks that are leveraged to the price of oil.

Here is why…. Because oil companies are leveraged, they can see 2x, 3x, even 5x or 10x gains from small change in price of oil.

Louis believes that oil stocks are still priced cheaper than any other sector.

His #1 stock recommendation Devon Energy (ticker: DVN) has a P/E ratio of just 9 right now. This is an incredible bargain in an oil bull market.

It is an all-American company, headquartered in Arkansas. It has projects in some of America’s best oil flats, including the Eagle Ford Shale and the Stock Formation in Oklahoma.

Devon has nearly 400,000 net acres of undeveloped drilling rights in North America. They just opened 65 new wells in the area.

Devon also pays a great dividend. In 2022, the company paid 6.27%.

It doesn’t matter if you are a seasoned expert or brand-new to the oil industry, Louis Navellier believes Devon is one of the safest plays today. Especially if you are looking for the combination of reliable dividends and strong growth potential.

5 Stocks for the New Oil Change

Louis system helped him identify four more stocks with the potential to generate incredible wealth. You can find more info and their ticker symbols in a special report called “5 stocks for the New Oil Age.”

By the way, one of these companies he recommended as an “urgent” buy back in February. It is heading into massive merger and plans to pay out a $15 per share dividend. If you act now, you can get in on time.

Every single stock in this model portfolio has operations in America.

Buying the right stock is just one step. Louis Navellier wants to make sure that we are ready for everything coming our way.

Louis Navellier used his 40 years of market experience to put together an exclusive bundle of reports. He calls these reports “The New American Age Bundle: 3 Steps to Survive and Profit.”

Each report is a critical step you must take to protect yourself in the days ahead.

- Get rid of “dead weight stocks”. The First report “10 Stocks to Sell in The New American Age” focuses on purging your portfolio of stocks that will drag you down as inflation rises.

- Invest in income-generating opportunities. Step two is critical for retirees or anyone that relies on their investments to cover their ordinary expenses. It will help you developing new income streams that will not be impacted by market turbulence. In second report “3 Income Opportunities for the New American Age” you will find recommendations that are delivering higher income than CDs or high-yield bonds.

- Build wealth by investing in leveraged assets. The third step includes Louis Navellier’s recommendation to put at least a portion of your wealth in stable assets like gold and silver. To maximize profit, you need to buy companies that are leveraged in gold. You can find his recommendation in the final report in this bundle, “The Best Gold Play for the New American Age”.

What is Growth Investor?

Growth Investor is Louis Navellier’s premier investing research service since 1980s. It has over 72,000 readers all around the world.

Over a twenty-year period, Growth Investor outperformed the S&P by nearly 3-to-1.

What is included in Growth Investor bundle?

When you sign up, you will receive all the resources you need to get started right away, including:

- 12 monthly issues of Growth Investor ($299 value). They will keep you up to date on everything that’s going on in the market. Every issue includes new actionable investment opportunity. This means you will get at least 12 stock picks per year.

- Unlimited access to their archive of reports with details of opportunities in nearly every sector. New reports will be added to the library throughout the year. They are free of additional charge. ($1,000+ value)

- Urgent weekly updates every Friday. This is where you will read professional analysis regarding events that happened in the past week. They will help you stay on top of the potential investments without spending your day to read the news.

- Emails with urgent market or stock news breaks with explanation what is happening and what it means for your Growth Investor recommendations.

- Full access to the Growth Investor Model Portfolio where you will see every one of his recommendations published and tracked. You can keep tabs on current positions and review the newest stock recommendations.

- Access to Growth Investor customer support team support every weekday

- Instant access to the special report: The New American Age Bundle: 3 Steps to Survive and Profit.

- Instant access to the special report 5 Stocks for the New Oil Age

How much is Growth Investor?

Retail price of Growth investor is $249. Louis Navellier’s personal goal is to get his message out to as many people as possible. For limited time you can have access to his world-class investing research for the lowest possible price. Currently full year subscription to Growth Investor is just $49 per year.

Plus, you get his new American Age Bundle completely FREE. You can keep these reports even if you decide Growth Investor is not for you and you request your cash refund.

This link will take you to the promotional offer where you can review everything before you submit your order.

Bottom Line: Should You Join Growth Investor?

If you are retired or planning to retire soon, we believe that Growth Investor subscription paired with Navellier’s New American Age bundle will prepare you for the months ahead. All you need to do at this stage is to act. With 365 days cash refund period this step is a no brainer.