Karim Rahemtulla and the team at Monument Traders Alliance are out with a new Last Great Value Stock presentation for The Trade of the Day Plus service. Find out Karim Rahemtulla’s Favorite Small Cap Play for 2022 here.

After the recent market pick, many stocks that were skyrocketing are suddenly going down. People are wondering which stocks are overvalued and what stock they can buy that has a chance to go up.

Karim Rahemtulla has an answer to this question, and he shares it in his new presentation.

It is a $2 stock, and he is calling it: “Last Great Value Stock”.

What Is Karim Rahemtulla’s Last Great Value Stock?

First, let’s make it clear, it is not some no-name penny stock. It is well known company that Fortune has included in their list of the top 50 most admired companies in the world.

It is a business that operates in dozens of industries around the world.

This company builds and supplies world-class engines and power systems.

It is also developing futuristic technologies that give it massive growth potential.

The reason why it is still trading cheap because the business operates in the physical world that did not recover right away after the pandemic.

It is finally catching up with incredible speed.

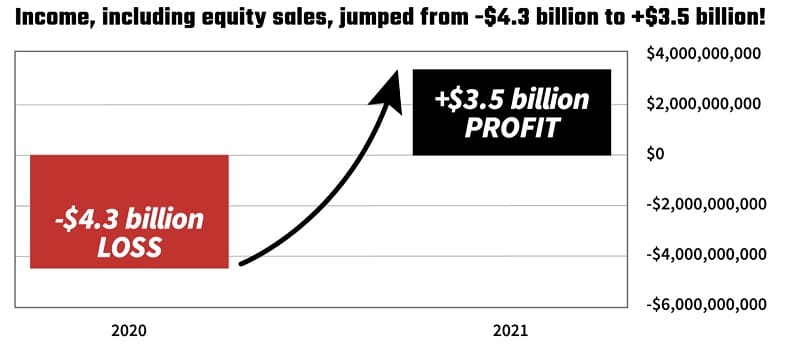

Income, including equity sales, swung from a $4.3 billion loss back in 2020 to nearly 3.5 billion in 2021. And it keeps growing.

Source: www.monumenttradersalliance.com

As the global economy opening back, the business for this company is booming again.

Rahemtulla is expecting a 300-500 % growth in 2022. So far this year, the sales are close to $75 billion.

Another major catalyst for the growth is an announcement coming on May 12 at company’s Annual General Meeting.

Rahemtulla believes that now you can grab the opportunity to get in as the recovery sends this stock soaring.

Why now is the right time to invest in Karim Rahemtulla’s Last Great Value Stock?

The company was badly impacted during the pandemic. As we mentioned above, it took a huge $4.3 billion loss in 2020.

But now, everything changed. The company is profitable again.

The Company is dominating the airline industry. It produces “the most efficient aero engine in service in the world today”.

It provides engines to Singapore Airlines, Italian Airline, South African Airline….

The company supplies jet engines to defense departments.

It has a $2.6 billion deal for 650 F130s for the U.S. Air Force. It also provides engines for defense departments in the UK, Germany, Spain, Italy and Australia.

It is the #1 engine supplier in the private business jet market.

Here is the right time to mention that this company has done something unique in this industry.

This company worked with Microsoft to create a new product, a new technology to provide aircraft maintenance that improves the performance of the aircraft. Something like a subscription service that brings monthly revenue. Now this company is getting paid per hour of flying time for each engine it maintains.

At $2 stock, Rahemtulla believes that this is the best value investment he has ever seen.

Who is Karim Rahemtulla?

Karim Rahemtulla started on Wall Street back in the 1980s. Shortly after, he became one of the youngest CFOs of a trading firm that cleared millions of dollars through Bear Stearns.

He had the chance to learn trading from some of the best in this business.

During his presentation he shares the two invaluable lessons that he learned:

The initial breakthrough was when he realized that the price is everything. With another words, it is not enough to find the right asset. The big gains are coming when you get in at the right price.

The second major lesson Karim has earned is that the market is always changing. If you are not adapting to the new reality, you will get left behind.

These two lessons served him well.

By the time he was 34 years old, he was able to build a multimillion-dollar portfolio.

Once he realized trading could provide him enough, he retired from Wall Street. Today he lives off his daily trading.

He admits he loves his life the way it is – working at his own peace, making money on his own terms, spending enough time with his family.

Along his way, he decided to start helping other regular people to learn his trading techniques.

He believes he can help people to achieve financial freedom through the Wall Street Daily, a publication where he is a co-founder.

Recently he co-founded another new venture called Monument Traders Alliance. It is a laser-focused on giving regular people the tools to dominate the markets.

According to their website, their mission is to change the way you approach speculation. Members of Monument Traders Alliance receive calculated, precise strategy speculations that have proved as successful and profitable for decades.

Rahemtulla says that he personally recommended 204 trades through their live research platform. 181 of them turned into winners (88.7% win rate).

On the average trade that lasts about 50 days, he has beaten the market on a relative basis by 4-to-1.

Bottom line: Karim is focused on “smart” trading. He is all about lowering risk while enhancing returns using strategies as LEAPS trading, spread trading, put selling, and following insider cluster buying.

Karim Rahemtulla’s Inflection Points or The Best Time to Make a LOT OF MONEY

You will probably agree that right now it is nearly impossible to find great stocks at cheap price.

We are all wondering what is going to happen in the markets next.

The tech stocks that dominated the market for the last few years reached their peak and are now too expensive to continue rising.

Currently we are seeing major pullbacks as we are experiencing new fundamental shift in the global economy.

Rahemtulla calls these shifts “inflection points”. These are the periods where money flows out of one sector and into another.

For example, the beginning of the pandemic. That was an inflection point when the physical economy gave way to the virtual economy. At that time money flowed into virtual economy stocks like Zoom, Netflix, Amazon, Moderna, etc.

People like Rahemtulla that saw the inflection point and took advantage, made good money.

Now something is changing once again. We’ve hit a new inflection point.

Money is flowing out of the virtual-based pandemic stocks and are moving back to the stocks that operate in the physical world.

Now that people are traveling again, a good example of are energy stocks. They are one of the best market performers.

The question is: How to find the best stocks?

The Key To Find The Stocks That Will Rise Next

Karim has a strategy. His advice is to look for companies that complete what he calls a “reversal”.

Reversal is the moment when a company swings back to positive income from a loss in a very short time.

Karim believes that reversal is happening right now to the company that he is talking about in the presentation.

The thing is that the company trades in an unusual way.

You will not find it on the Nasdaq or New York Stock Exchange.

It is not a penny stock on the pink sheets. It trades on a special exchange you might not be familiar with.

Looks like only real trading pros know how to get in on this company. And this gives people like Rahemtulla and his followers a big advantage.

Rahemtulla put together a special report called “The Last Great Value Stock”.

Source: www.monumenttradersalliance.com

Inside you will find all the details on the $2 stock, including its name and ticker.

Rahemtulla included instructions how to buy the stock in a regular brokerage account.

He also will break down all the revenue streams that will push the stock higher in the next months.

You are able to receive this report and other bonuses and recommendations as a package if you sign up to Rahemtulla’s research service called Trade of the Day Plus.

Rahemtulla’s Trade of the Day Plus – Is It Worth?

Rahemtulla is confident that based on his 35 years of experience on Wall Street, he can see what is happening there much faster than the average investor. He focused his energy and become best at targeting short-term gains.

In his presentation he says: “You can make substantial gains in the market, and it doesn’t have to take years”.

Until recently, the only way to get access to trades like this one was his high-end service, The War Room. It is very expensive subscription, retail value more than $7,000.

This is where he shows his subscribers his daily trades.

Here are the two main things that Rahemtulla will do for you as a member of With Trade of the Day plus:

- First, he’ll send you daily emails explaining what we’re watching in the markets.

- Second, he will use the same pro strategies he uses in The War Room and will send you one of his best trades once a week.

Looks like a great way to simply get started, learn some new strategies, and receive some good trades during the learning process.

What Will You Receive when You Join Trade of the Day Plus?

Here is a list of what is included in Trade of the Day subscription:

- Daily issues of Trade of The Day with the top moving stocks. Rahemtulla and his team will explain trading strategies and will give you an idea where markets are headed next.

- Weekly Trade of the Day Plus Recommendations. Every Wednesday you will receive a video breakdown of the #1 investment opportunity of the week.

- The Last Great Value Stock report (Value $99) that includes Rahemtulla’s favorite $2 stock with step-by-step instructions how to buy at the best price.

- Access to their model portfolio with all current recommendations.

- Access to their concierge team.

- Access to Trade of the Day Plus Vault with all of their past videos, reports and updates.

- Access to Trade of the Day Plus website

- FREE Bonus #1 (Value $99): Rahemtulla will show you the power of the Win-Both-Ways Trade. With this trade if the stock moves up, you win. If the stock goes down, you also win. It just must move. Sounds crazy, right? Once you understand this is a type of trade, this may become the only type of trade you want to make going forward. You will find all the details in a special report called How to Execute the Win-Both-Ways Trade.

- FREE Bonus #2 (Value $99): Rahemtulla’s small cap play for 2022. He and his team just finished a special report for their favorite small cap for the year ahead. It is based on an industry that has been increasing at a compound annual growth rate of 50% plus for the past few years. It is called “My Favorite Small Cap Play for 2022”.

- FREE Bonus #3 (Value $99): The “IPO Buying Guide 2022”. You probably know already that 2021 was a record year for IPOs. 980 businesses went public. This number is more than double the number for 2020. This is the reason why Rahemtulla and his team put together the “IPO Buying Guide 2022” for new Trade of the Day Plus subscribers. It has details for each one of their favorite new or recent IPO opportunities this year.

- FREE Fast-Action bonus (Value $99): “Option for Dummies 101” – This guide on trading option is meant to help anyone to trade options. Even if this is your first time. You will learn how to risk less money to make bigger returns. You can even make money when markets are crashing.

Here is The Deal

One-year basic subscription to Trade of the Day Plus costs $249. It includes Digital subscription only.

The deal is that you can subscribe now for only $49 ($79/year after) following this link. This is less than $5 per month for one year.

You will have 365 days to try everything at zero risk. That’s how confident is Rahemtulla that you will be happy with his work. They will let you keep everything you received as a subscriber even if you decide to quit.

Here are other subscription options you can explore:

Premium subscription for only $79. Retail value $249. Includes everything digital subscription plus SIX EXTRA Bonus Reports and Videos:

- Bonus special report: “5 Trading Secrets to Win Every Day in the Markets”

- Rahemtulla’s ultimate trader’s manual, The Top 5 Mistakes New Traders Make

- “Top 5 Stocks Under $25: Best Value Picks for 2022” (bonus report with MORE opportunities)

- The Big Book of Missing Money (instant-download e-book)

- Rahemtulla’s bonus options report: “5 Winning Options Strategies for Beginners”

- Masterclass eight-part video series: Wall Street’s Most Treasured Secrets… UNCOVERED! ($399 value).

Standard subscription for only $129. Includes Digital Subscription plus one extra report: “5 Trading Secrets to Win Every Day in the Markets”

Ready To Try Trade of the Day Plus? Click Here – Best Offer + Bonus