Joel Litman’s Altimeter is a boutique financial research and publishing firm providing individual investors with unique, unbiased investment recommendations and analytics.

FREE access to the Altimeter system ($1,200 value)

Joel Litman’s Altimeter Research – How it works?

Joel Litman’s Altimeter is the study of height or measuring altitude. Said differently, the study of things that go up. In the investment world, who doesn’t like things that go up?

As the consumer arm of Valens Research, we leverage the same underlying datasets, investment philosophy and strategies.

Primarily, we are guided by the knowledge that U.S. accounting guidelines – which American public companies are forced to follow – obscure the true results of a company’s profitability, misleading investors.

Warren Buffett: “The net earnings figure… is not representative of the business at all.”

Forbes: “Why GAAP Accounting Rules May Be Damaging to Investors.”

Billionaire hedge fund manager Seth Klarman: “Analysis of reported earnings can mislead investors as to the real profitability of a business.”

Instead of using traditional Wall Street analyses, we deconstruct them and reassemble them using our own Uniform Adjusted Financial Reporting Standards (UAFRS) – or Uniform Accounting, for short. This process shows us the true picture of a company’s potential.

Then we combine Uniform Accounting with additional, deep forensic analysis to consistently find mispriced companies poised for massive growth, which we detail for our subscribers.

— RECOMMENDED —

Stock Warning: 90 Days to Move Your Money

Stock Warning: 90 Days to Move Your Money

It doesn’t matter if you have money in the markets or are waiting on the sidelines. The short period we are about to enter could have the power to make – or destroy – fortunes. And what you do in the next 90 days could determine your financial success for the next decade. Here’s what’s happening and how to prepare.

Click here to watch (includes free recommendation).

Joel Litman’s Altimeter Live Demonstration

In a special webinar, Professor Joel Litman, President and CEO of Valens Research and Chief Investment Strategist of Altimetry, will expose a massive discrepancy in the U.S. accounting system that allows us to see the TRUE earnings of 32,000 stocks. He will also conduct a Live Demonstration of an “Investment Truth Detector” with findings that have been featured in Barron’s, CNBC, and the Harvard Business Review.

The points of discussion for this free event are:

1) How to see the TRUE earnings of any stock BEFORE the mass public… and how this information could help you double or triple your money.

2) A Live Demo of Professor Litman’s Investment Truth Detecting System on some of the best-known and least-known stocks in America.

3) How Joel Litman’s Altimeter is powered by a huge discrepancy in the U.S. accounting system you’ll never hear about from your broker, Wall Street, or the media, and how this gives you a huge advantage in the market.

4) How Professor Litman has seen gains high on different companies.

5) The truth about a little-talked-about company that Professor Litman says is the #1 stock in America that you should own right now.

Tune in on September 25th to watch Professor Litman as he uncover the TRUE earnings and profitability of some of the best-known and least-known stocks in America.

FREE access to the Altimeter system ($1,200 value)

Joel Litman’s Altimeter Investing Philosophy

There is a tremendous value in understanding a company’s true financial status. Unfortunately, performance metrics like PE Ratios and Discounted Cash Flow, and thus all derived analysis built on as-reported financials, are terribly distorted and, in some cases, useless.

How could this be?

There are Problems with As-Reported Financial Statements under GAAP and IFRS.

Important elements of as-reported corporate financial statements have become unreliable. The problem stems from significant inconsistencies in the rules and application of those rules in financial statements as-reported today.

Earnings can be reported to go up when in fact a firm’s performance has faltered. Price-to-earnings ratios show stocks to be expensive that are in actuality cheap. Margins, assets, capital expenditures, debts, and virtually all key financial performance indicators can be a far cry from an accurate representation of corporate activity.

A simple example is the FIFO/LIFO accounting policy that management teams choose for reporting cost of goods sold and inventory levels.

It is perfectly acceptable for one company to use the LIFO or Last-In-First-Out method for reporting cost of goods sold. Meanwhile, a peer company could choose the FIFO or First-In-First-Out method.

Both companies have elected a perfectly legal and acceptable accounting method under Generally Acceptable Accounting Principles. However, each of these firms now has incomparable profits, costs, and balance sheets. Many other key financial performance indicators will also be victim to this simple change.

We have identified over 130 similar inconsistencies.

Are CEOs and CFOs Lying About Their Results?

In most cases, no. The CEO and CFO have received much of the blame for the erosion in financial statement quality. Think Enron, MCI and Global Crossing.

However, the global financial reporting problem rests squarely with the rule-making process of the governing accounting bodies over time. In particular, with GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards).

The financial reporting authorities have established a set of standards that have been argued, debated, and then established over decades and decades.

Unfortunately, the result is a set of accounting rules with inconsistent policies that reflect a mixture of differing objectives for the financial statements.

So How Do We Use This to Our Advantage?

These accounting problems mean valuing a company on available information can be misleading.

In other words, Wall Street is getting it wrong! The data they are using, the screeners they are using, the models, etc. are all wrong.

In order to see the true picture, we disassemble the financial statements of more than 8,000 publicly traded companies around the world and then reassemble them using globally consistent standards that repair the problems cited above.

We have a team of more than 90 accountants and analysts who make more than 130 adjustments to create the true picture of a company’s financials.

Then we sift through the results looking for great companies that are widely mispriced.

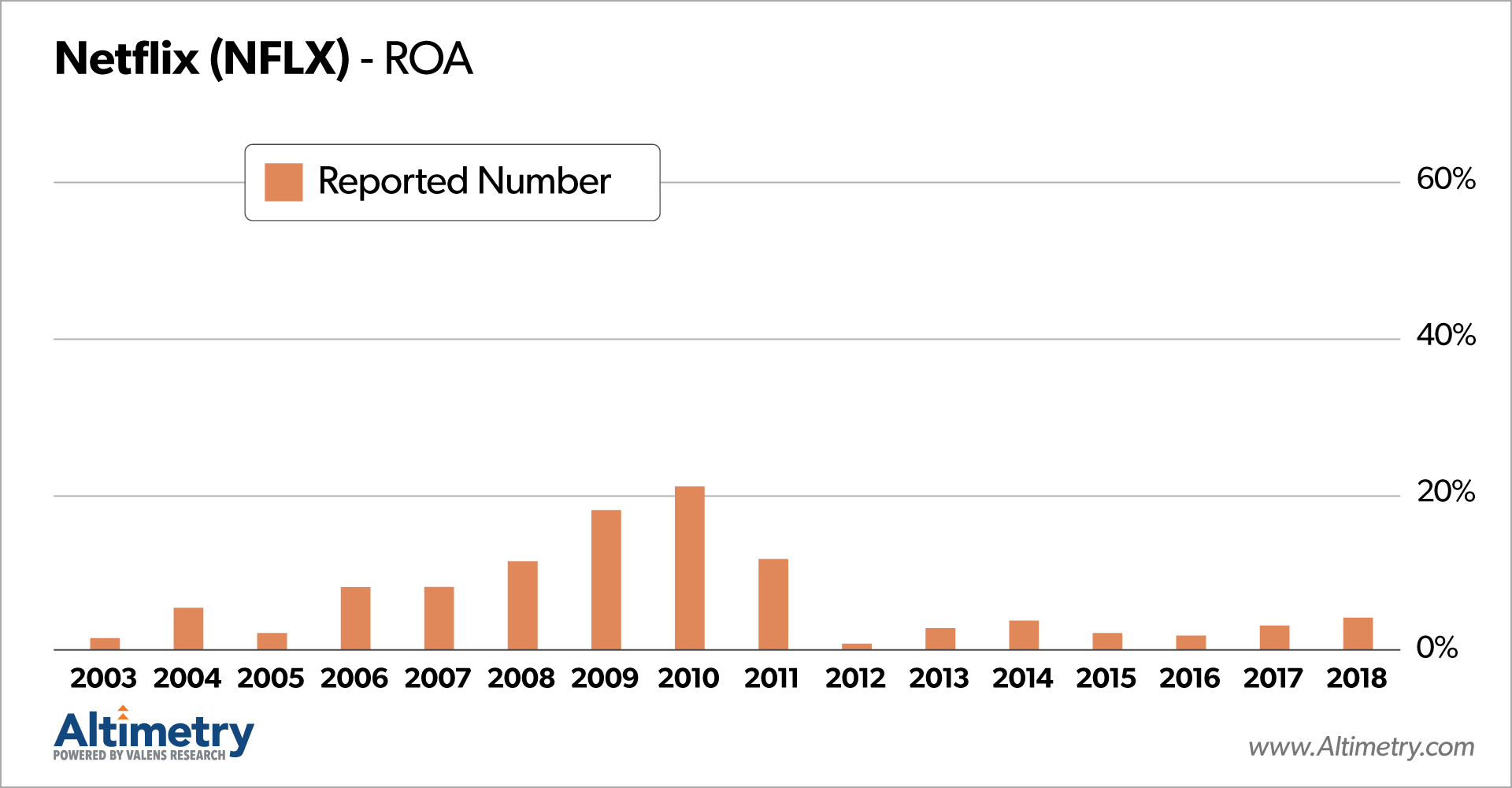

Here’s an example: Netflix (Nasdaq: NFLX):

The orange bars are the publicly reported RETURN ON ASSETS… In other words, the cash return that Netflix makes, based on each dollar it invests into its business. This is a pretty simple measurement of its earnings.

This is what the world believes to be true about Netflix.

Even in the early years, Netflix’s Return on Assets was only about 1.8%. Not very impressive.

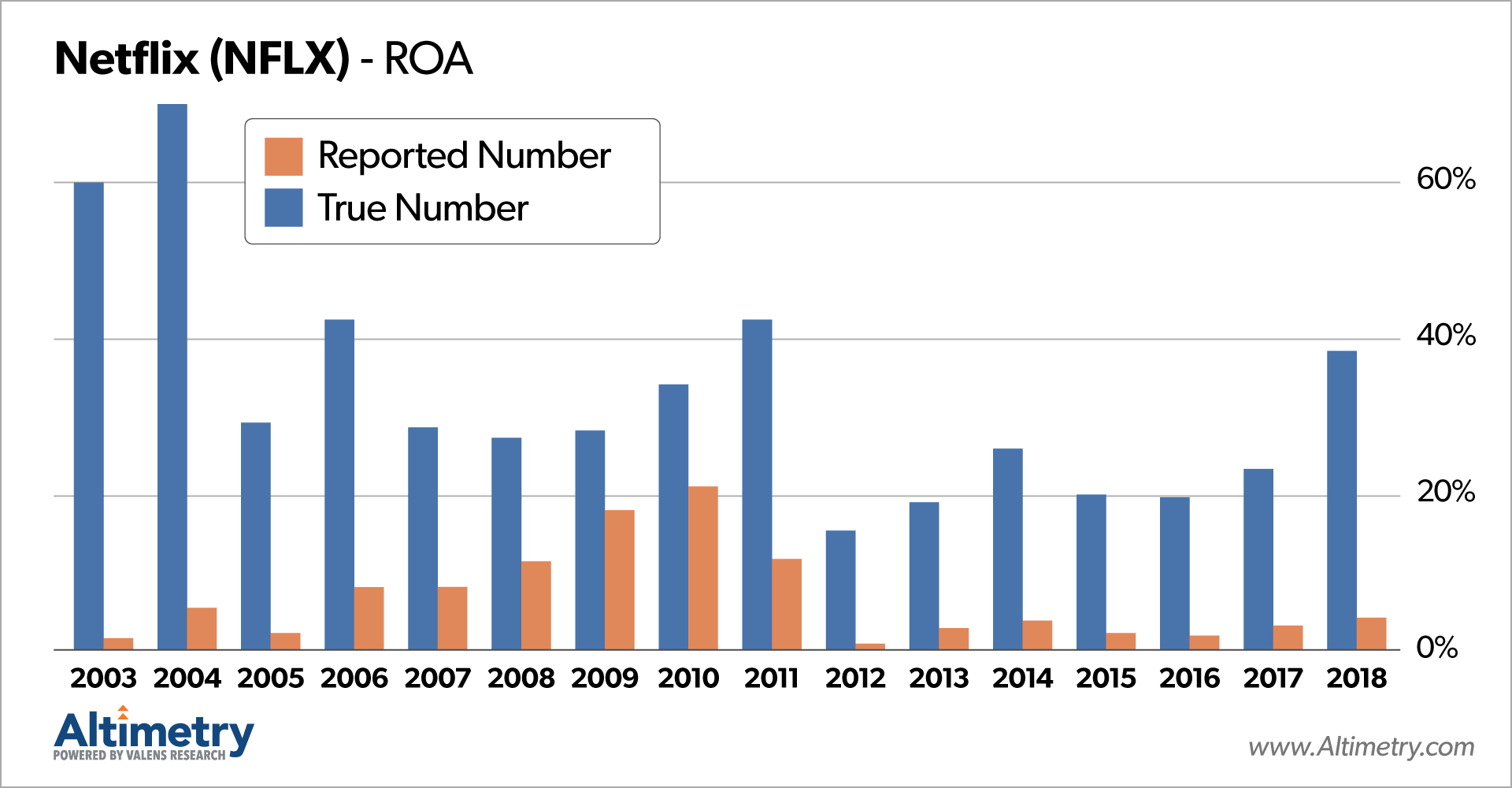

The blue bars are our adjusted and REAL Return on Assets for Netflix, dating back to 2003.

36 TIMES higher in some cases.

We arrived at this number by deconstructing and then rebuilding Netflix’s entire balance sheet, correcting all the built-in mistakes.

You could have bought the stock based on just this information alone as late as 2013, and still made 15 times your money.

Even as of last year, there’s still a major discrepancy in the reported Return on Assets. It’s almost nine times higher than what the public believes to be true.

— RECOMMENDED —

URGENT INFLATION REPORT

Americans Over 60 Must Do THIS Now!

Thanks to lousy fiscal policies, the U.S. is experiencing rapid price increases unlike almost anything in the last 39 years.

That’s why it’s so important to ACT NOW to preserve your retirement wealth (especially if you’re over 60).

This report is 100% FREE! Download it here!

Meet Joel Litman – the man behind the Altimeter program?

Professor Joel Litman is the Chief Investment Strategist at Altimetry, advising individual investors in equities, corporate credit, and macroeconomic strategy. He is also the President and CEO of Valens Research, as well as a member of the Board of Directors of COL Financial Group, a leading brokerage firm in Asia.

Professor Joel Litman is the Chief Investment Strategist at Altimetry, advising individual investors in equities, corporate credit, and macroeconomic strategy. He is also the President and CEO of Valens Research, as well as a member of the Board of Directors of COL Financial Group, a leading brokerage firm in Asia.

Litman has been on CNBC, quoted in Barron’s and Institutional Investor, and interviewed in Forbes.com. He has published in Harvard Business Review, is a top contributor to SeekingAlpha, and co-authored the highly-acclaimed book, DRIVEN: Business Strategy, Human Actions, and the Creation of Wealth.

Litman has taught or guest-lectured at Harvard Business School, U Chicago Booth, Wharton, LBS, SAIF Jiao Tong, and others. He is a Professor at Hult International Business School, an FT and Economist top-ranked international MBA program. He conducts seminars regularly for financial and industry conferences around the world such as CFA and CPA chapters.

Litman is Chair of the UAFRS Advisory Council which is spearheading usage of Uniform Adjusted Financial Reporting Standards aka Uniform Accounting. He helped build Credit Suisse’s HOLT University and the Center for S.E.V. and MBA Concentration at the Driehaus College of Commerce at DePaul University.

Past employment includes Credit Suisse, Diamond Tech Partners (now PwC), Deloitte, and American Express. He is a member of CFA Institute, the global association for investment professionals, and the Association of Certified Fraud Examiners. He is a CPA (Certified Public Accountant), received a B.S in Accounting from DePaul University and an MBA/MM from the Kellogg Graduate School of Management at Northwestern University.

Litman’s philanthropy is focused on community development through scholarships, job training programs, and extensive microfinance lending, particularly in the Philippines.