In Jeff Clark’s most recent presentation he talks about a historic trading opportunity that is forming right now. It will be centered around three specific sectors that are going to get an extraordinary boost. Jeff calls them the “Trump Surge Sectors.”

He expects these three sectors to surge wildly, up and down, following The Magic Pattern he discovered.

Read further to learn which are Trump’s Surge Sectors, what is The Magic Pattern and how Jeff dives deep into this idea with his service Jeff Clark Trader.

This unusual approach might give Jeff’s readers the chance to see large gains in today’s market uncertainty. I am sure this Jeff Clark Trader review will give you the necessary information to decide if you want to follow Jeff’s innovative trading idea.

What Is Magic Pattern?

In the stock market, which is very chaotic system, Magic Pattern can be used to identify predictable sequences. Many billionaires have used it to generate staggering returns. But they aren’t going to share this pattern with regular people.

Jeff has been exceptionally careful about keeping this discovery to himself. But he can no longer stay silent. Because the situation in America is in chaos, and it affects our everyday life.

However, it’s paving the way for one of the largest trading opportunities he has seen in his 40-year career. Everything revolves around what he refers to as the Trump Surge Sectors.

How The Magic Pattern Works?

As you know, markets experience significant cycles of ups and downs. These are referred to as bull and bear markets. Bull markets rise. Bear markets decline.

Regular investors rely on stocks increasing to generate profits. However, stocks don’t only rise. They operate in cycles. Up, then down. This repetitive motion explains why, according to JP Morgan, the average individual investor has made only 2.9% annually over the past two decades. Think about this statement…During one of the largest bull markets in history, regular investors barely managed to outpace inflation.

The challenge with traditional investment strategies is that you end up holding stocks while they appreciate and still holding them while they depreciate. And some stocks that fall may NEVER rebound. Fortunately, there’s an alternative.

Instead of becoming a casualty of market cycles, you can use them for the chance of substantial gains. It all hinges on the Magic Pattern. This pattern has repeated itself consistently, regardless of whether it’s analyzed in days, weeks, or years.

The same pattern that unfolds over the long run also manifests in the short-term. It’s the same pattern. Just with much higher frequency. Naturally, most people overlook these short-term fluctuations. But these short-term cycles can be seen as predictable sequences. And knowing how to trade these immediate ups and downs transforms everything.

Just because you know a stock is going to cycle up and down doesn’t mean you can start trading better. The key to success comes down to pinpointing the moment a stock PIVOTS and begins moving in the opposite direction.

Pivot Points: The Key To The Magic Pattern

Over decades of studying the Magic Pattern, Jeff has tested and analyzed nearly every market indicator available. He found out that none of them delivered consistent results.

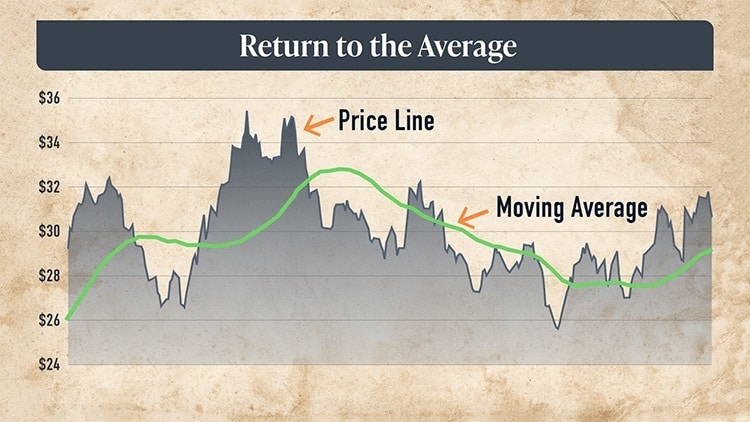

Rather than settling for mediocrity, he developed his own proprietary composite indicator. He calls it “Return to the Average,” also known as “Reversion to the Mean.”

As you may know, a stock’s Price Line fluctuates through cyclic patterns over time. It rises, then falls. This repetition is the core of the Magic Pattern. The Moving Average represents the average price of a stock over a designated timeframe.

Regardless of how far the Price Line deviates from the Moving Average, it inevitably returns. Each stock and ETF varies—some may have a “snap-back threshold” of just 5%, while others might be 20% or even higher.

Jeff’s algorithm monitors more than 4,000 stocks every day. When a stock reaches its “snap-back threshold”, it goes to Jeff’s Watch List for in-depth examination. Subsequently, Jeff uses his indicator to help identify the exact moment when the stock is poised to Pivot and reverse direction.

This unique tool combines three distinct indicators, refined through the view of his 40 years of trading experience. When these three indicators align in specific configurations, they signal a tradeable Pivot Point. At that point, it’s simply a matter of entering a simple option trade designed to capitalize on the short-term move.

Why short-term? In today’s fast-paced environment, traditional investing carries significant risks. Instead of purchasing stock and holding it for 3, 5, or even 10 years amidst all these unpredictable fluctuations, you can adopt Jeff Clark’s strategy and engage in short-term trading.

Jeff Clark’s Short-Term Way

For four decades, Jeff has been focused on options trading rather than stocks. I am sure many of you have yet to explore the advantages of options. A lot of people believe options carry high risk. This misconception has hindered countless investors from achieving financial freedom.

In reality, options were designed to LOWER RISK, minimizing the necessity of holding stocks through fluctuations over time.

When you purchase an option, your risk is limited to the premium you pay.

Another vital aspect: with options, we can profit whether stocks rise or fall. Once you learn the Magic Pattern, you can execute the same trade repeatedly. For instance, in just the past five years, Jeff has used the Magic Pattern to secure nearly 60 successful trades on GDX through his services. These have been impressive wins, including an 85% return in two weeks. I’ll repeat – nearly 60 successes with this same ETF.

The Magic Pattern is NOT exclusive to gold. This principle applies to all types of assets… And most importantly, with the Magic Pattern, investing can become much less complicated… and much less stressful.

For those who dream of a different reality. A reality where building wealth is still possible, Jeff has created a unique opportunity. If you’re curious about the Magic Pattern, now you have chance to take it for a test drive as part of Jeff Clark’s flagship publication Jeff Clark Trader. This offer allows you to experience how it works firsthand—without any long-term commitments. It’s the perfect way to find out what are The Trump Surge Sectors. Here’s more about them:

The Trump Surge Sectors

Jeff has pinpointed three sector ETFs that he believes will experience dramatic swings—potentially surging up and down by at least 2,700% during the new Trump Era. Investing in them will give you an opportunity to achieve similar gains.

To help you seize these opportunities repeatedly, Jeff has created a special report called “The Trump Surge Sectors.”

In this report, he explains why he believes President Trump’s policies will transform these ETFs into exceptional trading vehicles. Most importantly, he will guide you on how to capitalize on these opportunities—again and again—as the markets fluctuate.

The report is yours, completely free, as soon as you agree to take Jeff Clark Trader for a test drive today. And this is just the beginning of what Jeff Clark Trader has to offer.

How Jeff Clark Trader Works?

Each month, Jeff and his team handpick the top trade opportunity and send it directly to their readers for your consideration. And don’t be surprised if some months bring three, four, or even five trades—it all depends on the opportunities the market provides.

When the moment is right, they act. Keep in mind, these are short-term trades—designed to be closed within days, or sometimes even just hours.

What Is Included With Jeff Clark Trader Membership?

By joining right now, you’ll receive:

- 1-Month of Jeff Clark Trader. You will receive a minimum of one Trade Alert per month. In some months, you might see up to four or five trades, each having the potential to close returns of 120%, 222%, and 329% in just 11 weeks!

- Detailed Trade-Alerts, Trade Analysis, and Profit Alerts.

- Executive Report #1: The Trump Surge Sectors. (Value $99). This report will tell you everything you need to know to play these three sectors for maximum upside potential.

- Executive Report #2: The Magic Pattern (Value $99). Learn more about fractals, also known as the Magic Pattern, and how they are influencing technology, medicine, and—most importantly—the financial markets. Jeff goes into great depth about how he analyses a stock’s Magic Pattern using market indicators to find opportunities that might yield as much as 152%, 222%, or even 329%!

- Masterclass Training Video Series (Value $1,599). This 8-part video series (over 240 minutes) include all the must-know trading wisdom Jeff has accumulated over the last 40 years.

- Digital Trading Library of Trading Secrets.

- Options Trading Resources. Including all the tips and tactics he knows after 40 years trading options.

- The Jeff Clark Mobile App where you will keep track of all my trades, market analysis, updates, and profit alerts.

- Free Bonus: Complimentary 1-Year Subscription to TradeStops Basic (Value $299). TradeStops is a powerful portfolio tracking tool designed to help you monitor your newsletter positions and protect your investments, all while taking the emotion out of exit decisions.

- The 30-Day “No Questions Asked” Money-Back Guarantee!

How Much Is Jeff Clark Trader?

With this offer your membership will cost you only $19 per month. Regular price is $499 per year.

Jeff Clark Trader: Pros And Cons

Pros

- Discounted price.

- Bonus reports and training resources.

- 30-days money back guarantee.

- Short term deals for quick turnaround.

Cons

- Focused on options trading that might not be for everyone.

- Simple option-trading strategies best suitable for beginners

Is Jeff Clark Trader Right Tool For Me?

Having Jeff Clark and Magic Pattern in hand, you could be free. You can earn money from anywhere in the world, on your own terms.

This approach is quite different from how most people invest, and I’m not suggesting you abandon your current portfolio. If your strategy is working, stick with it.

However, consider this: incorporating the Magic Pattern into your investment toolkit could be a game-changer—especially in the coming weeks and months.

Think about it – America is in crisis. Amid the chaos, turmoil, and uncertainty, traditional investing is becoming increasingly challenging.

Goldman Sachs forecasts the stock market will yield a modest 3% annual return over the next decade. After accounting for inflation, traditional investors will be fortunate to simply break even.

If that approach suits you, that’s fine. But for those seeking a different path where wealth-building remains within reach, this offer could open a new chapter of your financial life.