The global race for rare earth minerals is heating up — and one revolutionary breakthrough could flip the script for American manufacturing, automotive giants, and savvy investors alike. At the center of this buzz is the “Rare Earth Killer” U.R.E. Magnet, unveiled in a high-profile report by Ian King, Chief Strategist at Strategic Fortunes.

King claims Tesla is ready to adopt a “Universal Rare Earth” (U.R.E.) magnet that could eliminate the need for China-dominated rare earths, potentially triggering a $3 trillion industrial revolution and unleashing a wave of profit opportunities for early investors. But is this headline-grabbing innovation truly legit, or just another overhyped investment trend? In this deep-dive we’ll break down the science, the supply chain crisis, Ian King’s thesis, the companies involved, and the red flags every smart investor should weigh before betting on this rare earth revolution.

We’ll analyze:

-

What are rare earth magnets and why are they so critical for technology?

-

How did China gain control over the global supply, and what risks does that create?

-

What exactly is Ian King’s U.R.E. magnet thesis, and how credible is it?

-

Which U.S. companies could profit — and what evidence supports their potential?

-

Is the $3 trillion figure realistic, or marketing hype?

-

How should investors evaluate King’s claims and the bigger opportunity?

Whether you’re looking for the next tech megatrend or simply want to make sense of the market’s latest buzz, read on for a no-nonsense, evidence-based guide to the U.R.E. magnet debate.

The U.R.E. Magnet Hype Meets Real-World Physics and Markets

The race to reduce America’s dependence on China-controlled rare earth magnets is shaping up as one of the most consequential industrial shifts of the decade. At the center of this narrative is a provocative thesis from Ian King, Chief Strategist of Strategic Fortunes: a “Universal Rare Earth” — U.R.E. — magnet made from abundant U.S. materials that could displace neodymium-based magnets in high-performance applications like EV motors, robotics, and energy systems.

According to King’s “Rare Earth Killer” report, a $3 trillion industrial revolution could follow, unlocking life-changing gains for early investors. Tesla is positioned as the spark: the company has publicly stated it aims to remove rare earths from future drivetrains, and speculation suggests a new magnet platform plus motor/control-system innovations could make that feasible. Add in U.S. reshoring incentives, defense concerns, and a global EV adoption curve, and you get a combustible mix of science, policy, and profit.

But is the U.R.E. magnet a credible breakthrough or just a cleverly packaged marketing hook? In this deep-dive, we’ll separate physics from promos, outline how a non-rare-earth magnet would actually achieve EV-grade performance, evaluate the commercial path, and map investable opportunity sets and risks. If you’re weighing this thesis for your portfolio or content strategy, use this guide as your field manual.

Rare Earth Magnets 101: Why They Matter and Where They Dominate

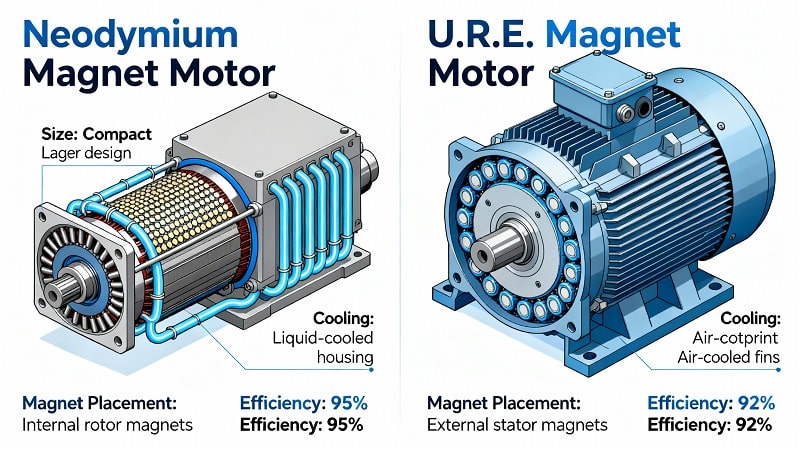

Rare earth magnets — most prominently neodymium-iron-boron (NdFeB), often doped with dysprosium or terbium for high-temperature stability — deliver the highest magnetic energy density of any commercially available permanent magnet. That translates into higher torque density in motors, smaller and lighter devices, more efficient power usage, and better performance under demanding thermal loads (with proper doping and design).

Applications extend across electric vehicles, where permanent-magnet motors deliver superior efficiency and power density; renewable energy, where wind turbines and industrial drives rely on high-performance magnets; consumer electronics, including speakers, haptics, and miniaturized actuators; and aerospace and defense, where guidance, actuation, and positioning systems require exceptional coercivity and reliability.

Yet challenges abound: heat tolerance is a critical constraint, supply chain concentration exposes industries to systemic risk, and material price volatility can ripple through manufacturing costs for critical sectors.

China’s Rare Earth Dominance: How We Got Here and Why It Matters

China’s vertical investment across mining, separation, and magnet production established a global choke point. By controlling capacity and underpinning costs, China can influence material flow, pricing, and policy outcomes. Any interruption, export quota, or shift in industrial strategy can disrupt global supply and pricing.

Building new capacity outside China is costly and slow, especially in chemical separation and scaled magnet manufacturing. Even with new mining, bridging the production capability gap will take years. Hence, the appeal of either designing out rare earths or replacing them with domestically abundant alternatives.

Tesla’s Rare Earth Pivot: Design Around or Replace the Magnet?

Tesla has signaled its intention to eliminate rare earths from future vehicle drivetrains. There are two logical routes: switching to motor architectures like induction or synchronous reluctance motors, or innovating a permanent magnet from common materials such as ferrites or manganese-based alloys.

Ultimately, what matters is system-level performance — not just the strength of the magnet, but how motor design, inverter technology, and cooling can offset material limitations. Recent advances in silicon carbide (SiC) inverters and field-oriented control mean that even slightly less powerful magnets can achieve elite efficiency and torque if the overall design is optimized.

Tesla’s choices influence the broader automotive and energy spaces. Rare-earth-free designs would push supply chains and suppliers to innovate and scale, with enormous downstream impacts.

Ian King’s “Rare Earth Killer” U.R.E. Magnet: The Thesis in Plain English

Ian King’s report pitches the emergence of a Universal Rare Earth (U.R.E.) magnet — a new class of rare-earth-free or rare-earth-minimized magnet intended to replace the five most critical rare earth elements across EV, industrial, and high-performance sectors, making Tesla the early adopter and catalyst.

For the U.R.E. to succeed, it needs to hit “good enough” magnetic performance standards, withstand high automotive temperatures, be scalable in domestically reliable supply chains, and secure lasting OEM partnerships. This would unlock big wins for magnet manufacturers, materials suppliers, electronics firms, and investors with positions in these ecosystems.

Can the U.R.E. Really Unlock a $3 Trillion Revolution?

The $3 trillion figure refers to cumulative value creation across EVs, industrial drives, robotics, electronics, and energy infrastructure over a decade or longer, if a credible non-rare-earth magnet achieves scale.

The likely road map is phased: first piloting in segments where increased magnet size or weight is not as critical, followed by industrial drives and finally automotive traction motors once reliability at high temperature and durability is proven.

Investors should expect a multi-year process — not an overnight shift.

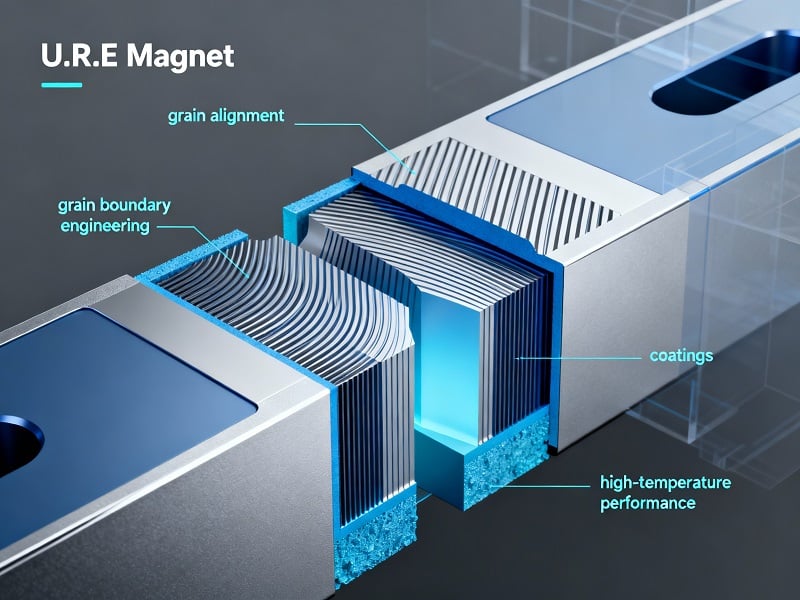

The Science: Ferrite, MnAl, MnBi, and Hybrid Designs

Ferrite magnets are cheap, abundant, and stable, but traditionally too weak for the highest-performance roles. Current research focuses on aligning nanostructures, engineering grain boundaries, and improving density, along with innovative coatings for corrosion and heat.

Manganese-based magnets (MnAl, MnBi) offer theoretical hope, especially MnAl in its tau-phase, but there are real-world challenges stabilizing these materials at scale and through standard manufacturing processes. Hybrid and composite designs, using clever engineering and new binding approaches, may also deliver future breakthroughs.

The critical challenge: consistently high coercivity and BHmax — the metrics that determine a magnet’s usable power and resistance to demagnetization at the elevated temperatures EVs generate.

Patent Clues and Engineering Breadcrumbs to Watch

Industry insiders track patents for new magnet compositions, process techniques for alignment and grain orientation, breakthrough coatings, and entire systems (such as new motor geometries or inverter controls) optimized to get the most out of abundant-material magnets.

Signals that a breakthrough is real include announcements of pilot lines, OEM qualification, public release of performance and reliability data, and major capital expenditures or government incentives for domestic production.

The Ecosystem: Who Could Benefit If U.R.E. Scales?

Winners could include advanced ferrite or manganese-based magnet suppliers, specialty powder, binder, and coating companies, sintering and hot-deformation equipment vendors, and the makers of advanced inverters and power electronics.

On the value chain front, any company reshoring magnet or component capacity to the U.S. or allied nations, and those providing testing, quality, and performance analytics, may benefit from the ecosystem’s expansion.

Inside Ian King’s “Profit Trilogy”: What It’s Promising

King’s “Rare Earth Killer” report stack presents three key investment angles:

-

The first report spotlights a U.S. supplier poised to deliver the new magnet material and become a central player in the market, with massive upside potential.

-

The second highlights a leading semiconductor manufacturer enabling the necessary control systems and power electronics for rare-earth-free architecture.

-

The third picks a small-cap chip innovator supplying critical devices for next-gen Tesla and space technologies.

Readers and investors are encouraged to focus not on headline multiples but on underlying signals and real business milestones, such as pilot programs and OEM endorsements.

Risks: The Questions You Must Answer Before You Invest

There are clear technical, commercial, and financial risks, including the possibility that even improved ferrites or manganese-based magnets won’t match neodymium’s coercivity or durability at high temperature; that production won’t scale efficiently; and that qualification for high-stakes, volume automotive use will take longer than anticipated.

Competition from incumbent magnet producers, emerging hybrid solutions, and continued price volatility in rare earth markets all add more complexity. There’s also a real possibility of fragmented market structure and aggressive IP litigation, which could slow innovation or raise costs.

Due Diligence Checklist: Turning Hype into a Testable Thesis

Practical due diligence means benchmarking technical progress (magnetic performance, high-temperature resilience, reliability), charting commercial signals (pilot lines, customer validation), understanding capex plans and policy incentives, and structuring your investments using a balanced core-and-satellite portfolio.

Track the well-capitalized players moving from lab breakthrough to industrial pilot; watch for public data and announced OEM agreements; and adjust risk sizing as milestones appear.

Conclusion: Is Ian King’s U.R.E. Magnet Legit?

An abundant-material, rare-earth replacement for automotive and industrial magnets is both a compelling vision and a legitimate technical goal. Early proof-of-concept results, alignment from Tesla and other OEMs, and real capital expenditure on pilot capacity all bodes well. But true industry disruption takes time, scale, and repeated, high-stakes validation.

For investors, the prudent approach is skepticism balanced by opportunity: track patents and pilot announcements, monitor OEM buy-in, and construct diversified, milestone-gated positions. A measured, evidence-based commitment gives you upside as the thesis advances—and protects you if timelines extend or technical hurdles prove insurmountable.

Frequently Asked Questions About Ian King’s U.R.E. Magnet and Rare Earth Investing

What is the U.R.E. magnet?

The U.R.E. (Universal Rare Earth) magnet is a proposed new class of permanent magnet made from abundant materials like ferrite or manganese alloys instead of rare earth elements. The concept aims to replace neodymium-based magnets in high-performance applications such as EV motors, while reducing dependence on China’s supply chain.

Who is Ian King and what is his “Rare Earth Killer” report?

Ian King is the Chief Strategist at Strategic Fortunes, a financial research and investment advisory service. His “Rare Earth Killer” report claims that a U.R.E. magnet breakthrough could trigger a $3 trillion industrial revolution, and he identifies specific companies positioned to benefit from this shift.

Can ferrite magnets really replace neodymium in electric vehicles?

Historically, ferrite magnets have been too weak for EV traction motors. However, recent advances in nanostructuring, grain-boundary engineering, improved coatings, and system-level motor design combined with advanced power electronics (like SiC inverters) could close the performance gap for certain applications.

Why are rare earth magnets so hard to replace?

Rare earth magnets like neodymium-iron-boron (NdFeB) offer unmatched magnetic energy density, coercivity, and high-temperature stability. Any replacement must match or approximate this performance not just in the lab, but in real-world conditions including heat, vibration, and long-term durability—all while being cost-competitive at scale.

Why does China dominate the rare earth market?

China invested heavily across the entire rare earth value chain—from mining and chemical separation to magnet manufacturing—over several decades. This vertical integration gives China control over supply, pricing, and export policies, creating a strategic choke point for global industries.

What would it take for the U.R.E. magnet to succeed commercially?

Success requires achieving “good enough” magnetic performance for EV and industrial use, demonstrating high-temperature stability and reliability, scaling up domestic manufacturing capacity, securing OEM partnerships and design-ins, and passing multi-year automotive qualification processes.

Is the $3 trillion market opportunity realistic?

The $3 trillion figure represents cumulative value creation across multiple industries—EVs, renewable energy, industrial drives, consumer electronics, robotics, aerospace, and defense—over a decade or more. While theoretically plausible if adoption is widespread, investors should be cautious about aggressive timelines and recognize that such transformations typically unfold over many years.

What are the signs that the U.R.E. thesis is real and progressing?

Key proof points include: announcements of pilot production lines with capacity targets, OEM qualification milestones and design-in wins, publication of performance and reliability data (especially high-temperature coercivity and demagnetization curves), capital expenditures for domestic magnet production facilities, and government incentives or partnerships supporting rare-earth alternatives.

What companies could benefit from a U.R.E. magnet breakthrough?

Potential beneficiaries span the ecosystem: advanced magnet manufacturers developing ferrite or Mn-based materials, specialty powder and coating suppliers, sintering and hot-deformation equipment makers, semiconductor firms producing SiC inverters and motor control chips, motor manufacturers specializing in non-rare-earth designs, and companies building out U.S. or allied-nation supply chains.

What are the main investment risks?

Risks include technical underperformance (magnets not meeting EV-grade standards), manufacturing scale-up challenges, extended OEM qualification timelines, competition from incumbent magnet producers and hybrid solutions, fragmented market adoption, intellectual property disputes, and the possibility that marketing timelines significantly overstate near-term commercial readiness.

How should I evaluate and invest in this opportunity?

Use a milestone-based approach: track patent filings and pilot announcements, monitor OEM partnerships and qualification updates, follow capex deployment and policy incentives, and build a diversified portfolio with core positions in established suppliers and satellite positions in emerging players with credible technology and traction. Adjust sizing as evidence accumulates.

What is Tesla’s role in the U.R.E. story?

Tesla has publicly stated its goal to eliminate rare earths from future drivetrains. Whether through motor architecture changes (induction/reluctance) or new magnet materials, Tesla’s adoption would validate the technology and likely accelerate broader industry adoption, making it a critical catalyst in Ian King’s thesis.

When might we see U.R.E. magnets in production vehicles?

Realistic timelines span multiple years: initial pilots and testing in less demanding applications, followed by industrial drives, and finally automotive traction motors once durability is proven. Automotive qualification alone typically takes 2–4 years, so investors should expect a phased rollout rather than an overnight transformation.

Are there alternatives to U.R.E. magnets for reducing rare earth dependence?

Yes. Alternatives include switching to induction or synchronous reluctance motors that don’t use permanent magnets, improving recycling and recovery of rare earths from end-of-life products, diversifying mining and processing capacity outside China, and developing hybrid motor designs that reduce (but don’t eliminate) rare earth content.

Where can I learn more about Ian King’s investment recommendations?

Ian King’s detailed stock picks and research are available through a subscription to Strategic Fortunes. The service includes monthly newsletters, model portfolios, trade alerts, and special reports including the “Rare Earth Killer” trilogy. Prospective subscribers should review the terms, pricing, and guarantee before committing.