Ian King’s Private SPAC Portfolio Extended Webinar is where Ian is going live to reveal his new strategy for targeting one of the hottest investments in the market – SPACs – also known as Special Purpose Acquisition Companies.

What Is Ian King’s Private SPAC Portfolio Extended Webinar?

On Tuesday, November 9 at 1 p.m. ET, renowned former hedge fund manager Ian King will be holding a highly anticipated event: Ian King’s Private SPAC Portfolio Extended Webinar.

For the past 18 months…

Hundreds of the fastest-moving private companies in the world have been completely sidestepping traditional IPOs.

Instead, they’re choosing to go public through a SPAC deal…

And they’re doing it at an incredible pace.

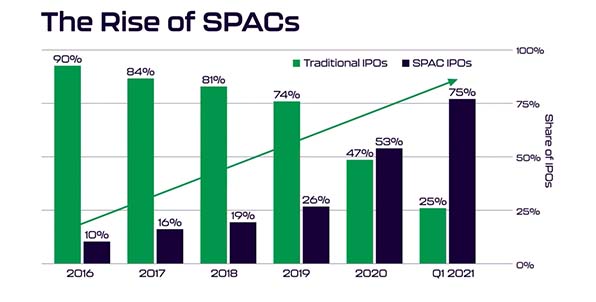

While the number of traditional IPOs has declined since 2016…

The number of SPAC IPOs has skyrocketed. And they’re churning out some of the market’s biggest winners like…

- 502% in a little over a year and a half on Virgin Galactic…

- 527% in 10 months on DraftKings…

- And 1,227% in just four months on QuantumScape.

That’s why SPACs are drawing the attention of some of Wall Street’s elite investors like…

- The founder of Virgin Group, billionaire Richard Branson…

- Co-founder of PayPal and early investor in Facebook, Peter Thiel…

- Famed fund manager and activist investor, Bill Ackman…

Over the last year, SPACs have dished out some of the highest gains in the market…

That’s why on November 9, 2021, Ian is going LIVE with a special extended webinar…

Meet Ian King

Ian King is a former hedge fund manager with over two decades of experience trading and analyzing the financial markets.

His market insights have been featured on Fox Business News, Investopedia, Zero Hedge and Seeking Alpha.

At 21, King started in the mortgage bond trading department at Salomon Brothers. He then spent time honing his skills in trading at Citigroup before spending a decade at New York-based hedge fund Peahi Capital.

While there, his team made a 339% total return in 2008 alone. He is also known as one of Investopedia’s top resourceful contributors.

In 2017, he came to Banyan Hill Publishing to help their readers get ahead of the markets. He currently has four services: Automatic Fortunes, New Era Fortunes, Strategic Fortunes and Next Wave Crypto Fortunes.

When Is Ian King’s Private SPAC Portfolio Extended Webinar?

Ian King’s Private SPAC Portfolio Extended Webinar has been scheduled to take place on Tuesday, November 9 at 1 p.m. ET. It is important to note here that this event has limited spacing, so the sooner one signs up, the more likely they are guaranteed a seat.

Ian King will show you…

- Why SPACs offer the best “pre-IPO” opportunities for individual investors. While handling billion-dollar debt offerings for Citigroup, Ian got a firsthand look at the IPO process. It’s not what most people think it is. He’ll explain exactly how IPOs are designed to benefit Wall Street — and how SPACs are leveling the playing field for smaller investors.

- The top benefits of SPACs like: Attractive Pricing, the “Profit Trigger” Event and the initial Money Back Guarantee that is written into every SPAC deal. SPACs skyrocketed in 2020 because of continuous improvements in investor protections. By being able to identify these critical elements, you’ll have the opportunity to realize gains as high as 1,000% in as little as the next 12 months.

- The exact strategy Ian uses to target the SPACs with the highest profit potential. Don’t be fooled by D-list celebrities, ex-pro athletes and politicians putting their names on SPACs. Ian will give away his private strategy for finding the right SPACs to invest in now.

- Why you can’t just go out and buy any SPAC to get the most out of this epic run. There are more than 700 private companies sitting on the IPO sidelines. All told they’re worth over $2.3 trillion. And many of them will choose to go public via a SPAC merger. Ian put together this extended webinar to make sure his readers know the benefits and the potential pitfalls associated with SPACs. You’ll get both in this presentation.

- An opportunity to save BIG on our latest research. You could go out and invest in these exciting opportunities on your own. But if you don’t know what to look for, retail investors could be putting their fortunes and futures in danger. That’s why at the end of this extended webinar, you’ll have the chance to get details on three of Ian’s favorite SPACs to invest in right now.

How To Sign Up for Ian King’s Private SPAC Portfolio Extended Webinar?

To get access to Ian King’s Private SPAC Portfolio Extended Webinar, all individuals have to do is enter their respective emails here.

Closing Remarks On Ian King’s Private SPAC Portfolio Extended Webinar

Right now, there are over 700 private companies — worth more than $2.3 trillion combined — that could soon list their shares on major indexes…

Including companies like…

- SpaceX

- Epic Games

- And Stripe

Many of them will choose to go public through a “new” investment vehicle…

That allows anyone to invest before the IPO.

That’s why on Tuesday, November 9 at 1 p.m. ET, tech expert Ian King is going LIVE with a special extended webinar.

He’ll show you why these new investment vehicles provide the best “pre-IPO” opportunities for individual investors.

Give you details on his new portfolio of “pre-IPO” stocks to invest in now for around $10 a share and reveal the built-in “profit trigger” that could send each of these stocks soaring, before they go public…