The stock market used to feel like a members-only club. You needed a fancy broker, a suitcase of cash, and a decoder ring to understand terms like “P/E ratios” or “ETF.” But now it isn’t just for guys on Wall Street. Today, you can start building a portfolio from your couch, in pajamas, with as little as $100.

This isn’t about timing the market or picking “the next big thing.” It’s about taking small, smart steps to grow your savings—whether you’re saving up for a house, a side hustle, or finally replacing that laptop. Let’s break down how to buy stocks online in simple easy steps.

1. Define Your Investment Goals

Before you dive into stock purchases, get clear on why you’re investing:

- Time Horizon

- Short-term (1–3 years): May favor less volatile investments.

- Medium-term (3–10 years): Balancing growth and stability.

- Long-term (10+ years): Riding out market cycles for maximum growth.

- Risk Tolerance

- Consider how much volatility you can stomach. Stocks can swing widely in value, so be honest about how much you can tolerate without panicking.

- Financial Objectives

- Retirement savings, buying a home, funding education, or generating passive income. Each goal may suggest a different portfolio mix.

Setting clear goals informs every subsequent decision—how much to invest, what kinds of stocks to choose, and how long to hold them.

2. Educate Yourself on Stock Market Basics

A foundational understanding of investing terms and concepts empowers smarter choices:

- Stock: A share of ownership in a company.

- Dividend: A portion of a company’s profits paid to shareholders.

- Market Order vs. Limit Order:

- Market Order: Buys/sells immediately at current market price.

- Limit Order: Executes only at or better than a specified price.

- Portfolio Diversification: Spreading investments across industries and asset classes to reduce risk.

- Bull vs. Bear Market: A bull market rises over time; a bear market declines.

Many brokerages offer free educational resources. Consider online courses, investment blogs, and beginner books.

3. Understand Fees, Taxes, and Account Types

Investment returns can be eroded by hidden costs and taxes. Familiarize yourself with:

- Trading Commissions: Many brokers today offer commission‑free trading, but always check for fees on certain orders or less‑common securities.

- Account Maintenance Fees: Some platforms charge annual or inactivity fees.

- Taxes on Gains:

- Short‑term capital gains (holding ≤1 year) are taxed as ordinary income.

- Long‑term capital gains (holding >1 year) enjoy lower rates in many jurisdictions.

- Account Types:

- Taxable Brokerage Account: No contribution limits, flexible withdrawals, but taxable gains and dividends.

- Retirement Accounts (e.g., IRA, 401(k) in the U.S.): Tax advantages but may have withdrawal penalties before a certain age.

Selecting the right account type and understanding fee structures helps you maximize net returns.

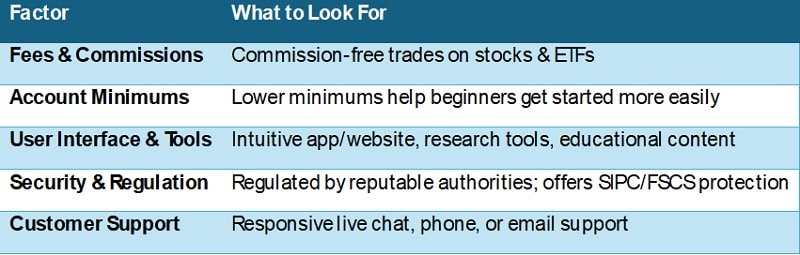

4. Choose an Online Brokerage

Selecting a broker is one of the most important decisions:

Read reviews, compare fees, test demo accounts, and choose a platform that fits your needs and comfort level.

5. Open Your Brokerage Account

Once you’ve selected a broker, the account‑opening process typically involves:

- Online Application

- Provide personal details: name, address, date of birth, Social Security/ID number.

- Verify Identity

- Upload government‑issued ID (passport, driver’s license) and proof of address.

- Agree to Terms

- Review and accept account agreements, margin disclosures, and fee schedules.

- Link Bank Account

- For funding and withdrawals, securely link your checking or savings account.

Most brokers approve applications within 1–3 business days. Once approved, you’ll receive login credentials to access your trading dashboard.

6. Fund Your Account

To place trades, you must first deposit funds:

- ACH Transfer (U.S.) or SEPA (Europe): 1–3 business days.

- Wire Transfer: Faster but usually carries fees.

- Check Deposit: Slower; may take up to a week.

- Instant Deposit Options: Some brokers allow instant access to a portion of your funds.

Begin with an amount you’re comfortable investing—many suggest starting with as little as $100–$500 to learn the ropes without taking on too much risk.

7. Research Stocks to Buy

A disciplined research process can help you pick stocks aligned with your goals:

- Fundamental Analysis

- Study financial statements (income statement, balance sheet, cash flow).

- Key metrics: Price-to-Earnings (P/E) ratio, Earnings Per Share (EPS), Return on Equity (ROE).

- Industry & Market Trends

- Consider sector growth prospects and macroeconomic factors.

- Use industry reports and news sources.

- Analyst Ratings & Reports

- Many brokers provide analyst consensus ratings (Buy, Hold, Sell).

- Read reports to understand competitive positioning and risks.

- Technical Analysis (Optional)

- Chart patterns, support/resistance levels, and moving averages for timing entries/exits.

- Diversify

- Avoid “putting all your eggs in one basket.”

- Aim for a mix of growth stocks, dividend‑payers, and different sectors.

Keep a watchlist of 10–20 stocks to track performance and news.

8. Place Your First Trade

With research done and account funded, you’re ready to buy:

- Select the Ticker Symbol

- Enter the company’s unique trading symbol (e.g., AAPL for Apple Inc.).

- Choose Order Type

- Market Order: Executes immediately at the best available price.

- Limit Order: Sets a maximum purchase price; only executes if the market reaches that price.

- Stop Order: Becomes a market order once the stock hits a specified “stop” price.

- Specify Quantity

- Full shares vs. fractional shares (if your broker offers them).

- Review & Submit

- Double‑check ticker, order type, quantity, and estimated cost.

- Confirm and submit your order.

- Order Confirmation

- You’ll receive a notification when the trade executes. Check your portfolio to see your new position.

9. Monitor and Manage Your Portfolio

Buying is just the beginning. Ongoing management includes:

- Regular Reviews

- Quarterly (or monthly) check‑ins on each holding’s performance and fundamentals.

- Rebalancing

- If one stock or sector grows too large relative to your plan, sell portions to maintain your target asset allocation.

- Stay Informed

- Follow earnings reports, dividend declarations, and relevant news.

- Use watchlists and price alerts to track significant movements.

- Tax Optimization

- Harvest losses to offset gains, where applicable.

- Consider holding winners long enough for long‑term capital gains treatment.

- Emotional Discipline

- Avoid impulsive trading based on market noise. Stick to your strategy unless fundamentals change.

10. Common Mistakes to Avoid

- Chasing Hot Tips

- Don’t buy based solely on rumors or “next big thing” stories.

- Overtrading

- Frequent buying/selling increases costs and can hurt returns.

- Neglecting Diversification

- Too much exposure to one stock or sector heightens risk.

- Ignoring Fees

- Small per‑trade fees or inactivity charges can add up over time.

- Letting Emotions Drive Decisions

- Fear and greed can lead to poor timing. Use predefined rules for buying and selling.

Conclusion

Investing doesn’t have to be scary or confusing. Starting your investing journey by buying stocks online is straightforward once you break it down into clear steps: define your goals, educate yourself, choose the right broker, open and fund your account, conduct thorough research, place orders wisely, and monitor your portfolio with discipline. Yes, you’ll make mistakes, but time and consistency are your secret weapons.

Frequently Asked Questions

How much money do I need to start investing?

Many apps let you start with $5 or less. Fractional shares mean you can buy a slice of expensive stocks (think Amazon or Google) without needing thousands upfront.

Is investing risky?

Yes, all investments carry risk, but you can minimize it by:

- Starting small: Learn as you go without betting the farm.

- Diversifying: Don’t put all your money in one stock.

- Thinking long-term: Markets rise and fall—don’t panic-sell over a bad week.

How do I pick which stocks to buy?

Don’t stress about being Warren Buffett 2.0. Start simple:

- Avoid FOMO-driven “hot tips” from Reddit. Slow and steady wins.

- Invest in companies you understand and use (e.g., your go-to coffee chain or tech brand).

- Consider low-cost index funds or ETFs (they’re like pre-made stock baskets).

Are there fees?

Some platforms charge fees for trades or accounts, but many (like Robinhood, Webull, or Fidelity) offer $0 commission trades. Always check the fine print—hidden fees love to hide.

How much time do I need to spend?

As much as you want. If you’re busy, set up automatic investments (like $20/week into an ETF) and check in quarterly. If you enjoy it, dive deeper—but don’t let it become a second job.

Can I lose all my money?

Diversification can protect you. Even if one company tanks, others may balance it out. That said, never invest money you can’t afford to lose.

When should I sell?

Not every dip is a disaster. Sell if:

- The company’s fundamentals change (e.g., scandals, declining sales).

- You’ve hit a financial goal (like saving for a down payment).

- You need the cash urgently (try to avoid this).

What’s the difference between a brokerage account and a retirement account?

- Brokerage account: Use it anytime, no withdrawal penalties. Taxes apply on profits.

- Retirement account (IRA, 401(k)): Tax perks, but penalties if you withdraw before age 59.5. Better for long-term goals.

How do I track my investments?

Most apps show your portfolio’s performance in real-time. For a bigger picture, use free tools like Yahoo Finance or Google Finance to monitor trends.

What if the market crashes?

First, breathe. Crashes are normal. If you’re investing for the long haul, stay calm and keep buying. Stocks tend to recover over time—panic-selling locks in losses.