Every investor dreams of it. Catching the one stock before it takes off. Getting in on Amazon back when it was “just an online bookstore.” Or Tesla when Wall Street mocked it as a failing car startup.

That single decision could have changed everything. $1,000 in Amazon’s IPO is now worth more than $1.5 million. A $5,000 stake in Tesla a decade ago is a small fortune today.

The truth? There is a repeatable way to spot these winners early. The challenge is filtering through the noise, ignoring the skeptics, and recognizing the few signals that separate true disruptors from short-lived hype.

This guide will show you how.

Key Takeaways

-

Big winners follow repeatable patterns. Companies like Amazon, Tesla, Apple, and Netflix weren’t lucky—they shared signals that investors can still recognize today.

-

Look for megatrends. Every breakout stock is powered by a massive, irreversible global shift.

-

Expect early skepticism. If Wall Street already loves it, the life-changing returns are usually gone.

-

Scalability is the secret weapon. Winners don’t just sell products—they build platforms that expand into multiple markets.

-

You don’t need dozens of winners. One or two “Amazons” in your portfolio over a decade can change your financial life.

-

Shortcut available. Jeff Brown’s Near Future Report helps investors zero in on these companies before they hit the mainstream.

Now let’s dive deeper into how you can recognize the next Amazon or Tesla before everyone else does—and position yourself for the kind of gains that can reshape your future.

The Million-Dollar Question

Every serious investor eventually asks the same thing: “If I could go back in time, what stock would I buy?”

The answers are predictable: Amazon, Tesla, Apple, Netflix, Nvidia.

And it’s true. Catching just one of those early winners can be life-changing. But hindsight is useless if you don’t know how to apply it.

The real question isn’t “What would I have bought?” It’s “How do I spot the next one?”

That’s what separates dreamers from doers in the market.

I’ve spent decades in the markets—watching people dismiss the companies that went on to change the world. I remember hearing colleagues laugh at Amazon’s “silly” online bookstore model. I remember seasoned investors shorting Tesla, convinced it was going bankrupt.

They weren’t dumb people. They were just blind to the repeatable signals of true disruptors.

And here’s the good news: those signals can be learned.

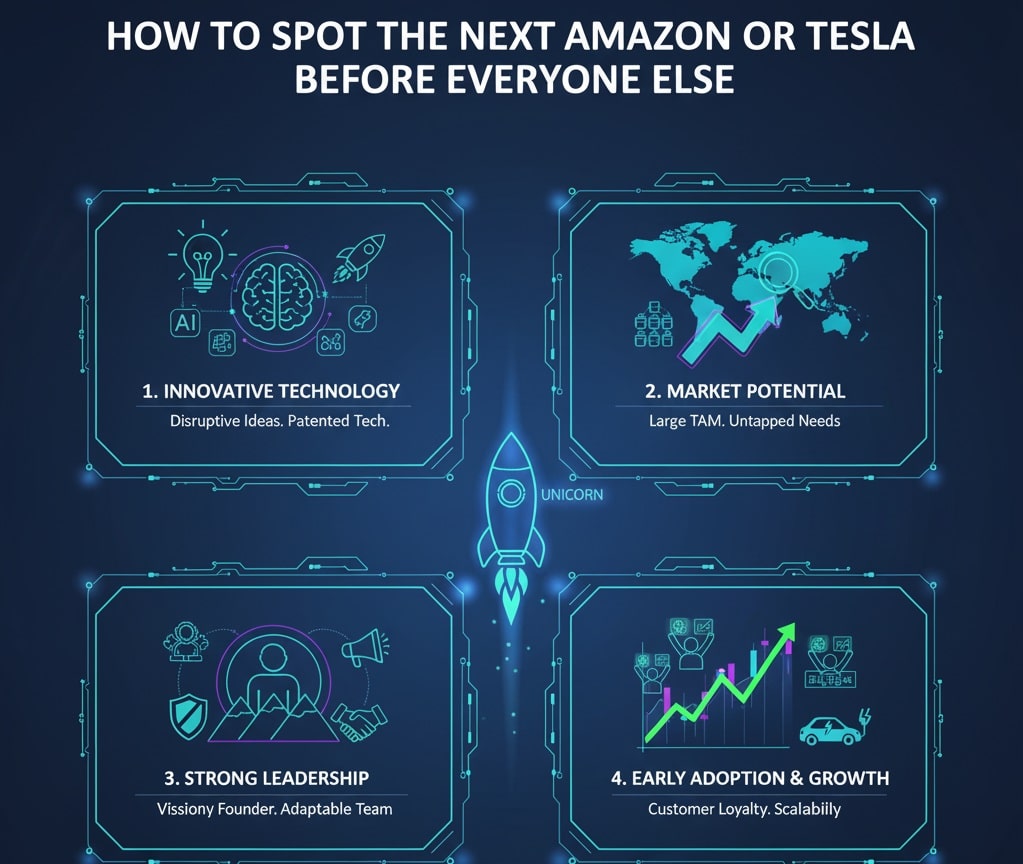

The 3 Signals of a Breakout Stock

The biggest winners of the past 30 years weren’t accidents. They all followed a repeatable blueprint. If you can learn to recognize these signals, you give yourself a massive advantage over 99% of investors.

They Ride an Unstoppable Megatrend

Every generational stock is powered by something bigger than itself.

- Amazon was never about books—it was about the rise of e-commerce.

- Tesla wasn’t about cars—it was about clean energy and the electrification of transportation.

- Apple wasn’t about MP3 players—it was about the shift to a mobile-first world.

The biggest winners plug into global, irreversible shifts in technology and consumer behavior. These aren’t fads. They’re movements that reshape entire industries.

Investor lesson: Before you buy into a stock, ask yourself: Is this company tied to a megatrend? Or is it just chasing a temporary fashion?

They Look “Laughable” in the Early Days

When Amazon IPO’d in 1997, the headlines mocked it as “Amazon.bomb.” When Tesla rolled out the Model S, major publications called it “a niche car company destined to fail.” When Netflix shifted from mailing DVDs to streaming, the consensus was that no one would pay to watch videos online.

The truth? Skepticism is a feature, not a bug. The best opportunities always look a little crazy before they look brilliant.

Investor lesson: If everyone already loves a stock, you’re too late.

They Scale Beyond a Single Product

This is where the magic happens.

Amazon scaled from books to electronics, groceries, cloud computing, entertainment, and logistics. Tesla scaled from one luxury car to mass-market EVs, solar panels, batteries, and AI-driven software. Apple scaled from iPods to iPhones, iPads, services, and a complete ecosystem of devices.

The biggest winners don’t just create products. They build platforms.

Investor lesson: When you’re evaluating a company, don’t just ask what they sell today. Ask what platform they’re building for tomorrow.

Putting It All Together

When you combine these three signals—megatrends, early skepticism, and scalability—you get the DNA of a generational stock.

The challenge is separating these rare gems from the thousands of companies that never make it past hype.

And that’s where the case studies come in.

Case Study #1: Amazon — From “Online Bookstore” to Empire

When Amazon went public in 1997, its IPO price was $18 a share. Adjusted for splits, that’s about 7 cents today.

Think about that: $1,000 invested at IPO is worth over $1.5 million right now.

And yet, in those early days, Amazon was dismissed as a joke. The press called it “Amazon.bomb.” Analysts insisted brick-and-mortar giants like Barnes & Noble would crush Jeff Bezos’s little startup.

But Bezos wasn’t building a bookstore. He was building the backbone of e-commerce.

-

Megatrend: The internet was rapidly connecting consumers and businesses. Shopping habits were about to move online.

-

Skepticism: Wall Street laughed. Even after Amazon grew beyond books, many called it “unprofitable” and “unsustainable.”

-

Scalability: Amazon scaled into electronics, clothing, groceries, streaming, advertising, and the most profitable of all — Amazon Web Services.

Investor takeaway: Don’t buy a company for what it is today. Buy it for the massive market it’s about to unlock.

Case Study #2: Tesla — From Bankruptcy Fears to EV Dominance

In 2008, Tesla was weeks away from running out of cash. Elon Musk admits he had to borrow money from friends to make payroll.

The stock was so hated that short sellers piled on in record numbers. Wall Street called Tesla “a niche car company” destined to collapse.

Fast-forward to today: Tesla is worth hundreds of billions. It single-handedly forced the global auto industry to shift toward electric vehicles.

What changed?

-

Megatrend: The world’s pivot to clean energy and electrification.

-

Skepticism: Investors couldn’t believe a startup could compete with Ford, GM, Toyota, or Volkswagen. They thought EVs were toys.

-

Scalability: Tesla went from a luxury sports car to mass-market sedans, SUVs, trucks, battery storage, solar panels, and AI-powered software.

Investor takeaway: The best investments usually look impossible at first.

Case Study #3: Netflix — From DVD Mailer to Streaming Giant

Remember when Netflix mailed DVDs in red envelopes?

Back then, Blockbuster dominated video rentals. Analysts laughed when Reed Hastings suggested people would stream movies online.

Fast-forward: Blockbuster is gone. Netflix is a streaming empire worth billions.

Why?

-

Megatrend: Internet bandwidth expanded, making streaming practical.

-

Skepticism: Critics said people would never give up DVDs, and that Hollywood wouldn’t license content.

-

Scalability: Netflix scaled from licensing content to producing its own original shows and movies — a global content empire.

Investor takeaway: Don’t just ask, “Is this practical today?” Ask, “Will the world evolve around this in 5–10 years?”

Case Study #4: Nvidia — From Niche Chips to AI King

Nvidia started as a graphics card company for gamers. Few outside tech circles cared about it.

But behind the scenes, Nvidia was quietly building chips capable of parallel processing — perfect for powering artificial intelligence, data centers, and self-driving cars.

Now Nvidia is the most valuable chip company in the world. Its GPUs are the backbone of the AI revolution.

-

Megatrend: The rise of AI, machine learning, and high-performance computing.

-

Skepticism: For years, Nvidia was “just for gamers.” Few realized its chips would fuel the next industrial revolution.

-

Scalability: From graphics cards to cloud computing, AI data centers, automotive AI, and more.

Investor takeaway: The biggest winners often hide in plain sight, disguised as niche players.

Case Study #5: Apple — The Ecosystem Play

Apple wasn’t always a giant. In fact, it nearly went bankrupt in the 1990s.

Then Steve Jobs returned. The iPod was the breakthrough. But it was the iPhone that changed everything — not just a product, but an ecosystem.

Today Apple is worth over $2 trillion.

-

Megatrend: Mobile computing overtook desktops and changed human behavior forever.

-

Skepticism: At first, the iPhone was mocked as “a toy” too expensive to compete with BlackBerry or Nokia.

-

Scalability: Apple built an ecosystem — iPhone, iPad, Mac, Apple Watch, AirPods, iCloud, App Store, Apple Music, Apple Pay, services.

Investor takeaway: Look for companies that don’t just sell products — they build platforms that keep customers for life.

Why Most Investors Miss Out

So if the signals are so obvious in hindsight, why do most investors miss them in real time?

1. Wall Street Groupthink

Most analysts are rewarded for being “safe,” not for being bold. That means they focus on big, stable companies instead of unproven innovators.

2. Short-Term Obsession

Investors get distracted by quarterly earnings. Amazon was “unprofitable” for years. Tesla was “overvalued” for a decade. Those who focused only on short-term metrics missed the long-term story.

3. Psychological Bias

Humans are wired to resist change. If something looks too different, our instinct is to dismiss it. That’s why disruptive companies often look like jokes at first.

4. Fear of Failure

No one wants to be wrong publicly. It’s easier to criticize a bold new idea than to risk believing in it early.

5. Lack of a System

Most investors don’t have a proven framework to separate hype from true disruption. Without one, it feels like gambling.

Bottom line: The investors who make life-changing gains are the ones willing to go against the crowd — and back their conviction with a system.

How to Spot the Next Amazon or Tesla (and Why Most Investors Hold Back)

The Biggest Objection: “Isn’t It Too Risky?”

Whenever I talk with fellow investors about finding the next Amazon or Tesla, the number one pushback I hear is:

“Sure, those examples are impressive. But how do I know which stock will be the winner? Isn’t it just gambling?”

That concern makes sense. Nobody wants to throw darts at a board and hope for a jackpot. And the truth is, plenty of tech stocks won’t make it. For every Amazon, there were dozens of Pets.com disasters. For every Tesla, there were multiple failed EV startups.

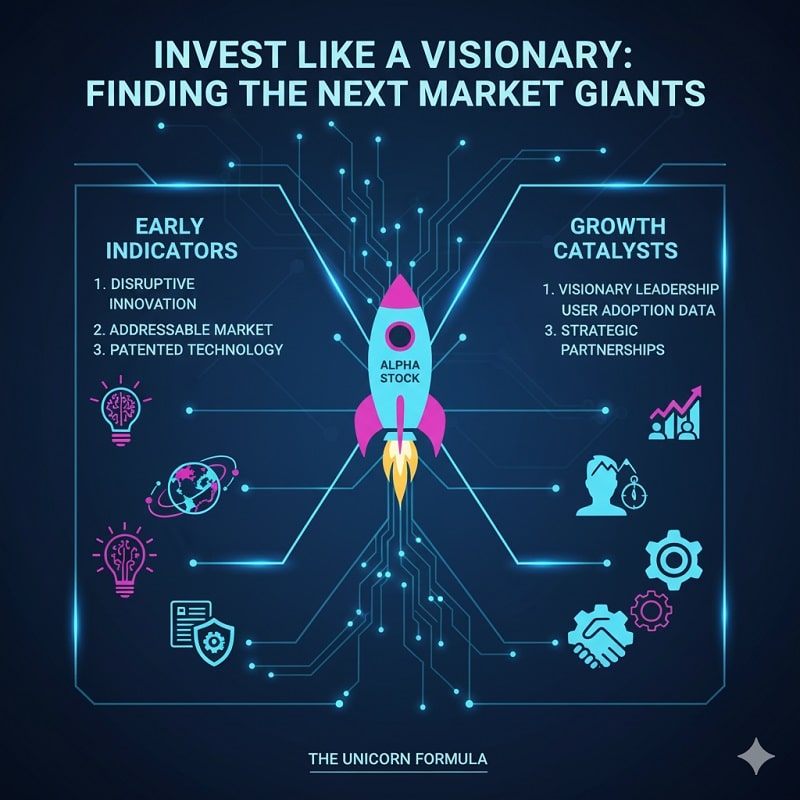

But here’s what most investors misunderstand: spotting the next big winner isn’t about wild guessing. It’s about using a repeatable framework to filter out hype and zero in on the companies positioned for long-term dominance.

How I Learned to Stop Guessing

Early in my investing journey, I made classic rookie mistakes.

I bought into a “hot” solar stock in 2007 because everyone on CNBC was talking about it. Within two years, I’d lost 80% of my money.

I jumped into a trendy 3D printing stock in 2013 thinking it was “the next industrial revolution.” That one got crushed too.

It wasn’t until I started studying pattern recognition — the common DNA of companies like Amazon, Netflix, Apple, and Nvidia — that things changed. I realized winners don’t come from hype. They come from megatrends, visionary leadership, scalable business models, and early adoption curves that snowball.

That’s when I stopped losing sleep and started investing with conviction.

Why Having a System Matters

Without a system, you’re left with two options:

-

Chasing headlines — which usually means buying at the top.

-

Doing nothing — which means missing out altogether.

Both are costly.

But when you have a framework — like the one Jeff Brown developed in his Near Future Report — the game changes.

Jeff isn’t guessing. He’s spent decades in high-tech executive roles, analyzing early-stage companies before they hit mainstream. His system filters through thousands of stocks, identifies the ones with breakthrough potential, and pinpoints the “sweet spot” where risk is low but upside is enormous.

It’s the same approach that could have led you to Amazon in the late 1990s, Tesla in the early 2010s, or Nvidia just a few years ago.

Why Jeff Brown’s Approach Works?

Jeff Brown built the Near Future Report on a simple principle: follow the megatrends, but buy the right companies within them.

-

AI: Everyone knows AI is big. But which AI stocks aren’t overpriced? Jeff finds the ones still under the radar.

-

Biotech: Gene editing and precision medicine will redefine healthcare. Jeff identifies the small-cap innovators, not just the Pfizer’s of the world.

-

5G/6G: The network revolution is still early. Jeff pinpoints the suppliers and chipmakers positioned for massive growth.

-

Blockchain: Beyond crypto speculation, real blockchain infrastructure companies are emerging. Jeff knows where to look.

While most investors chase the “headlines stocks” that everyone’s already talking about, Jeff zeroes in on tomorrow’s leaders before they’re household names.

That’s why his subscribers get a shot at Amazon-like returns before Wall Street catches on.

Why Now Matters

Timing is everything.

Right now, we’re standing at the start of multiple overlapping megatrends:

-

AI adoption is accelerating faster than experts predicted.

-

Biotech breakthroughs are moving from labs into clinics.

-

5G and soon 6G will reshape connectivity, IoT, and cloud.

-

Blockchain infrastructure is being adopted by Fortune 500s quietly but rapidly.

This is the same kind of moment that existed in 1995 with the internet, or in 2007 with smartphones.

The window of opportunity doesn’t last forever. By the time the average investor feels “safe” buying in, the big gains are gone.

That’s why now is the time to position yourself. Not later. Not after CNBC declares “the boom is here.” By then, it’s already too late.

Clear Next Step

Here’s the bottom line:

If you’ve ever looked back at Amazon, Tesla, or Apple and thought, “I wish I’d gotten in early,” then your best move today is to learn Jeff Brown’s framework.

He’s done the homework. He’s built the system. And he’s sharing it with investors through The Near Future Report.

👉 Click here to learn more about Jeff Brown’s Near Future Report.

Don’t wait until the crowd piles in. By then, the biggest profits will already belong to the investors who acted early.

FAQs: How to Spot the Next Amazon or Tesla Before Everyone Else Does

How do I know Jeff Brown isn’t just guessing?

Jeff’s career includes 25+ years as a high-tech executive at companies like Qualcomm and NXP Semiconductors. His system is built on insider-level knowledge of how tech companies succeed — and how they fail.

Aren’t these kinds of stocks risky?

All investing involves risk. But what Jeff does is reduce that risk by identifying companies with strong fundamentals, scalable models, and exposure to megatrends with massive tailwinds.

Why can’t I just buy the big names like Apple or Microsoft?

You can. But the life-changing gains come from getting in early — before a stock is a trillion-dollar giant. Jeff shows you how to spot tomorrow’s leaders at today’s prices.

What if I don’t know much about tech?

That’s the beauty of The Near Future Report. Jeff does the heavy lifting. You don’t have to be a tech expert — you just need to follow his research and recommendations.

Why act now?

Because multiple megatrends are converging at once. AI, biotech, 5G, and blockchain are all accelerating. Waiting until it’s “obvious” means missing the asymmetric upside.