In the fast-paced world of stock market investing, few opportunities capture the imagination like a major corporate transformation. Enter Tesla’s anticipated shift from electric vehicles to robotics, a move that could redefine the company and create trillions in value. At the forefront of this analysis is Rob Spivey, co-founder of a renowned financial think tank, whose service, Hidden Alpha, offers insights into this seismic change. Below, we’ll explore Spivey’s predictionsa and his Ultimate Robotics BUY LIST.

If you’re searching for a Hidden Alpha review or details on the Rob Spivey Ultimate Robotics BUY LIST, you’ve come to the right place. We’ll explore how Tesla’s November 6, 2025, announcement could launch a new era, backed by Spivey’s expert research.

The Dawn of Tesla 2.0: From EVs to Robotics Dominance

Tesla has long been synonymous with electric vehicles, but according to Rob Spivey, that’s about to change dramatically. In his detailed analysis shared through Hidden Alpha, Spivey predicts that on November 6, 2025—during Tesla’s Annual Shareholder Meeting—the company will unveil a “mind-blowing” new product that pivots it away from transportation entirely. This isn’t about self-driving cars or trucks; it’s a leap into robotics, specifically with the humanoid robot Optimus.

Spivey, whose Hidden Alpha service has helped subscribers double their money multiple times, argues that this pivot could create a multitrillion-dollar market. Tesla management itself predicts this new venture will be hundreds of times more popular than their cars, potentially outselling the iPhone by a 5-to-1 ratio.

For those researching ‘Hidden Alpha’, Spivey’s track record is compelling: his firm predicted the 2008 crash, the 2020 COVID bear market, and subsequent rally, with subscribers seeing gains like 785% on past recommendations.

Why robotics? Spivey points to Tesla’s history of scaling production—from 32,000 cars in 2010 to 1.8 million today, a 5,000% increase.

Applying this to robotics could target a $40 trillion market, dwarfing EVs ($4 trillion), solar ($400 billion), and autonomous vehicles ($13 trillion). Elon Musk’s recent actions, including a $1 billion stock purchase and a proposed trillion-dollar pay package tied to robotics milestones, underscore this shift.

In the Hidden Alpha Ultimate Robotics BUY LIST, Spivey highlights how this isn’t just Tesla’s story. Rivals like Apple, Nvidia, Amazon, and Alphabet are racing to catch up, admitting robotics could be “the most impactful and transformational technology the world has ever seen.” Musk’s edge? Tesla’s gigafactories, energy storage, AI prowess via Grok and the Colossus supercomputer, and data from self-driving tech.

Rob Spivey’s Background: From Boston Think Tank to Investor Guru

To understand the value in the Rob Spivey Ultimate Robotics BUY LIST, it’s essential to know the man behind it. Rob Spivey co-founded a financial think tank in Boston 15 years ago, now with global offices. Their work influences top money managers like JPMorgan, Goldman Sachs, BlackRock, and Fidelity. Spivey’s partner, Joel Litman, has lectured at the U.S. Marine War College and presented to the FBI and Pentagon.

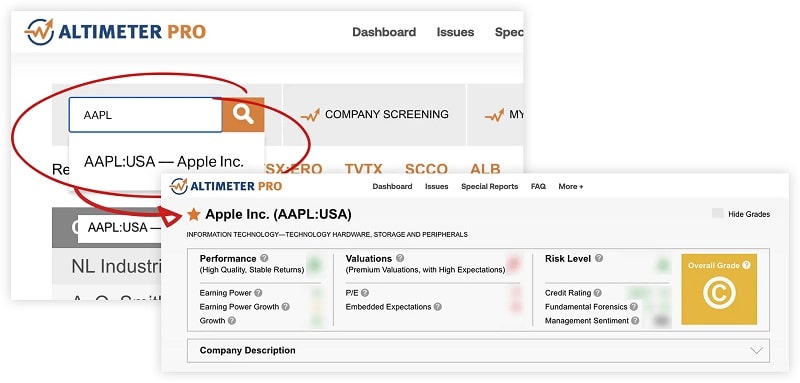

Hidden Alpha, their public-facing service, democratizes this elite research. Using a proprietary system called the Altimeter, they identify top stocks across sectors.

Since 2024, Hidden Alpha subscribers have had 20 chances to double their money, with gains like AppLovin (314.8%), LPL Financial (138.7%), and Texas Pacific Land (136.6%). This Hidden Alpha review wouldn’t be complete without noting their independence—they’re not Tesla fans per se, but data-driven analysts.

Spivey’s focus on Tesla’s pivot stems from months of research. He sees November 6 as a catalyst, where Musk might declare Tesla “all in on robots.” With shares down 50% in early 2025, this could be a “back from the dead” moment, potentially valuing Tesla at $30 trillion—a 3,000% gain.

Optimus: The Key to Tesla’s Trillion-Dollar Future

At the heart of Spivey’s Hidden Alpha Ultimate Robotics BUY LIST is Optimus, Tesla’s 5’8″, 125-pound humanoid robot. Capable of carrying 45 pounds at 5 mph, it’s designed for factory work—boring, tedious, and dangerous tasks. Already deployed in Tesla factories, Optimus could save billions by replacing 10% of the workforce, per Morgan Stanley.

Musk calls it “the biggest product ever,” planning 5,000 units in 2025 and 100,000 in 2026, scaling to 100 million annually. Spivey compares this to Tesla’s EV ramp-up, noting the board’s trillion-dollar incentive for Musk to deliver $7.5 trillion in robotics revenue.

In his Rob Spivey Ultimate Robotics BUY LIST, Spivey emphasizes Tesla’s “secret weapons”: gigafactories for mass production, megapack batteries for energy, self-driving tech for robot intelligence, and AI integration from xAI and Grok. No rival matches this synergy, positioning Tesla to lead a $26-$40 trillion market.

Competitors are scrambling: Apple shuttered its car project for robotics; Nvidia launched Jetson Thor; Amazon deploys warehouse bots; Alphabet invests in partnerships. Venture capitalist Marc Andreessen calls robotics “the biggest industry in history.” Spivey predicts the “Optimus Moment” will mirror the iPhone or ChatGPT launches, sparking a robotics bull market.

The Robotics Boom: Market Potential and Early Winners

Spivey’s research of the sector reveals explosive potential. Robotics isn’t niche—it’s multipurpose, automating tasks across industries. Automated assembly lines cut car production by 88%; Amazon’s bots speed deliveries. Soon, robots will handle home chores, hospital duties, military ops, and more.

Peter Diamandis forecasts robot labor at $10/day (40 cents/hour), disrupting the global economy. Elon envisions 10 billion humanoid robots by 2040. In 2025 alone, 20 robotics stocks doubled or more: Ouster (347%), Ondas (342%), nLIGHT (317%), Joby Aviation (197%), and Symbotic (170%).

Two new robotics ETFs launched this summer, signaling trillions in inflows. Spivey warns this is “first inning”—post-November 6, gains could dwarf these. His Hidden Alpha Ultimate Robotics BUY LIST uses the Altimeter to pinpoint winners, avoiding hype.

The Altimeter System: Hidden Alpha’s Secret Weapon

Central to Hidden Alpha is the Altimeter, a proprietary formula scoring stocks on quality. Backtested over three decades, top-30 picks crush the market. It flagged Meta (1,300% gain), Moderna (2,200%), and AMD (4,200%) early.

During sector booms like COVID’s “At-Home Revolution,” it nailed winners: eXp World (836%), Crocs (589%), RH (587%). For AI, it bullish on Nvidia (188%), Meta (170%), and others. Now, for robotics, it identifies “best of the best.”

Subscribers get monthly picks, a model portfolio (26% average gain vs. market’s 10.7%), and real-time analysis. Testimonials abound: Steven M. says it made him rich; Paul M. booked 735% gains. Risks apply, but results speak volumes.

Inside the Hidden Alpha Reports: What You Get

Subscribing to Hidden Alpha unlocks key reports:

- Inside Tesla’s $30 Trillion Pivot: Forensic analysis of Tesla, including “lie detector” on earnings calls. Similar to a $100,000 report that netted a client $10 million.

- The Ultimate Robotics BUY LIST: Top Altimeter-scored stocks. Beyond Tesla, picks-and-shovels plays supplying chips, sensors, AI to Apple, Microsoft, Meta, Google.

- How To Get Rich In the US of AI: AI stocks poised for robotics convergence (“embodied AI”).

Plus, 12-month Altimeter access and Hidden Alpha monthly service (normally $499/year, discounted trial).

Free Recommendation: Symbotic (SYM) – A Robotics Powerhouse

Spivey shares a free pick: Symbotic (SYM). This warehouse robotics leader serves Walmart, Target, Albertsons. Revenue surged 770% since 2021 ($252M to $2.2B). Traditional metrics show losses, but Altimeter reveals profitability. As robotics scales, SYM is primed to win.

This aligns with Hidden Alpha’s ethos: uncovering hidden value. Don’t miss the Rob Spivey Ultimate Robotics BUY LIST for more.

Why Now? The Urgency of November 6

With Tesla’s meeting looming, Spivey urges action. Musk’s “revenge” mindset—post-PayPal ousting, Twitter buy, political snubs—fuels breakthroughs. Silence since early 2025? He’s engineering, not politicking.

Post-pivot, Tesla could eclipse Apple, Nvidia, Microsoft, Meta, Alphabet combined. “Teslanaires” from 20,000% gains since 2010 could become billionaires.

Conclusion: Is Hidden Alpha Right for You?

Hidden Alpha, Rob Spivey’s expertise and the Ultimate Robotics BUY LIST are must-haves for robotics enthusiasts. Tesla’s pivot could mint fortunes; Hidden Alpha positions you ahead.

Subscribe risk-free: 30-day refund. Don’t delay—November 6 approaches. Grasp this trillion-dollar opportunity via Hidden Alpha Ultimate Robotics BUY LIST.

Frequently Asked Questions (FAQ) About Hidden Alpha and Rob Spivey’s Ultimate Robotics BUY LIST

Who is Rob Spivey, and why should I trust his Ultimate Robotics BUY LIST?

Rob Spivey is a seasoned financial analyst who co-founded a think tank 15 years ago, now serving top money managers like JPMorgan, Goldman Sachs, BlackRock, and Fidelity. His firm predicted the 2008 crash, the 2020 COVID bear market, and subsequent rally. The Rob Spivey Ultimate Robotics BUY LIST leverages his expertise and the Altimeter system, which has delivered gains like 785% on past picks, making it a trusted resource for investors eyeing the robotics boom.

What makes Tesla’s robotics pivot so significant?

According to Rob Spivey’s research, Tesla is shifting from electric vehicles to robotics with its humanoid robot, Optimus, potentially launching on November 6, 2025, at the Annual Shareholder Meeting. This pivot targets a $40 trillion market, far larger than EVs ($4 trillion) or autonomous vehicles ($13 trillion). Tesla’s advantages—gigafactories, energy storage, AI, and self-driving tech—position it to dominate, potentially making it more valuable than Apple, Nvidia, Microsoft, Meta, and Alphabet combined.

Why is November 6, 2025, a critical date for investors?

November 6, 2025, is Tesla’s Annual Shareholder Meeting, where Rob Spivey predicts Elon Musk will unveil Optimus or announce major robotics milestones. This “Optimus Moment” could trigger a robotics bull market, similar to the iPhone or ChatGPT launches, driving massive gains for Tesla and related stocks on the Hidden Alpha Ultimate Robotics BUY LIST.

What is Symbotic (SYM), and why is it recommended?

Symbotic (ticker: SYM) is a free recommendation from Rob Spivey, highlighted in the Rob Spivey Ultimate Robotics BUY LIST. It provides warehouse robotics and AI platforms for companies like Walmart and Target, with revenue surging 770% since 2021 ($252M to $2.2B). The Altimeter reveals hidden profitability, positioning SYM as a leader in the robotics supply chain.

Are there risks associated with investing in robotics stocks?

Yes, all investments carry risks. Market volatility, competition, and potential delays in Tesla’s robotics timeline (noted in Musk’s history) could impact returns. Hidden Alpha mitigates risks with data-driven picks, but past performance isn’t a guarantee of future success. Investors should conduct their own research and consider their risk tolerance.

How can I learn more about the robotics market’s potential?

The Hidden Alpha reports, particularly Inside Tesla’s $30 Trillion Pivot and How To Get Rich In the US of AI, provide detailed insights into the $40 trillion robotics market. They cover Tesla’s advantages, competitor moves, and stock opportunities, backed by Spivey’s research and Altimeter analysis.