Grey Swan Investment Fraternity, led by financial forecaster Addison Wiggin, serves as a critical resource for individuals seeking to navigate the complex and volatile landscape of global economics.

Drawing on decades of experience in financial forecasting and economic analysis, Wiggin brings his expertise to the forefront, offering detailed insights into the economic trends and events that shape both the present and future.

The Rise of Grey Swan Events

The term “Grey Swan” refers to financial events that, while largely predictable, are often ignored or underestimated by mainstream analysts and investors. Unlike “Black Swan” events, which are characterized by their unexpected nature and significant impact, Grey Swan events are those major occurrences that are foreseen by experts but fail to gain traction in public discourse until they are unavoidable.

According to Wiggin, these events are often rooted in economic, social, and political factors that have been in play for years, making them predictable for those who are paying attention.

Wiggin’s notable career is built upon the anticipation and analysis of such events. His most well-known predictions include the dot-com crash, the 2008 financial crisis, the housing bubble, and the rise of Bitcoin. These foresights, many of which were made years before the events actually unfolded, demonstrate the importance of understanding the deeper patterns within economic data.

The Grey Swan Bulletin is rooted in this philosophy, providing its members with actionable insights that allow them to prepare for the impending shifts in the economic landscape.

A Unique Approach to Forecasting

Wiggin’s approach to economic forecasting is distinctly different from the mainstream financial press. While traditional media outlets often focus on short-term market movements and immediate events, the Grey Swan Bulletin takes a more long-term perspective, analyzing trends that may not fully materialize for several years. This foresight is especially valuable in a time when economic instability seems to be at the forefront of global discourse.

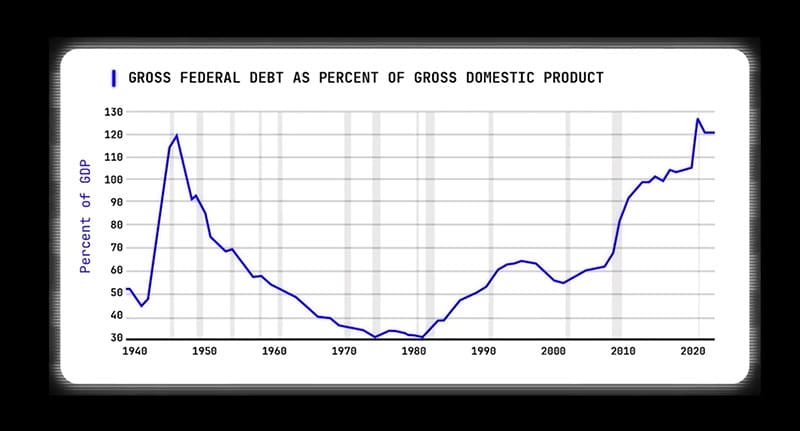

Drawing from extensive historical data, including insights gathered from the archives of the Federal Reserve, Wiggin presents his analysis through charts and statistics that illustrate the deep structural issues within the U.S. and global economies. These issues, such as the rising national debt, inflationary pressures, and the shifting dynamics of global trade, are all indicative of a larger crisis on the horizon.

The Grey Swan Bulletin focuses on uncovering the underlying causes of these phenomena, rather than just reporting on the symptoms.

Wiggin’s background in co-authoring books such as Empire of Debt and Financial Reckoning Day provides the foundation for the Grey Swan Bulletin’s analyses.

His deep understanding of debt cycles, inflation, and economic crises allows him to offer a unique perspective on the financial world, one that is grounded in the understanding that historical patterns tend to repeat themselves, though often with modern twists.

The Grey Swan Bulletin’s role is to prepare its readers for these repeating patterns, offering strategies that protect and potentially profit from the coming economic upheaval.

Addressing the $36 Trillion Bombshell

One of the key focuses of Wiggin’s latest analysis is what he refers to as the “$36 trillion bombshell.” This bombshell is linked to the growing fiscal crisis in the United States, with the Federal Reserve’s policies and the nation’s soaring debt being central to the unfolding disaster.

Wiggin argues that the U.S. economy is on the verge of a major collapse, one that could rival or exceed the Great Depression.

The Grey Swan Bulletin delves into the ramifications of this impending crisis, warning that traditional financial wisdom will no longer suffice. Instead, it advocates for an understanding of the peculiar aspects of the situation, suggesting that certain investments may thrive during a time when others falter.

By analyzing data from the Federal Reserve, including troubling signs of insolvency and financial mismanagement, Wiggin paints a picture of an economy on the brink of collapse. However, he also emphasizes that this crisis will present unique opportunities for those who are prepared.

The Fed’s Role in the Crisis

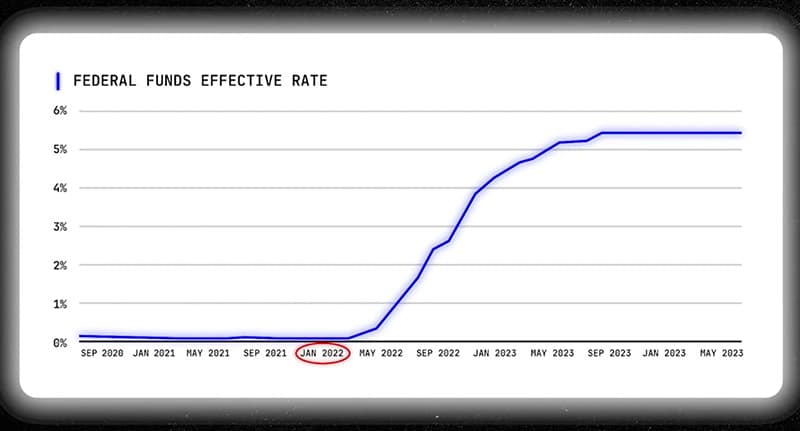

A critical component of Wiggin’s analysis involves the Federal Reserve’s role in the coming financial disaster. According to the Grey Swan Bulletin, the Fed is facing an unprecedented situation where it has lost control over key aspects of the economy, including interest rates and inflation.

As the Federal Reserve has increasingly relied on non-traditional measures such as quantitative easing and near-zero interest rates, the risks to the economy have grown exponentially.

The Grey Swan Bulletin suggests that the Federal Reserve’s actions, once seen as a way to stabilize the economy, are in fact accelerating the financial instability that will eventually lead to a full-scale crisis.

Wiggin provides detailed charts and data that show the alarming trends within the Federal Reserve’s balance sheet, illustrating how the institution is unable to maintain the facade of economic stability.

The Grey Swan Bulletin goes on to forecast the potential fallout from this financial instability, which may include the collapse of major banks, a loss of confidence in the dollar, and the erosion of savings for ordinary Americans.

Global Implications and the Future of the Dollar

Another central theme of the Grey Swan Bulletin is the potential decline of the U.S. dollar as the global reserve currency.

With countries like China, Russia, and members of the BRICS coalition increasingly seeking alternatives to the dollar in international trade, Wiggin warns that the dollar’s dominance is at risk. This shift could lead to a massive devaluation of the U.S. currency, causing inflation to spiral out of control.

Investing in the Midst of Chaos

As the U.S. economy faces unprecedented challenges, Wiggin encourages readers to adopt an unconventional approach to investing. The Grey Swan Bulletin emphasizes that the key to navigating the coming crisis is to think beyond traditional asset classes like stocks and bonds.

Instead, the focus should be on hard assets such as gold, energy resources, and real estate in areas less impacted by the economic turmoil.

Through detailed reports and expert recommendations, the Grey Swan Bulletin equips its readers with the knowledge needed to identify and capitalize on these investment opportunities.

Whether it’s finding value in overlooked sectors or understanding the implications of the global economic shifts, Wiggin’s team is committed to providing practical, actionable advice to help individuals safeguard their wealth and even profit during times of economic upheaval.

Grey Swan Investment Fraternity Service Overview

Addison Wiggin’s Grey Swan Investment Fraternity provides an exclusive service designed to help individuals navigate the complexities of global economic shifts and financial instability. The service focuses on offering subscribers expert analysis, actionable insights, and specific investment strategies aimed at preparing them for upcoming economic turmoil while providing opportunities to profit from these changes.

Here are the key features of the Grey Swan Investment Fraternity.

Monthly Grey Swan Bulletins

Each month, subscribers receive a comprehensive 12-to-18-page newsletter—the Grey Swan Bulletin—which offers in-depth analysis of current economic conditions and forecasts. The bulletin includes detailed investment strategies based on the latest financial developments, offering guidance on how to protect wealth and potentially profit during times of uncertainty.

Subscribers can expect coverage on sectors such as gold, commodities, AI, cryptocurrency, and other emerging trends, often highlighting opportunities not typically found in mainstream financial outlets like The Wall Street Journal or The Economist.

Special Reports

The service comes with exclusive Special Reports that dive deeper into critical financial topics. These reports are tailored to provide actionable insights, covering areas like inflation, the U.S. dollar’s diminishing role as the world reserve currency, and strategies for thriving during an inflationary period. Two major reports that come with the subscription include:

- The Death of the Dollar is as Good as Gold: This report explores how to hedge against the dollar’s decline and identifies key investments that will thrive amid the coming economic shifts.

- The (Almost) Perfect “Inflation Beater”: This report focuses on a particular investment that has historically outpaced inflation, even when the broader market has struggled.

EMPIRE OF DEBT: The Lost Chapter

As a part of the membership, subscribers get exclusive access to EMPIRE OF DEBT: The Lost Chapter, a previously unpublished section from Addison Wiggin’s bestselling book, Empire of Debt. This special bonus includes insights on the current state of U.S. debt, the Federal Reserve’s role, and how individuals can prepare for what’s ahead in the global financial system.

Expert-Led Insights

Subscribers gain access to the combined knowledge of top financial analysts who specialize in various areas of investment, such as income investing, momentum trading, commodities, and crisis investing. These experts share their predictions, strategies, and asset allocation models with Grey Swan members, providing them with critical information that would be difficult to find elsewhere.

The Daily Missive and The Edge

Subscribers are also provided with daily insights through The Daily Missive, a letter that covers immediate, time-sensitive market developments and financial trends. This helps keep investors informed in real-time, allowing them to act quickly on emerging opportunities. Additionally, the Edge newsletter offers strategies and tips on how to grow and protect wealth, regardless of market conditions. It serves as an extra layer of support for those looking to stay ahead of economic shifts.

Access to a Private, Members-Only Website

As a member, subscribers gain access to an encrypted, private website where they can access all reports, past newsletters, and additional resources from the Grey Swan team. This online platform offers a convenient way for members to stay up-to-date on the latest financial insights, as well as access archived content and special resources.

Exclusive Investment Opportunities

Grey Swan members are privy to exclusive investment opportunities that are designed to protect their portfolios during volatile times. These include recommendations for safe-haven assets, stocks, bonds, and commodities that are positioned to perform well as the dollar weakens or inflation surges. The service also identifies unusual squeeze trades, high-dividend stocks, and other unique investment strategies that could provide substantial returns.

Risk-Free Trial

One of the standout features of the Grey Swan Investment Fraternity is the 30-day risk-free trial. If a subscriber feels that the service doesn’t meet their expectations, they can cancel within 30 days and receive a full refund. This ensures that members can try the service with no financial risk, allowing them to explore its benefits without commitment. Furthermore, if a subscriber chooses to cancel, they can still keep all the reports and special materials they received during the trial period.

Access to Grey Swan Library

Subscribers gain free access to the Grey Swan Library, a comprehensive collection of previous reports, research, and exclusive financial resources. This library serves as a valuable resource for both new and experienced investors looking to deepen their understanding of economic trends and investment strategies.

Low-Cost Access

The service is offered at an affordable price, with an initial subscription rate of just $99 for the first three months. This discounted rate allows new subscribers to test the service and benefit from all its features at a lower cost. After the initial three-month period, the subscription renews at a regular rate of $199 every three months, providing continued access to all the resources, reports, and expert insights.

Conclusion

The Grey Swan Investment Fraternity offers a comprehensive, well-rounded service that helps investors prepare for and navigate through the unpredictable financial challenges ahead. By providing expert forecasts, actionable investment recommendations, and exclusive resources, Addison Wiggin and his team enable members to make informed decisions, protect their wealth, and even profit during economic upheaval.