Discover the key differences between Gold and Silver IRAs in our 2025 showdown to help you make informed investment decisions.

Are Gold & Silver IRAs A Good Idea – Everything You Need To Know

Considering rising economic uncertainty, persistent inflation, and geopolitical tensions, many Americans find themselves facing greater challenges today than they did 10–20 years ago, a time when the future seemed promising with a strong economy and thriving stock market.

Gold and Silver IRAs are a good option if you are seeking to diversify your portfolio and protect against long-term inflation. If you’ve been thinking if Gold & Silver IRA is right choice for you, read further to learn everything you need to know to make your decision.

What Is Gold & Silver IRA?

These tax-advantaged retirement accounts function similarly to traditional IRAs. However, instead of holding assets like stocks, bonds, CDs, or money market funds, these accounts allocate funds toward purchasing physical gold and silver. You will own physical gold, silver or other precious metals while still enjoying tax advantages. Like IRAs, gold and silver retirement accounts have annual contribution limits.

What Types Gold & Silver IRA?

Your gold or silver IRA could be traditional IRA where you’ll invest pre-tax dollars. Another option is to open Roth gold or silver IRA in which you will invest post-tax dollars. You can buy both gold and silver in a precious metal IRA, or you could open a self-directed IRA.

Self-directed IRAs offer the flexibility to invest in alternative assets typically unavailable through most traditional or Roth IRAs. With a self-directed IRA, you, as the account holder, have direct control over managing your account and deciding which types of assets to include.

Alternative assets that you can also include are real estate, agricultural commodities, cryptocurrencies, etc.

What Types Of Assets In A Precious Metal IRA?

Investing in physical precious metals such as gold, silver, platinum, and palladium through IRS-approved coins and bullion is possible with a precious metals IRA. To be eligible, the metals must meet certain purity requirements, such as gold being at least 99.5% pure, silver being 99.9% pure, and platinum and palladium being 99.95% pure.

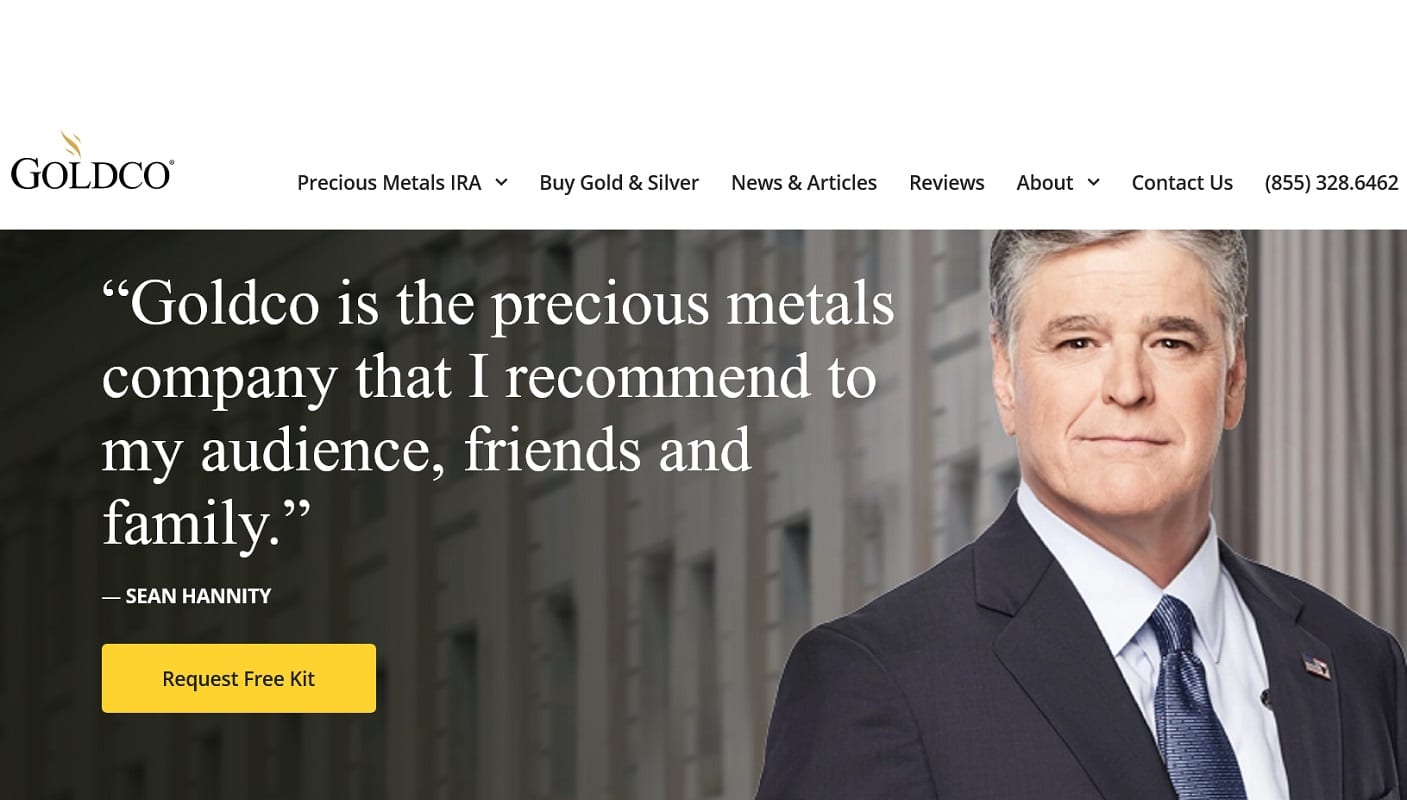

Any coin considered collectible is not eligible for purchase through gold and silver IRA. There are numerous gold and silver coins minted by the US Mint and authorized for IRA purposes. Most mints follow the requirements of US law and produce coins designed specifically to be purchased with IRA accounts. Goldco offers wide variety of approved coins.

Contribution Limits

Traditional IRA contributions are not restricted by your annual income, meaning anyone with earned income is eligible to contribute. However, the deductibility of your contribution may be limited depending on your circumstances. The IRA contribution limits per year are as follow depend on your age:

– $7,000 per year (for tax years 2024–2025) if you are under age 50.

– $8,000 per year (for tax years 2024–2025) if you are age 50 or older.

If you have more than one IRA account, the limit will apply to all your IRA accounts. The deadline to contribute to a Traditional IRA for the current tax year is typically April 15 of the following year.

If your income falls below certain thresholds or if neither you nor your spouse has an employer-sponsored retirement plan, your contributions to a Traditional IRA are fully deductible. However, if you (or your spouse) are covered by such a plan, the tax-deductible portion of your contribution may be subject to some limits.

IRA Funding

Individual contribution is one way of funding your IRA account. Another option is through rollover from your 401(K) accounts. Once you open a gold & silver IRA account, you can also transfer funds from your other IRA accounts, if you have. These transfers or rollovers are governed by IRS regulations and limits.

Gold & Silver IRA Distributions (Withdrawals)

Distribution regulations for IRA accounts are no different for gold & silver IRA. There is no need to prove hardship to take distribution from your IRA account. However, your distribution will be taxable and may be subject to 10% additional tax if you are younger than 59 ½ years.

Every year starting the year you turn 72 (or 70 ½ if you turn 70 ½ in 2019), you must take required minimum distributions (RMDs) from your IRA account. The IRA account balance as of December 31 of the previous year is divided by the relevant distribution period or life expectancy to determine the RMD amount for each year.

RMDs are not required for your Roth IRA.

Pros and Cons Of Gold & Silver IRA Account

Gold and Silver IRAs have numerous advantages and downsides. A combination of gold and silver can offer a well-rounded strategy, utilizing each metal’s advantages to enhance your retirement portfolio.

Pros

- Gold & Silver IRA will help you diversify your portfolio of tax-advantaged assets.

- Gold is considered less risky asset. It is a great option for people that do not want to take unnecessary risk, especially closer to the retirement age.

- Gold & Silver investments perform well during periods of recessions or market corrections.

Cons

- Precious metals historically offer lower returns than the stock market.

- Silver has inherent volatility and may be appealing to investors with higher risk tolerance or investors with smaller budget.

Is a Gold & Silver IRA Right For You?

Deciding whether a gold or silver IRA is right for you depends on factors such as your risk tolerance, retirement goals and confidence in the fiat currency system. Real, physical gold is hard to beat, whether you’re worried about bank collapses, excessive inflation, or simply want a bit more piece of mind. A common guideline is to allocate 5% to 10% of your portfolio to precious metals. Goldco has published a very informative report called “2025 The Ultimate Guide To Gold & Silver”.