In an era of economic uncertainty, where fiat currencies are losing purchasing power and governments grapple with unprecedented debt, investors are turning to timeless assets like gold. But not just any gold investment—enter gold royalties, a specialized approach that promises outsized returns without the hassles of physical bullion. Garrett Goggin, a seasoned gold analyst, has pioneered what he calls the Gold Royalty “Retirement Portfolio,” a strategy that claims to have delivered staggering gains, outperforming legends like Warren Buffett and the S&P 500 by massive margins.

Our Garrett Goggin’s Gold Royalty “Retirement Portfolio” review dives deep into Goggin’s portfolio, exploring its mechanics, historical performance, and why it could be the ultimate hedge for the chaotic 2020s. If you’re seeking a way to compound wealth at rates that sound almost too good to be true, read on to uncover the details.

Understanding Gold Royalties: The Foundation of Goggin’s Strategy

Gold royalties represent a unique niche in the precious metals sector, and Garrett Goggin positions them as the superior way to invest in gold. Unlike buying physical gold bullion, which comes with storage fees and limited upside, or investing in volatile gold miners prone to cost overruns and operational risks, gold royalties offer a streamlined, high-reward model. At its core, a gold royalty company acts like a specialized financier for gold mining projects. It provides upfront capital and expertise to miners, who in return pay a percentage of their gold production as royalties—often for decades.

This business model is what Goggin highlights as “almost magical” due to its capital efficiency. Gold royalty firms incur minimal ongoing expenses: no mining equipment, no employee-heavy operations, and no exposure to inflation-driven cost increases. Instead, they collect profits in physical gold, which preserves value through economic crises.

Goggin emphasizes that this setup allows royalties to compound wealth faster than traditional investments. For instance, a basket of the best gold royalty companies has reportedly compounded at 34% per year over the last two decades, far surpassing Buffett’s 20% annual returns at Berkshire Hathaway.

In his portfolio, Goggin argues that gold royalties have outperformed physical gold by more than 150X and the S&P 500 by 183X in less than 20 years. He backs this with examples of real gains: an initial $50,000 investment could have grown to $9.7 million, translating to $538,888 annually or $44,907 monthly.

These figures aren’t hypothetical; they’re drawn from historical performance of top royalty stocks since 2007. Goggin warns against common pitfalls like expensive bullion or shady gold IRAs, advocating royalties as a safer, more profitable alternative that can be bought like any stock in a regular brokerage account.

Garrett Goggin: The Man Behind the Portfolio

To appreciate the Gold Royalty “Retirement Portfolio,” it’s essential to understand its creator, Garrett Goggin. A self-proclaimed #1 analyst for gold investors seeking life-changing gains, Goggin’s journey began over 20 years ago when he foresaw the inevitable return of gold to the monetary system. Armed with credentials like the CFA (Chartered Financial Analyst) and CMT (Certified Market Technician), he dedicated his career to uncovering the ultimate gold investment.

Goggin’s background includes stints at major newsletter publishers, apprenticeships with gold legends like John Doody, and global travels to remote mining sites. In 2007, while researching gold royalties, he uncovered their extraordinary potential and launched his own publication. Today, hedge funds seek his insights for up to $100,000, but Goggin focuses on empowering regular investors. His work has appeared in press features, and he’s known for discoveries like “Golden Anomaly Profits” and Buffett’s favorite gold-buying indicators.

What sets Goggin apart is his exclusive focus on gold royalties. He claims no other analyst covers this space as comprehensively, and his portfolio’s track record—18,657% gains since 2007—validates this. Goggin’s obsession with gold cycles and monetary resets positions him as a guide for navigating the current bull market, where gold has surged past $4,000 amid geopolitical tensions and banking reforms.

The Economic Backdrop: Why Now for Gold Royalties?

Goggin’s timing couldn’t be more prescient. He frames the Gold Royalty “Retirement Portfolio” against a backdrop of what he calls “the most predictable crisis in history”—governments overspending, devaluing currencies, and eroding public faith in fiat money. The U.S. debt, now ballooning with annual deficits of $2.5 trillion, exemplifies this, as does the global debt pile of $324 trillion. Central banks are stockpiling gold at record paces, signaling distrust in the dollar.

At the heart of Goggin’s thesis is Basel III, a set of banking regulations he dubs a “stealth gold revaluation.” Slated for implementation but delayed to at least 2026 due to insufficient physical gold supply, Basel III reclassifies gold as a “tier-1” asset. This requires banks to hold unencumbered physical gold on their balance sheets, ending the era of paper gold claims that artificially suppressed prices. Goggin reveals how institutions like JP Morgan manipulated futures markets with “spoof” bids, facing fines but minimal consequences—until now.

This shift, orchestrated by the Bank for International Settlements (BIS) in Switzerland—the “central bank for central banks”—marks the biggest monetary change since 1971. The BIS operates with impunity, immune to national laws, and its directives are binding. Goggin notes that central banks’ undisclosed gold purchases may be even higher than reported, preparing for a synchronized global debt devaluation.

In this environment, gold isn’t “going up”—the dollar is “going down.” Goggin stresses that owning gold the right way is crucial; bullion might double or triple, but royalties offer 150X more upside. With gold reclaiming its role as real money, royalty companies stand to benefit immensely, compounding gains faster than the 18,657% of the past two decades.

Trump’s Role in the Gold Renaissance

A surprising element in Goggin’s narrative is President Trump’s pivotal involvement. Far from resisting change, Trump embraces it, viewing a weaker dollar as key to reviving U.S. manufacturing through tariffs and trade deals. Goggin portrays Trump as a realist who understands the end of the debt cycle, with $8 trillion needed in 2025 alone and $21 trillion by 2028.

Trump’s history with bankruptcies equips him to restructure the U.S. financial system, and he reportedly supports gold’s return. Hints include massive gold deliveries from London to New York, Treasury Secretary Scott Bessent’s comments on monetizing U.S. assets, and Trump’s cryptic tweets. The petrodollar’s erosion, with Saudi Arabia accepting yuan for oil, accelerates this transition. Goggin argues Trump is front-running the dollar’s repricing to keep America dominant in the new monetary order.

This political tailwind amplifies gold royalties’ potential. As uncertainty mounts—Musk’s DOGE initiative barely dents spending—royalties provide a “layup” for investors, turning small stakes into generational wealth.

The Magic of the Gold Royalty Business Model

Delving deeper, Goggin explains why royalties are “the last investment you’ll ever need.” Their asymmetry stems from providing financing without bearing mining risks: no equipment, no permits, no fraud exposure. Royalties collect perpetual income in gold, immune to inflation—unlike miners, whose costs rise.

Capital efficiency is the secret sauce. A royalty firm needs just four employees: a geologist, lawyer, deal structurer, and accountant. Initial investments yield decades of profits; examples include stakes of $2 million returning $1.5 billion or $100,000 ballooning to $359 million. This model enables 34% annual compounding, making royalties “boring” yet predictable—ideal for chaotic times.

Goggin contrasts this with volatile miners (prone to nationalization or disasters) or stagnant ETFs. Royalties are liquid, fee-free, and payable in value-preserving gold, positioning them as the ultimate retirement vehicle.

Reviewing Goggin’s Top Three Gold Royalty Picks

The portfolio’s core is a curated list of top royalties, and Goggin generously shares his top three to get started.

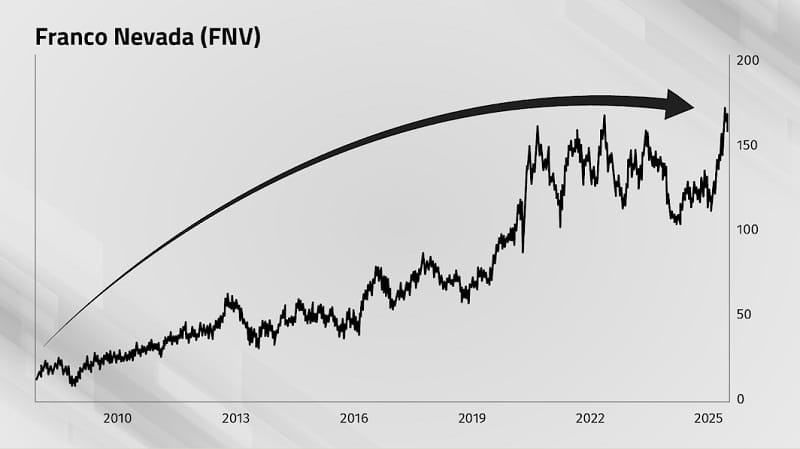

Gold Royalty Pick #1: Franco Nevada (FNV) Franco Nevada is Goggin’s crown jewel, the inventor of the modern royalty model. Founded in 1986, its first deal involved betting $2 million on a Nevada mine, uncovering 50 million ounces of gold and generating $1.5 billion in profits. Today, with a $32 billion market cap and royalties on dozens of projects, FNV is a must-own. Buy and hold in any brokerage for long-term compounding.

Gold Royalty Pick #2: The Desert Gamble Turned Goldmine This unnamed pick (described vividly) started with a $100,000 investment in promising desert land, sold for $2.4 million plus a 1% royalty. That royalty yielded 119,000 ounces, worth $359 million at $3,000 per ounce—a 3,590X return. Recently bought out, shareholders receive a premium and 2.5 shares of the new entity. Goggin advises holding through Q3 2025 for spinoff benefits and untapped profits.

Gold Royalty Pick #3: The Dividend Aristocrat This reliable performer has raised dividends for 24 straight years, earning “dividend aristocrat” status. It’s a “buy and forget” stock, expected to continue payouts amid gold’s rise. Ideal for income-focused investors, it complements the growth-oriented picks.

Goggin recommends starting with $250 per pick, potentially turning $500 into $1,455,283 over time. For full exposure, his portfolio includes about a dozen more.

What’s Inside the Gold Royalty “Retirement Portfolio”?

Subscribing unlocks comprehensive tools:

- Starter Guide: Why Gold Royalties Are Structured To Get Lucky: Details on royalty mechanics, outperforming miners, and real stories like Franco-Nevada’s billion-dollar windfall.

- 12 Monthly Newsletters: In-depth reports on three companies each, plus lead articles on precious metals developments.

- Model Portfolio Access: 16 active recommendations.

- Members-Only News and Articles: Goggin’s insights on market plays for huge gains.

Priced at $3,500 regularly, Goggin offers a 50% discount to $1,750 for a year— a bargain given hedge fund valuations. Testimonials rave: one subscriber gained $22,304 in 45 days; another praises lifetime access for high-value research.

Potential Drawbacks and Considerations

While compelling, Goggin’s claims rely on back-tested data; future performance isn’t guaranteed. The delay in Basel III buys time but underscores systemic fragility. Investors should assess risks like market volatility, though royalties’ structure mitigates many.

Conclusion: Is This the Retirement Game-Changer?

Garrett Goggin’s Gold Royalty “Retirement Portfolio” stands as a bold, data-backed strategy for thriving in a devaluing world. With gold’s monetary resurgence via Basel III and Trump’s policies, royalties offer unparalleled compounding—18,657% historical gains, 150X over physical gold. Whether starting small or scaling up, this could transform financial destinies. Don’t overlook this “ultimate gold investment”—it might just be the boring, brilliant path to wealth preservation and growth.

Frequently Asked Questions (FAQ) About Garrett Goggin’s Gold Royalty “Retirement Portfolio”

What is the Gold Royalty “Retirement Portfolio”?

The Gold Royalty “Retirement Portfolio” is a curated investment strategy by gold analyst Garrett Goggin, focusing on gold royalty companies. These firms finance gold mining projects and collect royalties in physical gold, offering high returns with minimal risk compared to traditional gold investments like bullion or mining stocks. The portfolio claims historical gains of 18,657% since 2007, outperforming the S&P 500 by 183X and physical gold by 150X.

What are gold royalty companies, and why are they different?

Gold royalty companies provide upfront capital to gold miners in exchange for a percentage of the mine’s production, paid in physical gold. Unlike miners, they don’t bear operational risks, equipment costs, or inflation-driven expenses, making them highly capital-efficient. This allows them to compound wealth at rates like 34% annually, as Goggin highlights, with profits tied to gold’s value, not fiat currencies.

Who is Garrett Goggin, and why should I trust his recommendations?

Garrett Goggin is a gold investment analyst with over 20 years of experience, holding CFA and CMT credentials. He’s worked with industry legends like John Doody and claims to be the #1 analyst for gold royalties, with hedge funds offering $100,000 for his research. His focus on royalties led to a portfolio that delivered 18,657% gains since 2007, backed by his deep understanding of gold cycles and monetary systems.

How do gold royalties compare to other gold investments?

Gold royalties outperform physical gold, which requires storage fees and offers limited upside (potentially doubling or tripling in value). They also avoid the volatility and risks of gold miners, such as cost overruns or nationalization. Royalties can be bought like stocks in a brokerage account, offering liquidity, no storage costs, and 150X higher returns than bullion over two decades, per Goggin’s data.

What is Basel III, and why does it matter for this portfolio?

Basel III is a set of banking regulations reclassifying gold as a “tier-1” asset, requiring banks to hold unencumbered physical gold. This “stealth gold revaluation” ends paper gold manipulations, increasing demand for physical gold. Delayed to at least 2026 due to supply shortages, Basel III is expected to drive gold prices higher, boosting royalty companies’ profits as they collect gold-based income.

How does President Trump influence this investment strategy?

Goggin suggests Trump supports gold’s return to the monetary system to weaken the dollar and boost U.S. manufacturing via tariffs and trade deals. His policies align with a global shift away from the dollar, exemplified by the petrodollar’s decline (e.g., Saudi Arabia accepting yuan). This creates a favorable environment for gold royalties, as gold’s value rises amid currency devaluation.

What are the top three gold royalty picks mentioned?

Goggin highlights:

- Franco Nevada (FNV): The pioneer of gold royalties, turning a $2 million investment into $1.5 billion, with a $32 billion market cap.

- Unnamed Pick #2: A $100,000 investment yielded $359 million via a 1% royalty; recently bought out, offering shareholders a premium and 2.5 shares of the new entity.

- Unnamed Pick #3: A “dividend aristocrat” raising dividends for 24 years, ideal for income-focused investors.

How much do I need to invest to see significant returns?

Goggin claims a modest $250 per pick could have grown to $727,641 over 18 years, or $3,368 monthly. A $50,000 investment in top royalties could have reached $9.7 million, yielding $44,907 monthly. Starting small can still yield substantial gains, especially with gold’s expected rise due to Basel III.

What does the Gold Royalty “Retirement Portfolio” subscription include?

The subscription, priced at a discounted $1,750 annually (regularly $3,500), includes:

- Starter Guide: Explains royalty mechanics and success stories like Franco-Nevada’s billion-dollar deal.

- 12 Monthly Newsletters: Three company reports and market updates.

- Model Portfolio Access: 16 active royalty recommendations.

- Members-Only News: Exclusive insights for navigating market opportunities.

Are there risks to investing in gold royalties?

While royalties are less risky than miners, market volatility and economic shifts pose risks. Historical gains (18,657% since 2007) don’t guarantee future performance. The Basel III delay highlights gold supply constraints, which could affect short-term prices. Investors should consult financial advisors and assess their risk tolerance.

How do I get started with the portfolio?

Visit the secure checkout page to subscribe for $1,750. You’ll gain access to the portfolio, including the top three picks and 16 additional recommendations. Buy royalties through any brokerage account, starting with as little as $250 per stock.

Why is now the right time to invest in gold royalties?

With fiat currencies losing value, central banks hoarding gold, and Basel III reinforcing gold’s monetary role, royalties are poised for outsized gains. Goggin argues the delay in Basel III (to 2026 or later) gives investors a window to build positions before demand spikes, potentially driving returns higher than the past 18,657%.

Can I buy gold royalties without the subscription?

Yes, royalties like Franco Nevada (FNV) are publicly traded stocks. However, Goggin’s subscription provides a curated list of 16 top performers, detailed analysis, and monthly updates, which he claims are unmatched elsewhere, maximizing your potential for life-changing gains.

What if I’m new to gold investing?

Goggin’s portfolio is designed for accessibility. The starter guide explains royalty mechanics in simple terms, and the stocks are easy to buy via brokerage accounts. His focus on “buy and forget” investments suits beginners seeking low-maintenance, high-reward options during economic uncertainty.