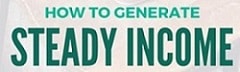

Whitney Tilson is a successful value investor, financial educator, and stock market analyst. Since he began his career in the economic field, he strictly follows the principles of value investing and gained extensive experience in the search for stocks with excellent potential.

As a former hedge fund manager and the founder of Empire Financial Research, Tilson is one of the key figures in the investing world, and he shares his market insights, stock picks, and financial tips with investors. Known for his research and profound knowledge about the market, Tilson has emerged as an influential figure in the financial world, more precisely as a man who gives brilliant predictions about the stock market and other economic trends.

Table of Contents

Who is Whitney Tilson?

But who is Whitney Tilson? He started his professional investment banking journey and later managed a hedge fund called T2 Partners, which he co-founded. Tilson has consistently advocated for long-term disciplined investing based on value investment in his career. Tilson is fond of providing clear and logical predictions of the market recommendations for promising investment when invited to speak in front of an audience or the media.

Whitney Tilson Bio

Whitney Tilson was born in 1966 and grew up in New York City. He has a bachelor’s degree from Harvard College and a Master of Business Administration from the Harvard Business School. Tilson worked for a short period in investment banking and consulting and co-founded T2 Partners LLC in 1999, which he managed for over a decade. In doing this, he gained the reputation of a trusted value investor, and his work was inspired by personalities such as Warren Buffett and Charlie Munger. Tilson closed his hedge fund and started teaching people about finance and investing in 2019 through Empire Financial Research. Through it, Tilson offers ideas and concepts to other investors to enable them to make informed investment decisions regarding the value investing principle in the stock markets.

Whitney Tilson Net Worth

Specific details on Whitney Tilson’s net worth have not been disclosed, though it is known that he is worth tens of millions of dollars. His fortune was mainly earned by working as a hedge fund manager and investor. From managing T2 Partners LLC, Tilson was able to make good profits for his clients and, hence, enhance his wealth. Moreover, his business establishments, such as Empire Financial Research, have been complemented by his sales of books, public speaking, and media appearances, which have increased his net worth. Tilson’s disciplined investment approach and ability to manage changing market conditions have helped him preserve and grow his wealth.

Whitney Tilson’s Financial Newsletters

Whitney is the lead analyst for Stansberry Investment Advisory, The Quant Portfolio and Commodity Supercycles.

Whitney graduated magna cum laude from Harvard with a bachelor’s degree in government. Upon graduation, he helped Wendy Kopp launch Teach for America. He then went on to earn his MBA at Harvard in 1994. He graduated in the top 5% of his class and was named a Baker Scholar.

In his professional life, Whitney founded and ran Kase Capital Management, which managed three value-oriented hedge funds and two mutual funds. Starting out of his bedroom with only $1 million, Tilson grew assets under management to more than $200 million.

The Quant Portfolio

Whitney Tilson and the team at Stansberry Research has developed a new systematic way to find out which of the 4,817 different stocks could double your money. It has 91% accuracy by measuring the likelihood of every potential outcome, BEFORE you get in, including the optimal time to buy.

The Stansberry Score is using capital efficiency, financials, valuation, and momentum to rank which stocks offered the greatest potential upside, and the least amount of risk. The scores ranged from 0 to 100, with anything over 80 being a great opportunity.

The system takes all stocks with the greatest score. Then, by using the Monte Carlo Method, explores every possible combination of those stocks to generate precisely a thousand different portfolios. Finally, it calculates which portfolio can yield the maximum, consistent return for you.

Stansberry’s system shows you, based on the size of your portfolio, EXACTLY how much money to invest in each stock. You can get access to this new technology as part of the new subscription called The Quant Portfolio.

Stansberry Investment Advisory

Stansberry’s Investment Advisory was launched in 1999. Since then, this newsletter has predicted the most promising emerging trends and the most influential economic forces affecting the market – with uncanny accuracy – over the past 25 years.

From the Internet boom and bust… to the real estate boom… to the collapse of natural gas prices… to the current oil boom in the U.S., these and other accurate predictions have led Stansberry’s Investment Advisory subscribers to incredible gains.

Today, hundreds of thousands of people in 120 countries read this newsletter each month.

Commodity Supercycles

Commodity Supercycles is an investment-advisory service that is designed to help you understand and take advantage of the world’s most promising investments in the energy and natural resources space.

Whitney Tilson Predictions

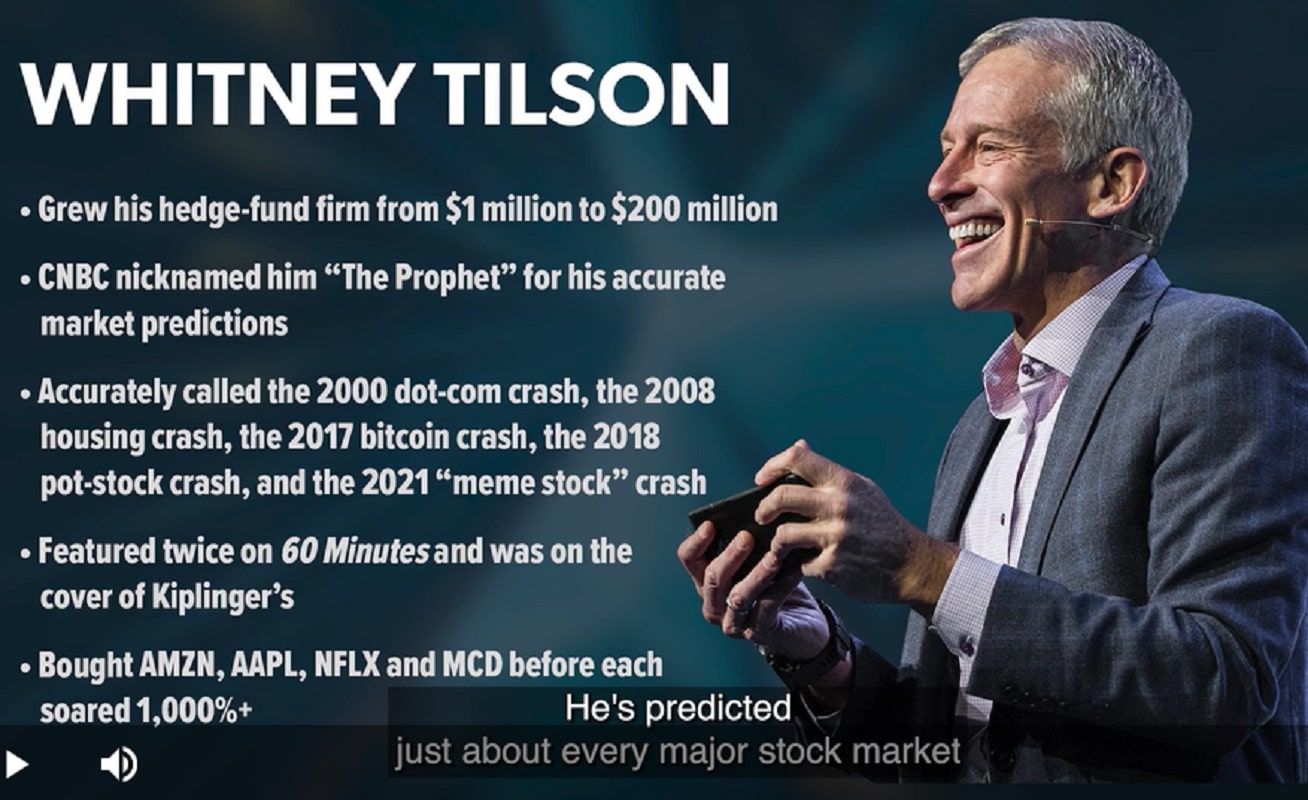

Whitney Tilson is well-known for his market predictions, often taking a contrarian stance and identifying trends before they become mainstream. His proficiency in assessing market trends and changes in the economy has made him gain much credibility among investors. Tilson’s investment forecasts range from individual stock performances to more significant macroeconomic trends. This helps investors to be aware of the risk and return possibilities of a particular market in the future period.

Whitney Tilson’s Stock Predictions

Whitney Tilson’s stock predictions are highly sought after by investors looking for insight into undervalued opportunities. Over the years, Tilson has made bold predictions about significant companies, often recommending stocks that are overlooked or undervalued by the broader market. For example, Tilson was early recommending stocks like Berkshire Hathaway and Apple, which have since experienced significant growth. His stock predictions are based on rigorous research and analysis, with a focus on companies that demonstrate strong fundamentals, sound management, and long-term growth potential. Tilson’s ability to identify these companies before they became widely recognized has been one of the key drivers of his success as an investor.

Whitney Tilson’s Real Estate Market Outlook

In addition to his stock expertise, Whitney Tilson has also provided valuable insights into the real estate market. Over the years, he has offered predictions on the direction of the U.S. housing market, particularly after the 2008 financial crisis. Tilson was one of the few investors who foresaw the collapse of the subprime mortgage market and the subsequent housing crash. His insights into real estate have helped investors understand the underlying risks and opportunities in the market, particularly in times of economic uncertainty. Tilson continues to share his views on real estate as part of his broader analysis of macroeconomic trends, helping investors navigate the complexities of the housing market.

Investment Philosophy and Strategy

Inspired by the likes of Warren Buffett and Charlie Munger, Tilson emphasizes the importance of patience, discipline, and rigorous research in his investment approach.

Whitney Tilson’s Value Investing Approach

Whitney Tilson’s approach to value investing involves a deep analysis of a company’s financial health, competitive positioning, and long-term prospects. He looks for businesses with durable competitive advantages, strong management teams, and stable cash flows. Tilson is particularly interested in companies that are temporarily out of favor with the market but have the potential to recover and generate substantial returns for investors. By focusing on the long-term fundamentals of a business rather than short-term market fluctuations, Tilson’s value investing strategy aims to minimize risk while maximizing potential gains.

Whitney Tilson’s Stock Picks

Over the years, Whitney Tilson has built a track record of successful stock picks, many of which have outperformed the broader market. He has consistently recommended companies that align with his value investing principles, such as Berkshire Hathaway, Amazon, and Facebook. Tilson’s stock picks often focus on sectors that are undergoing significant transformation, such as technology, consumer goods, and financial services. His ability to identify these high-potential opportunities early has helped his followers achieve strong returns. Tilson continues to share his stock picks through his newsletters and educational platforms, providing individual investors with access to his research and recommendations.

Empire Financial Research

Whitney Tilson founded Empire Financial Research in 2019 to provide individual investors with access to high-quality investment research and analysis. The firm offers a range of newsletters and reports that cover various investment strategies, including value investing, growth stocks, and special situations. Through Empire Financial Research, Tilson aims to democratize access to financial information, helping everyday investors make better-informed decisions in the stock market.

Founding and Growth of Empire Financial Research

Since its founding, Empire Financial Research has increased, attracting a large following of investors who value Whitney Tilson’s insights and investment recommendations. The firm’s flagship product, the Empire Stock Investor newsletter, provides subscribers with regular stock picks and market analysis based on Tilson’s value investing approach. In addition to stock recommendations, Empire Financial Research offers educational resources to help investors improve their understanding of the market. The firm’s success is a testament to Tilson’s credibility and reputation as a trusted source of financial advice.

Educational Resources

Whitney Tilson is committed to educating investors about the principles of value investing and the strategies needed to succeed in the stock market. He offers a variety of educational resources, including online courses, books, and seminars, to help individuals build their financial knowledge and improve their investment skills.

Whitney Tilson’s Online Courses

Whitney Tilson shares his extensive investing knowledge with a broader audience through his online courses. These courses cover value investing, stock analysis, and portfolio management. Designed for beginners and experienced investors, Tilson’s courses provide a practical, hands-on approach to investing, helping participants develop the skills they need to succeed in the stock market. His teaching style is engaging and accessible, making complex financial concepts easy to understand.

Books: “The Art of Value Investing” and “More Mortgage Meltdown”

Whitney Tilson co-authors two widely acclaimed books on investing: “The Art of Value Investing” and “More Mortgage Meltdown.” In “The Art of Value Investing,” Tilson shares insights from some of the world’s most successful investors, offering readers practical advice on implementing value investing strategies in their portfolios. “More Mortgage Meltdown” provides an in-depth analysis of the 2008 financial crisis and its aftermath, focusing on the risks and opportunities in the housing market. Both books have been well-received for their thoughtful analysis and actionable insights, making them valuable resources for investors.

Media Presence and Influence

Whitney Tilson is a frequent speaker at investment conferences and regularly appears in the media to share his insights on the stock market and broader economic trends. His thoughtful commentary and ability to explain complex financial concepts in simple terms have made him famous in the financial media.

Speaking Engagements and Interviews

Tilson has spoken at numerous investment conferences and events, where he shares his insights on value investing, stock selection, and market trends. He is also frequently interviewed by major financial news outlets, including CNBC, Bloomberg, and Fox Business, where he analyzes current market conditions and investment opportunities. Tilson’s ability to articulate his investment philosophy clearly and concisely has made him a sought-after commentator in the media.

Whitney Tilson’s Berkshire Hathaway Valuations

Whitney Tilson is well-known for his detailed analysis and valuation of Berkshire Hathaway, one of his favorite companies and a key holding in his investment portfolio. Tilson’s valuation work on Berkshire Hathaway has been widely recognized for its thoroughness and accuracy, earning him praise from fellow investors and financial experts. He regularly updates his valuation models for Berkshire Hathaway, providing investors with valuable insights into the company’s intrinsic value and long-term growth potential.