According to Eric Fry, editor of Fry’s Investment Report the financial markets will offer a few different, sometimes obscure, ways to profit this year. For example, the three following trends might provide a chance to book a few gains…

— RECOMMENDED —

Man Who Predicted Collapse of 70 Stocks: DO THIS

Man Who Predicted Collapse of 70 Stocks: DO THIS

Wall Street legend Eric Fry has predicted the collapse of more than 70 stocks over his career…

Here’s what he says you need to do to prepare in 2022.

The new year is not even three weeks old, and yet we investors are already facing challenging conditions… and suffering losses here and there.

In the words of folk singer Sheryl Crow, “No one said it would be easy, but no one said it would be this hard.”

I would not be surprised if stock market behavior remained erratic and volatile for several more months, if not for the entire year.

Even so, the financial markets will offer a few different, sometimes obscure, ways to profit this year.

For example, the three following trends might provide a chance to book a few gains:

- Crude Oil’s “Swan Song” – The path toward an “oil-lite” world could pass through soaring crude prices.

- B.M.N. – Borrow money now because new a bull market in interest rates could be heading our way. That means bond prices could start dropping sharply (because bond prices fall when interest rates rise).

- The Revenge of Caution – Unlike 2021, aggressive risk-taking will likely perform much worse in 2022 than relatively cautious strategies.

Trend No. 1: Energy’s Swan Song

No matter how “doomed” crude oil may be over the long term, it could deliver some spectacular short-term gains.

In the here and now, demand for oil during the last several months has been rebounding sharply. As it continues to rebound, it could reach about 104 million barrels per day (MBPD), which would be about two MBPD higher than the world’s oil producers have ever supplied to the market.

Former restaurant worker now with over 40 1,000% winners shares urgent message

Most folks assume that OPEC and others could easily ramp production to satisfy any significant surge in demand. But that assumption rests on a frail statistical foundation.

The U.S. has supplied almost all of the world’s crude production growth during the last decade, not OPEC. Pulling that rabbit out of the hat a second time will not be easy, as U.S. shale production topped out two years ago.

Furthermore, oil and gas companies have been slashing the exploration budgets for many years. As I mentioned in last month’s Fry’s Investment Report issue (which you can learn how to access here), global investments in oil and gas exploration and production have plummeted by about 65% since 2014.

Net-net: Bountiful new supplies of crude oil seem highly unlikely.

A tightening oil market, coupled with a rising inflationary trend, provides ample reason to expect oil stocks to deliver market-beating results in 2022.

Trend No. 2: B.M.N. (Borrow Money Now)

Interest rates have been falling for the last 40 years, more or less. But two major bugaboos might cause that long-term trend to reverse decisively in 2022. Those two negative influences are sky-high inflation and sky-high federal deficits.

As most folks are aware, the CPI inflation rate is running red-hot at a 40-year high of 7%. That means the buyer of a 30-year Treasury bond yielding 2.0% is receiving a robust after-inflation return of minus 5% per year.

That math is not the kind that builds wealth. Sooner or later, bond buyers might demand more than 2% interest to tie up their money for 30 years… especially because the federal deficit is still running at a $215 billion monthly clip, or $2.6 trillion per year.

That rate is somewhat better than the $341 billion monthly pace of one year ago, but still not great. In order to keep the lights one, the U.S. government must still borrow $215 billion per month from the public – i.e., $2.6 trillion per year.

Without the price-insensitive Federal Reserve sopping a big chunk of that titanic Treasury bond supply, who will? And at what price?

Why the wealth gap is growing wider

Someone will buy our bonds, of course. But they might demand a much higher rate of interest to do so.

If rates do move higher, one of the ETFs I have recommended as a hedge trade in Investment Report could deliver nice gains this year. Since this ETF wins when bond prices lose, a rising interest-rate trend would push its price higher.

A rising interest-rate trend is not a certainty, of course. But it is enough of a possibility to warrant concern… and perhaps a portfolio hedge or two.

You can learn how to get access to my hedging recommendations by clicking here.

Trend No. 3: The Revenge of Caution

I expect the “character” of the financial markets to shift noticeably from a “risk-on” bias to “risk-off.” In other words, I expect investors to behave more cautiously and timidly than they did in 2021.

Generally speaking, therefore, I’m expecting relatively cautious investments to outperform their relatively risky counterparts. What does that mean?

Here are three of my guesses:

- During 2022, the Vanguard Value Index Fund (VTV) will outperform the ARK Innovation ETF (ARKK).

- 90-day T-bills will outperform long-term Treasury bonds.

- Hedge Funds will outperform the S&P 500 Index.

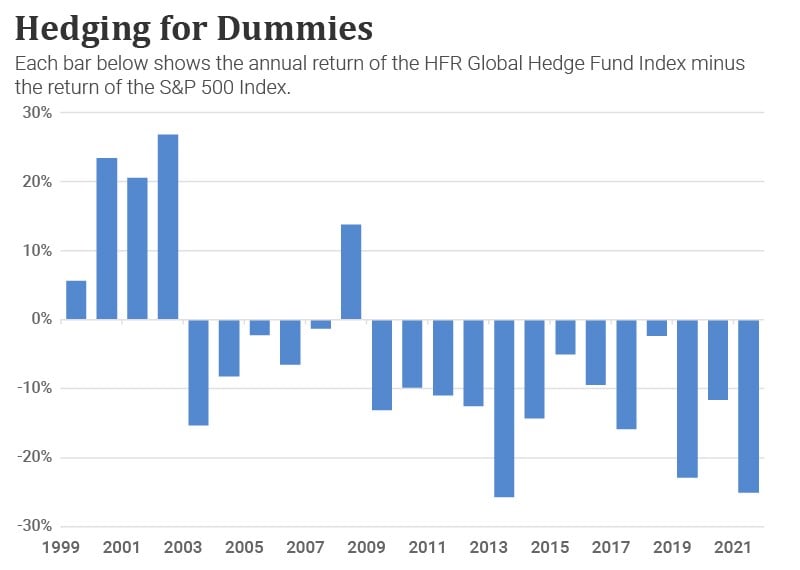

The chart below sheds light on the latter speculation; it shows that the HFRX Global Hedge Fund Index has produced a smaller return than the S&P 500 Index for 13 straight years.

2022 could well become the 14th year, but I’m betting against that outcome. Instead, I’m guessing that this hedge fund index will top the S&P 500 for the first time since the dark days of 2008.

Markets are forever and always cyclical. Sometimes cycles take their sweet time to shift direction, but they always do… eventually.

Once upon a time, hedging was a worthwhile activity. As you may have noticed on the left side of the chart, the HFRX Index outperformed the S&P by a wide margin for four straight years.

That was the start of a 10-year span that saw the HFRX Index climb 72%, while the S&P 500 slumped 13% over the same time span. But that was before the Fates shifted and began smiling on unhedged strategies once again.

I believe the Fates may be shifting once again. We’ll see.

— RECOMMENDED —

The man who predicted the exact week of the 2020 crash is now naming the EXACT DATE he believes stocks could crash this year. He’s sharing 90 years of evidence… five stocks to play it… And he’s even giving away a FREE recommendation using the same strategy that could have doubled your money 26 different times so far.

56 new billionaires were created in the U.S. in 2020, during one of the worst economic downturns we’ve ever seen. I’ve uncovered how the wealthy elite continue to grow their income while others live paycheck to paycheck, and I share my findings through a video recorded in one of the richest zip codes in the country. Click here to learn more.