Dr. David Eifrig, in his most recent presentation for his Prosperity Investor flagship research service, unveiled some striking forecasts. Now, the question arises: should investors give credence to his cautionary message? To provide our readers with a definitive answer, an in-depth analysis of his esteemed Prosperity Investor service was conducted in our comprehensive review.

Dr. David Eifrig’s Prosperity Investor Review: Overview

Prosperity Investor, a cutting-edge research service offered by the renowned analyst Dr. David Eirfrig through Stansberry Research, focuses exclusively on healthcare investment opportunities.

This monthly advisory service empowers readers to capitalize on the immense growth potential of healthcare stocks through regular newsletter reports, expert stock recommendations, comprehensive research briefs, and other valuable resources.

At the helm of Prosperity Investor is Dr. David Eifrig, who serves as the lead editor, leveraging his extensive expertise in the field.

Furthermore, members can gain access to additional advantages by enrolling in Doc Eifrig’s Healthcare Singularity bundle, which will be further elaborated upon later.

Meet Dr. David Eifrig

Dr. David “Doc” Eifrig, MD, MBA is a senior partner at Stansberry Research and a former Vice President at Goldman Sachs who left Wall Street to become an eye surgeon… and later left medicine to help retirees manage their health and wealth in retirement.

He warned of rising inflation way back in January 2020… predicted the oil boom of 2022… and warned a crash was coming before we experienced the worst year for stocks since 2008…

All the while recommending opportunities that could have made you as much as 321% on a top U.S. mutual fund company… 506% on an American multinational conglomerate holding company… 243% on a leading commercial real estate services and investment firm… and an incredible 1,229% on a tech play.

He’s the man behind Retirement Millionaire, Retirement Trader, Income Intelligence and Prosperity Investor where he’s demonstrated readers a current string of 156 consecutive winning trades over nearly three years.

Healthcare Sector: There’s No Better Place To Find “Forever Stocks”

Doctor David Eifrig’s latest presentation highlights a significant long-term growth opportunity of the decade, which distinguishes itself from the trendy assets like tech and crypto that are currently in the spotlight.

Surprisingly, this opportunity arises from the often underestimated but highly dependable healthcare sector, the largest segment of the US economy.

Healthcare has consistently demonstrated commendable performance with steady gains over the past few decades. This revelation presents a promising prospect for prosperity investors.

According to David Eifrig, there’s no better place to find “forever stocks” – the kind you can and should stash away for as long as you can with barely a second thought, no matter what the market or economy is doing.

This sector also famously outpaces inflation year after year – something you can use to your tremendous advantage if you know how.

Meaning today, you could see the biggest gains of a lifetime in some of the most defensive stocks on the planet.

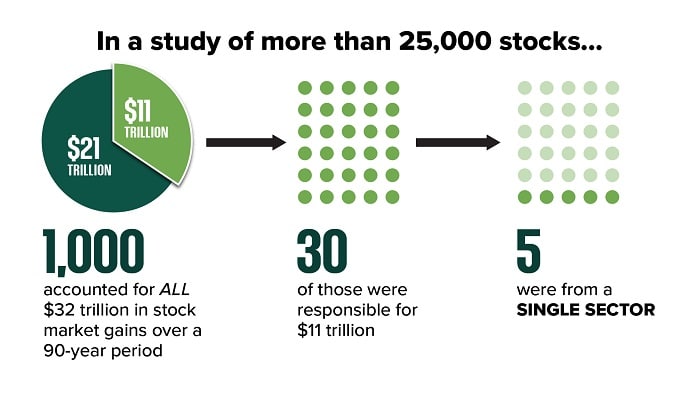

See, in a studyof more than 25,000 stocks, researchers found that just 1,000 of them – a mere 4% of the total – accounted for all of the $32 trillion in stock market gains over a 90-year period.

Just 30 of those – the top one-tenth of 1% – were responsible for $11 trillion. A third of the total gains over nearly a century.

And of those 30 stocks, five were from a healthcare sector.

Did you know that shares of Johnson & Johnson (JNJ) have produced a “lifetime cumulative return” of 2.9 million percent?

And drug maker Bristol Myers Squibb (BMY)?

3.5 million percent.

Those returns are extraordinarily rare of course. They happened over decades of compounding and reinvestment.

But consider this.

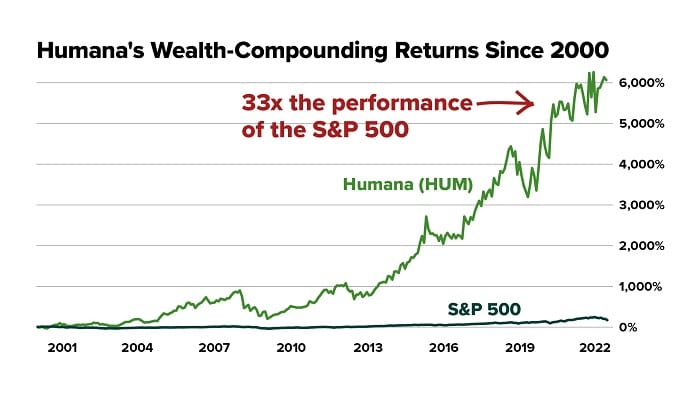

Even the insurer Humana (HUM) would have compounded your wealth by more than 20% per year since 2000…

Thirty-three times the performance of the S&P 500.

UnitedHealth Group (UNH) – 21% per year since 1990.

That’s the kind of steady, compounding growth that most people scoff at – yet the world’s greatest investors would absolutely kill for.

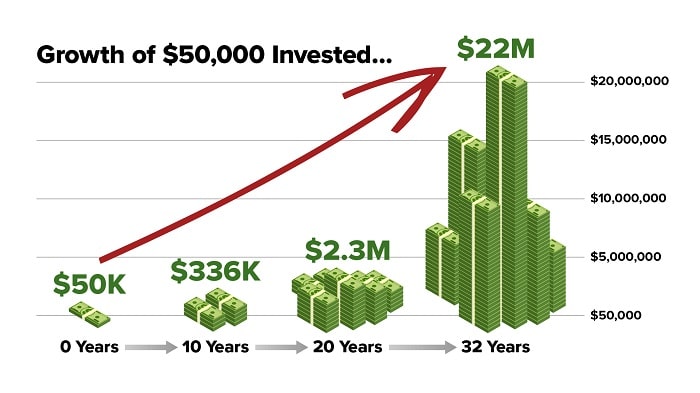

Growth that would turn $50,000 into:

- $336,000 over 10 years…

- $2.3 million over 20 years…

- More than $22 million over the full 32-year span

In some ways, it makes perfect sense you’d find these gains in health care.

Now, Eifrig has identified a promising prospect on the horizon that holds the potential to deliver a ten-fold return for its initial investors.

This promising opportunity goes by the name of the “HealthCare Singularity”, and it has the capacity to drive a significant expansion within the healthcare industry in the coming years. This could lead to substantial prosperity for the astute investor.

What Is the HealthCare Singularity?

The digitization of everything in health, combined with the computation tools to harness it…

Is what David Eifrig calls the ‘HealthCare Singularity’.

In 2020, Google’s DeepMind AI outsmarted a team of highly trained radiologists in identifying breast cancer from x-ray images.

The computer found nearly 10% more cancers – cases that were being missed by human eyes – yet also produced fewer false positives than the doctors.

Researchers at the Houston Methodist Research Institute in Texas have developed their own AI – that can diagnose cancer risk 30 times faster than a human doctor with 99% accuracy.

And last year, a promising cancer drug designed by artificial intelligence entered clinical trials.

According to the journal Nature, the typical five-year development timeline was compressed to just eight months thanks to a system that can sort through and compare millions of molecular candidates.

These are the sort of developments we’ve imagined for decades… but that never seemed to materialize.

Now they’re all happening at once.

And it’s why folks like venture capitalist D.A. Wallach – early investor in Spotify, SpaceX, Neuralink, and many others – are pouring money into health care technology today.

These developments go way beyond changes like the rise of telehealth or a new vaccine.

And if they seem speculative or optimistic… I think you’ll soon feel differently.

But keep in mind: the upside potential is astronomical if even a fraction of it comes to pass.

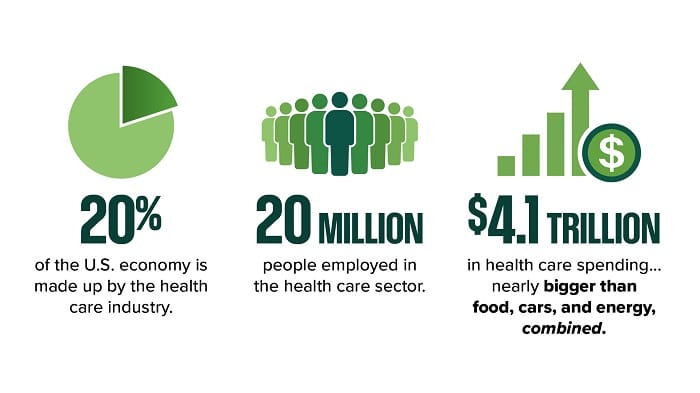

Health care makes up nearly 20% of the U.S. economy.

It employs over 20 million people.

At $4.1 trillion, it’s not just bigger than every penny spent nationwide on food… cars… or energy.

It’s bigger than all three put together.

How To Invest Into the HealthCare Singularity?

Eifrig has devised a multi-step method to maximize the potential of the HealthCare Singularity.

Initially, it is advised to accumulate the high-quality healthcare stocks that have consistently outperformed the S&P 500 year after year.

Subsequently, one should transition to Eifrig’s top-rated stocks related to the HealthCare Singularity, ensuring early involvement in one of the most substantial market growth opportunities to date.

Eifrig and his team have extensively researched each of these prospects and identified the premier stocks to invest in for both categories. Their comprehensive research findings, compiled into a series of detailed reports, are being shared exclusively with members of Prosperity Investor.

By subscribing to Prosperity Investor through this offer, you will receive the complete HealthCare Singularity research collection, along with a range of additional bonuses, for a limited time.

Next, our Prosperity Investor review puts the entire “HealthCare Singularity” bundle under the microscope, so you can get a full picture of everything that’s included with this deal.

Prosperity Investor Review: What’s Included?

Here’s everything you’ll receive:

$3,500 OFF One Full Year of Prosperity Investor

Each month, for the next year, Doc and his team will e-mail you their absolute best ideas in this cutting-edge space, designed to help you prosper in the markets… your retirement… your total wealth… and your health.

(Even if you never touch one of the stock recommendations, these ideas could literally save you hundreds of thousands – even millions – in medical costs.)

Special Report: Low-Risk “Fortress” Health Stocks to Potentially Double the Market, Every Year

You’ll get the complete details on the “fortress” health care stocks you can buy now and plan to hold on long term. Doc expects these stocks to compound your wealth by at least 20% per year, with LESS RISK than almost any other investment in the world.

Special Report: 3 Chances at Multibagger Gains in the Health Care Singularity

You’ll learn about three exciting new innovative companies in this space… stocks that Doc and his team think will be big winners in health care – 3X-plus potential – trading at shockingly low valuations today.

Special Report: 5 Ways to Grow Your Healthspan, Starting Now

This is like a roadmap to the rest of your health, beginning right now. Doc wants you to be rich AND be able to enjoy your life fully. These are his top five ideas, based on the latest clinical research and technology.

Special Report: Four Ways to Get Moving… Because Your Life Depends on It

Doc believes that movement is a literal sign of life… “If you’re moving, you’re living.” In this report, Doc explains how exercise is needed to maximize your healthspan and lifespan… He shows you the four types of movement to bring better health… and shares how to keep yourself accountable…

Special Updates & Alerts

Throughout the month, Doc and his team will e-mail you updates as needed, telling you when to lock-in gains… add to or close an open position… or simply tell you about any new major developments in the health care sector.

Recession-Proof Investments 2024

In this closed-doors panel discussion featuring Doc and six other analysts and editors, you’ll learn all about their favorite recession-proof investments to protect and grow your wealth. Many others paid $2,499 for access to this insightful panel, but you’ll receive it as a free bonus when you sign up today.

Dr. David Eifrig’s Big Book of Retirement Secrets

In this just-updated 2024 version, you’ll learn Doc’s biggest secrets for living a healthy and wealthy life in retirement – including how to legally hide money from the U.S. government, 10 questions you must ask your cancer doctor, and how to turn $10,000 into $1 million.

Health & Wealth Bulletin

You’ll have instant access to Doc’s daily newsletter, delivered straight to your inbox Monday through Friday at 3:30 p.m.

Prosperity Investor Review: Subscription Fee

Prosperity Investor normally costs $5,500 for one full year.

But because of the extraordinary opportunities unfolding in life sciences and the ‘HealthCare Singularity’ – you can try this research at a fraction of the price, with a slew of bonuses…

Meaning, if you get in today – before this special offer expires – you can receive one full year of Prosperity Investor at the special price of just $2,000.

Prosperity Investor Review: Refund Policy

You can take the next 30 days and review everything that Dr. David Eifrig and his team send you, including all of Doc’s new special reports, his trade recommendations, and his entire model portfolio.

While they cannot offer cash refunds, if for any reason you’re not completely satisfied with Dr. David Eifrig’s work, simply call Stansberry Research Customer Care team and you’ll receive 100% of the money you spend back to you in the form of Stansberry Credit.

This credit can be applied toward any of the other Stansberry Research products over the next year.

Prosperity Investor Review: Is It Worth It?

Prosperity Investor is a top-notch research service that offers comprehensive solutions specifically tailored for the healthcare sector.

The subscription cost is justified by the immense value it provides, and the HealthCare Singularity deal is absolutely outstanding.

Subscribers can avail a remarkable $3,500 discount along with a wealth of expert research and analysis focused on the healthcare industry.

Additionally, the package encompasses four exclusive investment reports, an exclusive panel discussion featuring Doc and six other analysts and editors, Dr. David Eifrig’s Big Book of Retirement Secrets, a complimentary daily newsletter, and much more.

The special reports alone have the potential to uncover numerous promising healthcare stocks, and subscribers continue to receive new recommendations every month through the newsletter.

The best part is that it comes with a 100% satisfaction guarantee, ensuring that unsatisfied customers can receive a full credit refund in the form of Stansberry Credit within the first 30 days.

For a premier healthcare research service, consider exploring Prosperity Investor. In the realm of research, quality aligns with price, and Prosperity Investor is an outstanding opportunity within the healthcare singularity deal presented by Doc Eifrig.