Get Dan Ferris ONE-step Inflation Protection plan including details of tiny Oil Royalty Stock which is the “Best Oil Business on Earth,” with hundreds of percent upside potential if you get in now…

If you’re worried about what’s going to happen in the markets next… this interview with Dan Ferris is for you.

Don’t have time to watch the full interview? Here we make sure to include the essential information and our thoughts about his approach.

You’ll learn for FREE the details of a simple, one-step investment strategy that might show you a series of triple-digit gains or greater, starting right now. This strategy involves only regular stocks. It is a brilliant way to not just beat the inflation, but also benefit from it.

Let’s start with Ferris’ mantra

Prepare, don’t predict

He believes that a painful stock market collapse may well have already begun. We’ve already got a chilling preview with the worst January for stocks since the financial crisis. Then the massive collapse in the big tech, then the war in Europe, massive global supply crises…

Have you listened to Stansberry Investor Hour podcast, where Dan is the host? If you answered yes, you’ve probably noticed that he’s never been afraid to speak out against popular (and often dangerous) conventional wisdom in the markets. Likely saving a lot of money for those who follow him.

His readers of Extreme Value, the investment advisory where he is the editor, are way ahead of the average investor. Because they have access to his very rational and sensible view that is supported by history and the facts.

But the real story is that Dan believes in the next few years a lot of people are going to lose nearly everything they’ve saved. They will have to live with crappy, stressful retirement.

This is completely avoidable.

Open your eyes and you will see

The Bubble

Look at the big picture. We are sure most people that are reading this have seen it before. You’ve been through it. We got a preview around the beginning of the year for the S&P, and even earlier, around last Thanksgiving for the Nasdaq.

Even if you can’t remember how you felt in 2000 or 2008, I’m sure you can recall how you felt in February.

After that the war broke out in Europe…and inflation…the situation just keeps getting worse.

There’s no doubt about what’s going to happen. This is so similar to 2008… and 2000… and even 1929.

Nobel Laureate economist Robert Shiller has warned that stocks and bonds have never been more overvalued in modern history. Despite recent market turbulence, the famous stock valuation index he established is nearing its second highest level since 1881.

To make it clear, let’s compare the total market cap of the S&P to our entire country’s GDP (the value of all goods and services we produce).

The historical average is around 80%. Back in the 2000 bubble, the percentage jumped to 121% right before the crash. These days it is around 200%. This is nearly the highest level ever in the history. This is an alarming stat that the stocks are too expensive.

Bloomberg has good data going back 30 years of price to sales comparison.

The S&P peaked around 2x sales before the 2000 crash. It was 1.5x sales ahead of 2008 crash.

It’s never been as high as 3x sales until just recently. And what we know, based on historical studies, is that when it gets high, we can expect low or even negative returns for stocks over the next 10 years.

That’s it. This is the time to act. Now. Not when the stock market is down 50% or 70%.

Of course, I have no idea where the market will be when you read this. The volatility has been really high, and we’ve had some particularly bad days, weeks, and even months.

But Dan’s opinion is that we may see market falls by 70% or more.

We’ve just had more than a decade of the perfect market conditions imaginable.

You don’t get many chances in life to experience that… and many of us are unlikely to see this again.

So please, do yourself the favor of protecting yourself now.

Listen carefully what Dan is going to share in this video. He is talking about the assets to own that could protect you when the bubble bursts and positioned you for big gains.

But forget about hypothetical risks. We know something for sure is already here-

Inflation

The highest readings in over 40 years! Moody’s Analytics found inflation is costing the average U.S household an additional $327 per month.

Now The Fed is saying a series of interest rate hikes will help. But the safe bet – the rational bet – is for significant inflation for a long time. And we rather expect that and be wrong than the other way around.

Because if inflation over the next decade plays out the way Dan is expecting, it is a financial disaster even without a crash.

That’s why Dan Ferris’ recommendation is to invest in the assets he is proposing. Now. As soon as possible. It’s anti-crash protection and anti-inflation protection. And over the next ten years, it’s expected to skyrocket. Without a doubt, he believes this is the trade of the decade.

What is Dan Ferris’ solution?

Dan recommends owning some physical gold. It offers protection you can’t find in any asset that can be manipulated, lake most stocks. He thinks you should own some gold bullion or gold through an ETF that is backed by physical metal.

Take advantage of his recommended ticker symbol. He is so confident that you do not need to make additional research. The ticker symbol is P-H-Y-S and his opinion is that it is much higher quality way to own gold.

He goes even further here. He is basically giving us an approach for the next five years without even spending on research from him or anyone else.

Here is Dan Ferris three recommendations for FREE

- Buy some gold, considering commodities ETF.

- Own some land or equities.

- And buy great business with pricing power.

These are for sure “inflation-proof” assets. They hold their value, even benefit during times of inflation.

You can start with hard assets like oil, gold, land, timber…things like our food supply, things like the real, physical mines that keep our world running.

By no means is this a great plan. We all understand what happens to the pricing when inflation occurs. They soar to new heights. You don’t go to the movies if a movie ticket costs five times as much.

However, even if a barrel of oil costs five times more than before, the world still requires it. So, I’m hoping you’re the owner of the oil company rather than the movie theater chain.

But be cautious. You’re going to have a hard time if your so-called hard asset is a house of cards constructed on debt. And, unfortunately, there’s a lot of it out there in commodities now.

The next massive opportunity

Dan and his team designed a set of resources that anyone can use easily in this exact moment. You can access them 100% risk free. It is a very rare chance to catch the beginning of a 10 or 15-year cycle in commodities. He believes if you catch early a handful of positions, you could be set up for life.

Let’s see some examples:

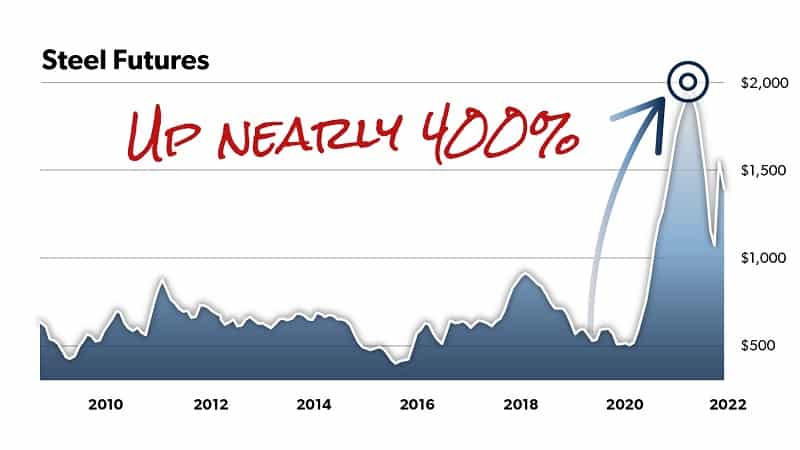

Steel Futures or something called rolled coil steel

Here is a diagram of the price of Natural Gas. Almost 100% increase in just three months.

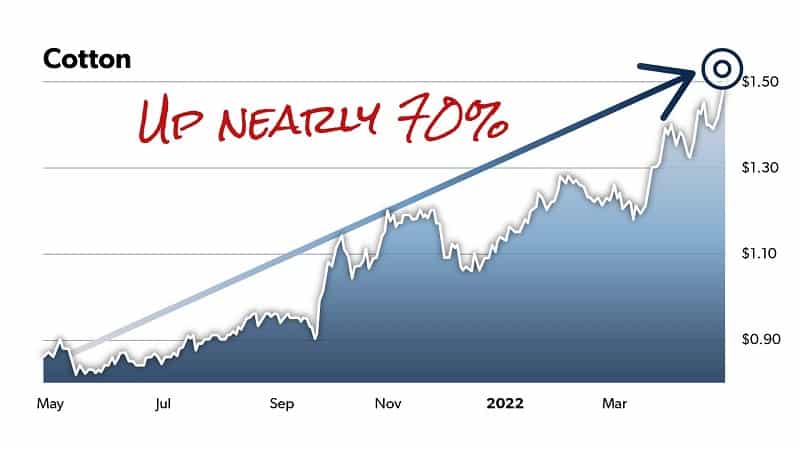

Cotton is another example. It just hit its highest price in 10 years. Look at the numbers, it is up about 70% in a year.

Another great example is shipping. It jumped 6x since pre-pandemic.

Let’s go back to the main idea…Even though the prices go high, commodities are ridiculously cheap.

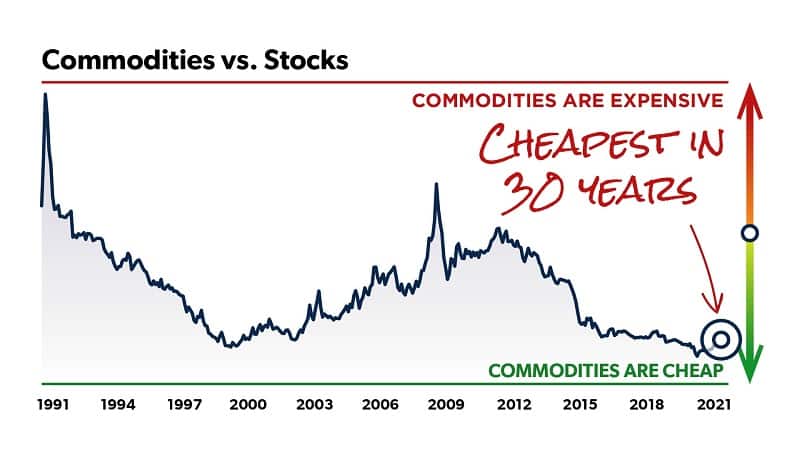

This chart shows the big picture. It shows the ratio between the S&P GSCI Commodity Index and the Dow since 1991

Since the dot-com bubble’s lows, commodities have been the cheapest compared to stocks. The dot-com bubble, not the housing crisis. Currently they are in almost exactly the same place they’ve been 20 years ago.

Dan Ferris #1 inflation protection oil stock

Oil is obviously soaring. Most people would think of Exxon, Chevron, or X-L-E (a popular fund that tracks the energy sector).

Dan considers his pick one of the best opportunities of the next five years, and one of the best stocks they have ever found in more than 20 years of publishing research. In this environment it might increase by hundreds of percent.

He and his team call it “The Best Oil Business on Earth”. Considering what inflation is doing to oil prices, it could be a 10-bagger. Not only that but it is going to give you flat dividend along the way. More than 6% at current prices.

It is a royalty company with one of the best setups.

A “royalty” is a payment you receive repeatedly from a single asset. Once you own a royalty-producing asset, you never have to spend another dollar. And you can keep collecting profits worth many times your investment.

This model has existed since the Middle Ages when you had to pay the king if you wanted to take anything out of the ground. That is why it is referred to as royalty. There is certainly a lot of money to be made in royalties.

Dan Ferris 5-stock Inflation Protection Portfolio

So, Dan and his team found a handful of unique stocks that have these qualities baked in. He is talking about high quality businesses that are often backed by world-class physical assets and can give you leveraged upside to the prices of things like food, energy, and commodity prices.

They put together an entire recommended model portfolio of these exact stocks. It includes five stocks. Each one of them is inflation protection. They are going to soar in the next market cycle.

Every one of them is a backdoor play that people will never find. This gives you potentially 3x more upside than obvious stocks that people usually buy.

We mentioned above about “the Best Oil Business on Earth”. It is included in this portfolio.

Beside it, there is another oil royalty play that’s very similar. This business has 24,000 royalty acres. That’s money that comes in with no marginal cost – no further investment.

The third stock in the 5-stock Inflation Protection Portfolio is a large global company. Even though we cannot live without it, you wouldn’t think of as an inflation hedge. This is the infrastructure behind keeping our lights on, Amazon purchases, groceries, etc. When the inflation pushes the prices up, this company makes more money.

So, you’ve got oil covered, you’ve got gold, and you’ve got two stocks outside of commodities that are going to be a “treasure trove” in the coming years.

Dan and his Stansberry team have done the work of finding the stuff that has the potential to crush inflation. You will only need a plan that includes these five stocks. Buy them and then just watch them grow for the next five years.

Stansberry readers have had the chance to make some nice gains on royalty stocks over the years. They’ve seen gains as high as 220% on one royalty company in just six months. The secret is to get in early at very cheap price.

What is Stansberry’s Investment Advisory?

Stansberry Investment Advisory is where you can find a dedicated portfolio of Dan Ferris’ ideas. It is completely done-for-you approach to:

- Protect your downside

- Beat inflation

- See massive potential gains

Keep in mind, the average open recommendation in Stansberry’s Investment Advisory is up 81%. Last year, 77% of their recommendations were winners, which is a world-class result.

And the average yearly increase was 27.7%. This return is based on the outcomes of all their recommendations in 2021, scaled to a 1-year period.

Keep in mind every investment has some level of risk. Past achievement is no guarantee of future success. Do not invest any money that you are not willing to lose.

What is included in Stansberry’s Investment Advisory?

Here is everything you will receive with all the bonuses included in this offer:

- 1-year access to Stansberry’s Investment Advisory. This is a great source of information about current market. Each month you will get Stansberry’s research issue with the #1 value stock for long-term investment or an undervalued growth stock that is poised to soar. Each opportunity with potential to double your investment in the years to come. You will be able to read every monthly issue they’ve ever published. They are written in normal English, no hard-to-understand terminology.

- Special report: The 5-Stock Inflation Protection Portfolio – inside you will find everything you need to know about the five stocks recommended by Stansberry team.

- A model portfolio with over 22 recommendations currently in buy range

- Special report: The No. 1 Stock on Earth to Beat Inflation. Here you will learn exactly why Dan calls it “the best oil business on Earth”.

- Special Report: The World’s Two Most Valuable Assets in a Time of Crisis. Inside you will get details about the two hard-asset investments that have outperformed everything else, including silver and gold over the long term. These are investments you can easily make today in the U.S. We strongly advise you to check them out, and consider getting in. Holding on them for years is a great way to protect your wealth against any type of crisis that might unfold in America.

- Full, subscribers-only access to the Stansberry’s Investment Advisory Library. It includes instant access to dozens of reports and books they have published, including The Battle for America. This e-book provides inside look at the direction our country is heading both financially and geo-politically. It contains countless numbers of ideas how to improve your investing. The most profitable and stable form of leveraged investing (page 105); how to make commodity investing potentially less risky (page 145); the No. 1 way to invest for retirement (page 189); a strategy for buying elite businesses at bargain prices (page 205), and much more.

- Stansberry Digest where you can get “inside the room” at Stansberry Research. This is the place where their editorial team shares the most important news, ideas, significant events and opportunities.

How much is Stansberry Investment Advisory?

Regular price of this research advisory is $199 per year. For limited time you can become a subscriber for 75% OFF. Use this link to receive Stansberry’s Investment Advisory at the special price of $49!

Stansberry 100% Satisfaction Guarantee policy

We would like to mention here about Stansberry 100% Satisfaction Guarantee policy within first 30-days of your purchase. If you are not happy by the quality of their work, simply let them know, and you will receive a full refund. You will be able to keep their research and ideas you’ve already received.