In the world of finance, where uncertainty reigns and fortunes are made or lost in the blink of an eye, few names carry the weight of Jeff Clark. A veteran trader with a 40-year career, Clark has built a reputation as a seer of market turbulence, accurately predicting some of the most seismic financial events of the past quarter-century.

From the 2008 financial meltdown to the 2020 COVID crash, the 2022 tech collapse, and the 2025 tariff-induced market shock, Clark has consistently sounded the alarm before chaos engulfed Wall Street. Now, as 2025 unfolds with markets teetering on the edge, Clark is issuing his most urgent warning yet: a fresh wave of volatility is imminent, and it could reshape the financial landscape.

On Wednesday, June 11, at 10 a.m. ET, Clark will host the Countdown to Chaos event alongside TradeSmith CEO Keith Kaplan, unveiling a groundbreaking tool designed to detect his proprietary “chaos pattern.” This pattern, rooted in divergence and mean reversion, has been the cornerstone of Clark’s ability to deliver over 1,000 winning trades during the most turbulent market periods. For investors battered by 2025’s wild swings or those seeking to capitalize on volatility, this event promises to reveal not just the risks but the opportunities hidden within the chaos.

Let’s explore Clark’s track record, his chaos pattern strategy, the looming market threats, and why his upcoming event could be a pivotal moment for investors in 2025.

Jeff Clark: The Oracle of Options

Jeff Clark’s Track Record

Jeff has been trading the markets for more than 40 years. That’s a rare level of experience these days, especially in the realm of options trading.

And the way Jeff trades options is just so different from what you see everywhere else. It’s all about highly calculated risk, using systematic approaches that always put the odds in his subscribers’ favor.

For the proof, look no further than the track record Jeff makes publicly available on his website.

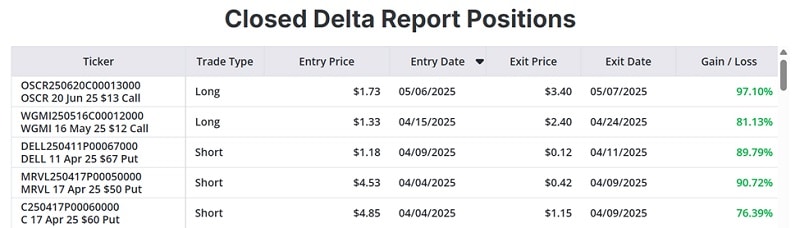

Below are, specifically, all the trades Jeff has recommended to his Delta Report subscribers since Liberation Day (you know, that day that began the worst stock market sell-off since the pandemic panic):

Three short put trades into the steepest part of the decline, where traders could have collected 76%, 91%, and 90% in premium all in the span of four trading days.

Then, two strategic long call trades for 81% and 97% gains as the market began to recover.

Did you make five profitable options trades in a row for an average return of 87% during the last two months?

If you followed Jeff, you probably did something like that.

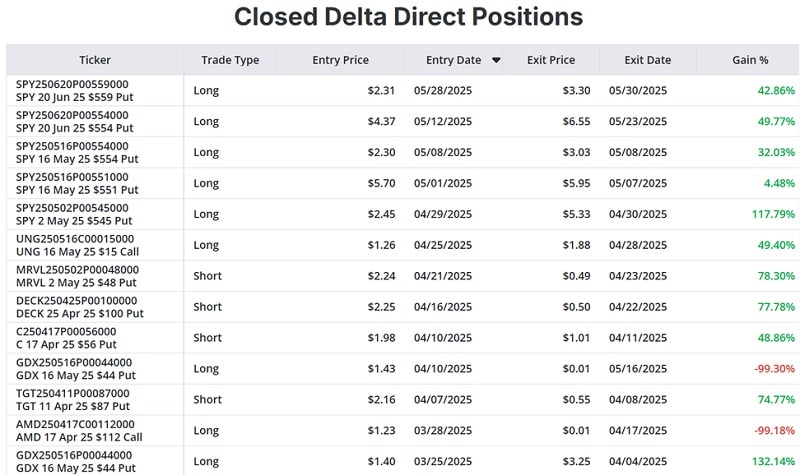

And that, of course, is only if you followed his Delta Report trades. In his live trading blog, Delta Direct, Jeff recommended quite a few more…

Out of 13 trades, 11 were profitable and all but one were double digits. The two losers only gave up a little more than a dollar in option premium per contract.

Note the names. Jeff traded gold miners (GDX), consumer stocks (TGT, DECK, C), tech (AMD, MRVL), and the broad market (SPY). The guy’s no one-trick pony. He watches the whole market and finds the setups that matter.

Here’s the great news for you…

To celebrate the coming integration of Jeff’s system into TradeSmith as part of his Delta Report service, we’re letting anyone who’s interested access Jeff’s live trading blog, Delta Direct, for 100% free for the next week.

I don’t think this has ever been done before. People have paid thousands of dollars over the year to access this research. (I’ve seen it firsthand.) And from today through next Wednesday, we’re making this invaluable resource available for free.

Clark’s prescience is not mere luck. He has a documented history of calling major market events well before they unfold. In 2008, he warned of the impending financial crisis, enabling his readers to secure gains as high as 490% in 25 days from stocks like Palomar Medical. In 2020, he foresaw the COVID-induced market crash and guided his followers to double their money at least ten times that year. The 2022 tech crash, which saw the Nasdaq plummet 32%, was another event Clark predicted weeks in advance, delivering 12 opportunities for 100%+ gains, including a 333% return in just two days from Citigroup. Most recently, in September 2024, Clark anticipated the 2025 tariff shock that erased trillions from markets in April, followed by a dramatic rebound, allowing his readers to capture gains like 97% in two days from OSCR and 90% in five days from Marvell Technology.

What sets Clark apart is his ability to thrive in chaos. While most investors flee volatility, Clark embraces it, using his “chaos pattern” to identify short- and intermediate-term market moves with uncanny accuracy. His approach, grounded in options trading and a deep understanding of market dynamics, has made him a trusted voice for those seeking to protect and grow their wealth in turbulent times.

The Chaos Pattern: Decoding Market Volatility

At the heart of Clark’s success is his proprietary “chaos pattern,” a strategy based on divergence and mean reversion. Divergence occurs when an asset’s price moves in the opposite direction of a technical indicator, signaling a potential reversal. Mean reversion, meanwhile, is the tendency of prices to return to their historical average after extreme movements. By combining these principles, Clark has developed a system that identifies market turning points, allowing him to capitalize on both upward and downward swings.

Unlike traditional buy-and-hold strategies, which can leave investors vulnerable during volatile periods, Clark’s chaos pattern thrives on market dislocations. It’s a strategy tailor-made for times like 2025, where tariffs, geopolitical tensions, and economic uncertainty have kept markets on a rollercoaster. Clark’s system doesn’t rely on macroeconomic factors like interest rates or trade policies but on a unique set of technical signals that have proven reliable across decades of market cycles.

During the Countdown to Chaos event, Clark will unveil a new tool developed in collaboration with TradeSmith, designed to scan the market daily for these chaos patterns. This tool, previously used exclusively by Clark, will now be accessible to everyday investors, offering a window into the same strategies that have yielded over 1,000 winning trades. Backtests of the tool show staggering potential, with gains like 197% in 17 days from Netflix, 322% in 14 days from Amazon, 469% in 10 days from Alphabet, and 636% in seven days from Tesla. For investors seeking to navigate 2025’s turbulent markets, this tool could be a game-changer.

2025: A Year of Unprecedented Volatility

The year 2025 has already proven to be a wild ride for investors. In April, global markets experienced a dramatic sell-off triggered by President Donald Trump’s “Liberation Day” tariff announcements, which imposed sweeping levies on imports from countries like China (245%), the European Union (20%), and others. The S&P 500 dropped 10.1% by March 13, and trillions of dollars were wiped out in just two days, marking the largest global market decline since the 2020 COVID crash. Yet, within hours of Trump pausing tariffs on all countries except China, markets soared, with the S&P 500 posting its third-largest single-day gain in post-World War II history.

This volatility is not an anomaly but a continuation of a year marked by uncertainty. Tariffs, trade wars with China, Canada, and Mexico, and a growing U.S. budget deficit have created a perfect storm for markets. The S&P 500, despite a 6% gain in May, remains down roughly 9% for the year, and bond yields have spiked as investor confidence in U.S. fiscal policy wanes. Companies like Klarna, Chime, and StubHub have paused IPO plans due to the unpredictable environment, while zero-day-to-expiration options have fueled intraday market swings, with trading volumes surging 23% since the start of the year.

Clark’s warning, however, points to a threat beyond tariffs or economic policy. His chaos pattern is flashing a major warning sign, one that has preceded every violent market event over the past 20 years. Unlike past predictions tied to specific catalysts, Clark believes the coming volatility is driven by a structural market dynamic, one that could blindside millions of investors. With the S&P 500 near its bounce target but showing signs of fragility, and bonds failing to act as a safe haven, the stage is set for a chaotic period that could rival the crises of 2008 and 2020.

The Countdown to Chaos Event: What to Expect

On June 11, 2025, at 10 a.m. ET, Jeff Clark will take the stage with TradeSmith CEO Keith Kaplan to deliver a comprehensive briefing on the looming market chaos. The Countdown to Chaos event is not just a warning but a roadmap for investors looking to turn volatility into opportunity. Here’s what attendees can expect:

-

The Chaos Pattern Revealed: Clark will explain the mechanics of his chaos pattern, showing how it has predicted major market moves for decades. Attendees will learn how to spot these patterns themselves, empowering them to anticipate and profit from market swings.

-

Ten High-Potential Opportunities: Clark will share ten real-time trading opportunities flagged by his new chaos pattern tool. These trades, designed to deliver 100% or more in a matter of days, will be provided free to attendees, offering a concrete starting point for leveraging volatility.

-

A Groundbreaking Tool: For the first time, Clark will introduce a daily market scanner developed with TradeSmith, capable of identifying chaos patterns in real time. This tool, backed by backtests showing triple- and quadruple-digit gains, could revolutionize how investors approach volatile markets.

-

A Secret Project: Clark will unveil a mysterious project designed to deliver ten high-potential trading opportunities every morning. This initiative promises to make his chaos pattern strategy accessible to a wider audience, potentially transforming the way retail investors trade.

-

Free Access to Jeff’s Trading Room: Event VIPs will gain complimentary access to Clark’s private Trading Room, a $5,000 value, where he shares daily insights and trading recommendations. This exclusive access ensures attendees stay ahead of market developments leading up to and following the event.

The event will also feature exclusive research and interviews shared daily on the Countdown to Chaos website, preparing attendees for the volatile months ahead. By signing up for the free VIP service, investors can access this content and stay informed about Clark’s latest market insights.

Why Volatility Is Opportunity

For most investors, volatility is a source of fear, a signal to sell and seek safety. But for Jeff Clark, it’s the lifeblood of opportunity. His chaos pattern strategy thrives in turbulent markets, where rapid price swings create mispricings that can be exploited through options trading. Unlike stocks, which require large capital commitments for significant returns, options allow investors to amplify gains with minimal downside risk when used strategically.

Clark’s track record speaks for itself. During the 2008 financial crisis, he delivered 26 opportunities for 100%+ gains, including a 490% return in 25 days. In 2020, amidst the COVID crash, he handed readers ten chances to double their money. The 2022 tech crash saw 12 such opportunities, with gains like 230% in 21 days from Pan American Silver. Even in 2025’s tariff-driven turmoil, Clark’s readers pocketed gains like 90% in five days from Marvell Technology. These results underscore a critical truth: volatility, when approached with the right strategy, can be a wealth-building tool.

The Countdown to Chaos event is designed to equip investors with this mindset and the tools to act on it. By sharing his chaos pattern and the new TradeSmith scanner, Clark aims to democratize his approach, allowing everyday investors to navigate 2025’s challenges with confidence. For those who have suffered losses this year or fear another market drop, the event offers a lifeline—a chance to not just survive but thrive in the chaos.

The Broader Context: A Market on Edge

To understand the urgency of Clark’s warning, it’s essential to examine the broader market context. 2025 has been a year of extremes, driven by a confluence of economic and geopolitical factors. The Trump administration’s aggressive trade policies, including tariffs as high as 245% on China, have disrupted global supply chains and triggered widespread market uncertainty. The S&P 500’s 10.1% drop by March 13 and the subsequent April crash were direct results of these policies, which also led to a spike in bond yields as investors lost confidence in U.S. fiscal stability.

Beyond tariffs, other risks loom large. JPMorgan estimates a 60% chance of a U.S. recession in the second half of 2025, driven by slowing growth and a struggling consumer base. The correlation between stocks and bonds, traditionally a stabilizing force, is breaking down, forcing investors to rethink risk models. Zero-day options, which expire the same day they’re traded, have amplified intraday volatility, with trading volumes surging to 8.5 million in April. Meanwhile, central banks, including the Federal Reserve, are struggling to navigate this uncertainty, with Fed Chair Jerome Powell indicating a cautious approach to rate changes.

Clark’s warning, however, transcends these macroeconomic concerns. His chaos pattern is flashing a signal that has reliably predicted market dislocations for two decades, suggesting that the next wave of volatility could be driven by internal market dynamics rather than external events. With the S&P 500 trading at 19 times forward earnings and earnings estimates being revised downward for 18 straight weeks, the market is vulnerable to a significant correction. For investors, this underscores the importance of being prepared—not just to weather the storm but to profit from it.

Jeff Clark’s Legacy: From Classroom to Trading Floor

Clark’s journey to becoming a market oracle is as compelling as his predictions. Before founding his brokerage house, he developed and taught a college course on markets and trading for MBA students, honing his ability to distill complex financial concepts into actionable strategies. His San Francisco-based firm served around 100 high-net-worth clients, managing their wealth through some of the most challenging market environments. This experience shaped Clark’s approach, which prioritizes risk management and capitalizing on short-term opportunities.

After retiring from money management, Clark turned to investor education, founding a firm dedicated to teaching his strategies to a broader audience. His newsletter, Market Minute, has become a go-to resource for traders seeking insights into fundamentals, technical patterns, and volatility. Through his work, Clark has empowered a new generation of investors to approach the markets with confidence, leveraging his chaos pattern to turn uncertainty into profit.

Why You Should Attend

The Countdown to Chaos event is more than a market briefing; it’s a call to action for investors facing an uncertain future. Jeff Clark’s track record, from predicting the 1987 crash to navigating 2025’s tariff shock, demonstrates his ability to see what others miss. His chaos pattern strategy, refined over four decades, offers a proven framework for profiting in volatile markets. With the introduction of a new daily scanner and ten high-potential trading opportunities, the event promises to equip attendees with the tools and knowledge to thrive in 2025’s chaos.

For those who have suffered losses this year or fear another market drop, Clark’s insights could be a lifeline. His strategy doesn’t require predicting the direction of the market but identifying moments of extreme volatility where mispricings occur. By joining the free VIP service, attendees can access exclusive pre-event content and Clark’s Trading Room, ensuring they’re fully prepared for what’s coming.

Conclusion: Seizing Opportunity in Chaos

As 2025 unfolds, the financial markets stand at a crossroads. Volatility, driven by tariffs, geopolitical tensions, and structural market dynamics, shows no signs of abating. Yet, within this uncertainty lies opportunity for those with the right tools and mindset. Jeff Clark, with his chaos pattern and decades of proven success, offers a path forward—a way to not just survive but prosper in the face of market turmoil.

The Countdown to Chaos event on June 11, 2025, at 10 a.m. ET is a must-attend for any investor with money in the markets. By revealing his chaos pattern, introducing a groundbreaking trading tool, and sharing ten high-potential opportunities, Clark is poised to change how investors approach volatility. Don’t miss your chance to learn from one of the most respected traders in America. Sign up for the free VIP service, secure your spot, and prepare to turn chaos into profit.