Now, more than ever, it is important to invest wisely. As the financial markets are ever-changing, the knowledge of the best stocks to invest in Robinhood November 2025 can be a strategic advantage to both new and experienced investors. Within Robinhood, you can easily access any type of investment, whether it is to support your personal financial goals or not. This manual examines the best industries, plans, and resources to yield maximum profits at minimum risk.

Why Robinhood is a Preferred Choice Among Investors

- Intuitive design: The application allows stock trading to be available even to those who are not experts.

- Commission-Free Trades: The best is to maximize returns to save on unnecessary fees.

- Fractional Shares: Invest in high value stocks without having to raise a large capital.

- Brokerage Accounts Accessibility: Investment management, spy on the market capital, and industry stock performance, all under a single roof.

The smooth fusion of tools and resources at Robinhood enables investors to make well-informed decisions, which is even more likely to select the best stocks to invest in Robinhood November 2025.

Key Factors to Consider Before Investing

Profitable investments will not be made by chance. Pay attention to such critical points:

- Market Cap:

- Big-cap stocks are stable and yield frequent dividends.

- Mid-cap stocks are a compromise in between growth and risk that is easy to manage.

- Small-cap stocks have the potential to give high returns yet more volatile.

- Sector Performance:

- In certain economic conditions, some sectors are more superior to others.

- Usually monitor the trends of track sectors to determine new opportunities.

- Personal Finance Goals:

- Is your investment short term or long-term wealth generation?

- Make your stock selection to match your financial plan.

- Risk Tolerance:

- Risky stocks are also likely to generate greater returns, but are not always appropriate to every investor.

- Diversifying is the way to minimize the possible losses.

Top Sectors to Watch in November 2025

Diversification into various industries is one of the methods of strategic risk reduction.

- Technology Sector Stocks

- There are booming companies of AI, cloud computing, and semiconductors.

- Look at not only those who are already giants but also newcomers.

- Bullet Points:

- Artificial intelligence companies of the future.

- Cloud providers that have recurring revenue.

- The companies that are the beneficiaries of international demand are semiconductor manufacturers.

- Healthcare Sector

- The elderly and new treatment methods ensure that healthcare is profitable.

- Growth leaders are usually biotech and pharmaceutical companies.

- Bullet Points:

- Firms that have good pipelines in biotech.

- Health care equipment companies that deal with worldwide health issues.

- Companies involved in the pharmaceutical business that experienced steady market cap growth.

- Green Energy and Green Investments

- Governments and investors are concerned with environmentally-friendly solutions.

- Companies in solar, wind and electric vehicles (EV) are trending.

- Bullet Points:

- Solar panels manufacturers with growing market share.

- Charging solution and EV battery providers.

- Diversified exposure in renewable energy ETFs.

- Consumer Goods & Services

- Necessary commodities do not reduce during recession periods.

- Firms that have a good brand name are stable.

- Bullet Points:

- Major food and beverage companies.

- Electronics that have increased market potential.

- E-commerce leaders who are global trend setters.

Stocks to Buy This Month

In order to find the most profitable stocks to invest on Robinhood November 2025, take into account:

- Good Performing Established Stocks:

- Demonstrated profits, predictable dividends and good fundamentals.

- Cases: Tech and healthcare companies that have strong market caps.

- Emerging Growth Stocks:

- Strong growth potentials between mid-cap and small-cap companies.

- Risky and extremely lucrative propositions.

- Bullet Points:

- Balance portfolios with growth and stable stocks.

- Monitor industry-related ETFs in order to have diversification.

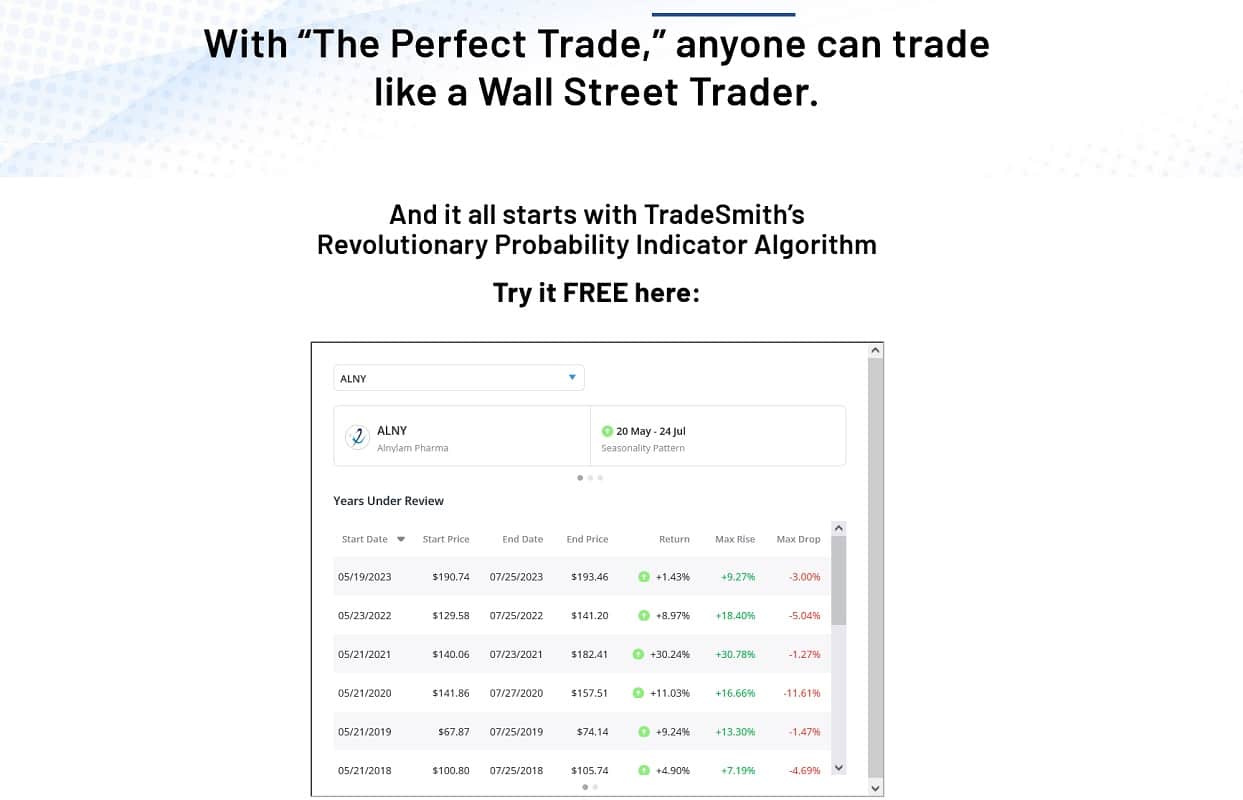

- Investments according to quarterly returns and patterns.

Risk Management Strategies

Securing your investments is no less important than picking stocks.

- Diversification: Investment diversification to minimize risk on a sector and market level.

- Stop-Loss Orders: Have pre-established large loss prevention stops.

- Portfolio Monitoring: Monitor the performance of brokerage accounts regularly.

- Market Updates: Know the industry stocks and market capital movements to make an opportune decision.

Short term vs Long-term investment strategy

It is paramount that you know your investment horizon:

Short-Term Trading:

- Attend movements in stocks or industry movements.

- There should be active monitoring of brokerage accounts.

Long-Term Investing:

- Based on strong fundamentals and healthy growth of the market cap, invest in companies.

- Make investments to match the retirement or personal finances.

Tools and Resources on Robinhood

Robinhood gives users numerous investment optimization tools:

- Stock Screeners: Select sector, market cap, and performance.

- Watchlists: Monitor possible stocks to purchase with ease.

- News & Alerts: Be informed about stock movement in the sector.

- Portfolio Analytics: Evaluate the congruity with the personal financial objectives and the risk tolerance.

Market Trends and Prospect November 2025

Diversifying on the best stocks to invest in Robinhood November 2025: Understanding market trends will assist in choosing the best stocks.

- Technology & AI: Costly innovation keeps growing.

- Healthcare and Biotech: An aging population drives the need of healthcare solutions.

- Renewable Energy: Investments are motivated by government incentives and interest of the people.

- Consumer Goods: They are safer since they are stable and they are always in demand.

Tips for Maximizing Returns

- Keep Ahead: Park financial news and updates every day.

- Apply Diversification: Investment diversification between sectors and company size.

- Strategize: Adjust investment decisions to personal finance goals.

- Review: Portfolio check Periodically: Adjust risk and growth potential.

Conclusion

The stock market needs planning, knowledge as well as constant monitoring. A balance between companies that are stable and those that have good performance and those that have potential growth in the coming years is the best stock that can be invested in Robinhood November 2025.

Through the help of the tools of Robinhood, researching the trends in the sector, tracking market capitalization, and focusing investments on personal objectives of the financial system, investors are able to optimize returns and reduce risk. Diversification in industries and effective risk management will help to have a solid portfolio that will generate profits within the short term and wealth in the long term.